- Justin Sun deposits $37.3 million in OWN, which is a sign of confidence in the future.

- The price of OWN has increased by 11.69% in the last 24 hours.

EIGEN has recorded impressive market activity lately, with its price rising 11.69% to $5.23 over the past 24 hours. The cryptocurrency fluctuated between a low of $4.69 and a high of $5.23 during this period, reflecting some price volatility.

However, despite these fluctuations, EIGEN’s market capitalization at the time of writing was $1.08 billion – up 6.72%, further strengthening its appeal to investors. In fact, tThe cryptocurrency saw its all-time high of $5.38 just four days ago, on December 12, 2024.

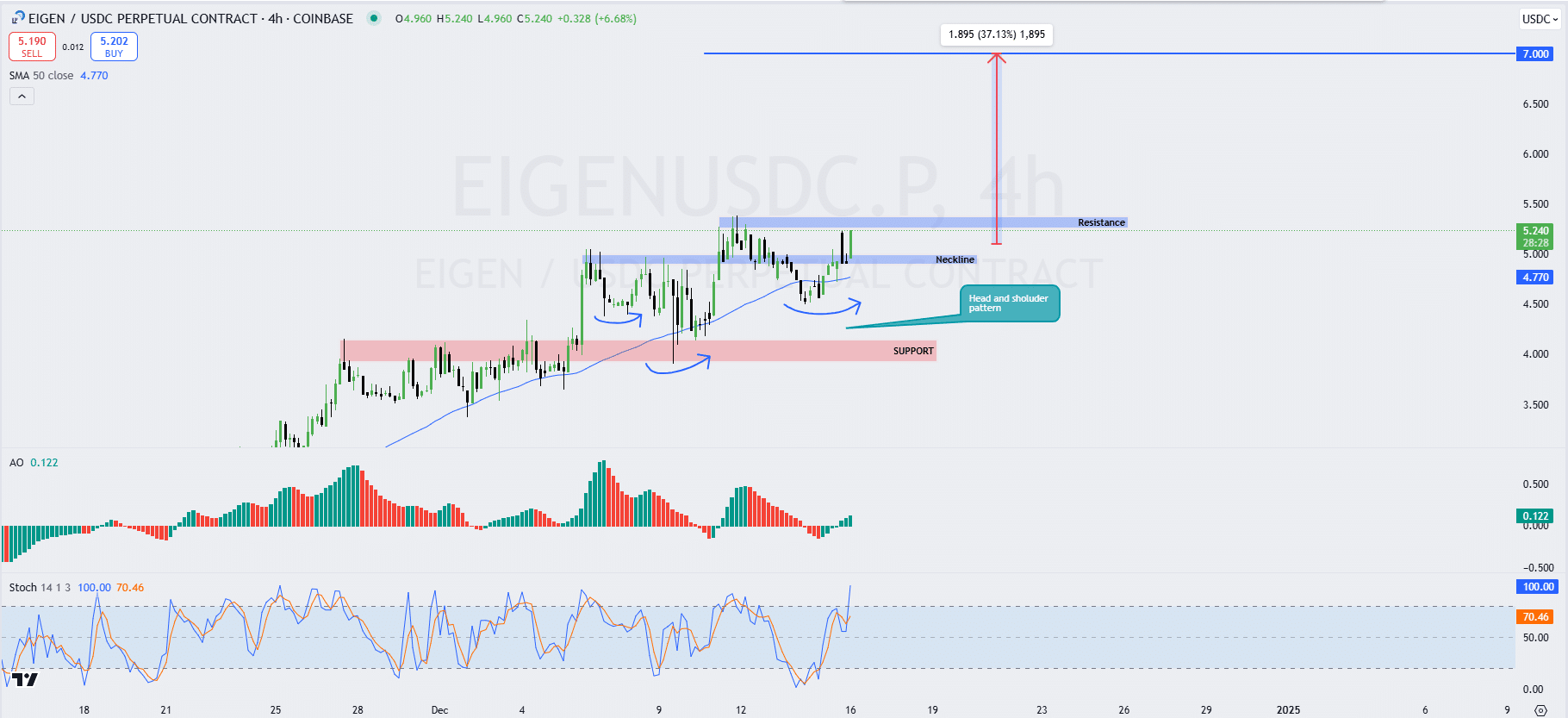

Head and Shoulders indicate EIGEN’s potential for sustainable growth

On the price charts, EIGEN clearly showed a head and shoulders pattern, a pattern that often indicates a continuation of the uptrend.

