- Binance will suspend FTM deposits and withdrawals and delist all its trading pairs.

- The report clarified that all FTM tokens will be exchanged to S at a 1:1 ratio.

Amid ongoing market uncertainty, Fantom’s native token, FTM, is making waves and attracting significant attention from crypto enthusiasts.

On December 24, BinanceThe world’s largest cryptocurrency exchange, has published a report highlighting that it will support Fantom’s rebranding and token swap.

What happens to FTM?

According to a recent report, Fantom will change its name to Sonic (S) in early January 2025. Following this rebranding announcement, Binance stated that it will suspend FTM deposits and withdrawals and delist all its trading pairs, including FTM/BTC, FTM/USDT, and FTM/ETH, effective on January 13, 2025, at 3:30 UTC.

Additionally, the FTM token will adopt the ticker “S” on Binance.

Once the rebranding process is complete, Binance will open trading for the trading pairs S/BTC, S/BNB, S/ETH, S/EUR, S/FDUSD, S/TRY, S/USDC and S/USDT starting January 16. 2025, at 8:00 UTC.

Following this announcement, traders and investors have expressed concerns about its impact on the FTM price. However, the report clarified that all FTM tokens will be exchanged to S at a ratio of 1:1 (1 FTM = 1 S), indicating that there will be no significant impact on the price.

At the time of writing, FTM was trading around $1 and has experienced a 0.35% decline in the last 24 hours. During the same period, trading volume increased by 37%, indicating greater participation from traders and investors after this update.

