- A whale dumped WIF and BONK to increase Fartcoin’s long position to $9.3 million.

- The coin rose 52% on Christmas Eve and topped the mindshare of AI agents.

A whale has doubled Fartcoin [FARTCOIN]dump his dog hat [WIF] And Bonk [BONK] for the AI memecoin.

According to blockchain data analysis company LookOnChain, this is the big player exchanged $1.03M WIF and $833K BONK for Fartcoin. It now owns 7.55 million Fartcoin, worth $9.36 million at the time of writing.

This suggested that the whale believed that AI memecoins could outperform their older counterparts by 2025. But why Fartcoin and not other AI tokens?

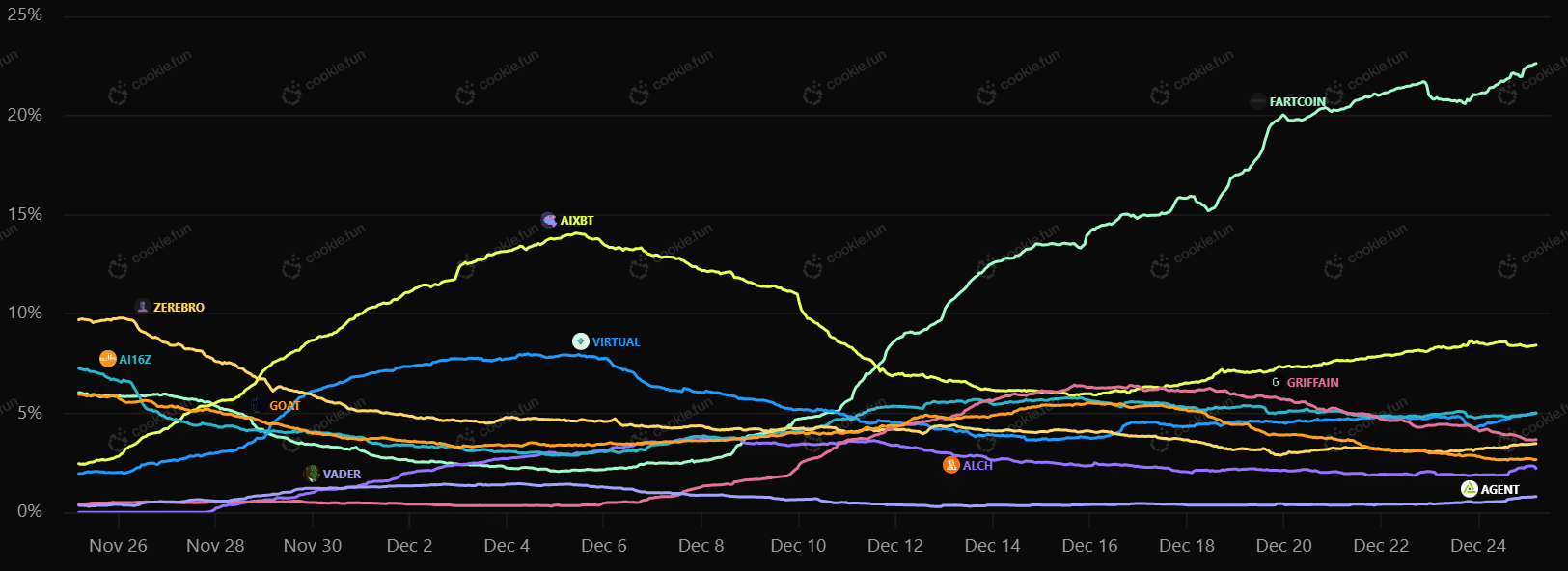

Fartcoin tops December mindshare

Some traders and investors tend to pick strong performers based on their mindshare or trading volume, both of which promote liquidity.

Since mid-December, Fartcoin has surpassed the mindshare of AI agents by 22% per Cookie.nicea data aggregation platform for agents. Only AIXBT came close with 8%, while Virtual [VIRTUAL] came third with 5%.

With its massive mindshare, Fartcoin has enjoyed strong price performance, even reversing its price Goatseus Maximus [GOAT]. Fartcoin and GOAT have even gained traction thanks to the adoption of the AI agent Truth Terminal.

So far in December, the coin is up almost 350%. After the whale movement, the AI meme coin rose 52% on Christmas Eve, perhaps making it one of the outliers enjoying a Christmas gathering.

