- The CRV is up 7.33% in the last 24 hours.

- Curve Dao defies market odds amid increased accumulation.

While Bitcoin [BTC] and other altcoins have experienced some declines, Curve DAO [CRV] determines his own path.

After hitting a low of $0.687, Curve Dao has risen on the price charts for three consecutive days.

In recent days, the altcoin has managed to reach a high of $0.93. At the time of writing, Curve Dao was trading at $0.836. This represented an increase of 7.33% in 24 hours. Prior to these gains, CRV was in a downward trajectory, falling 22.94% on the weekly charts.

Now that the trend reversal seems inevitable, the question arises whether CRV can continue to defy the bearish trend in the crypto markets and continue the uptrend.

What CRV graphs indicate

According to AMBCrypto’s analysis, Curve Dao is building upward momentum amid increased retail and whale accumulation.

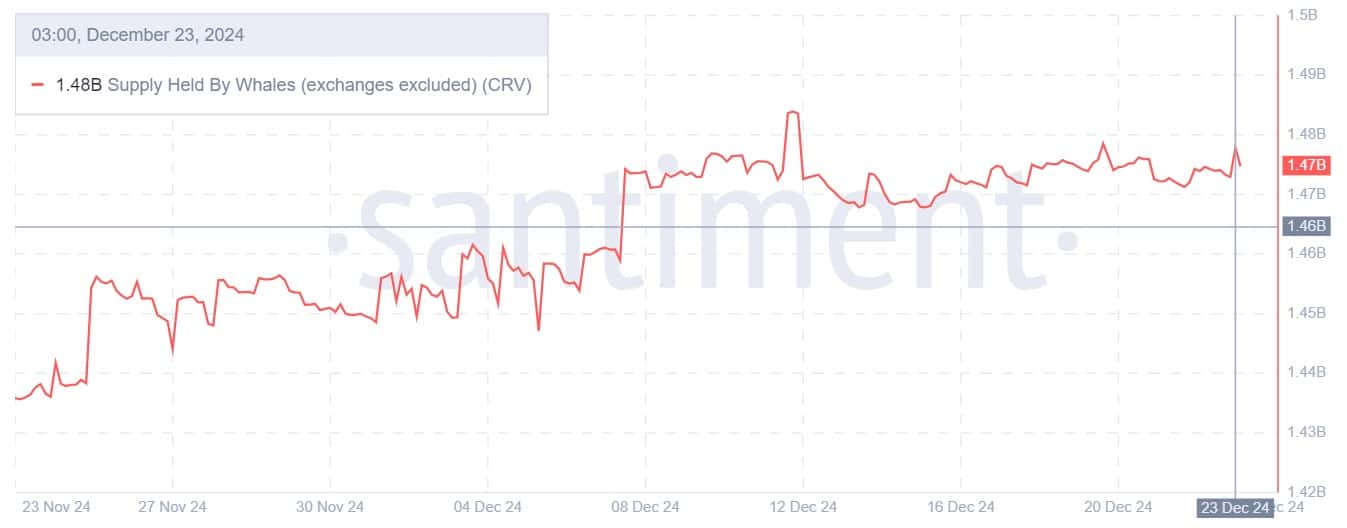

Source: Santiment

For starters, we can see this increased accumulation among large keepers with the increase in whale supply, from 1.44 billion to 1.48 billion.

For example, whales have purchased 400 million tokens in recent weeks. When whales turn to accumulation, it shows their confidence in the market and prices are expected to rise in the near future.

