- 78% of Litecoin addresses have held their LTC for more than a year.

- The LTC has fallen by 11.09% in the past 24 hours.

Since reaching a recent high of $147 two weeks ago, Litecoin [LTC] is struggling to maintain upward momentum.

Especially in the last 24 hours, we have seen the highest decline for the altcoin, reaching a local of $94. At the time of writing, Litecoin was even trading at $96. This marked a decline of 11.09% on the daily charts. Likewise, the altcoin has fallen 20.12% over the past week.

Despite the recent dip in the price charts, long-term holders of LTC remain optimistic and expect more gains.

78% of Litecoin long-term addresses remain bullish

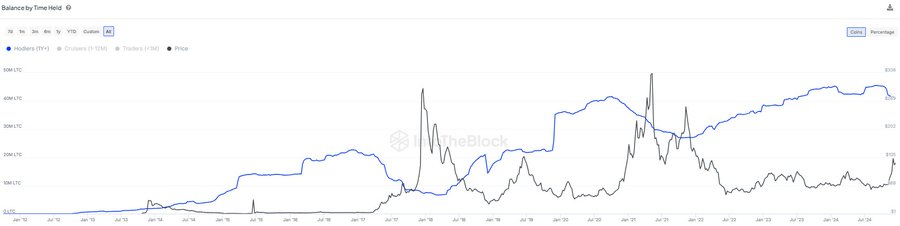

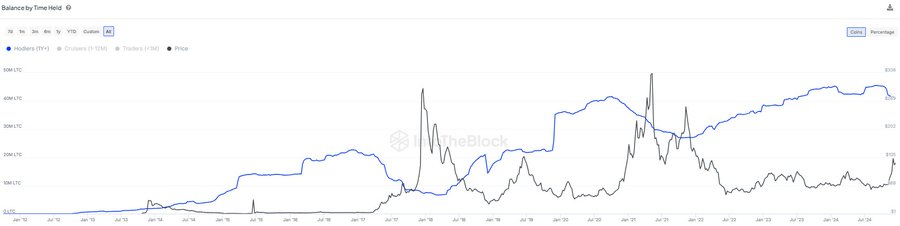

According to InTheBlok78% of Litecoin addresses have held their LTC for more than a year. These addresses have accumulated during bear markets and sold around peak prices.

Source: IntoTheBlock

While previous cycles have seen an increase in selling of long-term positions, this cycle was different.

In this cycle, LTC has seen a slight decline in long-term investments. However, this decline is less pronounced than in previous cycles. This indicates that fewer long-term holders are selling their LTC compared to previous bull markets.

Therefore, many holders are anticipating further price growth as they are still waiting for the peak in the current cycle. This indicates optimism among long-term owners.

What LTC charts suggest

While long-term investors have sold less compared to other cycles and remain bullish, the market as a whole remains bearish.