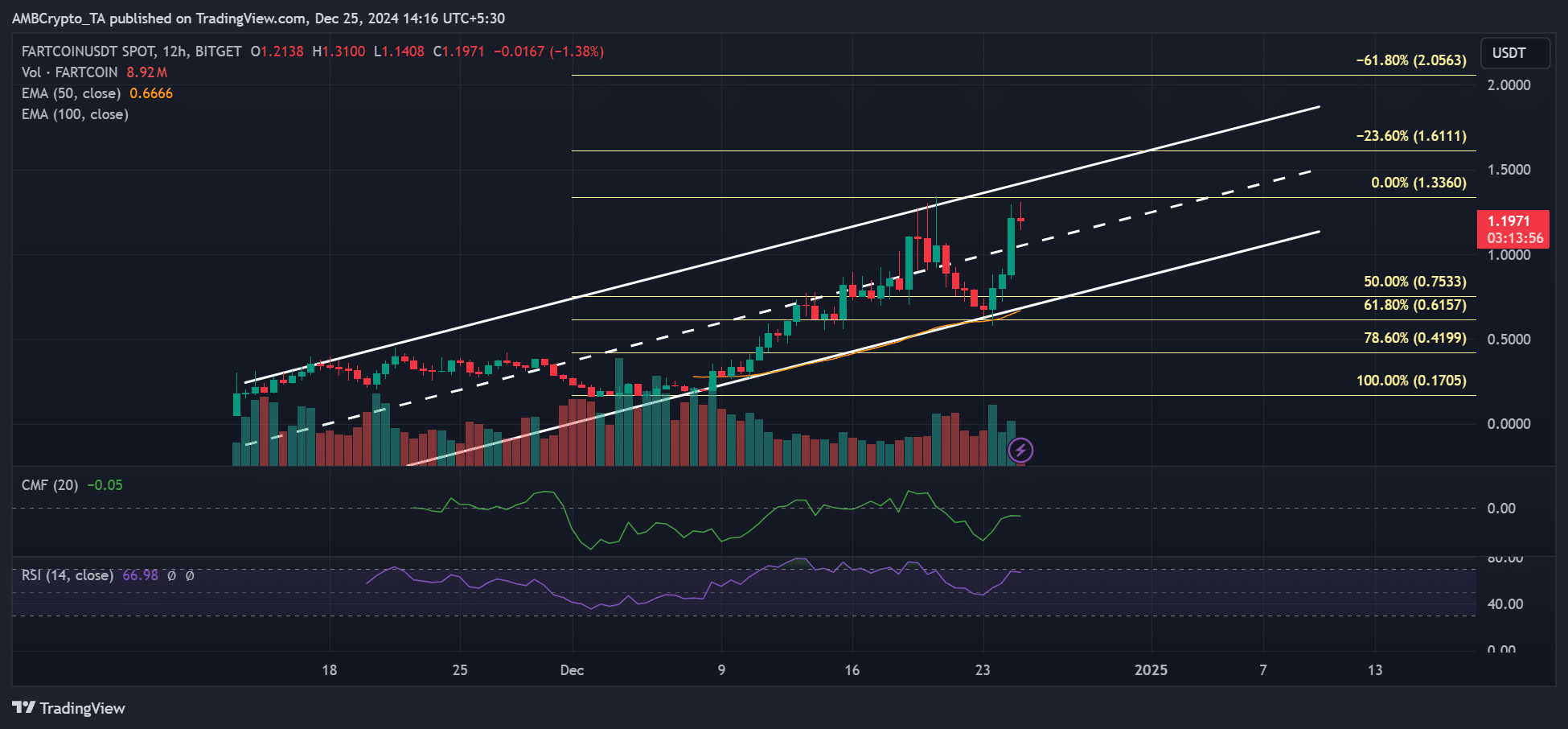

Source: FARTCOIN/USDT, TradingView

The recent pump has effectively erased early losses from December, but was close to reaching the range highs of around $1.4.

Any price rejection at the high end and a drop to the mid-range or low end of the range could be a great buying opportunity if strong mindshare is maintained.