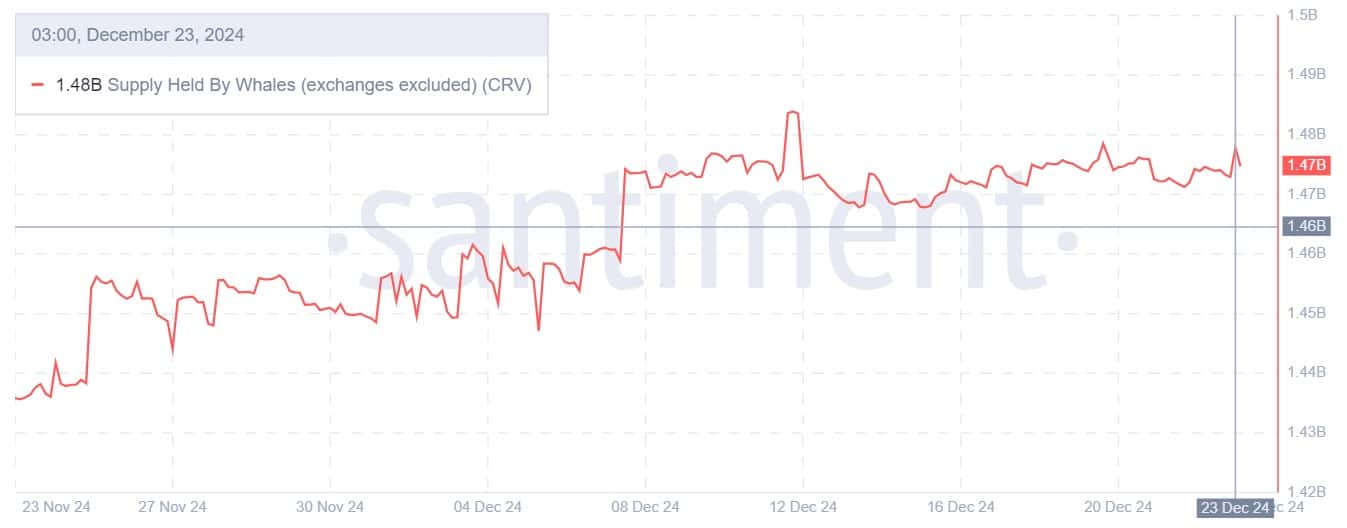

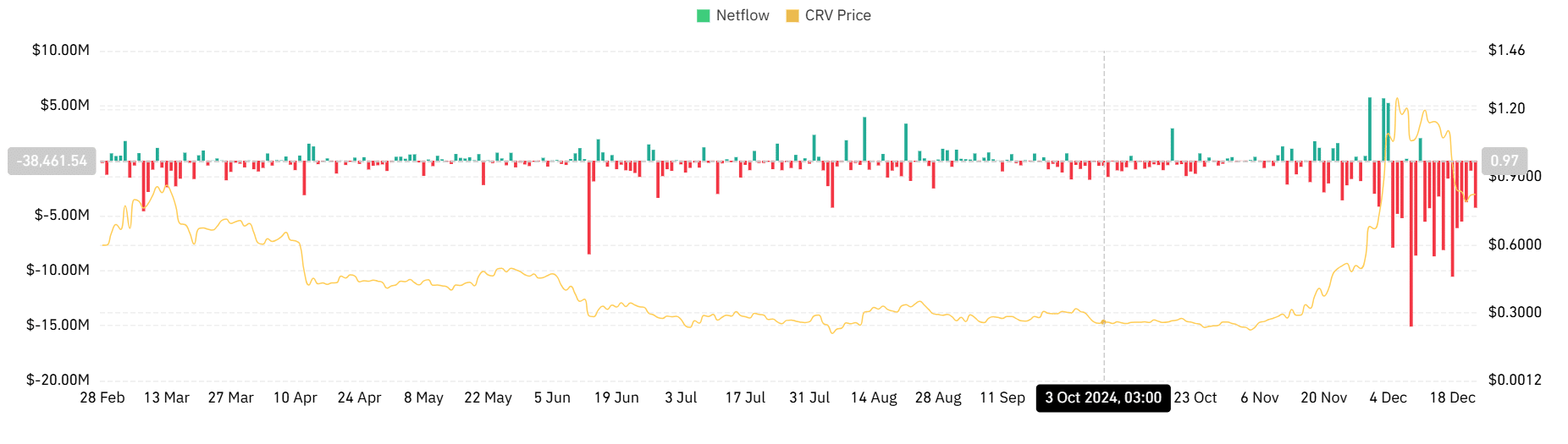

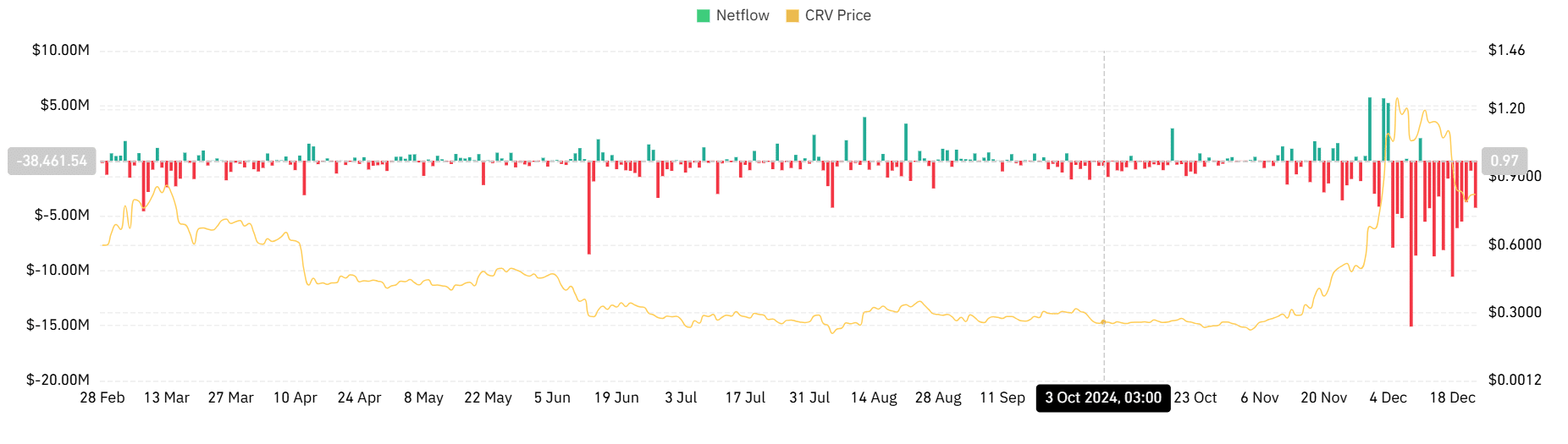

Source: Coinglass

Additionally, Curve’s spot net flow has remained negative over the past week, indicating that investors are actively accumulating CRV. A negative net flow in the spot market implies that most traders are withdrawing their assets from the exchanges into private portfolios or cold storage.

This often indicates accumulation and long-term bullish prospects. When traders withdraw assets from exchanges, the supply for immediate supply decreases.

Source: Tradingview

This bullish outlook is further evidenced by CRV’s bullish crossover on its Stoch RSI. The crossover indicates that recent prices are closing closer to highs, indicating increasing bullish momentum.

This further indicates a possible reversal of the downtrend to the uptrend.