Fantom technical analysis and key levels

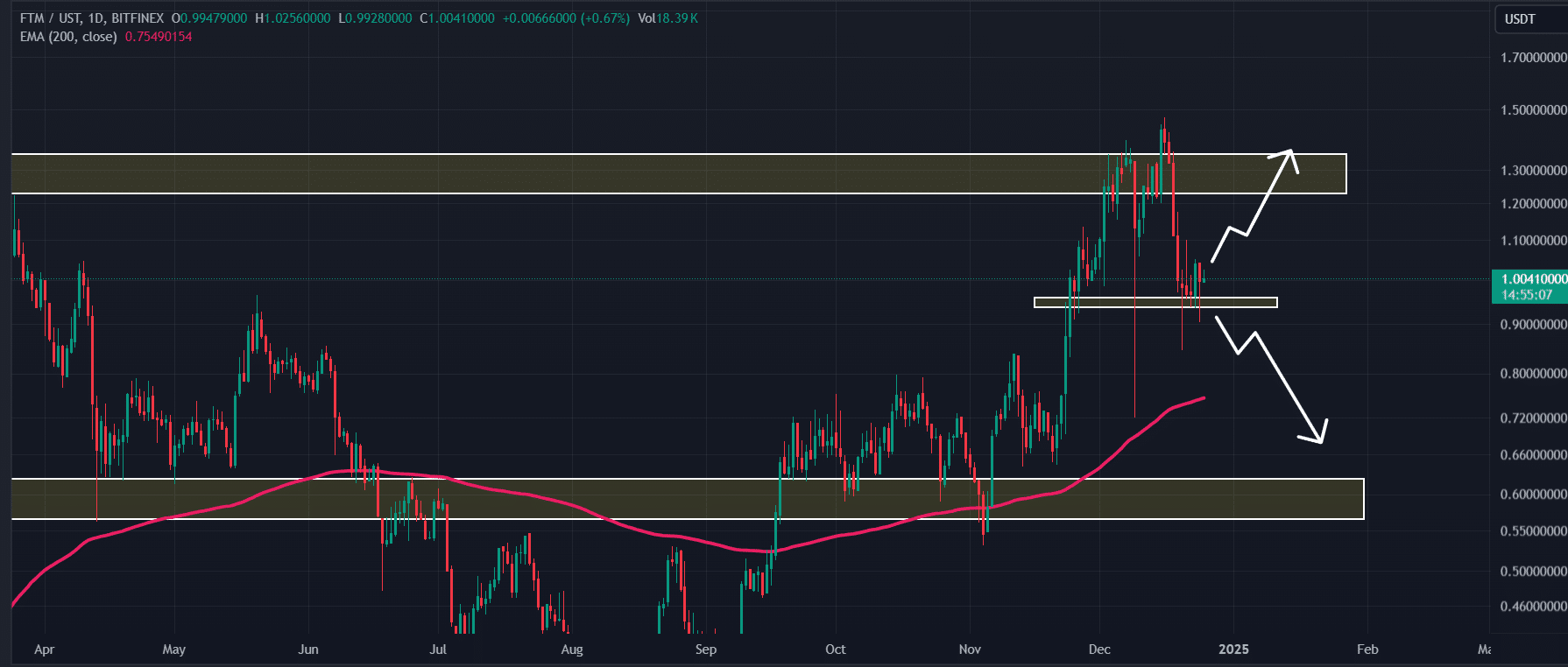

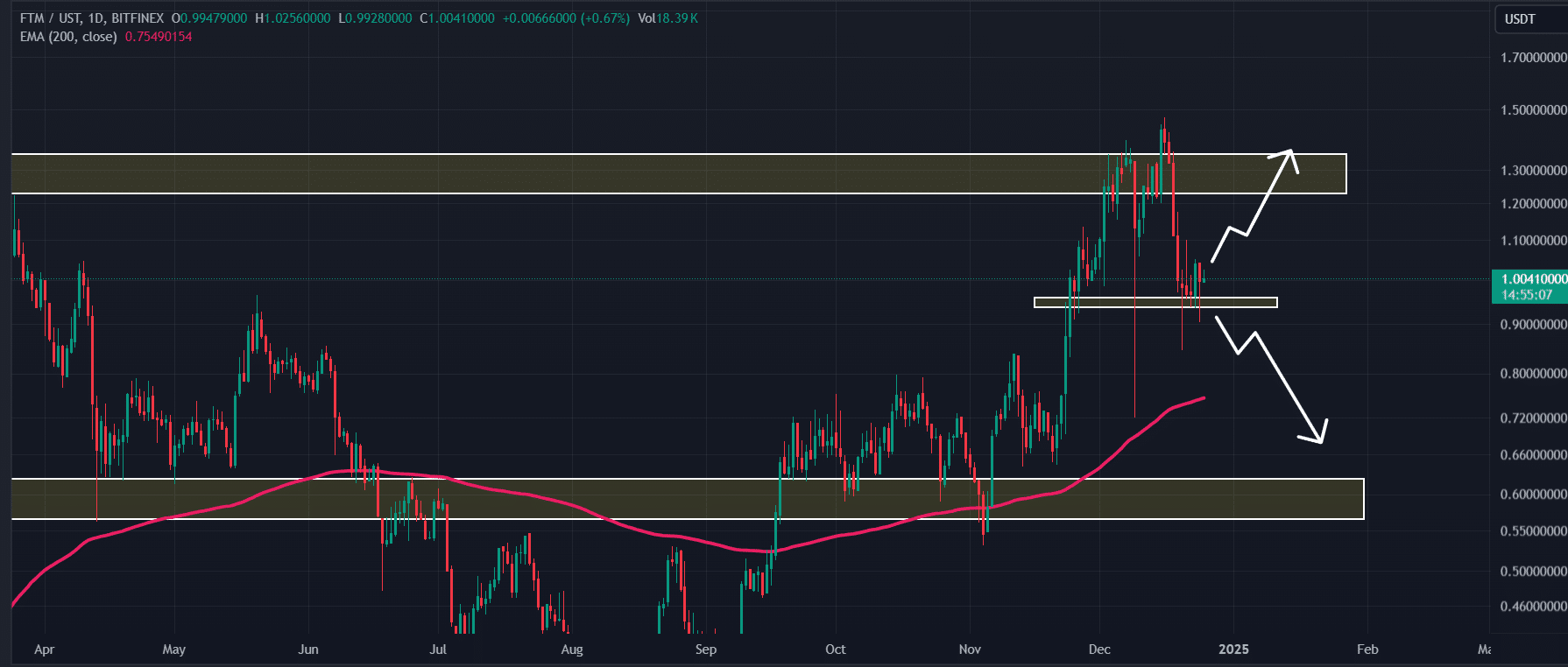

According to AMBCrypto’s technical analysis, FTM is at a crucial support level at $0.95.

Based on the recent price action and historical momentum, if the altcoin holds this support level, there is a high chance that it could rise 40% to reach the next resistance level of $1.43 in the future.

Source: TradingView

Conversely, if FTM fails to hold the $0.95 support level and closes a daily candle below $0.91, there is a high possibility that the price could fall by 30% to reach the next support level of $0.64 to reach.

Based on the price behavior at these support levels, traders and investors may encounter a buying or selling opportunity.

