- Ethereum whale records 5160 tokens worth $20 million.

- ETH has made a moderate recovery, up 3.7%.

Over the past month, Ethereum [ETH] has been trading in an uptrend. Since the local low of $2,355, the altcoin has risen to $4,096.

However, since reaching this level, it has undergone a correction and returned to $3501. At the time of writing, Ethereum was trading at $3,899. This marked a decline of 0.6% on the daily charts.

This market pullback created a buying opportunity, especially for large holders, with whales turning to buying the dip.

Whales continue to collect ETH

According to On Chain Tracker Look at chainWhales accumulate ETH after the altcoin price drops. As such, a whale created a new wallet and withdrew 5160 ETH tokens worth $20 million from Binance.

With whales accumulating ETH, it shows confidence from large holders, especially as long-term holder profits continue to rise.

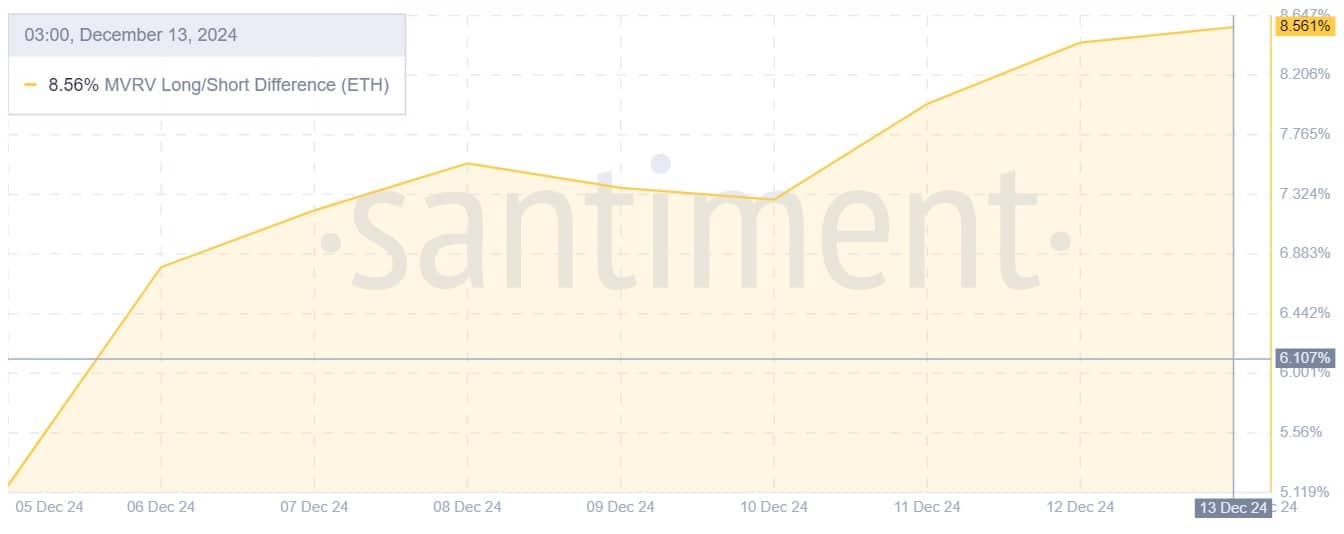

Source: Santiment

We can see this because the MVRV long/short difference in Ethereum has been continuously increasing over the past week. It has increased from 5.17% to 8.56%, which is not only a sign of market confidence but also of rising profitability.

What ETH Charts Say

According to AMBCrypto’s analysis, Ethereum is currently experiencing strong bullish sentiment amid buying pressure from large holders.

