- 58.9% of the top AAVE traders had short positions at the time of writing.

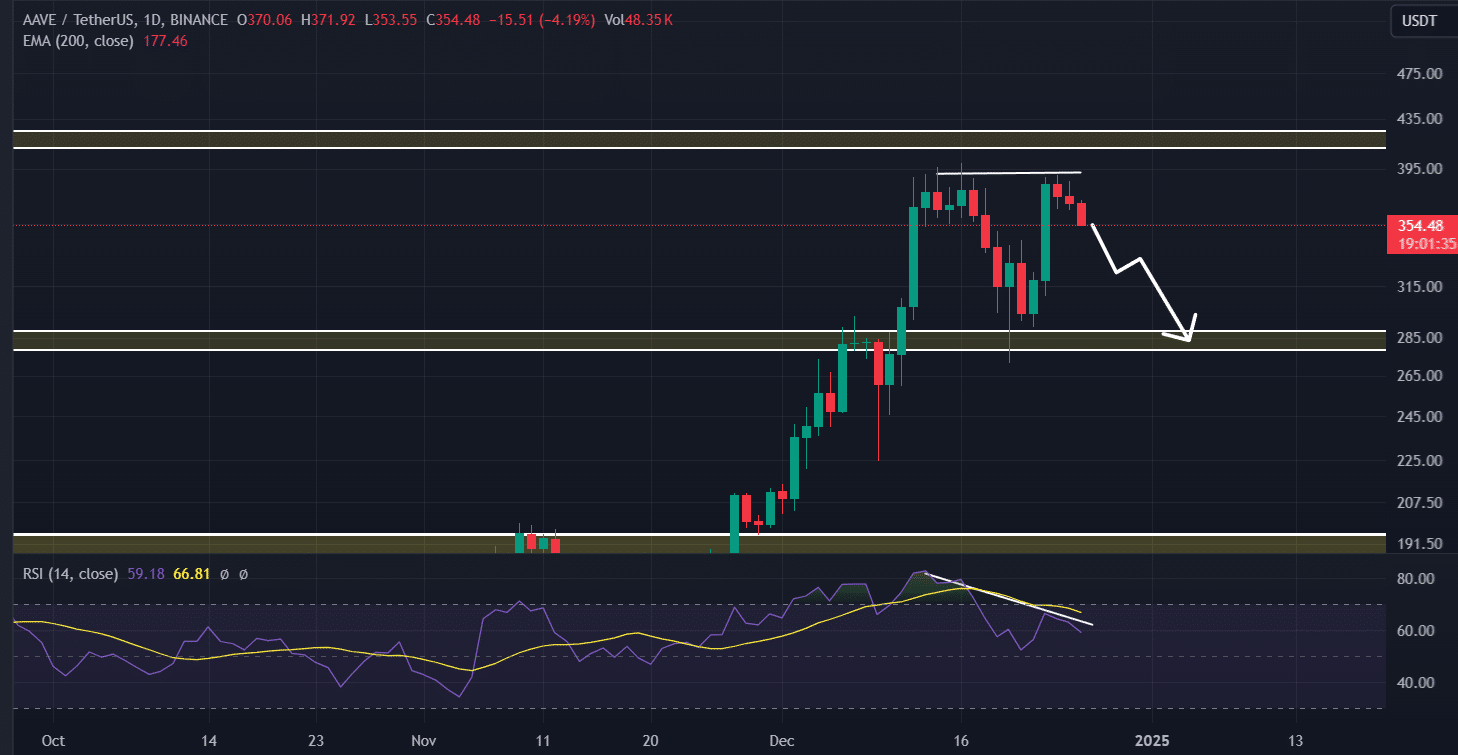

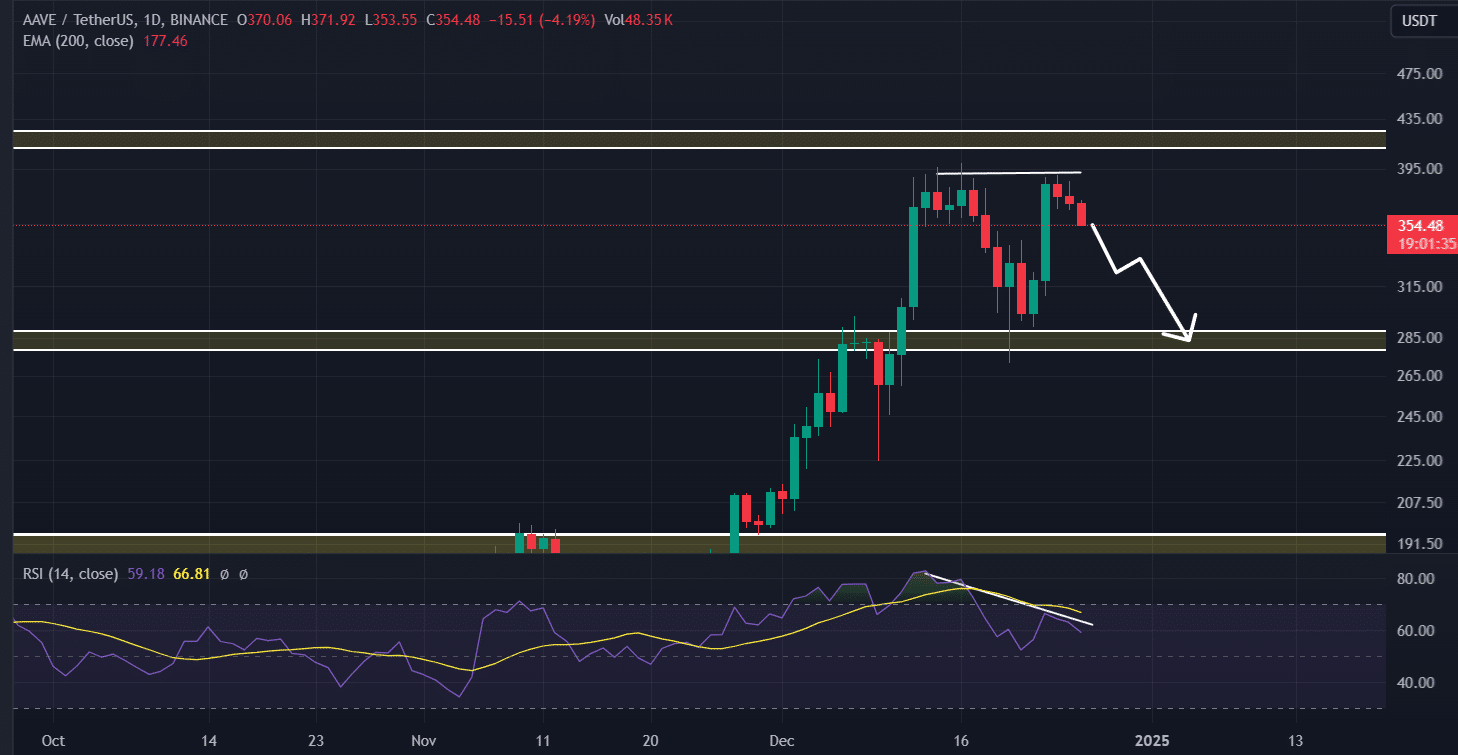

- The daily chart of AAVE showed a bearish divergence and a double-top price action pattern.

Amid ongoing market uncertainty, Aave [AAVE] appeared poised for a price drop in the coming days after a bearish price action pattern emerged on the daily time frame.

Besides the bearish price action, another potential factor contributing to AAVE’s negative outlook is market sentiment and the likelihood of profit booking on the altcoin.

In addition to AAVE, other major cryptocurrencies, including Bitcoin [BTC]Ethereum [ETH]and XRP are also experiencing similar trends.

AAVE looks bearish

AMBCrypto’s look at the on-chain analytics company Mint glass revealed that AAVE’s Spot Inflow/Outflow showed that exchanges have witnessed a remarkable inflow of over $5.2 million in AAVE.

In the cryptocurrency landscape, inflows refer to the movement of assets from wallets to exchanges, often signaling potential selling pressure that could lead to a price drop.