FTM’s bullish on-chain metrics

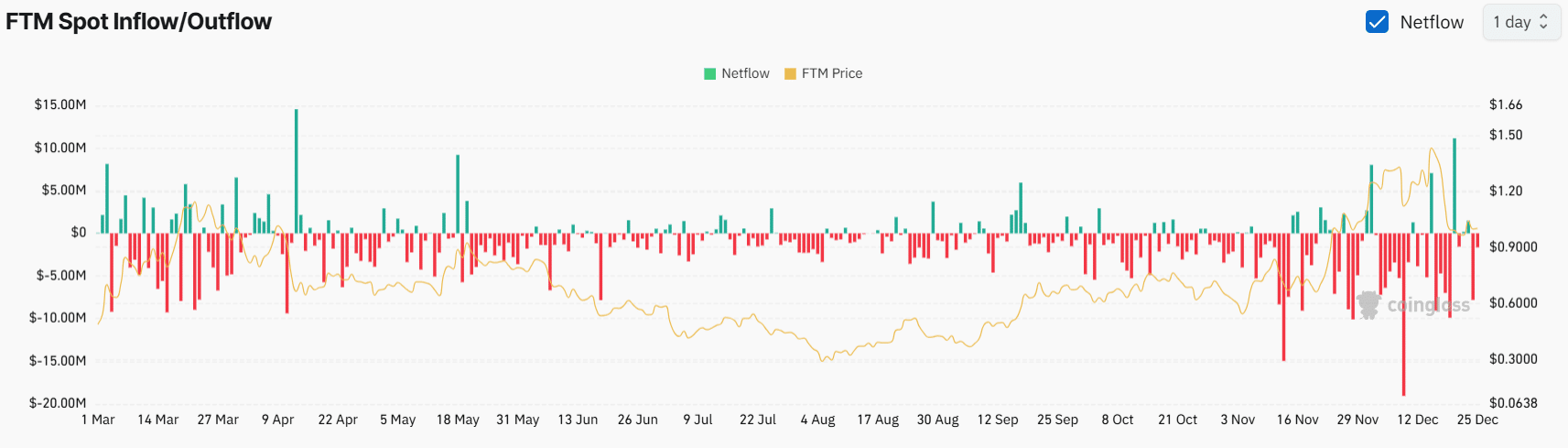

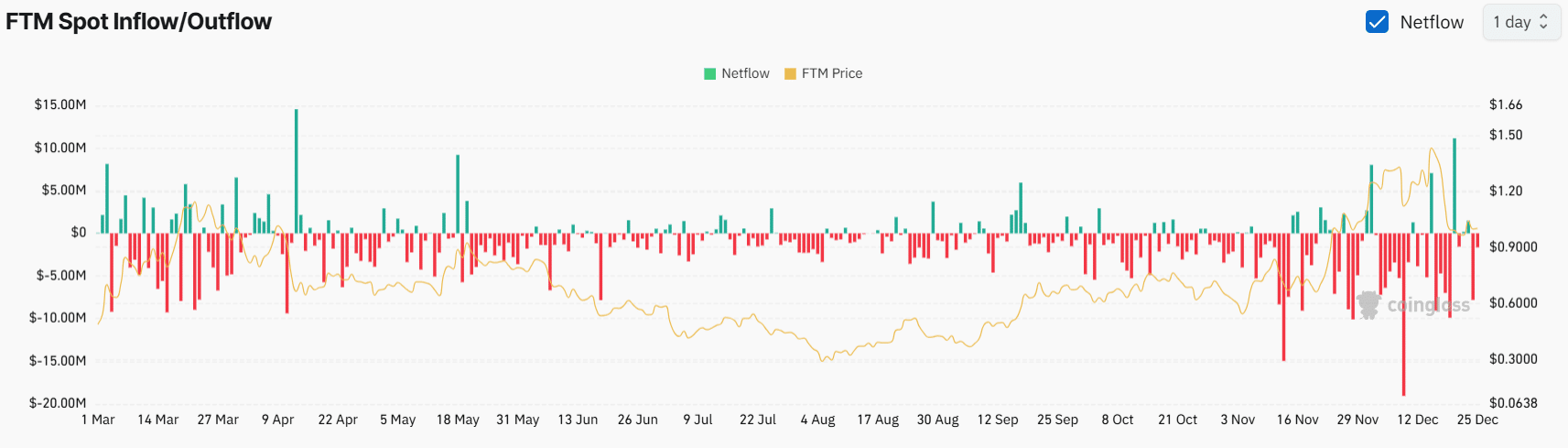

However, interest from traders and long-term holders following this announcement appears to be neutral as they continually build new positions and accumulate tokens, according to on-chain analytics firm Coinglass.

FTM spot inflow/outflow data shows that exchanges have witnessed a significant outflow of $9.5 million of FTM tokens in the last 24 hours.

These notable outflows indicate that long-term holders have withdrawn tokens from exchanges to wallets, indicating potential upside momentum and an ideal buying opportunity.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024-25

Meanwhile, FTM Open Interest (OI) is up 14%, indicating the formation of new positions and increased trader participation over the past 24 hours.

When these on-chain metrics are combined with the technical analysis, there are no bearish signs, pointing to potential upside momentum in the coming days.