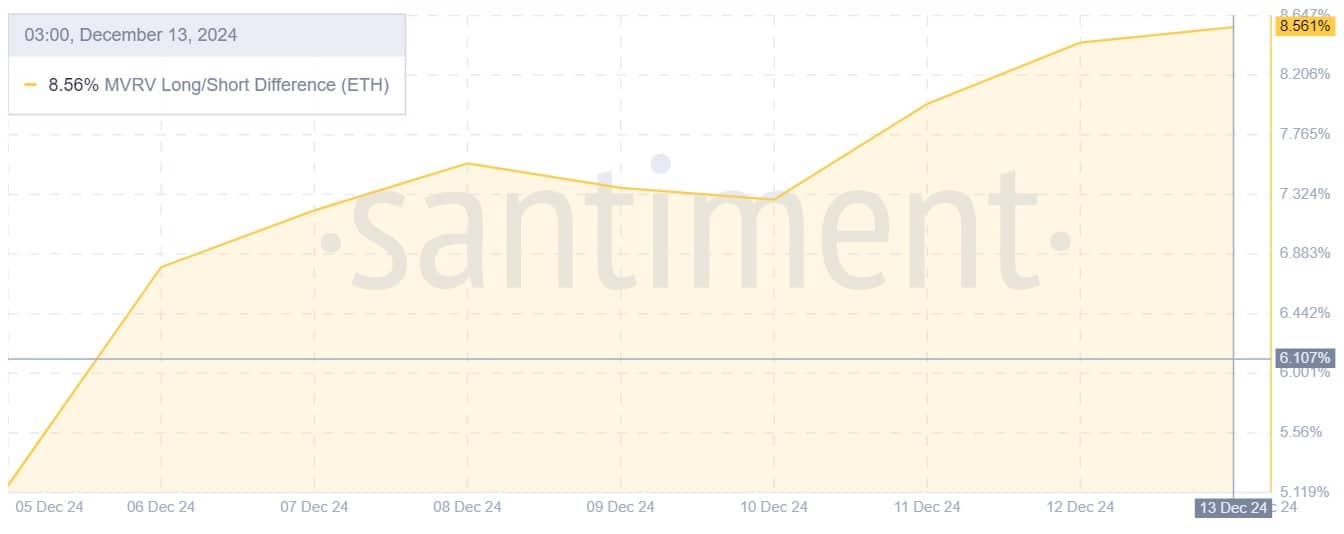

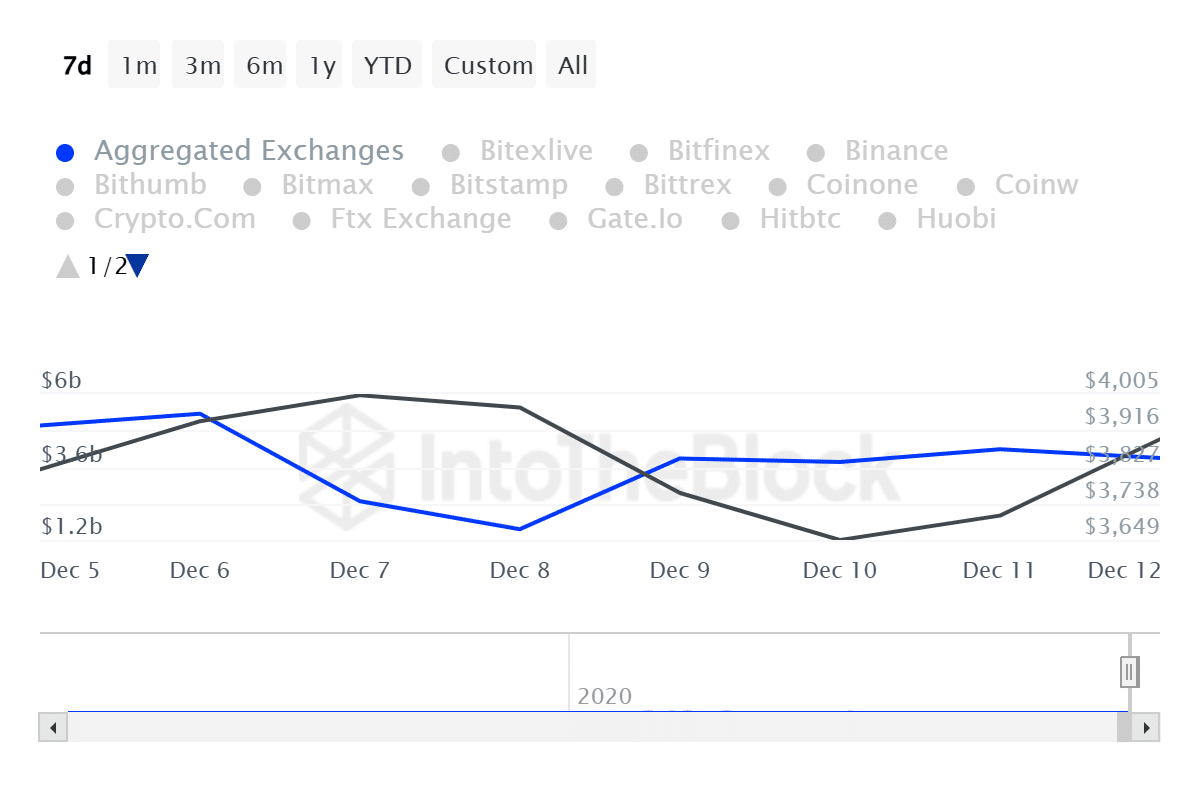

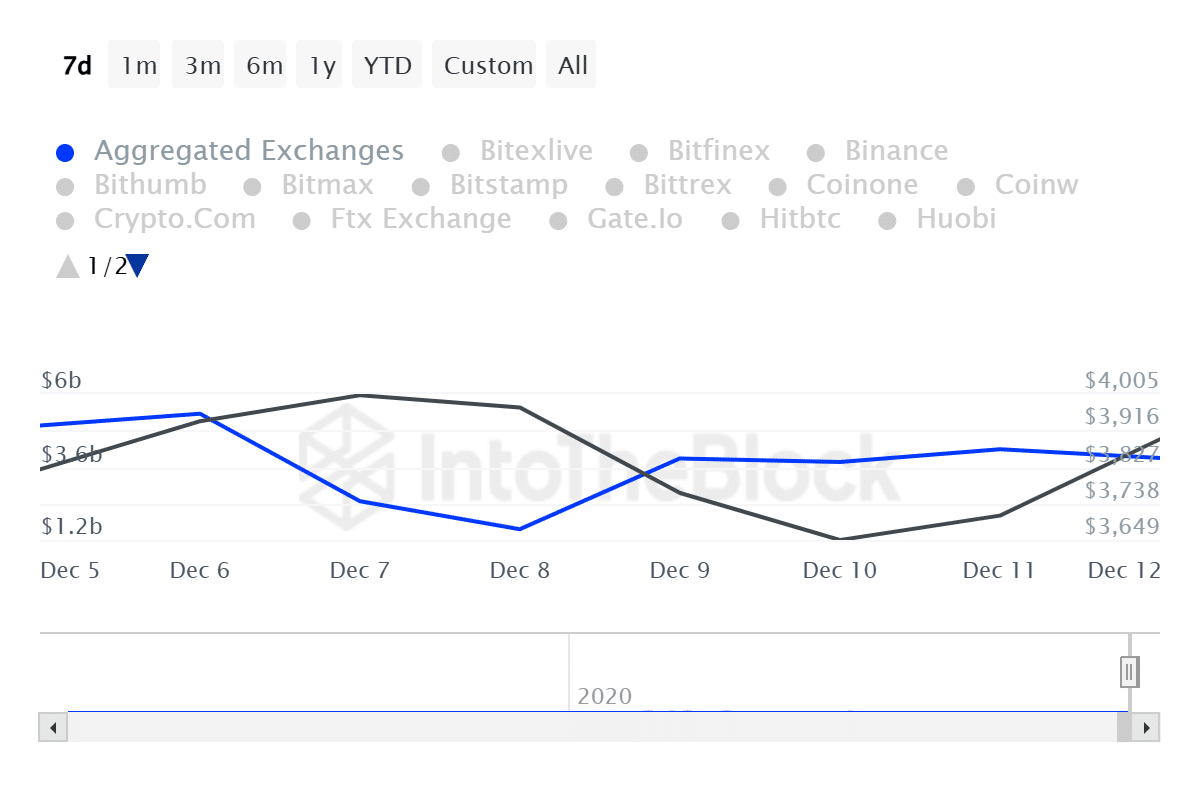

Source: IntoTheBlock

As such, Ethereum investors have turned to accumulating the assets. This accumulation trend is reflected in an increasing outflow volume.

According to IntoTheBlock, outflows from exchanges rose from $1.56 billion to $3.89 billion last week. This implies that more investors are transferring their ETH tokens to private wallets than to exchanges.

