This article is available in Spanish.

In his last video published on December 21, crypto analyst Rekt Capital attempted to answer the question “What is the worst case scenario for Bitcoin right now?” to answer. After reaching a new all-time high at $108,374 on December 17, the BTC price has fallen by more than -11%.

How Low Can the Bitcoin Price Go?

Rekt Capital placed Bitcoin’s price decline in a historical perspective and underlined the historical importance of weeks 6, 7 and 8 in an ‘uptrend in price development’. Based on previous cycles such as 2013, 2016-2017 and 2021, he explained that Bitcoin has a strong tendency to correct during these specific periods, with some dips reaching as much as 34% or even higher.

“Understanding these weeks is critical as they are often problematic for Bitcoin,” Rekt Capital said, citing previous cycles that saw significant downturns within this time frame. For example, in week 7 of the 2013 cycle, Bitcoin had a dramatic pullback of 75% over 13 weeks. Similarly, the 2016-2017 period saw a 34% decline in week 8, highlighting the recurring vulnerability during these specific weeks.

Related reading

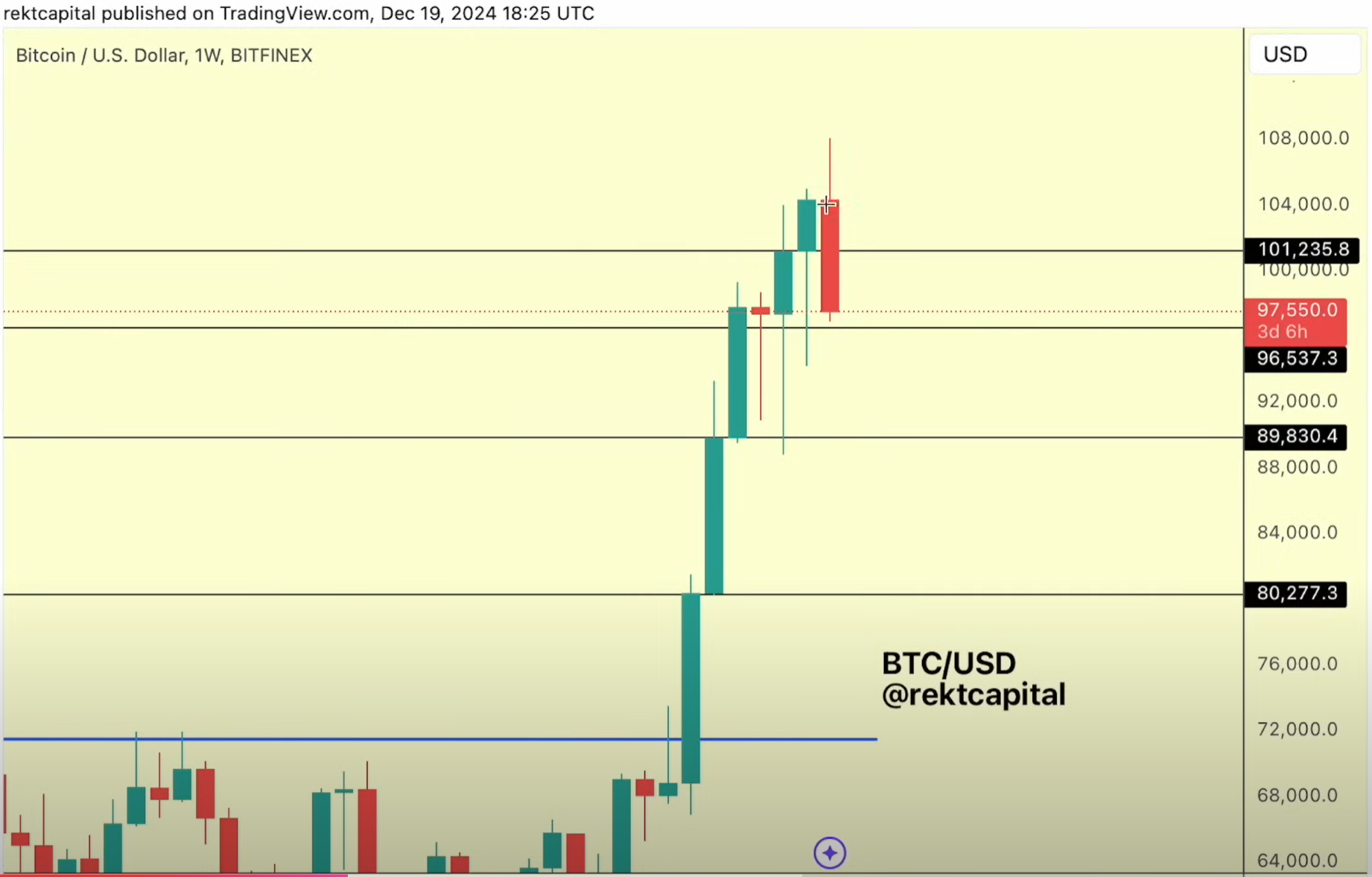

As of the current cycle, Bitcoin has undergone a retracement of over 10%, putting the price in a historically critical support zone of $96,537 on the weekly chart. Rekt Capital emphasized the importance of this support level, noting: “This area of historic support has enabled the move towards $108,000.” He warned that failure to maintain this support could lead to a more severe correction to $89,830.

