This article is available in Spanish.

XRP, the cryptocurrency behind Ripple, has been a hot topic lately, with analysts predicting a possible price increase to $11. Before this can happen, however, XRP must face a significant challenge: a short-term price correction. Despite the positive long-term view, assets are expected to experience a pullback before a meaningful rally can take place.

Resistance at $2.73 is currently the key level XRP must overcome for further price movements. Crypto analyst Ali Martinez sees this resistance as crucial for XRP to maintain a bullish trend.

Related reading

The crucial breakthrough

Breaking through at $2.73 and following an upward move could open a gateway to see the digital asset reach $11. However, failing to do so could spell trouble for the coin, sending it all the way down to a potential low of $2.05.

Given its highly volatile price range, investors are closely watching XRP’s movement to know whether it will rise or correct.

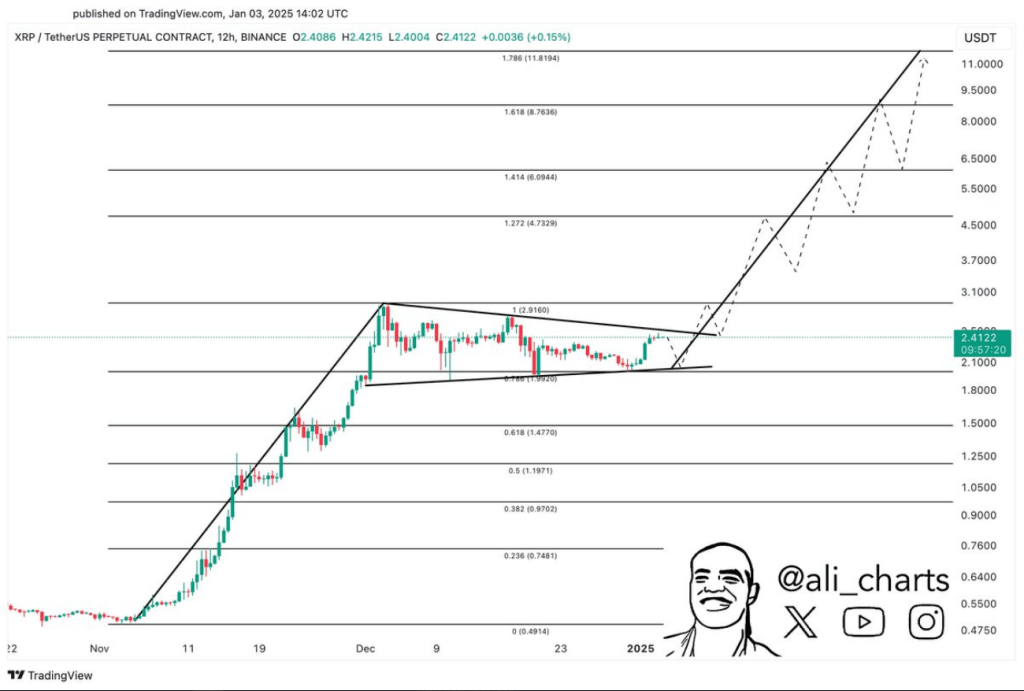

$XRP still consolidating within the banner of a huge bull pennant pattern. Until the resistance at $2.73 is broken, a pullback to $2.05 remains possible before a potential break to $11! pic.twitter.com/ET39FJMtAc

— Ali (@ali_charts) January 4, 2025

Technical point of view

In terms of technical analysis, other well-known analysts who follow the Elliott Wave Theory say that XRP is in a correction. After experiencing an impulsive five-wave rally, they believe XRP is now preparing for an ABC correction pattern.

This type of correction usually comes after a long rally and acts as a breather before the next big move. Other analysts expect that the correction will end around mid-January 2024, giving traders a good opportunity to buy in before another rally.

This correction may temporarily lower the price, but could pave the way for a much bigger increase in the coming months.

Bullish sentiment

With all the associated risks of short-term price corrections, the overall sentiment is still heavily bullish for XRP. One of the main reasons for this is a resolution recently passed regarding Ripple’s long term court case with the US Securities and Exchange Commission (SEC).

A favorable ruling in the case removed much of the uncertainty about XRP’s regulatory status in the public eye and made it one of the most attractive investments for many. Positive: expectations for a more lenient crypto-friendly policy from the government and not for a broader market, creating upward momentum.

Related reading

A better future for XRP?

While a correction can be expected in the short term, a long-term view on XRP still bodes well. If this correction plays out as expected, it could be a good starting point for those interested in investing in the potential next rally.

The road to $11 is still ahead of us, but if XRP stays on the same track, it will be a show to see. As usual, traders and investors should remain vigilant in anticipation of key resistance levels and market trends.

At the time of writing, XRP was trading at $2.41, up 0.1% and 15.4% in the daily and weekly time frames.

Featured image from Trackinsight, chart from TradingView