- BTC showed bearish signals ahead of the FOMC meeting.

- Despite caution in the short term, analysts remained optimistic in the medium term.

Bitcoin [BTC] led the crypto market with notable de-risking ahead of the Fed’s interest rate decision, as analysts prepared for a possible ‘hawk-like downgrade’.

The cryptocurrency fell from a record high of $108,000 to $103,000 just hours before the FOMC meeting. The markets had priced in a new rate cut of 25 basis points.

But analysts expected a “hawkish tone” due to persistent US inflation, which could affect the Fed’s interest rate path through 2025.

A similar view was shared by crypto trading firm QCP Capital. The company noted,

“The tone may be somewhat hawkish as inflation stabilizes above 2% and a strong labor market keeps the Fed cautious.”

What’s next for BTC?

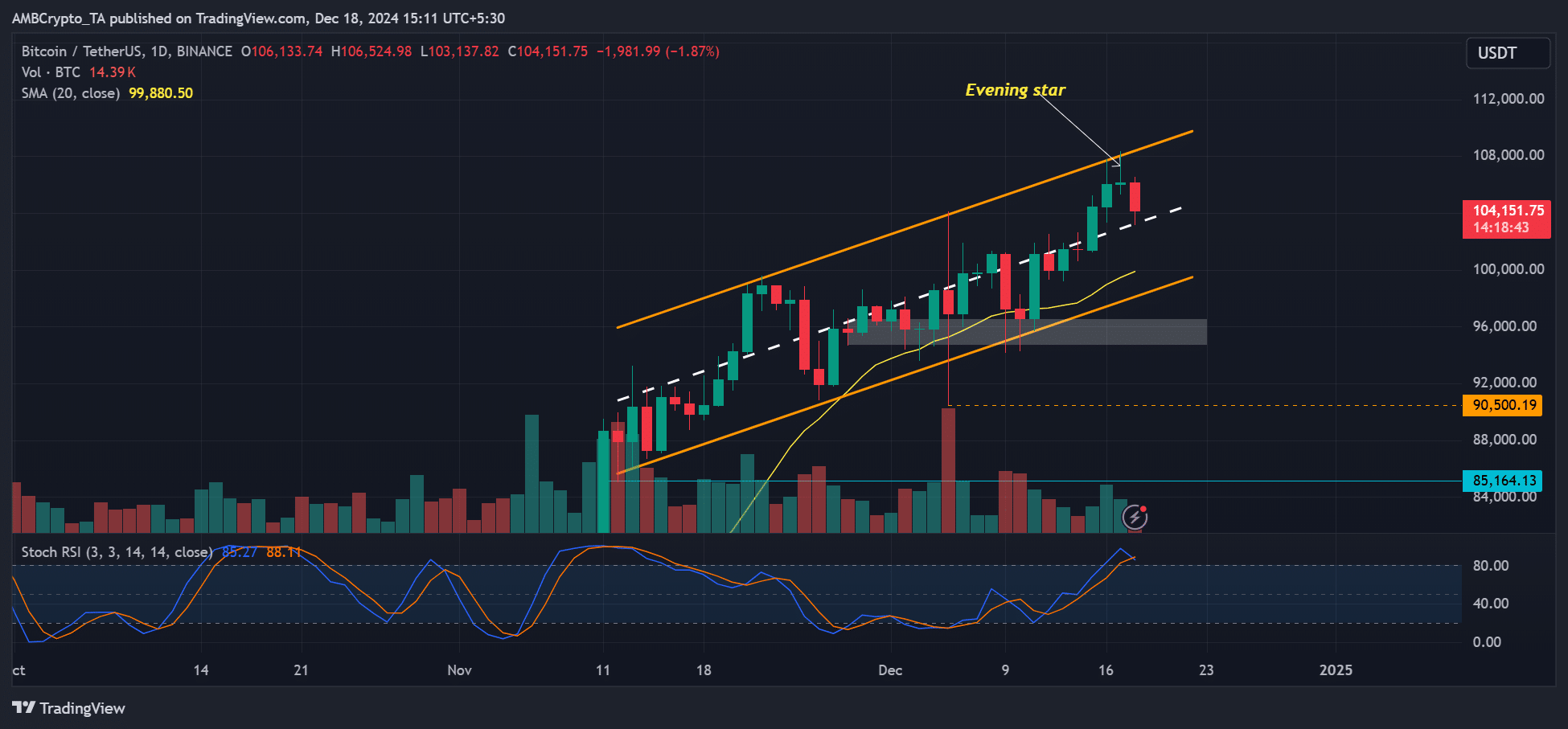

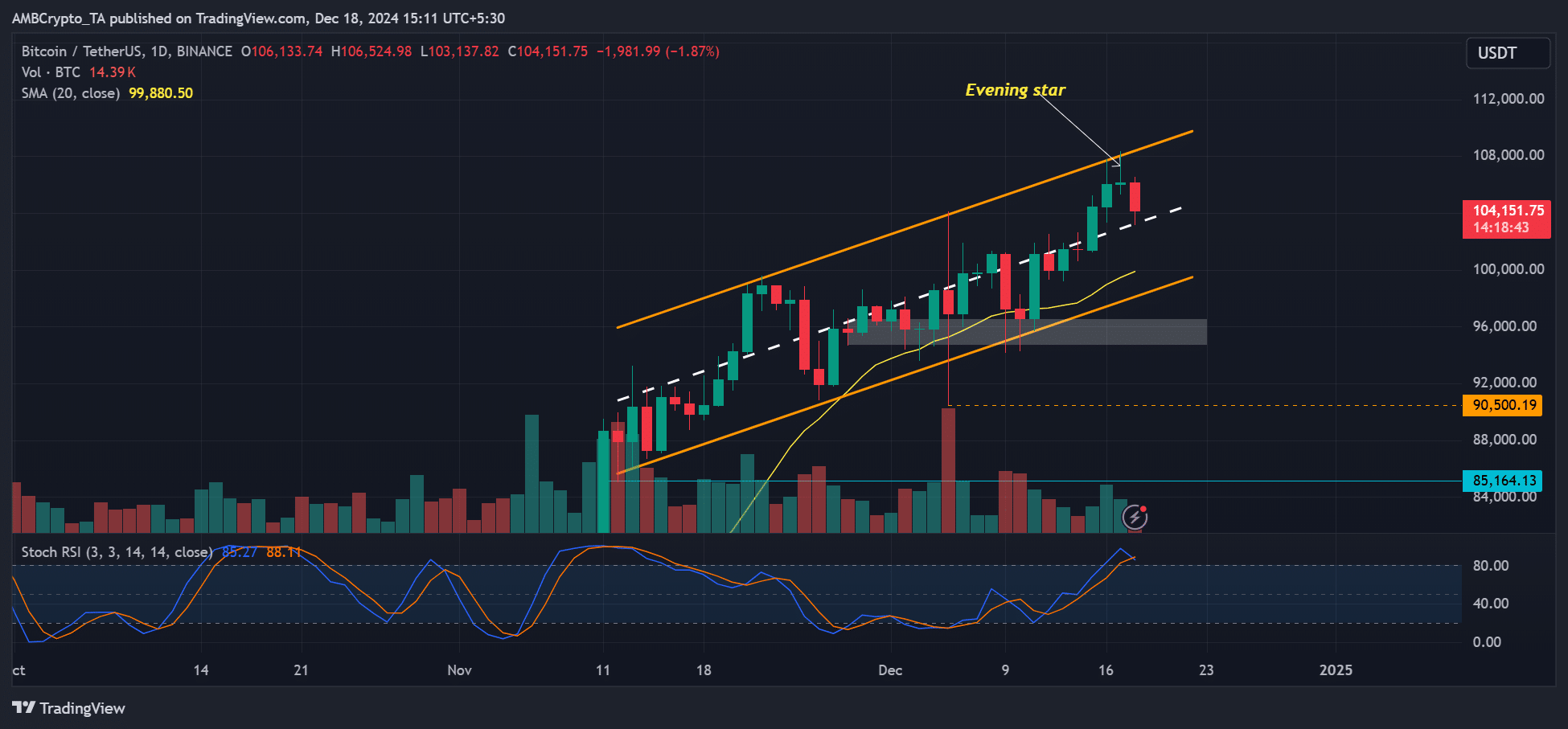

The company added that the BTC chart showed bearish signals, including an evening star, a signal of a potential trend reversal.

“The technical outlook for BTC also appears cautious, with BTC printing an evening star on the daily time frame and showing bearish divergences.”

Source: BTC/USDT, TradingView

For the unfamiliar, the evening star is a bearish reversible candlestick pattern with three candlesticks; a large bullish candle, followed by a smaller one and finally a large bearish candle.

This suggested that a BTC crash could be likely in the near term.

Interestingly, options traders have been cautious since last week. They preferred fences on potential price declines through put options rather than chasing price increases, as they did in previous weeks.

In fact, the recent BTC new highs of $107,000 and $108,000 were met by short-term bearish sentiment from options traders.

At the time of printing, Deribits The 25-delta risk reversal (25RR) was negative for options expiring on Friday, December 20, underscoring the bearish sentiment and wealth of put options.

Source: Deribit

Put options expiring on January 3, 2025 also traded at a slight premium to calls (bullish bets). The remaining maturities of the first quarter of 2025 (through March) were between 1 and 3 volatility points.

This was completely different from a few weeks ago, when volatility points could climb to 4-5 as options traders chased the rallies. Whether the trend will change after the FOMC meeting remains to be seen.

That said, QCP Capital maintained a bullish long-term outlook through 2025 despite near-term caution in the options market.

Another analyst, Stockmoney Lizards, echoed the bullish long-term outlook, which stated that there was room for additional growth for BTC based on the monthly RSI value.

Source: