- Fantom’s price rise is supported by strong network growth and key resistance targets around $1.50.

- Technical indicators and market sentiment highlight cautious optimism about continued upward momentum.

Phantom [FTM] has turned heads with a dramatic 23.13% increase in the past 24 hours, bringing the price to $1.07 at the time of writing.

This impressive growth, fueled by rising network adoption and positive onchain metrics, begs the question: is Fantom on track to lead a broader crypto market rally in the coming weeks?

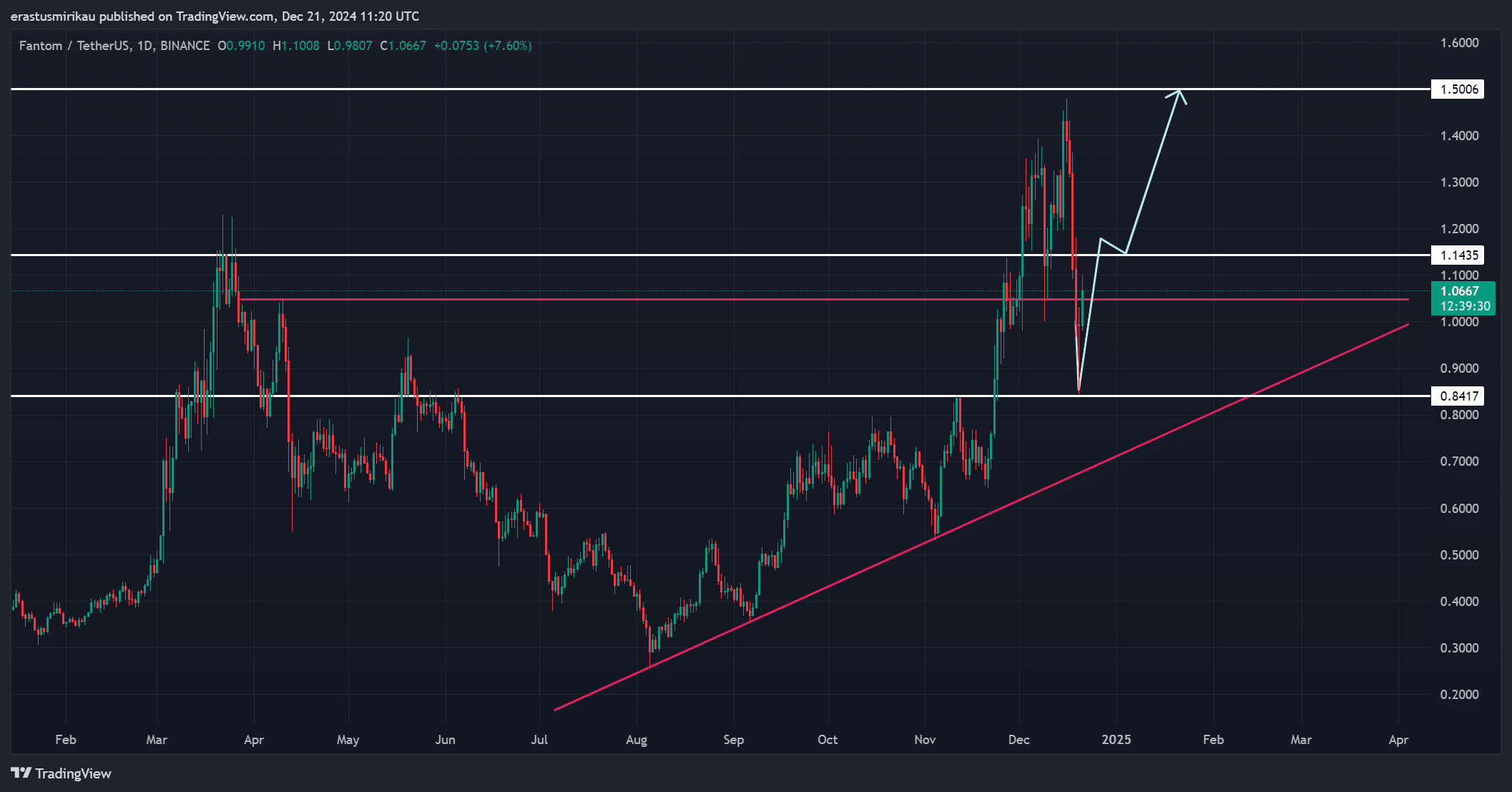

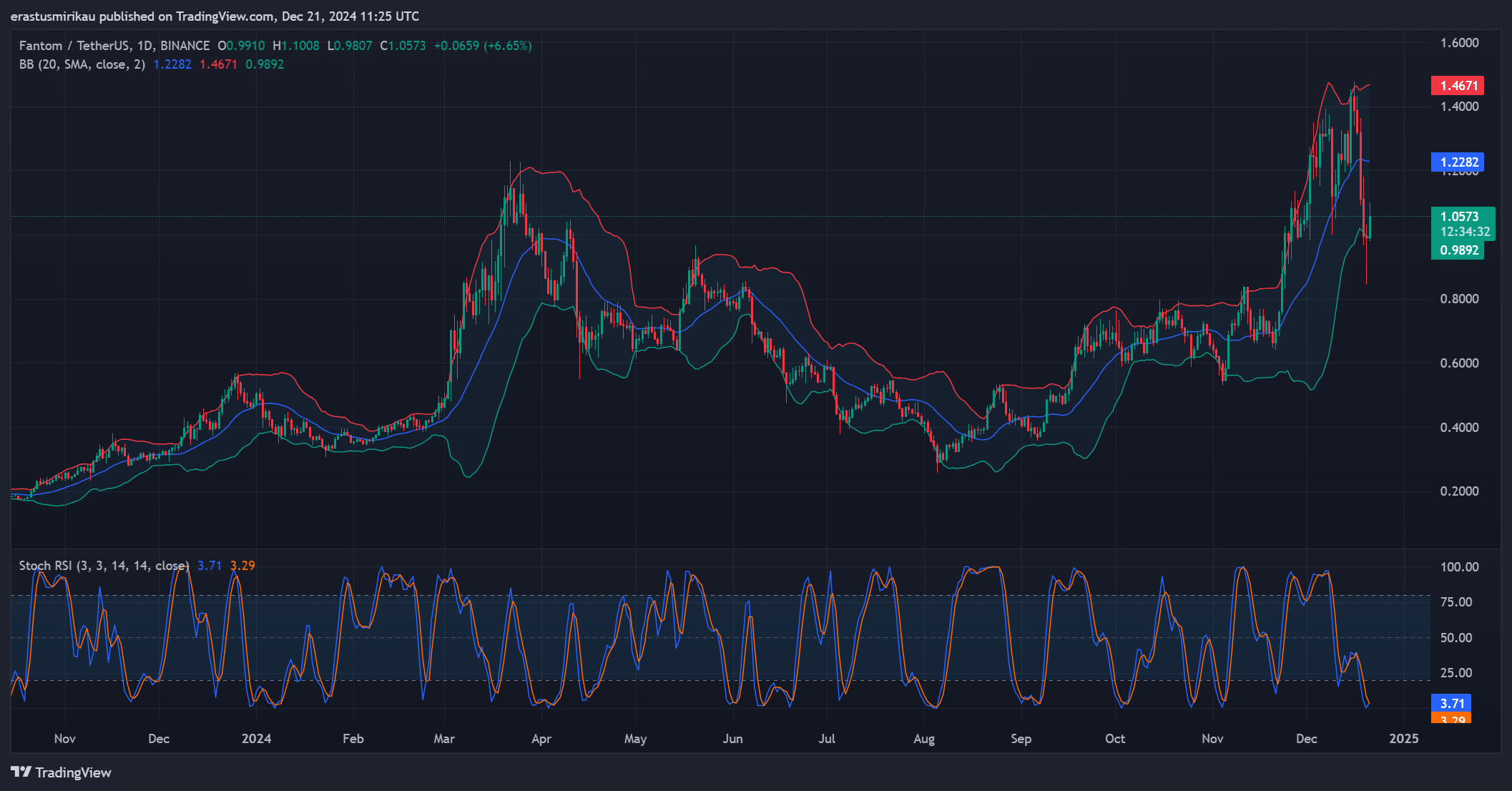

