- MicroStrategy seeks approval for an increase in share count of 10 billion MSTR.

- MSTR’s 263% YTD gain was more than double BTC’s 112%.

MicroStrategy, the pioneer of Bitcoin corporate treasury plans to increase the number of MSTR shares to 10 billion to accelerate the BTC acquisition program.

In one submit Together with the US regulator, the Securities and Exchange Commission (SEC), the company notified shareholders of a special meeting to seek approval for the share increase.

If the proposals are approved, the number of Class A common shares would increase from 330 million to 10.3 billion shares. Similarly, the preference share would be expanded from the current 5 million to 1 billion.

This would bring the total number of shares to over 11 billion, which the company said would help it achieve its BTC acquisition strategy, dubbed the ‘21/21 Plan.’

MicroStrategy to Buy More BTC?

The plan was first announced in October 2024. It aims to raise $42 billion in capital over the next three years through the issuance of shares ($21 billion) and $21 billion of debt instruments (convertible bonds).

Part of the board’s statement on the recent proposal to increase the number of shares read:

“We are seeking shareholder approval to increase the number of authorized shares of preferred stock so that we can expand the types of securities we offer to the market, in execution of our business strategy, including as part of our 21/21 plan, and /or or undertake other strategic activities without using cash or Class A shares.”

Commenting on the update, Joe Burnett, director of market research at Unchained, said: claimed that this move could push the BTC price higher. He said,

“MSTR wants to issue an additional 10 billion shares. At current market prices, that would be $3.3 trillion – or 36 million Bitcoins… I suspect the price of Bitcoin will go much higher.”

However, others were concerned that this move could dilute the value of the current MSTR.

Since announcing the 21/21 plan, MicroStrategy has acquired 192,042 Bitcoins, including the last offer of 5,262 BTC announced on December 23. The company now owns 444,262 BTC, worth almost $42 billion at current prices.

