As blockchain technology continues to evolve, understanding user engagement is crucial for assessing the success of any network. A particularly insightful measure is daily active addresses. This refers to the number of unique blockchain addresses that participate in transactions on a given day, either by sending or receiving assets. Essentially, it provides a snapshot of how many users are actively interacting with a blockchain at any given time, making it a reliable measure of real-world usage and popularity.

On December 27, 2024, CryptoRank published a chart ranking the top 10 blockchains of the year by their average daily active addresses. This data, from CryptoRank and Artemis.xyz, highlights some fascinating trends in blockchain adoption and provides insight into the platforms that have led the way in driving user engagement. Let’s dive into the top three blockchains that dominate this metric, followed by a brief overview of the remaining networks in the top 10.

Top 10 #Blockchain by Daily Acive Addresses in 2024:

$NEAR

$SOL

$TRX pic.twitter.com/sEn1F3Qcw0

— Crypto Rand (@crypto_rand) December 30, 2024

1. NEAR Protocol: 2.7 million daily active addresses (+766% YoY)

NEAR Protocol emerged as the leader in 2024, with 2.7 million daily active addresses. This marks an astonishing 766% year-over-year growth, largely driven by the focus on scalability and easy-to-use developer tools. NEAR uses an innovative sharding technology called Nightshade, which splits the blockchain into smaller, more manageable pieces, enabling high transaction throughput at low costs. This efficiency has made NEAR a top choice for developers creating decentralized applications (dApps).

NEAR’s success was further amplified by the rapid adoption of blockchain-based gaming and social dApps on its platform. These applications attracted new users unfamiliar with blockchain technology, allowing NEAR to build a robust and growing ecosystem. Combined with significant investments from the NEAR Foundation in developer grants, the rise of the protocol underlines its appeal to users and builders alike.

2. Solana: 2.6 million daily active addresses (+702% year-over-year)

Solana comes in second place, with 2.6 million daily active addresses and an impressive 702% year-over-year growth. The network’s popularity in 2024 was largely fueled by the vibrant memecoin ecosystem, which saw massive trading activity on platforms like Pump.fun. These memecoins attracted both retail and institutional investors, significantly improving Solana’s usage metrics.

In addition to memecoins, Solana’s fast, low-cost infrastructure made it a go-to blockchain for decentralized finance (DeFi) and non-fungible token (NFT) projects. Developers and users flocked to the network to take advantage of its efficiency, while institutional interest grew as Solana proved its scalability and reliability. This combination of factors has made Solana one of the best blockchains of the year.

3. TRON: 1.9 million daily active addresses (+20.3% year-over-year)

TRON secured the third spot with 1.9 million daily active addresses, representing a steady growth of 20.3% compared to the previous year. TRON’s dominance in stablecoin transactions, especially those involving Tether (USDT), has been a major driver of its user base. With low transaction fees and fast transfers, TRON became a platform of choice for users seeking seamless, cost-effective stablecoin operations.

The blockchain also maintained a strong presence in the decentralized finance (DeFi) sector, partnering with several global payment systems and financial institutions. While its growth was not as dramatic as NEAR or Solana, TRON’s consistent performance and usefulness secured its place among the top blockchains of 2024.

A quick look at the rest of the Top 10

Besides the top three, the remaining blockchains on the list showed various strengths and challenges.

BNB Chain saw 1 million daily active addresses, a slight decline of 4.8% from the previous year. Despite the decline, BNB Chain remains a hub for DeFi and token trading, maintaining its stake in the blockchain ecosystem.

Polygon (MATIC) recorded 855,000 daily active addresses, delivering robust 139% year-over-year growth. As a Layer 2 scaling solution for Ethereum, Polygon continues to attract gaming, NFT and DeFi projects, cementing its role as an essential part of Ethereum’s ecosystem.

Base, Coinbase’s Layer 2 solution, reached 655,000 daily active addresses and saw exceptional year-over-year growth of 2,098%. Its tight integration with Ethereum and Coinbase’s easy-to-use platform has significantly boosted its adoption.

Sui emerged as a standout performer with 519,000 daily active addresses, experiencing an extraordinary 908% year-over-year increase. This growth is attributed to its innovative programming language and rapidly growing ecosystem of decentralized applications (dApps).

