- Ethereum ETFs staged a recovery, bringing relief to the 17 million holders in the red.

- ETH will have to go one step further to stay ahead in the competitive altcoin race.

The New Year buzz is still quite active now, especially with Bitcoin [BTC] consolidate on graphs. Historically, the first quarter has been bullish for the crypto market, typically creating an environment well suited for altcoins to raise capital.

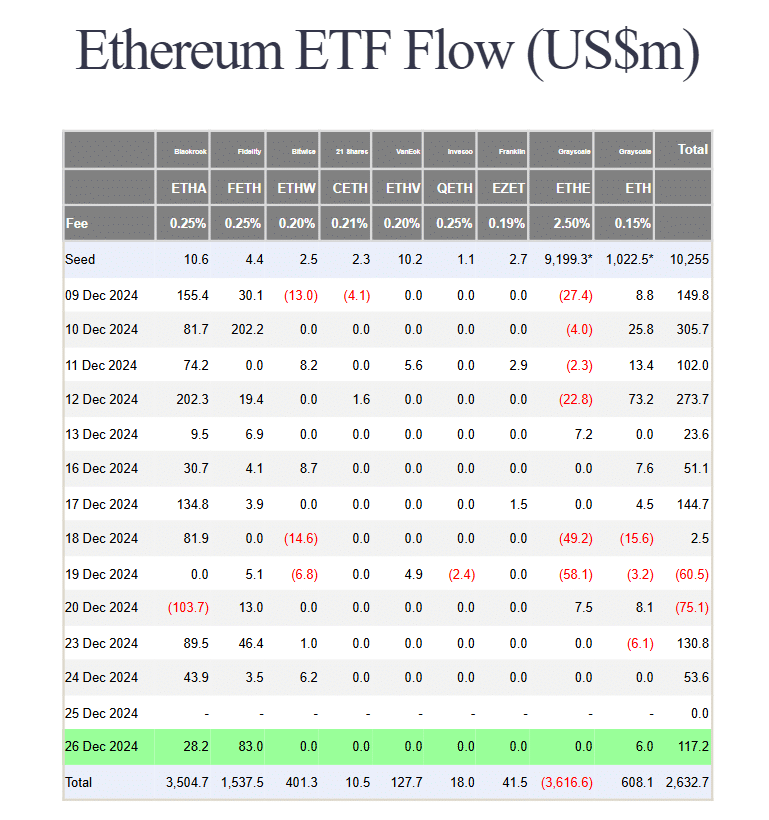

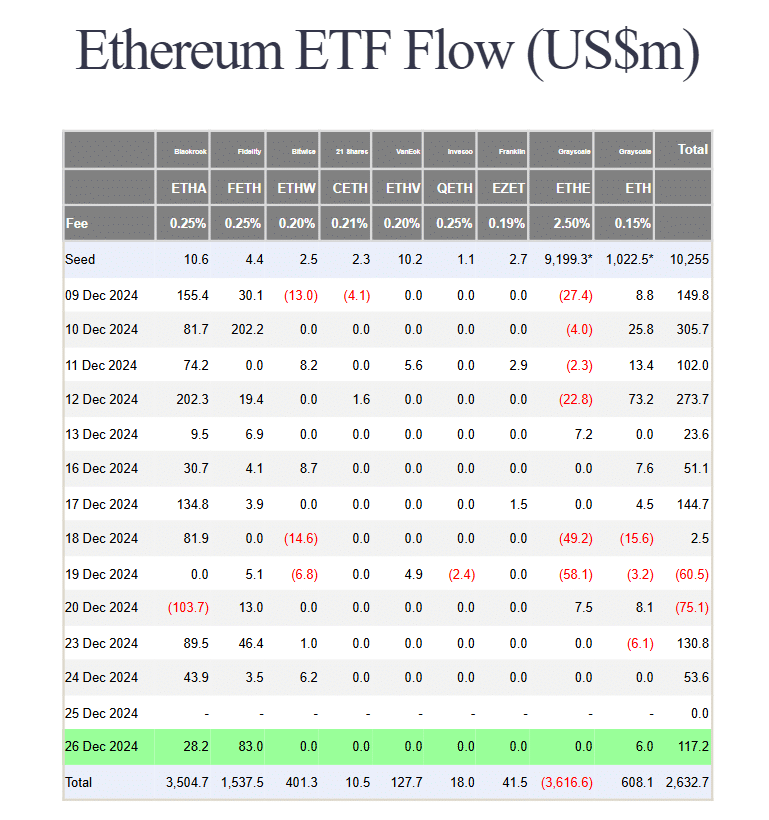

Meanwhile, Ethereum [ETH] ETFs are also gaining popularity, with impressive inflows. In fact, Fidelity’s Ethereum ETF (FETH) saw net inflows of $83 million — a sign that investors may be starting 2025 with an emphasis on diversification.

While it may be too early to draw firm conclusions, Ethereum’s 1.04% price increase seemed to point to an emerging trend worth keeping an eye on.

There is still a long way to go for Ethereum

Since the ‘Trump pump’, the market has seen several momentum shifts. What initially looked like a strong bull rally, with Bitcoin reaching the $100,000 mark by the end of the year, has since waned. As a result, ‘high risk’ sentiment is clearly keeping investors cautious.

Ethereum is not immune to this shift either. After the initial rise, the price fell back to the level of a month ago, wiping out much of the election-related gains. With approximately 17 million Ethereum addresses Now that it is in the red, the pressure for a rebound increases.

And yet, amid the uncertainty, net inflows of $117 million through ETH ETFs are providing much-needed relief.

Source: Farside Investors

This is a positive sign, especially after two consecutive days of subdued institutional interest. A sign that Ethereum may still be ready for recovery.

That said, a full recovery to $4,000 still seems far away. Technically this would require an 18% jump. And given the recent performance over the past thirty days, this may seem a bit too optimistic in the short term.

There are other players in the race for dominance

Like Ethereum, other altcoins are improving their underlying technology to offer investors attractive long-term prospects. One that particularly stands out is XRP.

Interestingly, XRP’s daily price action at the time of writing revealed signs of consolidation, with intense buying and selling pressure creating a stalemate. This tug-of-war has caught the attention of major players, and it has bet on XRP for potentially big returns.

With its impressive triple-digit profits, practical example integrations and strong support from whales,

Read Ethereum [ETH] Price forecast 2025-2026

On the other hand, Ethereum’s chart has been more volatile. After reaching its yearly high of $4,106 just 10 days ago, ETH fell as much as 21% in a week. So while a recovery is possible, it is slow, indicating a lack of immediate buying interest in the market.

Looking ahead, the next few days could be a make-or-break for Ethereum. While fresh capital could push BTC into consolidation, potentially benefiting altcoins like Ethereum, the current lack of consistent support in ETH’s price means a quick recovery is unlikely.

Furthermore, competition between altcoins is increasing and Ethereum will need to show more consistency if it wants to stay at the forefront of the pack.