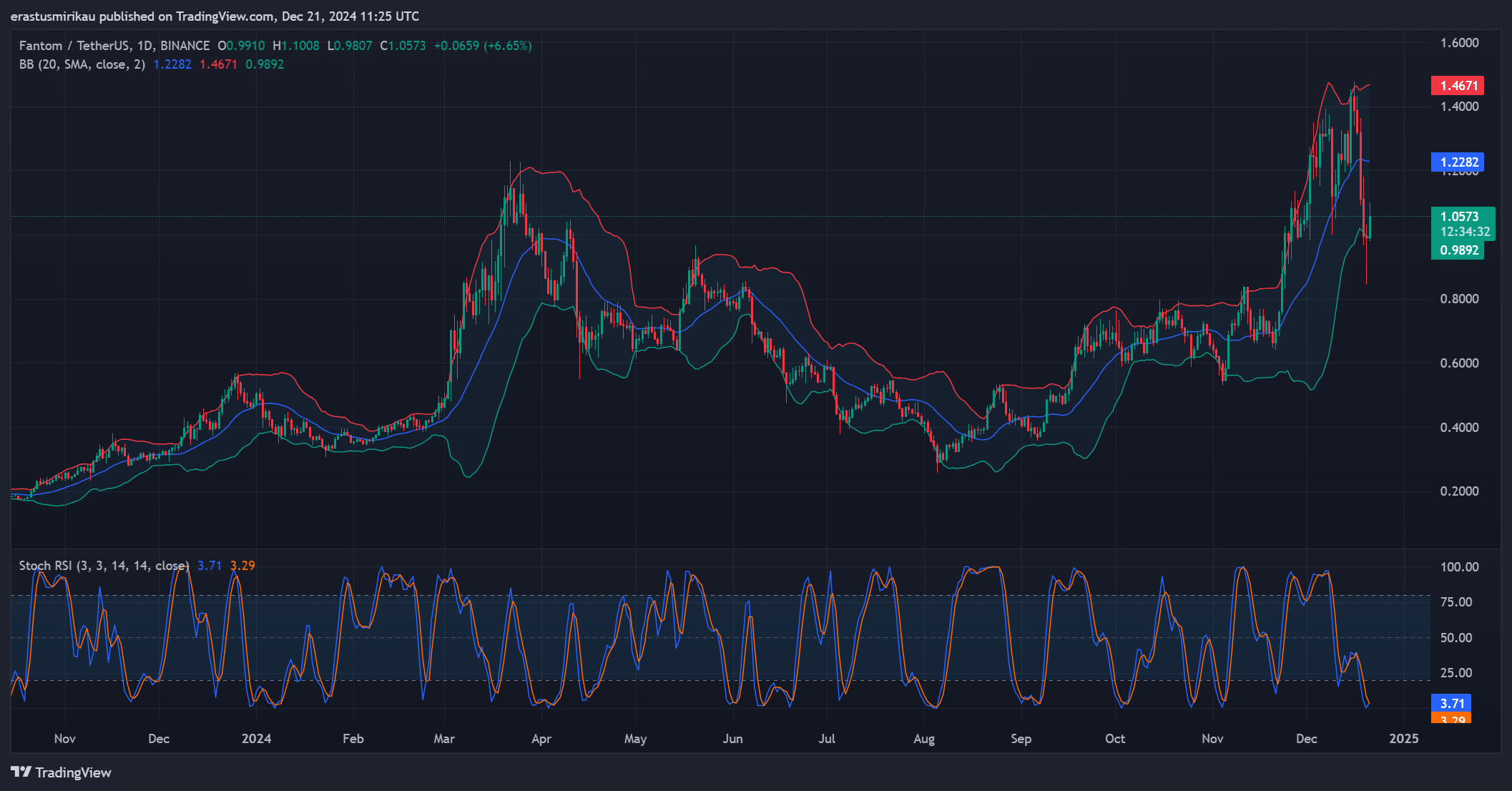

Fantom chart analysis: price movements, key levels and targets

Fantom’s chart shows a robust bullish structure, with the price moving past the critical $1.00 level and now acting as strong support. The next resistance is at $1.14, an important psychological and technical level.

Furthermore, if momentum continues, FTM could test the $1.50 resistance, a break above which could confirm an ongoing rally. However, traders should remain cautious of a potential retracement as the support at $0.84 aligns with a long-standing ascending trendline.

Therefore, maintaining the current momentum is crucial for Fantom to achieve these ambitious goals.

Source: TradingView

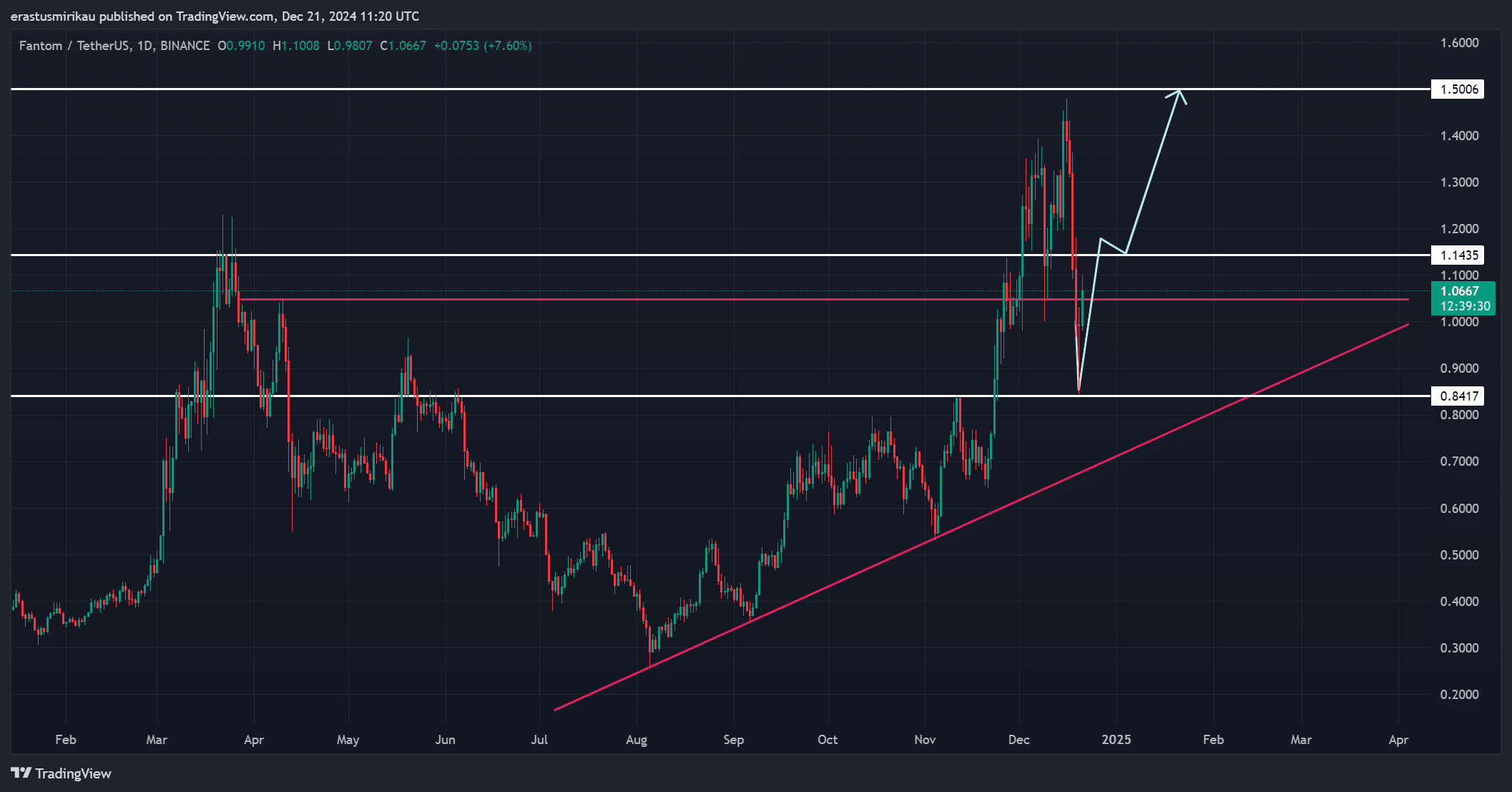

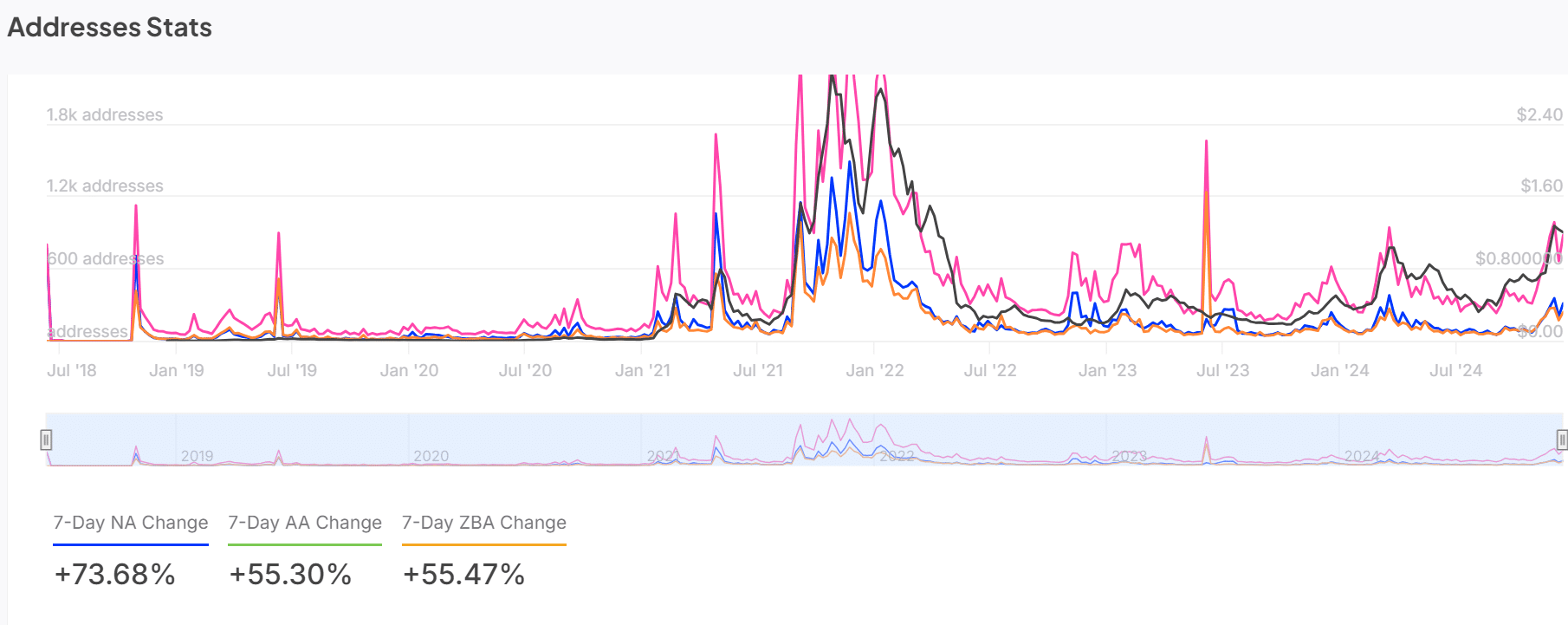

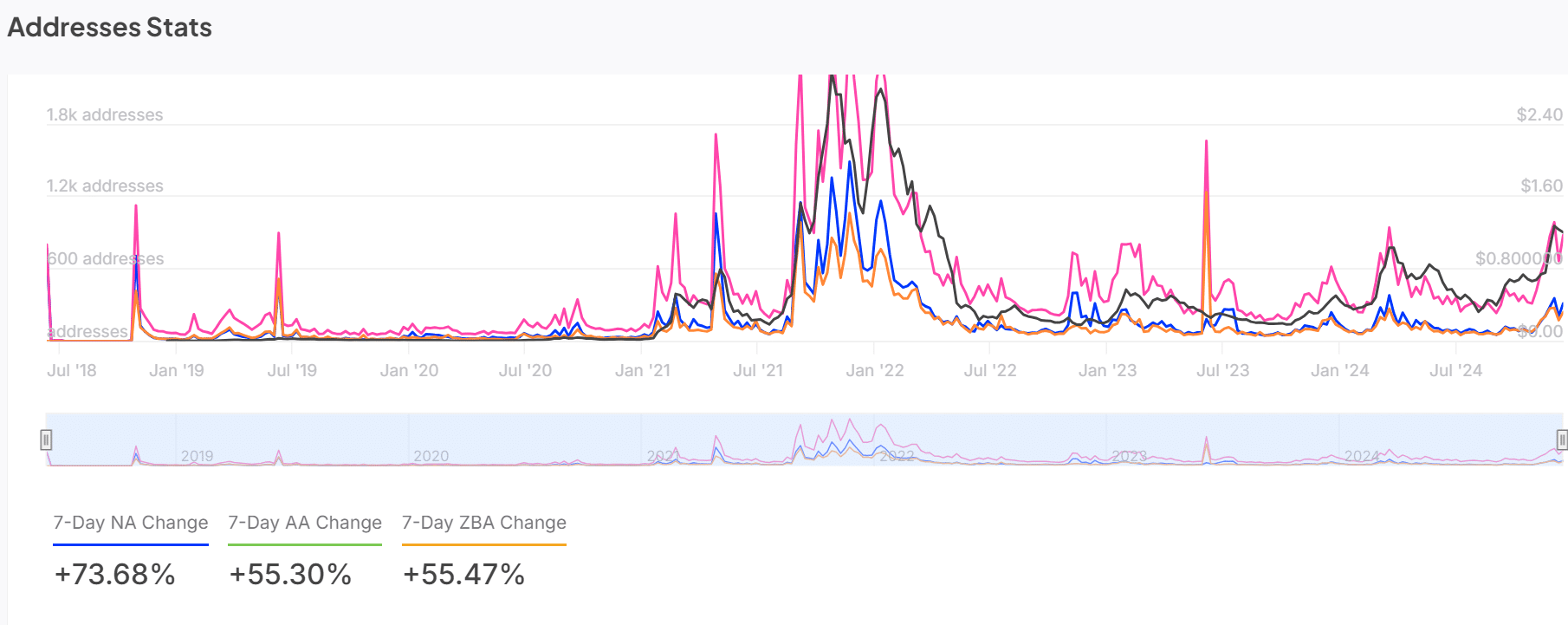

Network growth metrics indicate significant user interest. The number of new addresses increased by 73.68% in the past week, while zero balance accounts increased by 55.47%. This shows strong adoption as more users join the ecosystem.

Furthermore, the increasing activity reflects growing confidence in FTM, which directly supports the continued price increase. As adoption trends remain positive, they can drive sustainable growth in the token’s value.

Source: IntoTheBlock

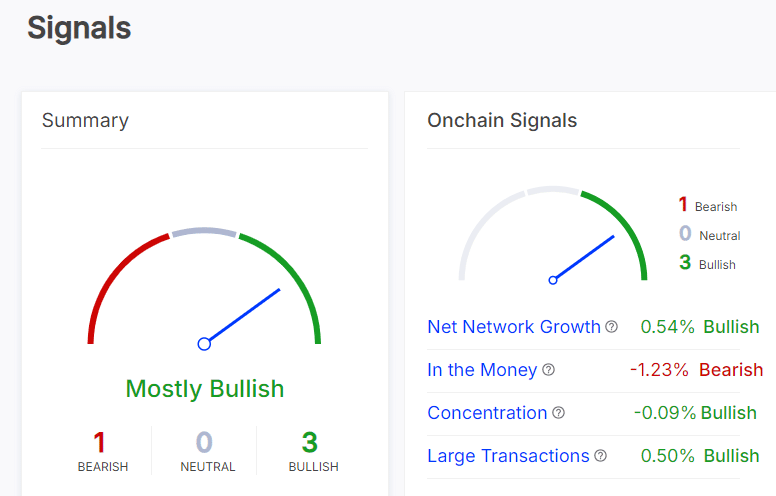

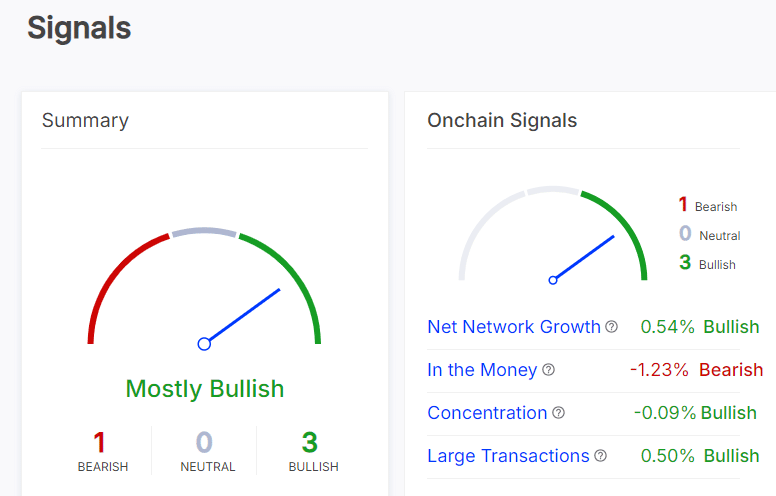

Signals in the chain: bullish or cautious?

FTM’s onchain signals offer a mostly bullish outlook. Net network growth is +0.54%, confirming steady growth. However, the ‘In the Money’ measure fell -1.23%, indicating slight profit-taking among investors.

On the other hand, large trades increased by 0.50%, indicating that institutional and high-quality trades continue to support the bullish trend. Although there is caution in the short term, the overall outlook remains positive.

Source: IntoTheBlock

FTM technical indicators: volatility and momentum

Fantom’s technical indicators point to increasing volatility and momentum. The Stochastic RSI is at 3.71 and 3.29, indicating oversold conditions with the potential for further upside.

Furthermore, FTM’s price is close to the upper Bollinger Band at $1.22, reflecting bullish pressure, while the lower band at $0.98 offers support. However, breaking the USD 1.14 resistance remains crucial for unlocking higher targets such as USD 1.50.

