New data from a crypto insights platform shows that Bitcoin (BTC) exchange-traded funds (ETFs) saw the largest single-day net outflows since launching in January.

In a new thread on the social media platform X, market information agency Spot On Chain reports say that Bitcoin ETFs witnessed an outflow of hundreds of millions of dollars on December 19, when the price of the crypto king fell below the $100,000 mark.

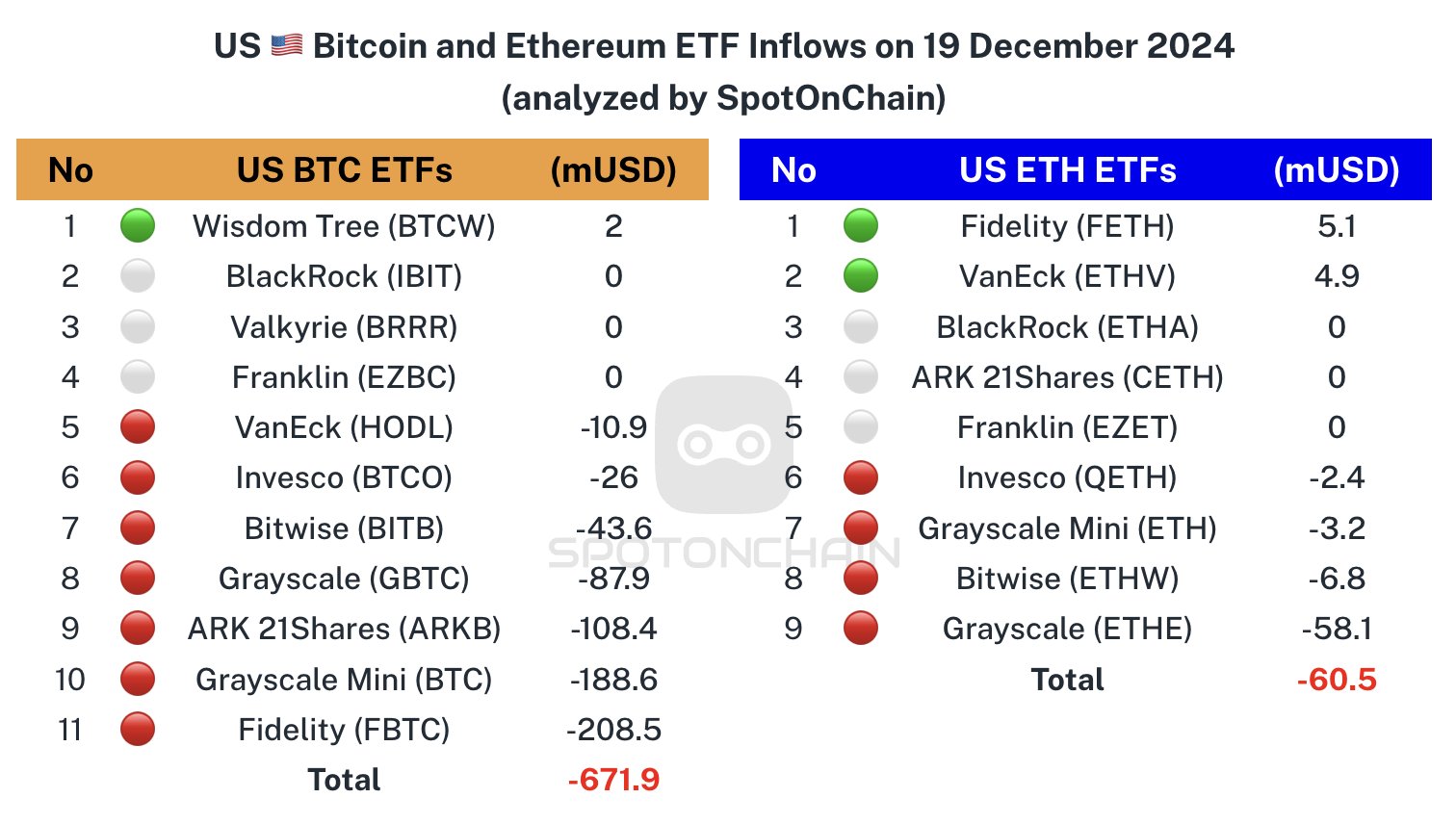

According to Spot On Chain, the ETF leading the way in total outflows was Fidelity’s FBTC, while BlackRock’s IBIT ETF remained sideways. December 19 also marked the end of a 15-day inflow streak for Bitcoin ETFs.

“The US BTC ETFs just experienced their LARGEST net outflows since launch: $671.9 million. Fidelity’s FBTC led the outflows with a record $208.5 million, while BlackRock’s IBIT was flat with a net outflow of $0.

This also marked the end of a 15-day inflow streak for BTC ETFs and an 18-day streak for ETH ETFs. In the last 24 hours, BTC fell by 4.22% and ETH by 7.97%.

According to blockchain tracker SoSoValue, other BTC ETFs witnessed notable outflows involve Grayscale’s GBTC, which raised $87.86 million; ARK Invest’s ARK 21Shares ARKB, which traded at $108.35 million; VanEck’s HODL, which traded at $10.91 million, and Invesco’s BTCO, which traded at $25.97 million.

The top crypto asset by market cap is trading at $97,417 at the time of writing. On December 17, it peaked at about $108,000.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Athitat Shinagowin/Andy Chipus