The neckline of this pattern seemed to be near $5, and if the price breaks above the resistance level around $5.38, there could be potential for a rise towards $7 – representing a 37.13% upside from the level of the press.

Additionally, there was a solid support zone around the $4.77 neckline, providing a level of stability to the market.

OWN 4-hour chart source: Tradingview

The reading of 70.46 by the Stochastic Oscillator indicated that EIGEN was in the overbought area. Therefore, a pause or correction could be on the horizon soon.

And yet, the Awesome Oscillator’s 0.122 supported the prevailing bullish sentiment, indicating positive momentum.

Can EIGEN keep the momentum going with increasing investor involvement?

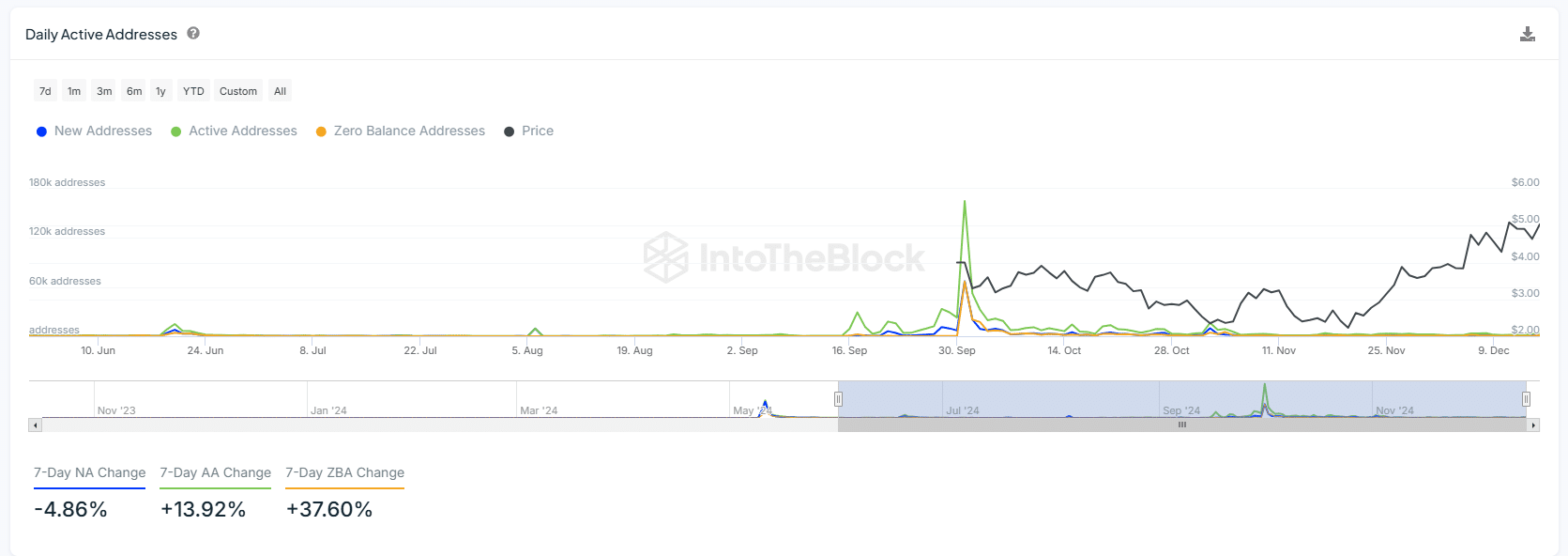

Around September 2024, a significant price increase to around $6 increased both the number of new and active addresses, indicating greater user engagement. However, in December 2024, when EIGEN’s price stabilized around $5, there was a slight decline of more than 4.8% in new addresses.

Shortly afterwards, however, active addresses rose by 13.92% – a sign of growing engagement from existing users.

Source: IntoTheBlock

At the same time, zero balance addresses rose by 37.60%, indicating that many users are holding their positions without actively trading, likely in anticipation of further price movements.

