- MicroStrategy’s acquisition of Bitcoin caused share prices to rise, underscoring MicroStrategy’s role as a major BTC holder.

- The company’s inclusion in the Nasdaq 100 increased visibility, but risks associated with Bitcoin remained.

Shares of MicroStrategy rose nearly 5% on Monday, following the company’s announcement of a significant Bitcoin gain [BTC] acquisition and inclusion in the Nasdaq 100.

The software company turned Bitcoin whale bought another 15,350 BTC for $1.5 billion, bringing the total to about 440,000 BTC.

The move sparked optimism among investors and highlighted MicroStrategy’s commitment to Bitcoin and its impact on the company’s stock and the broader market.

MicroStrategy’s Bitcoin Strategy

MicroStrategy’s aggressive Bitcoin accumulation continues to cement its role as the largest corporate holder of BTC. With the latest purchase, MSTR’s position has largely expanded over the past 40 days.

Analysts at Bernstein estimate that 40% of this total was acquired within this period, marking an acceleration in purchasing that coincides with renewed bullish sentiment around Bitcoin.

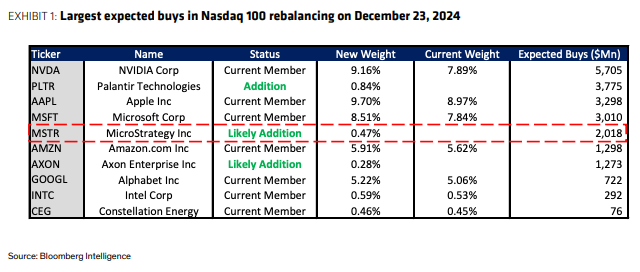

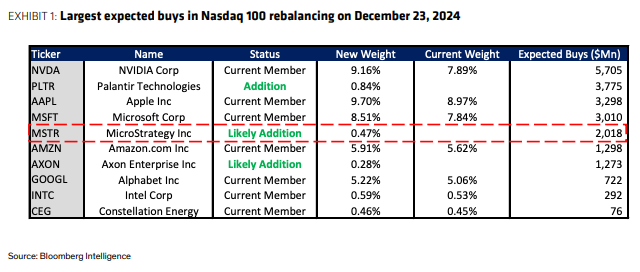

Notably, MicroStrategy has also been given a 0.47% weighting in the Nasdaq 100 index.

Source: Bernstein

This buying wave is driven by optimism surrounding Trump’s pro-crypto policies, such as the appointment of Paul Atkins to the SEC.

Since adopting Bitcoin in 2020, MicroStrategy has financed acquisitions through debt, equity and cash flow, demonstrating its strong commitment to Bitcoin despite its volatility.

Nasdaq 100 Inclusion and Implications

MicroStrategy’s inclusion in the Nasdaq 100, effective December 23, along with Palantir and Axon, showed growing market confidence in its Bitcoin strategy.

The announcement lifted shares 5% before closing flat, with year-to-date gains of more than 580%. This inclusion boosted the stock’s visibility and was able to attract institutional inflows, increasing liquidity and performance.

However, it also strengthened MicroStrategy’s role as a Bitcoin proxy, by linking its shares to BTC price movements.

With Bitcoin surging above $106,000 amid Trump’s crypto-friendly rhetoric, sentiment remains positive, although the stock’s volatility has traditional investors concerned.

MicroStrategy Stocks: Critics and Skeptics

Despite MicroStrategy’s Bitcoin-driven rise, critics argue its strategy carries excessive risk. Short seller Lemon research has recently taken a bearish position, claiming that the stock

“Completely separate from the fundamentals of BTC.”

Such skepticism stems from MicroStrategy’s heavy reliance on debt and the speculative nature of its Bitcoin holdings, which increase downside risks during BTC market corrections.

“Now that investing in Bitcoin is easier than ever (ETFs, $COIN, $HOOD), $MSTR volume has completely disconnected from BTC fundamentals. While Citron remains bullish on Bitcoin, we hedged with a short position on $MSTR. Much respect to @saylor, but even he needs to know that $MSTR is overheated.

Skeptics highlight the concentration risk: While BTC’s rally is boosting stocks, Bitcoin’s fate remains tied to Bitcoin’s price volatility.

As MicroStrategy doubles down on BTC, questions remain about the sustainability of this risky strategy in uncertain conditions.