MiCA is now live across the European Union, marking a milestone for digital asset supervision. Industry participants now operate within an EU-wide framework that includes stablecoins, token issuances and services such as custody and exchange.

As the Bretton Woods Commission wrote, the process involved years of consultation and negotiations, culminating in a rulebook that addresses oversight gaps and promotes transparency.

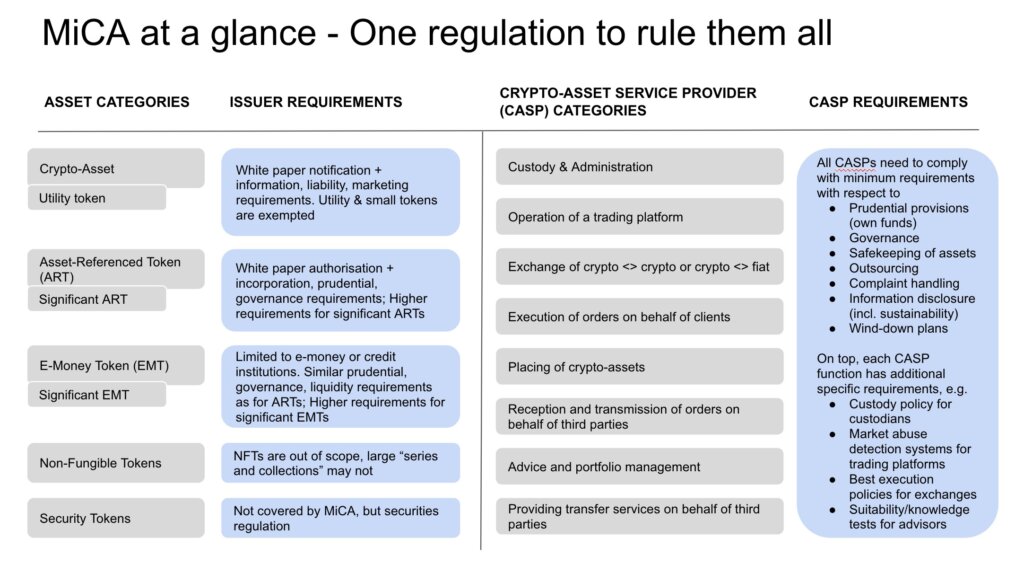

Companies issuing e-money tokens (EMTs) must be incorporated in the EU or have relevant e-money licenses, while asset-referenced tokens face higher disclosure and governance requirements when they reach certain volume or user thresholds. The measures also include stricter rules on reserve management, redemption and disclosure, signaling the bloc’s focus on financial stability in digital asset markets.

Patrick Hansen, policy director at Circle, wrote an extensive piece explaining how stablecoin issuers have little choice but to comply or lose access to the entire EU market. Tether, the world’s largest stablecoin issuer, tellingly chose the latter option CryptoSlate that the competition is frustrated by the different approach to stablecoins. He said,

“Every day you wake up, you scratch your head and you don’t understand why these few Italian guys are doing much better than you. Of course you get frustrated, right?

So you know, if your business model is called Kill Tether, then you know you need to rethink your product.

Expectations for crypto companies in the EU

Crypto-asset service providers (CASPs) that offer activities such as brokerage, exchange or custody face licensing requirements that will allow them to operate in all member states once they are authorized in one jurisdiction. This shift replaces the previous patchwork of national regulations, reducing barriers for companies pursuing cross-border growth and providing a passport-like mechanism similar to the approach used in the EU’s traditional financial services.

Some companies are expected to consolidate or forge partnerships as it can be more difficult for smaller companies to meet compliance obligations. Trading platforms must also establish controls against market abuse and insider trading. Authorities may ban the offering of tokens if disclosures or risk management procedures appear incomplete.

MiCA formally excludes protocols that run “in a fully decentralized manner” from its scope, but many operations may not meet the threshold for true decentralization.

The same ambiguity exists around large-scale NFT collections, which could be deemed fungible by regulation, requiring compliance with White Paper and issuer obligations. There is also uncertainty surrounding ‘privacy coins’, which may be delisted if full identification of the holder proves impossible.

Overall expected impact of MiCA

Industry responses from Bretton Woods and Circle indicate a shared understanding that the practical success of MiCA depends on its technical standards and enforcement practices. Companies are adapting their product offerings, focusing on clarity in disclosures and compliance with token issuance and reserve management rules. As Hansen noted, adoption of the framework could attract projects seeking certainty, especially if concerns about enforcement actions elsewhere persist.

There are broader questions about global adoption. The US has yet to formalize regulation of stablecoins, and enforcement patterns, while appearing progressive, vary widely across Asia. The European model could influence other jurisdictions, leading to a ‘race to the top’ in consumer protection and alignment with international standards.

According to Bretton Woods, a coordinated approach would promote the passportability of stablecoins and limit the risks of regulatory arbitrage. Some lawmakers have discussed a MiCA 2.0, indicating that non-fungible tokens, DeFi or additional technology features could eventually be revisited under an updated directive. Officials note that any new iteration will depend on the law’s initial results.

Hansen points to MiCA’s similarities with other EU technology initiatives, where regional standards ultimately influenced commercial and legal frameworks abroad. Whether MiCA becomes a standard global reference will depend on its implementation in practice, the role of national authorities and how effectively the measures protect markets while enabling companies to innovate. Meanwhile, industry moves to secure a MiCA license continue, with major banks and exchanges adapting their operations or acquiring smaller players.

Many expect MiCA to bring greater institutional involvement, aided by uniform licensing and consumer protection. However, the cost of compliance remains a factor that could shift business to well-capitalized platforms. Investors could see broader adoption of regulated services, while smaller teams could focus on specialized niches or move to regions where obligations are less stringent. Policymakers have vowed to keep an eye on the outcome, believing that a united EU position on crypto could strengthen capital formation and user protection.

As the framework applies, stablecoin issuers and CASPs will face earlier enforcement deadlines than other market participants, with the rest of the rules being implemented over the course of the year. Regulators will also issue binding implementation standards that clarify timelines, technical disclosures and operating conditions for token projects.

Hansen confirms that companies planning to navigate the European landscape are engaging with authorities and preparing compliance strategies accordingly. He believes that MiCA has created an environment of clear responsibilities for participants, and that its ability to encourage responsible growth under consistent rules will measure how it shapes the crypto markets.

Implementation will continue in phases as the EU refines technical guidelines and monitors licensed entities. The outcome will show whether MiCA is a workable model that balances innovation with supervision.