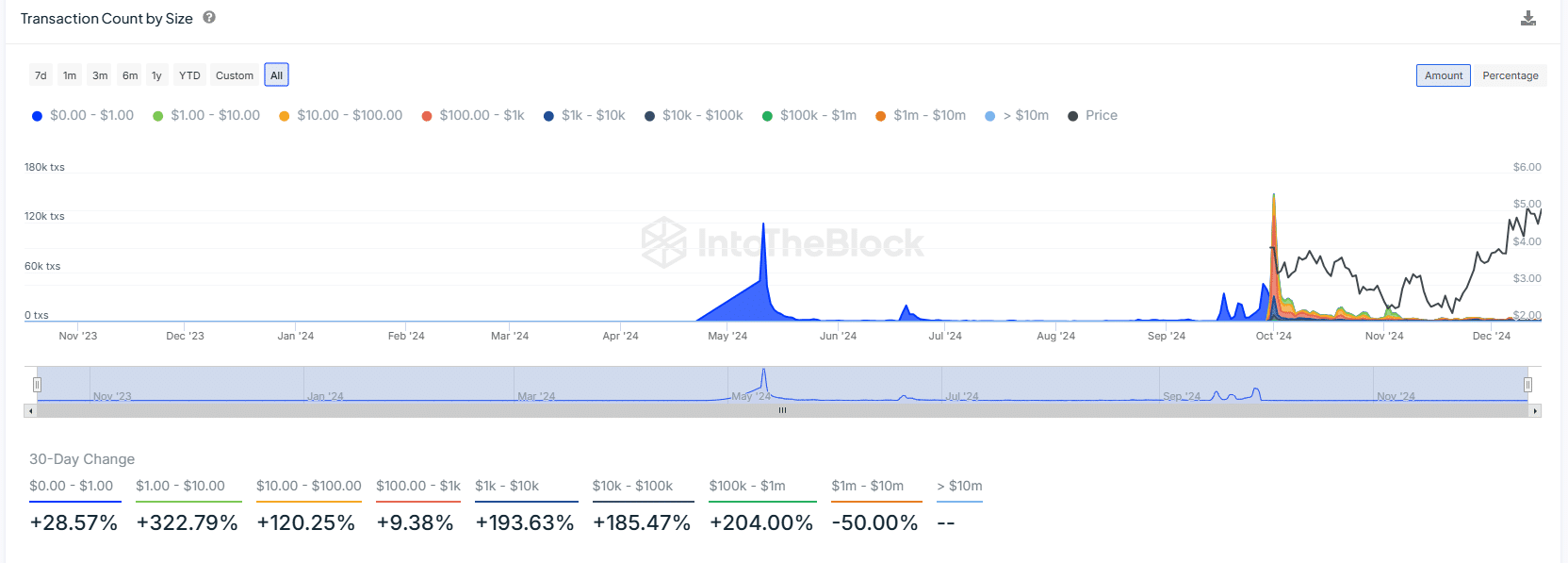

The transaction activity over the past 30 days also reflected growing interest in various market segments. Small transactions in the $0-$1 and $1-$10 categories saw significant increases, with the $1-$10 range growing by 322.79%.

This increase was likely driven by retailers reacting to OWN’s price action. Larger transactions in the $100-$1,000 and $1,000-$10,000 range also saw big growth, with increases of 120.25% and 193.63% respectively.

Notably, the transaction category between $10,000 and $100,000 grew by 185.47%, underscoring confidence among high-net-worth individuals and institutional players.

Source: IntoTheBlock

On the contrary, larger transaction categories such as those above $10 million remain inactive, indicating that institutional investors are not yet fully engaged in large transactions.

This can be interpreted as a sign of broader participation from both private and institutional investors.

Justin Sun’s strategic steps underline the confidence

On December 10, 2024, Sun deposited 196,380 OWN, worth $964K, in HTX.

This move is part of a larger strategy, as Sun has claimed and deposited 9.378 million OWN worth $37.3 million since October 1, 2024, at an average price of $3.979.

As of December 2024, Sun owns 196,380 OWN, which has increased in value. His actions indicate a pattern of strategic moves within the cryptocurrency market, and his continued accumulation of OWN will likely impact market sentiment going forward.