- Spot Bitcoin ETFs absorbed 4,349.7 BTC, far exceeding the supply from miners this week.

- Institutional demand reduces liquidity, increasing Bitcoin’s price sensitivity and volatility risks.

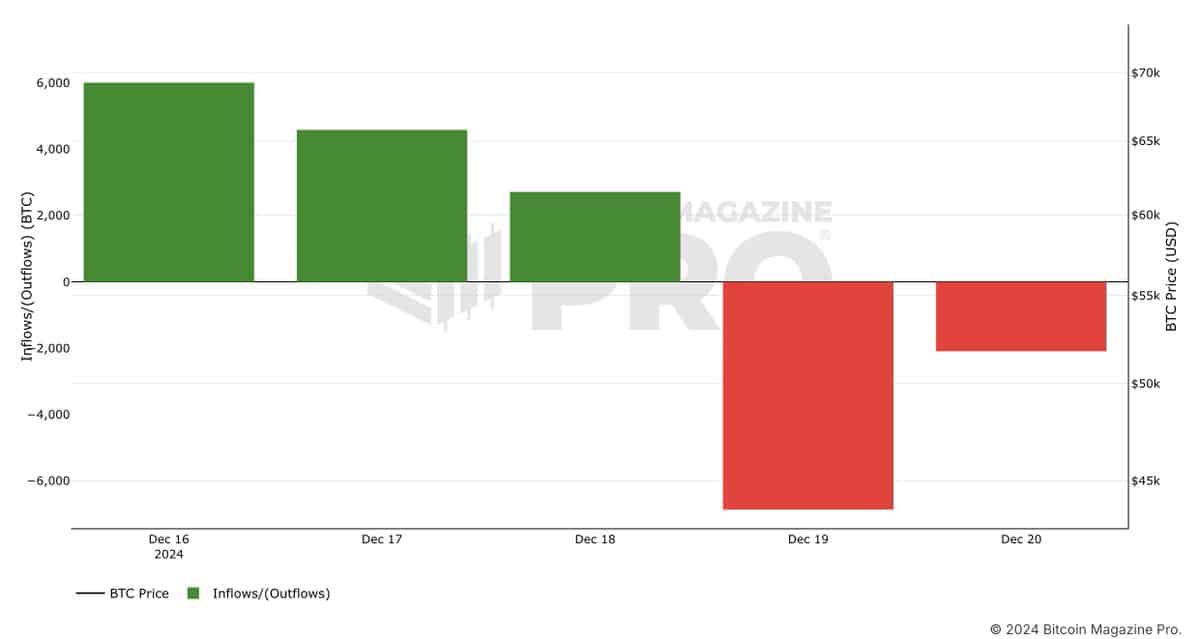

Institutional demand for Bitcoin [BTC] shows no signs of abating even with price volatility. In the past week, spot Bitcoin ETFs recorded inflows of 4,349.7 BTC, worth $423.6 million – almost double the 2,250 BTC mined during the same period.

This imbalance highlights the growing dominance of institutional investors in shaping market dynamics and raises critical questions about Bitcoin’s ability to meet escalating demand.

Bitcoin ETFs absorb liquidity faster than miners supply it

Place Bitcoin ETFs have emerged as a cornerstone for institutional exposure to Bitcoin, offering a simplified alternative to direct asset custody. This week’s inflows are an example of the changing dynamics, with ETFs accumulating more BTC than miners can produce.

Source:

The difference between ETF inflows and miner output reflects tighter liquidity in Bitcoin markets. As miners grapple with post-halving challenges, ETFs continue to absorb a significant portion of the circulating supply.

Institutional investors, undeterred by the recent price declines, appear committed to Bitcoin as a long-term macroeconomic hedge, reinforcing its appeal beyond speculative trading.

Institutional inflow dominates

In December alone, spot Bitcoin ETFs attracted $5.5 billion in inflows, further widening the gap between supply and demand. This increase in demand illustrates institutional confidence in Bitcoin’s continued potential despite price corrections.

However, the imbalance could increase market volatility as limited liquidity makes prices more sensitive to shifts in investor sentiment.

The increasing dependence on institutional capital underlines Bitcoin’s evolving market structure. While this trend strengthens its legitimacy as a macroeconomic asset, it introduces risks related to concentrated demand, increasing both price potential and downside volatility.

The liquidity crisis increases volatility risk

The continued mismatch between ETF inflows and miner production has led to a liquidity crisis, positioning Bitcoin for increased price sensitivity.

If institutional demand remains robust, limited supply could create upward price pressure. Conversely, the concentration of holdings among institutional players can exacerbate sell-offs during market downturns.

Read Bitcoin’s [BTC] Price forecast 2024-25

As Bitcoin’s role as a macroeconomic hedge deepens, the market faces challenges in balancing institutional dependence with stability.

Navigating these dynamics will require careful attention from investors as Bitcoin’s price trajectory is increasingly influenced by the changing tides of institutional sentiment.

Next: Shiba Inu Sees Turnaround as Whales Bulk During Recession – What’s Next?

Source link