Source: TradingView

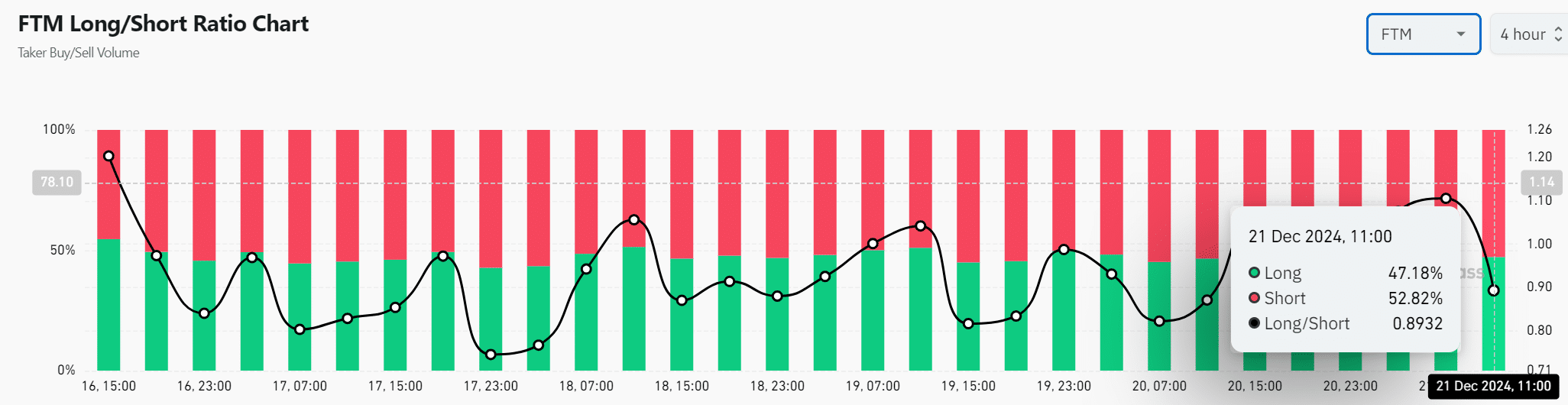

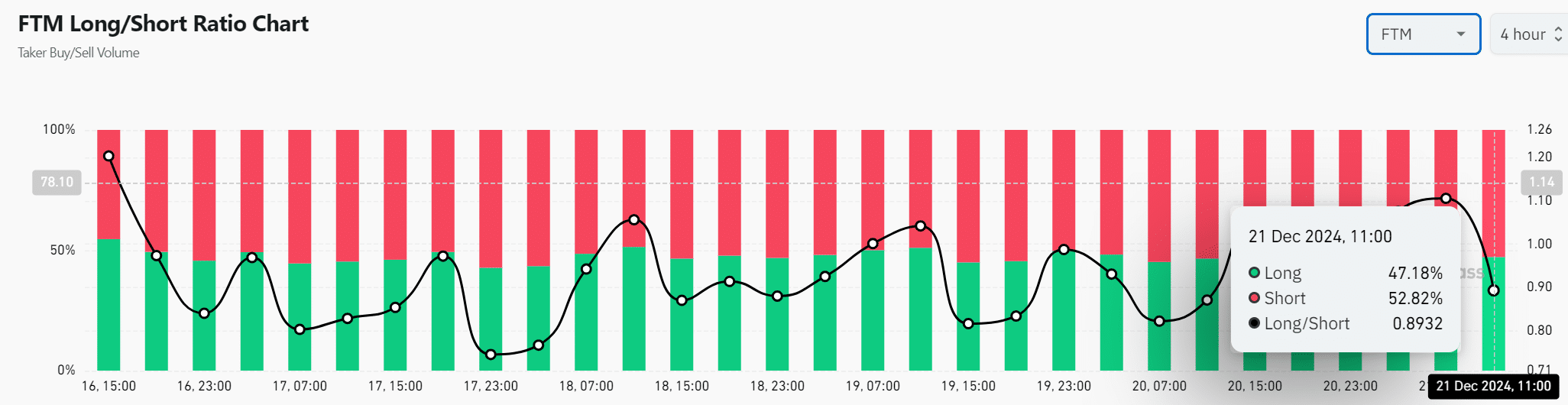

The long/short ratio for FTM shows cautious optimism. While 52.82% of traders are short, 47.18% remain long, showing a balance between bullish and bearish expectations.

This ratio reflects mixed sentiment as traders weigh the possibility of continued gains against the risk of short-term corrections.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024-25

Fantom looks poised to lead the next market rally. The strong price momentum, network adoption and bullish signals collectively indicate that FTM is well positioned for further growth, provided key resistance levels are breached.