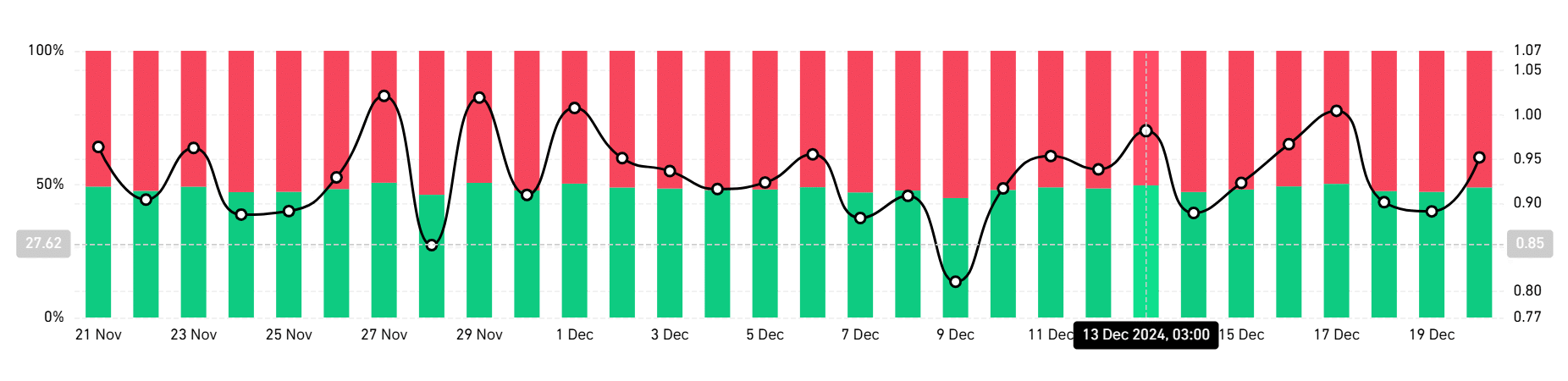

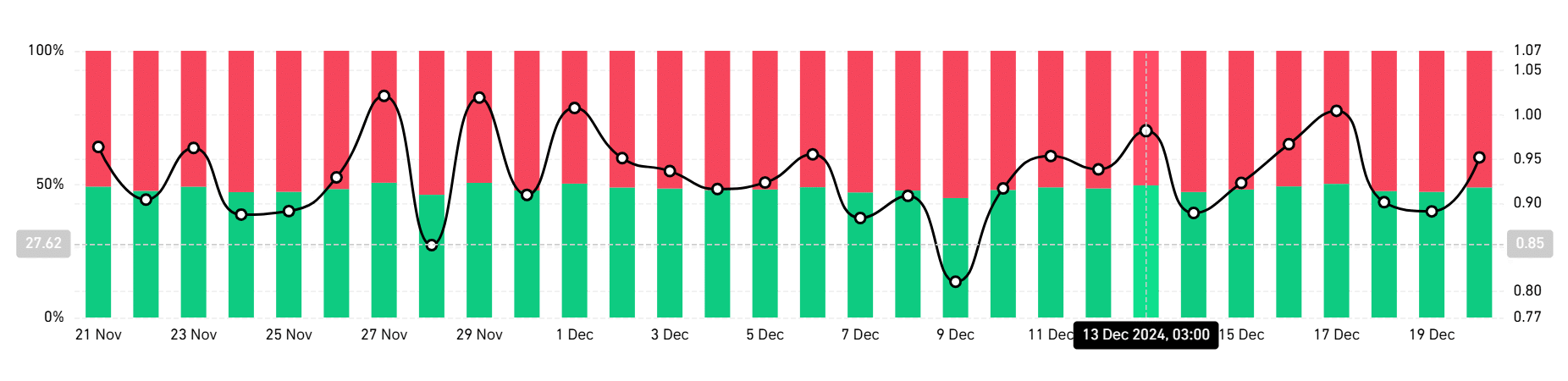

Source: Coinglass

As such, we can see this bearishness as most investors are taking short positions. According to Coinglass, the long/short ratio shows that those who go short dominate the market. This implies that most traders expect prices to fall.

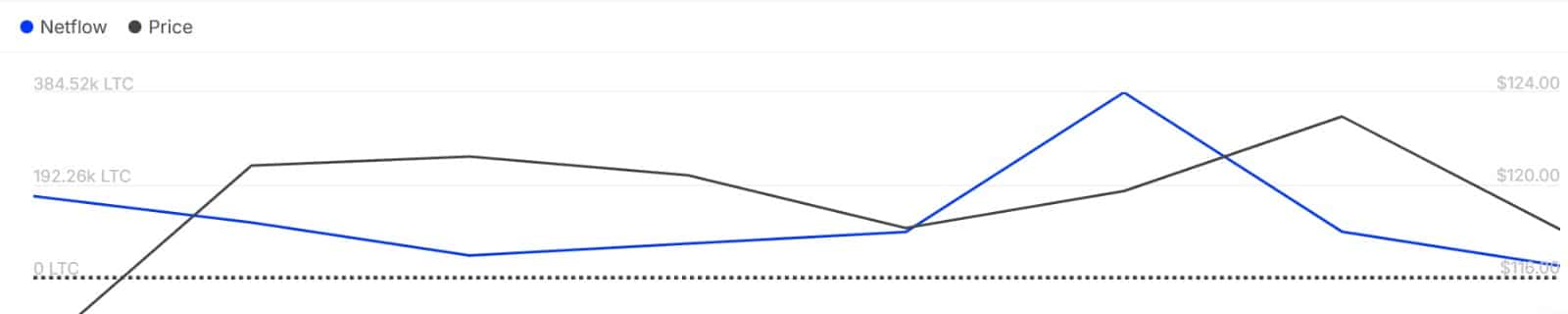

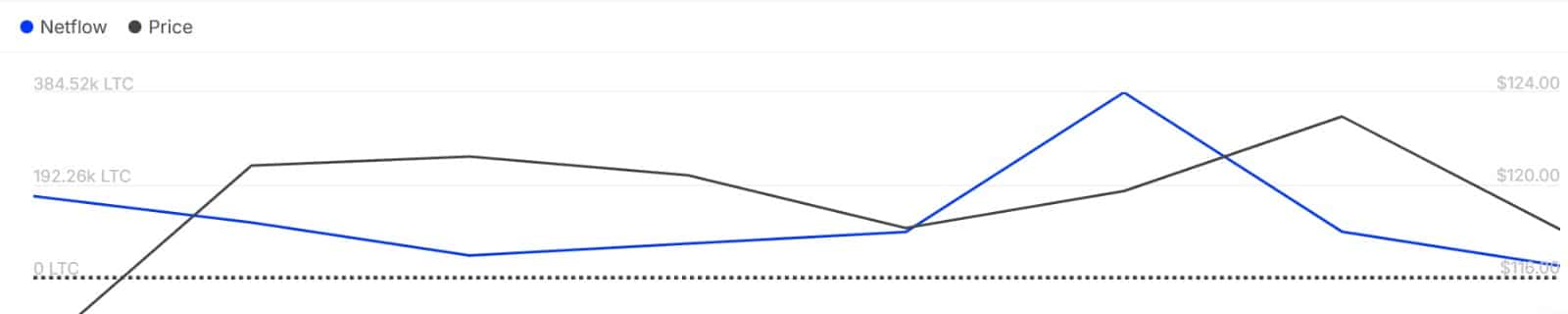

Source: IntoTheBlock

Moreover, large investors are also bearish and have continued to reduce their capital inflows into LTC. As such, the net flow of Litecoin’s large holders has fallen from 384.52k to 21.89k.

This means that the outflow has exceeded the inflow for 4 consecutive days.

Source: Tradingview

Finally, sellers have dominated the market over the past twelve days. This dominance is evidenced by a continued decline in the Relative Strength Index. The RSI has fallen from 71 to 40 and is approaching oversold territory.

Read Litecoins [LTC] Price forecast 2024–2025

In conclusion, while long-term investors are optimistic, retail traders are not. The market therefore experiences negative sentiment in the short term. If this sentiment holds, LTC could fall to $91.47.

However, if the bullishness of long-term holders spreads across the market, LTC will regain the $100 level.