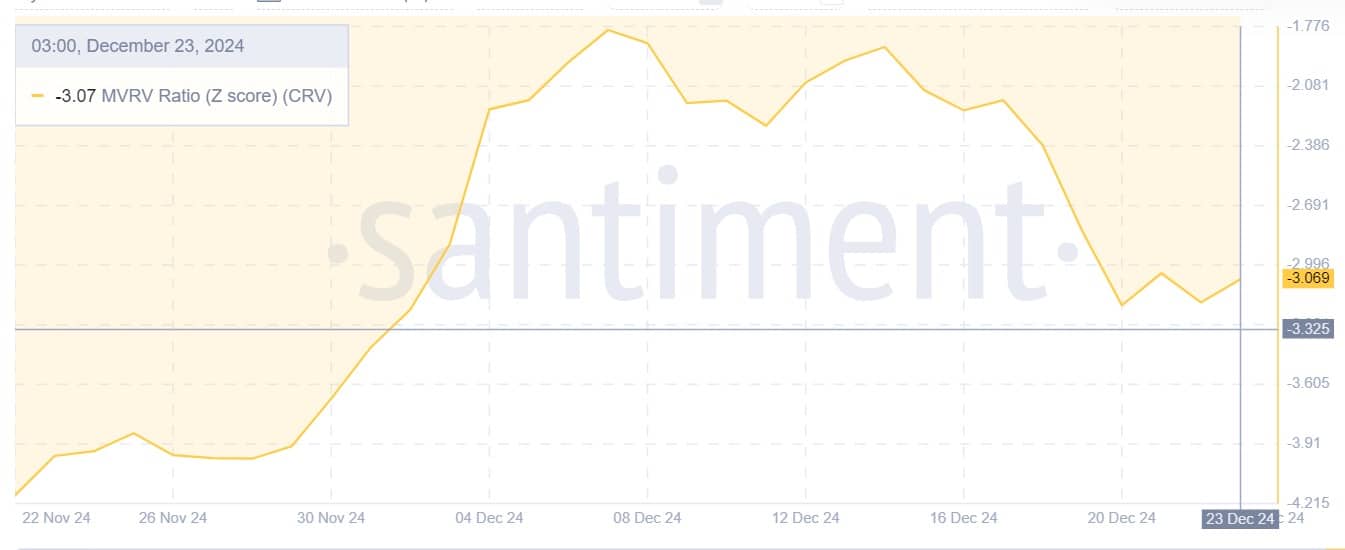

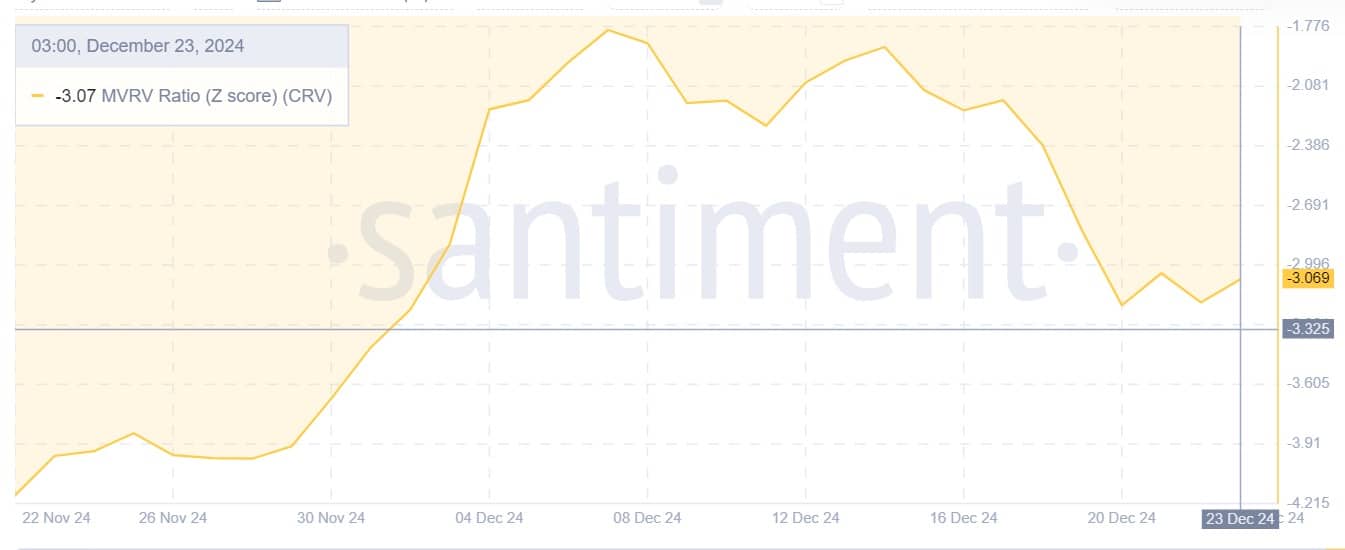

Source: Santiment

Finally, CRV’s MVRV score ratio indicates that the asset is currently undervalued. With a negative value of -3.07, this indicates bearish sentiment in the short term. Although bearish, undervaluation presents a buying opportunity as investors buy the dip.

Is your portfolio green? Then view the CRV Profit Calculator

Will the upward trend continue?

Simply put, Curve Dao is currently bucking the bearish trend due to increased accumulation as buyers enter the market to buy the dip. With both retailers and whales being bullish, it looks like CRV is poised for a trend reversal and the uptrend could continue.

If these conditions continue, CRV could see more gains on the price charts and regain the $1.1 resistance level. However, if the bears outweigh the bulls again, CRV risks a dip to $0.69.