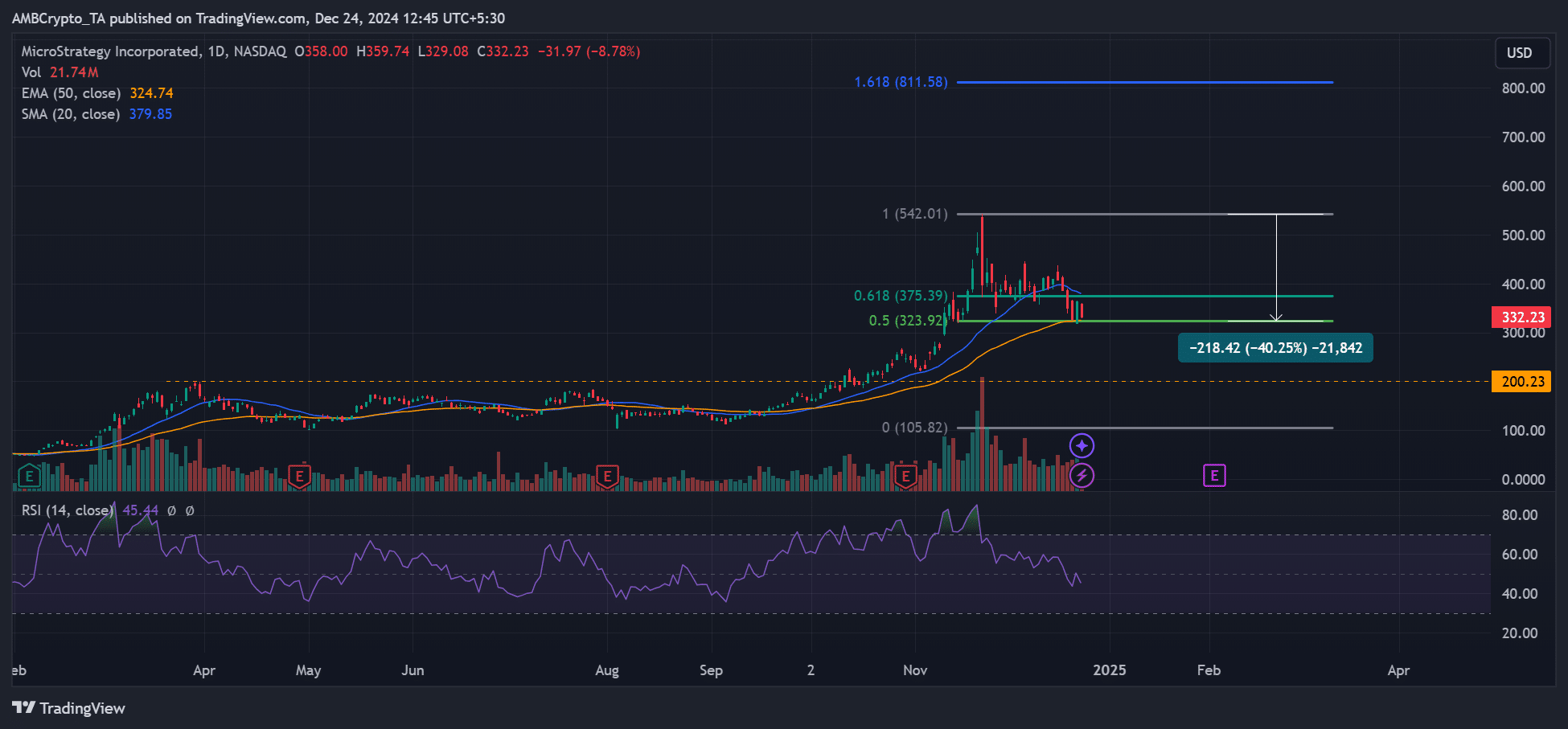

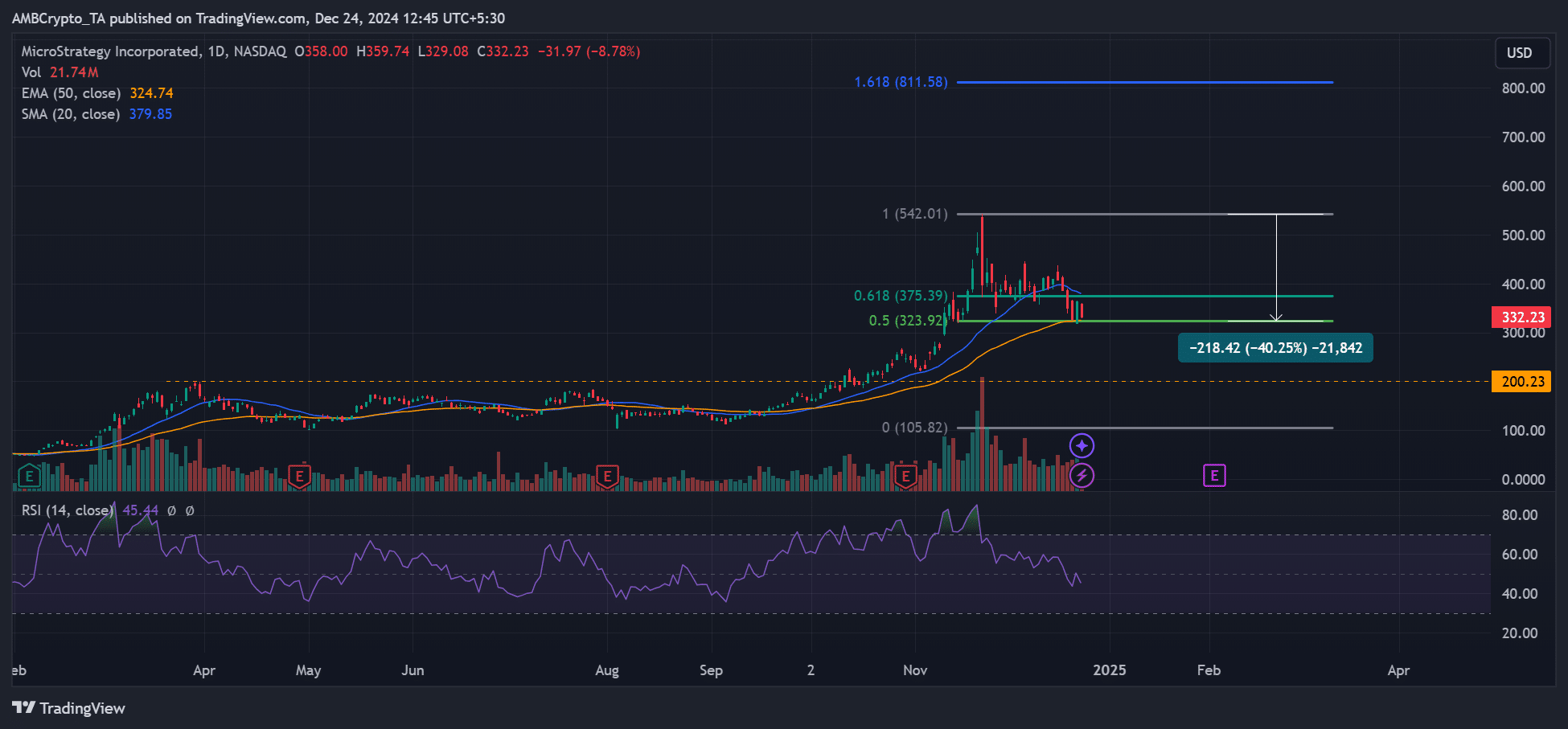

MSTR rose 11% after MicroStrategy’s latest BTC offer. However, the stock price fell almost 40% during the BTC correction from $108,000 to a low of $92,000. But it posted a 263% year-over-year (YTD) gain, compared to BTC’s 112%.

Source: MSTR, TradingView

Although at the time of writing, MSTR was defending the 50% Fib level and the 50-day EMA confluence at $323; any additional BTC correction could lower the stock’s value.