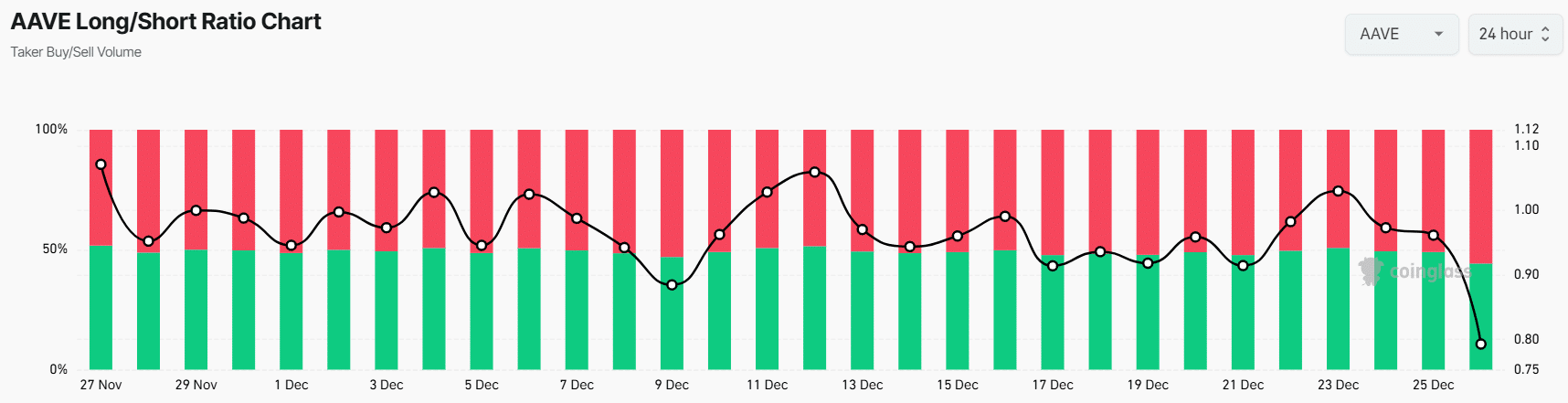

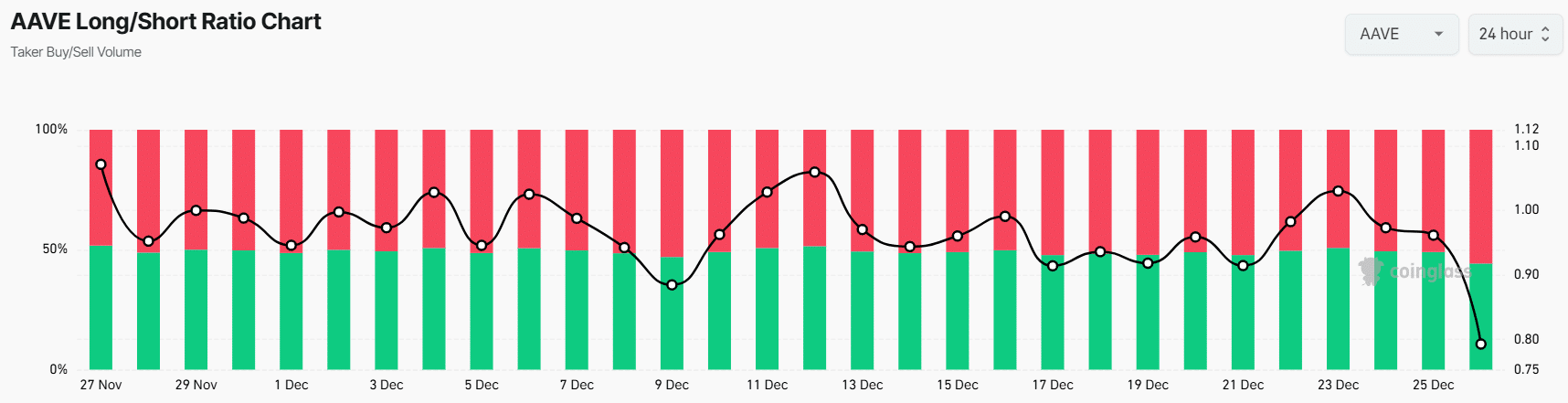

In addition to the recent activity from long-term holders, traders appear to be betting on the short side, anticipating a possible price drop, as reported by Coinglass.

At the time of writing, AAVE’s Long/Short ratio stood at 0.79, the lowest since late November 2024. A ratio below 1 indicates strong bearish sentiment among traders.

Source: Coinglass

58.9% of the top AAVE traders were short positions at the time, while 41.10% were short positions.

So it appears that traders and long-term holders are leaning more toward short positions, contributing to a bearish outlook for the asset. This trend is consistent with the recent formation of bearish price action.

AAVE technical analysis and upcoming levels

According to AMBCrypto’s technical analysis, AAVE has formed a bearish double-top price action pattern. The chart shows a bearish divergence on the daily time frame, indicating a potential price decline in the coming days.

Source: TradingView

Based on the recent price action and historical momentum, the value is likely to drop 18% and reach the $290 mark in the near future.

Read Aave’s [AAVE] Price forecast 2025–2026

Current price momentum

At the time of writing, AAVE was trading around $350, having dropped more than 9% in the past 24 hours.

During the same period, trading volume fell 28%, indicating reduced participation from traders and investors amid the bearish price action.