Bitcoin (BTC), the world’s most recognized blockchain, recorded 496,000 daily active addresses, down 19% year-over-year. While Bitcoin remains the dominant asset in terms of market capitalization, the decline in the number of daily active addresses reflects users’ changing priorities.

The Open Network (TON), the blockchain associated with Telegram, saw exponential growth in 2024, with the number of daily active addresses increasing by 5,185% to 414,000. This growth was fueled by TON’s integration with Telegram, leveraging the messaging platform’s massive user base to drive adoption.

Finally, Arbitrum, a leading Ethereum Layer 2 solution, achieved 413,000 daily active addresses, up 180% year-over-year. Arbitrum’s ability to scale Ethereum applications while maintaining low costs and high throughput has made it a major player in the Ethereum ecosystem.

Comparing activity with total value locked: A broader perspective

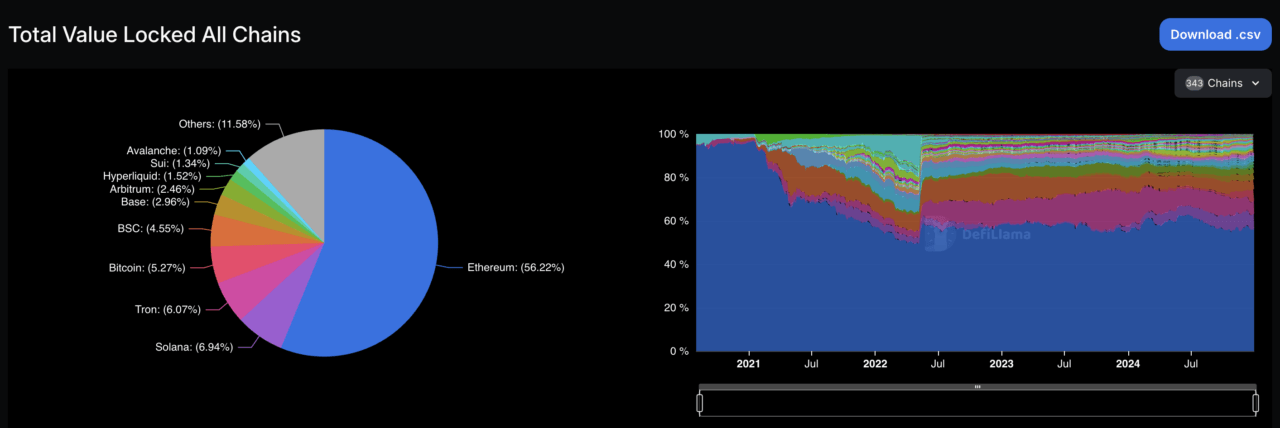

An additional lens through which to evaluate blockchain ecosystems is Total Value Locked (TVL), a metric that represents the total dollar value of assets locked in decentralized finance (DeFi) protocols on a blockchain. TVL measures how much capital users have committed to DeFi applications, such as lending, staking and liquidity provision. Unlike daily active addresses, which emphasize user activity, TVL provides insight into the financial depth and maturity of a blockchain’s DeFi ecosystem.

By this metric, Ethereum is unparalleled, with 56.22% of the total TVL across all chains as of December 30, 2024, according to data from DeFiLlama.

Source: DefiLlama

Ethereum’s dominance stems from its established DeFi ecosystem, which hosts the most diverse and advanced set of decentralized applications, supported by its early adoption and a strong developer community. However, Ethereum’s supremacy in TVL is in stark contrast to its position in daily active addresses, where it is not leading. This difference highlights the different nature of these metrics: TVL captures capital tied up in protocols, requiring fewer but larger transactions, while daily active addresses emphasize the frequency of user interactions, often tied to smaller, retail-driven activities.

Solana and TRON, which rank second and third in terms of daily active addresses, are significantly lower in the TVL rankings. Solana accounts for 6.94% of the total TVL, and TRON accounts for 6.07%, putting them behind Ethereum.

The contrast between TVL and daily active addresses highlights the diverse strengths of blockchain networks. While Ethereum excels in financial liquidity and high-value applications, chains like Solana and TRON thrive on user engagement and transaction activity. Together, these metrics provide a more nuanced understanding of the blockchain landscape, demonstrating that no single metric can paint the full picture of a network’s adoption and utility.

Featured image via Pixabay