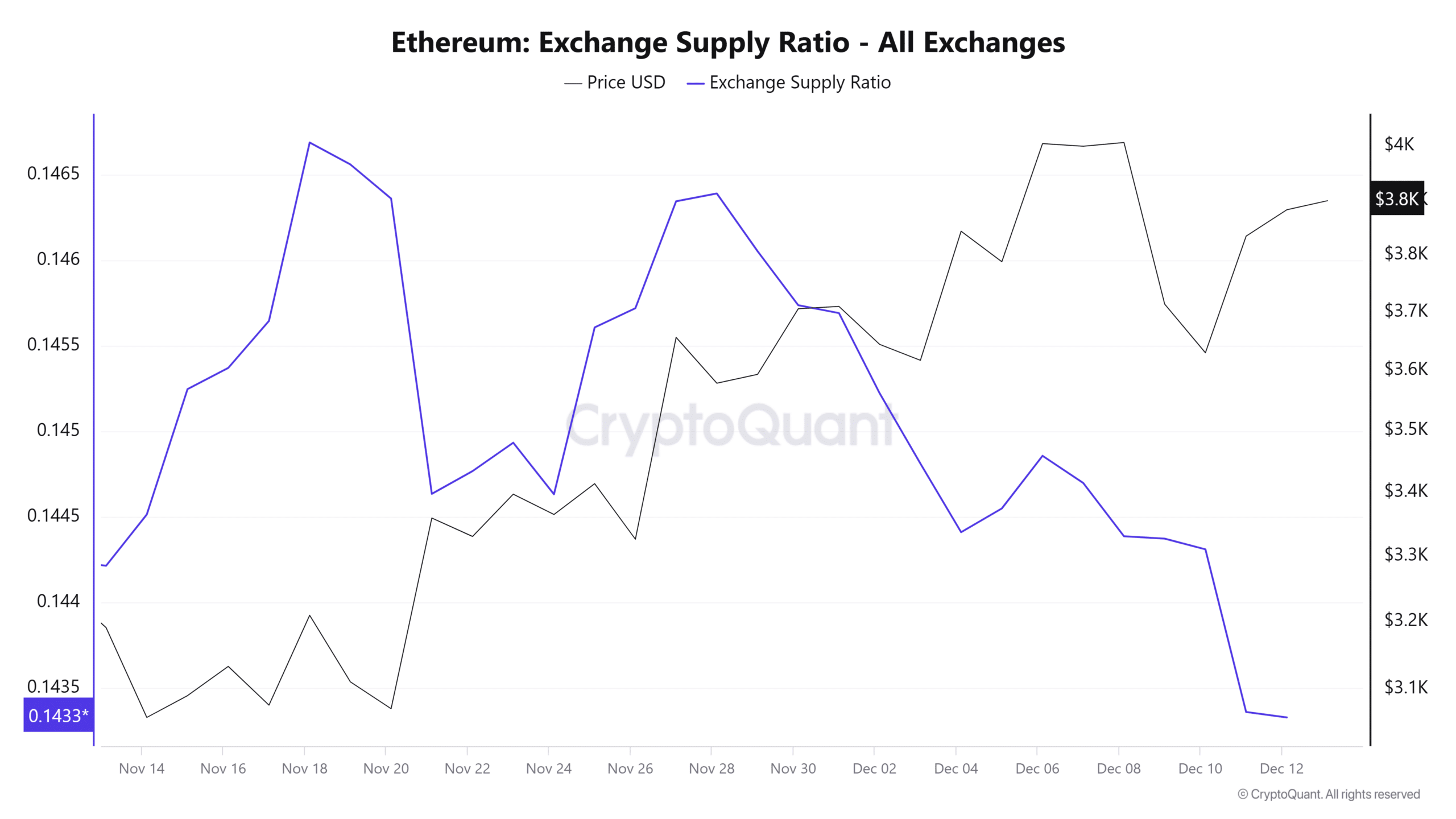

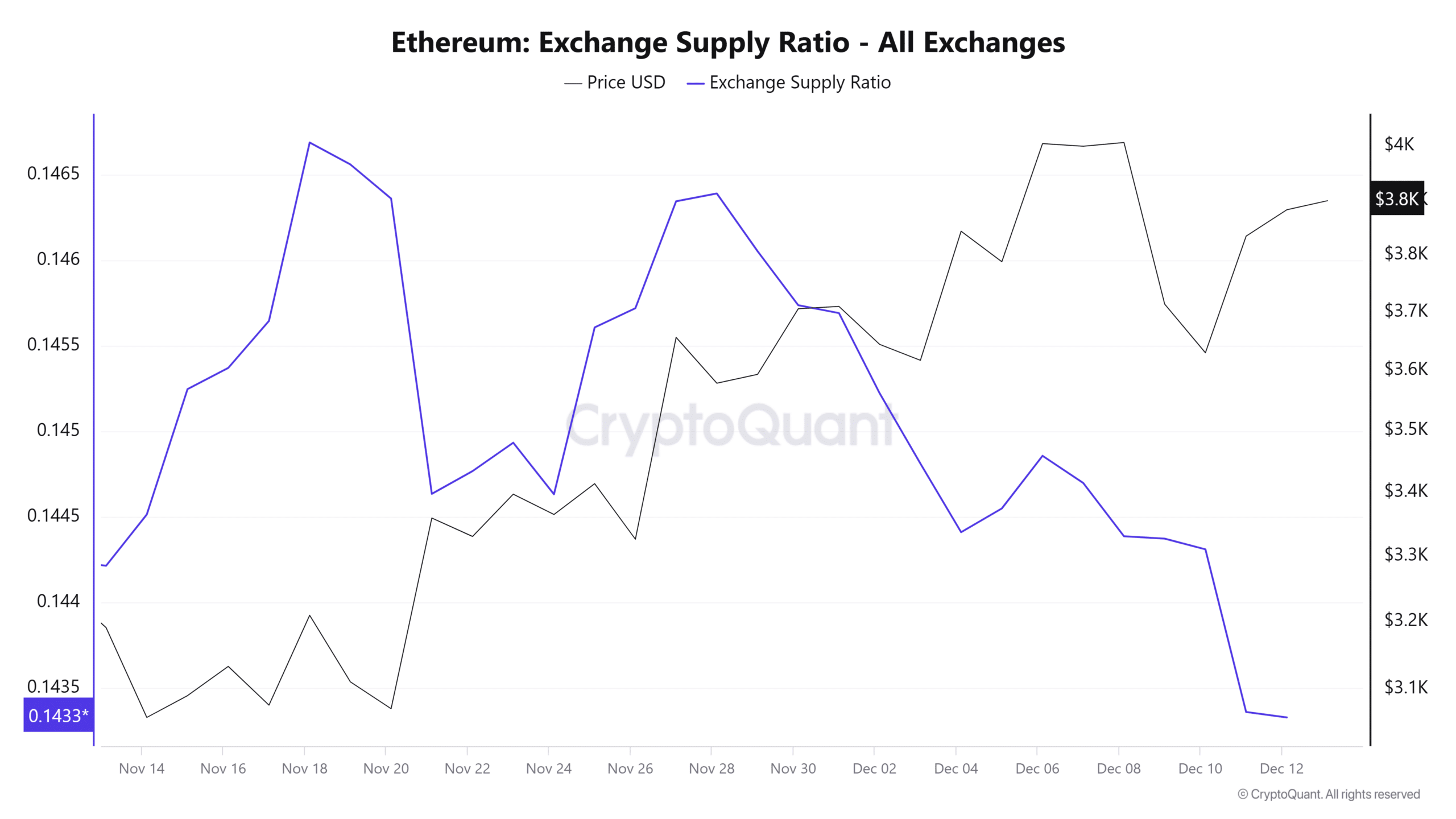

Source: Cryptoquant

This trend is further supported by a declining exchange rate supply ratio. This has fallen from 0.1468 to 0.143. Such a decline implies that more and more investors are optimistic and are keeping their assets outside the stock market.