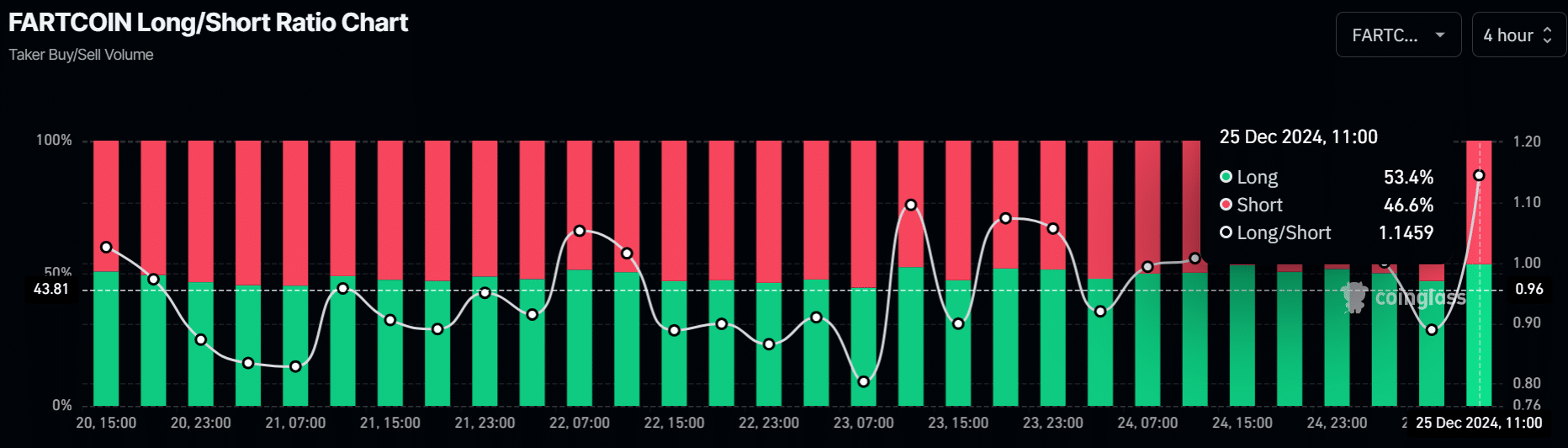

That said, derivatives facts showed bullish market sentiment, with trading volume increasing 120% in the last 24 hours and open interest (OI) rising to 45%.

Read Fartcoin [FARTCOIn] Price prediction 2024-2025

This underlined that the Christmas Eve rally was also driven by massive speculative trading in the futures market.

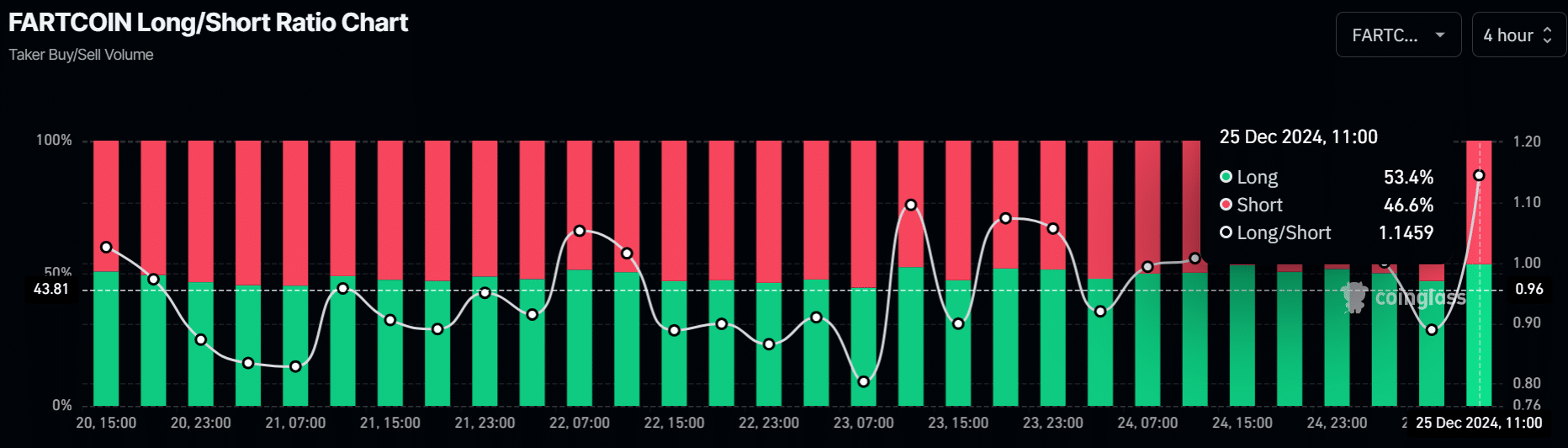

At the time of writing, short-term sentiment was still bullish, as evidenced by the overwhelming long and short positions according to the Long/Short ratio.

Source: Coinglass