While examining the price action over the past few days, Rekt Capital pointed out the emergence of a bearish engulfing candle in the weekly time frame – a technical indicator often associated with potential reversals. “We are losing resistance that has turned into support,” he noted. This loss signals a possible transition into a correction period as the price struggles to maintain its upward trajectory.

Related reading

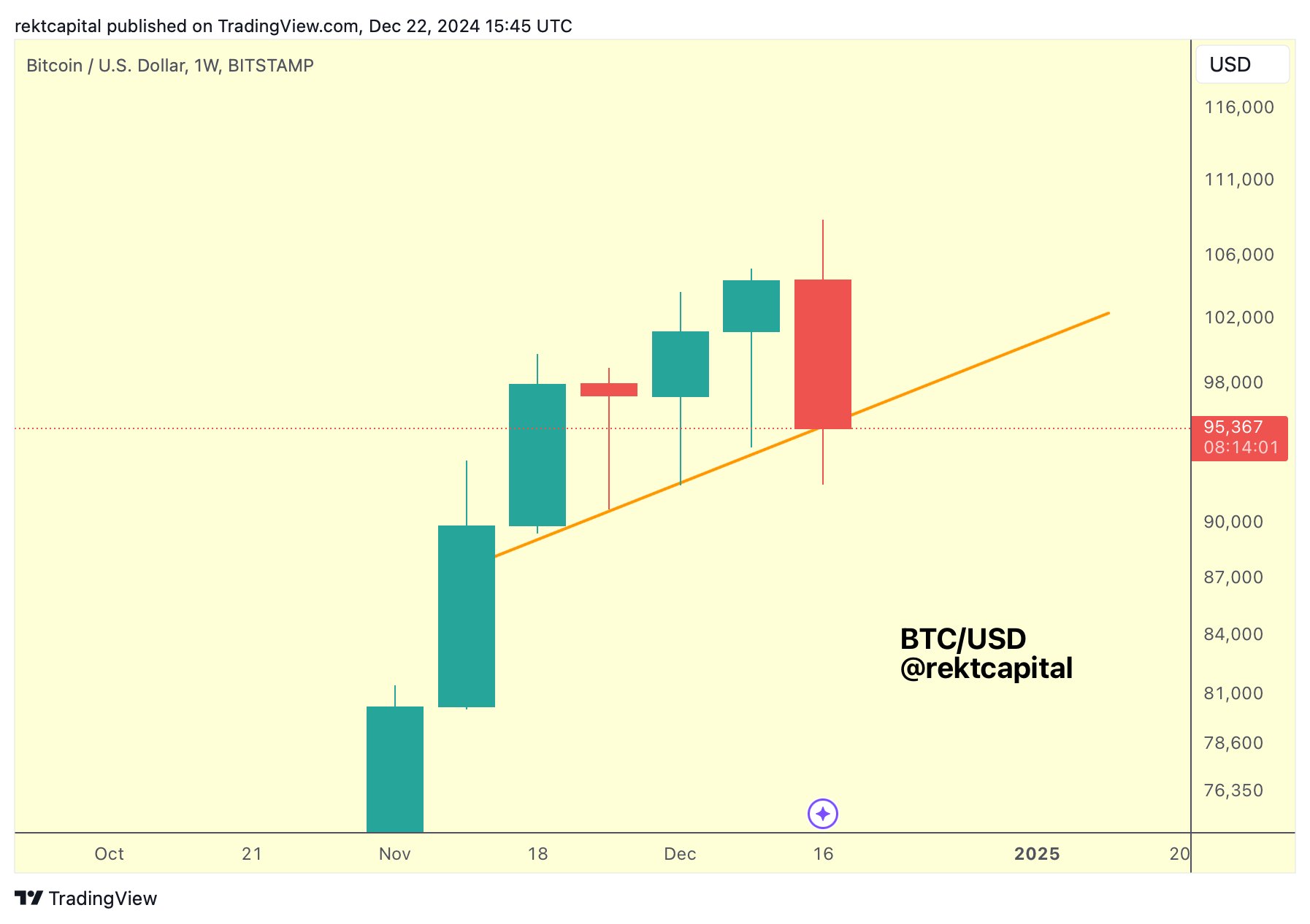

Rekt Capital also pointed out in its analysis the importance of maintaining the five-week technical line. “If we lose this five-week technical uptrend and the orange trendline, it would be increasing evidence that we may be moving into a correction period,” he warned.

Additionally, he addressed the CME gap between the $78,000 and $80,000 price levels, a crucial area that remains unfilled. “Plunging into dips of 26%, 27% and 28% could fill the entire CME gap,” Rekt Capital said.

Historically, CME gaps have tended to be filled, while there are some that have never been filled.

Despite all the warning signs, Rekt Capital maintains a bullish stance over the long term. “These pullbacks enable future upward trends in the parabolic phase of the cycle,” he explained. Based on previous cycles, he illustrated how corrections have historically provided the necessary “breathing space” for the market.

For example, in the 2021 cycle, Bitcoin experienced a 16% pullback in week 6 and an 8% decline in week 8, yet the overall trend continued to rise. Likewise, the current 10% retracement, while significant, could serve as a preliminary stage for the next phase of price discovery.

At the time of writing, BTC was trading at $95,000.

Featured image created with DALL.E, chart from TradingView.com