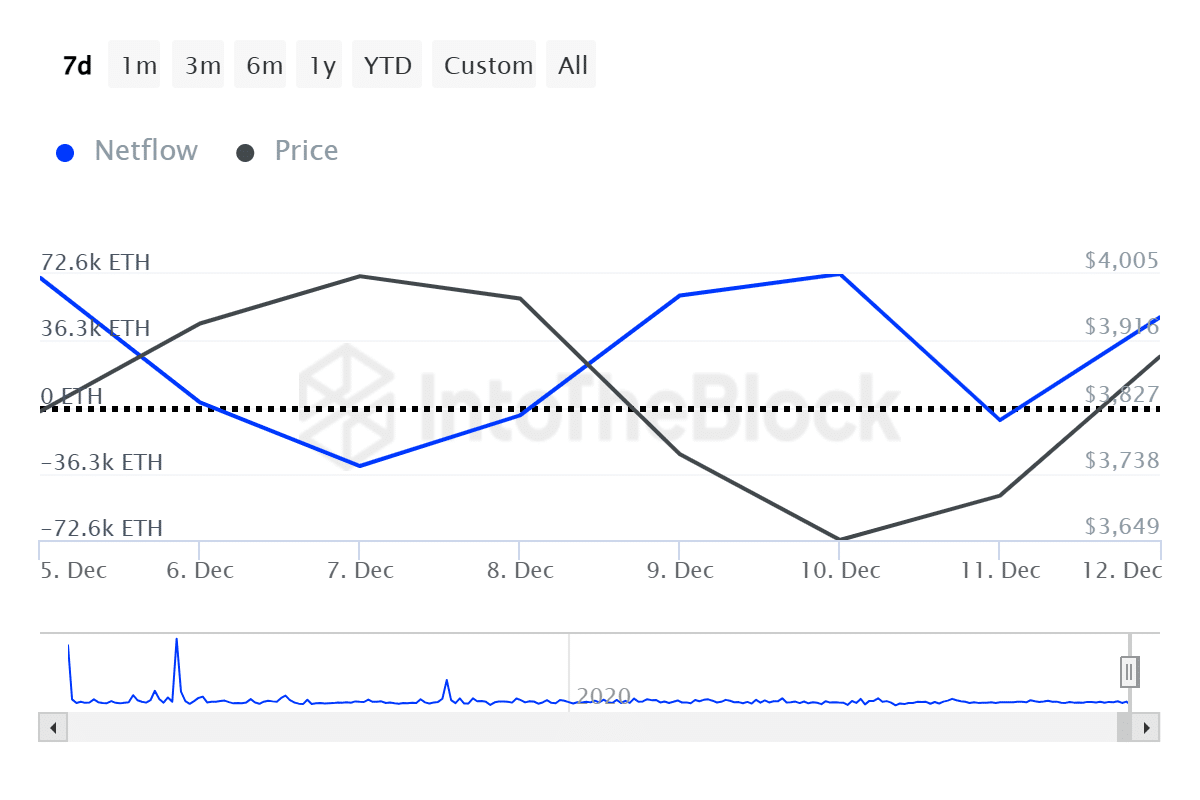

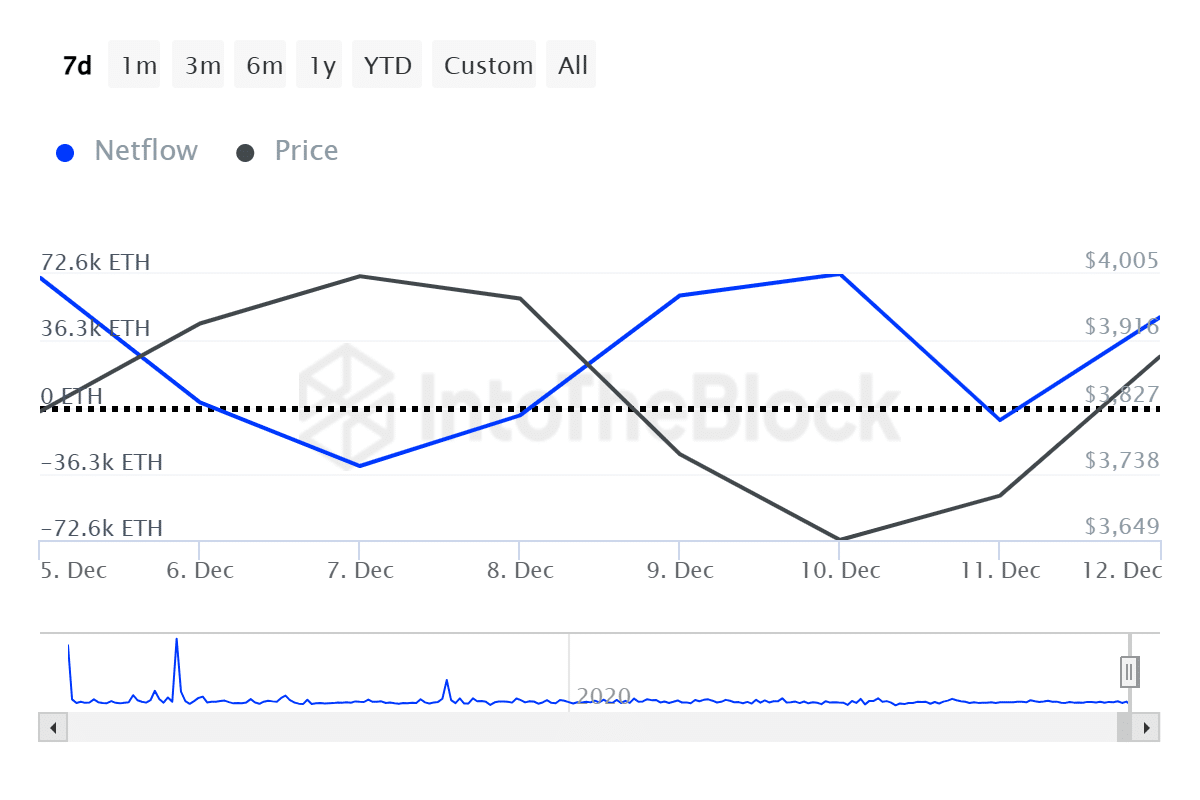

Source: IntoTheBlock

Finally, this bullishness among whales is reflected in the increasing net flow of large holders. Over the past day this has risen from negative 7.16k to 48.96k. When net flows experience such a dramatic increase, it means that more capital is flowing into an asset than is flowing out.

Read Ethereum’s [ETH] Price forecast 2024–2025

As noted above, Ethereum is currently experiencing positive sentiment among large holders. Therefore, with greater accumulation and inflows of funds, ETH could see more recovery on its price charts.

So, if these sentiments prevail, Ethereum could recover $4,000 in the near term. If buyers then fail to recapture the market, ETH could fall to $3713.