- Data showed that the exchanges witnessed an outflow of WLD worth $20.20 million.

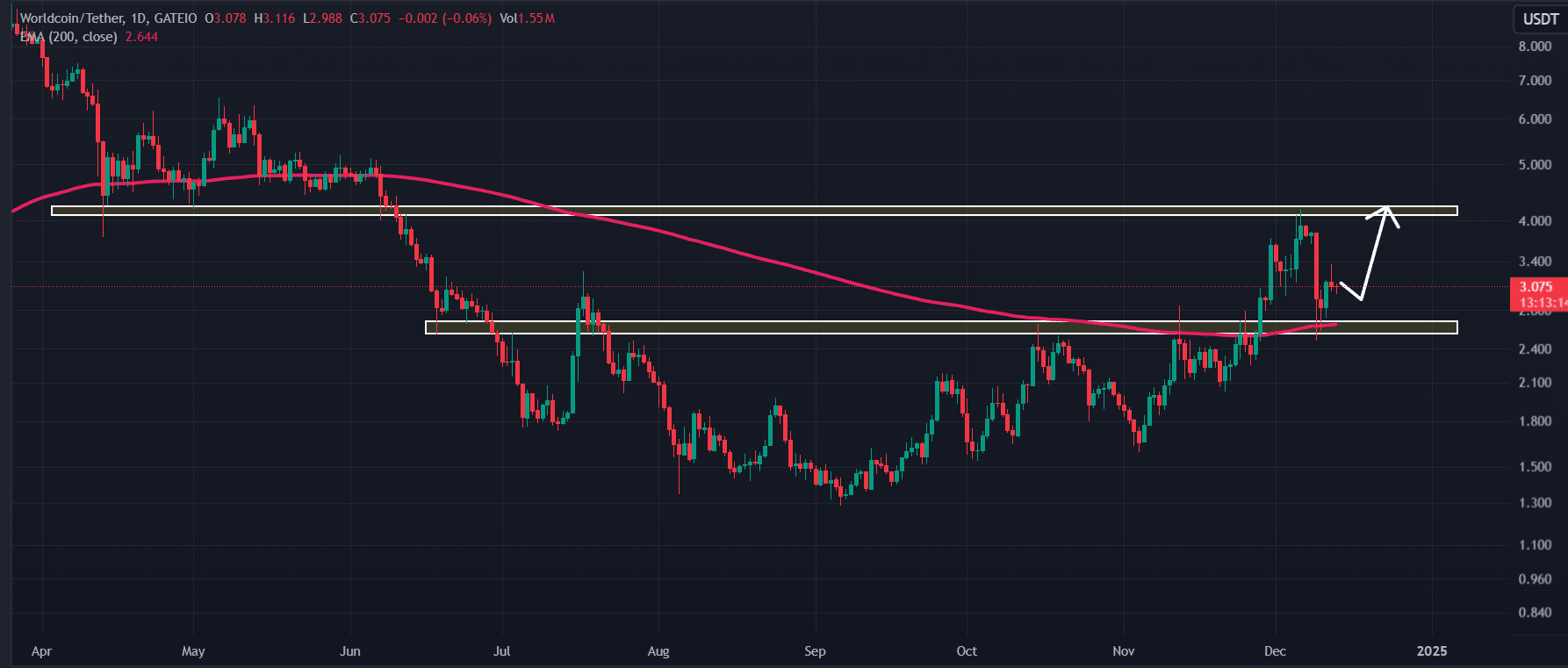

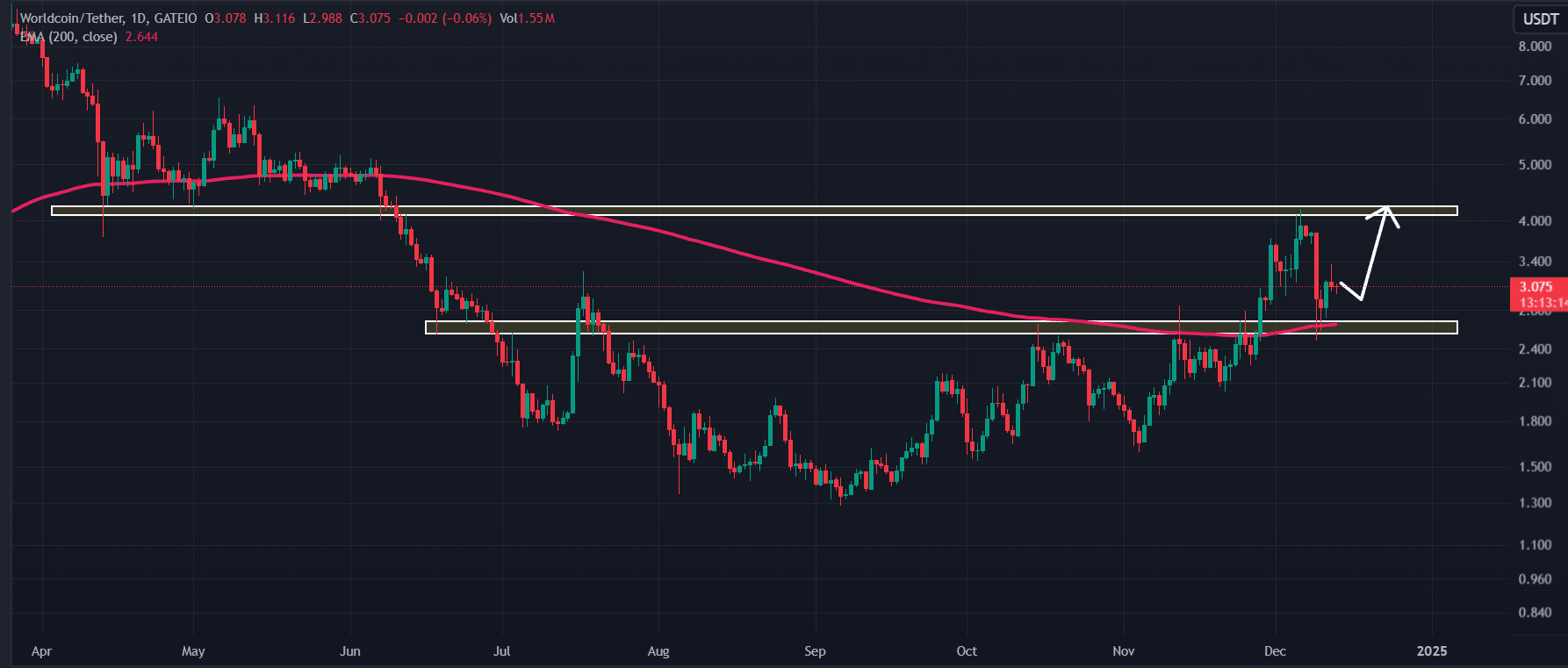

- If Worldcoin stays above the $2.5 level, it could rise by 30% to reach the $4 level in the future.

World currency [WLD] is receiving significant attention from crypto enthusiasts following its recent breakout and impressive upward momentum. This outbreak has not only attracted investors but also attracted the interest of whales and institutions, as reported by on-chain analytics company IntoTheBlock.

Worldcoin’s large txn volume increases 252%

IntoTheBlocks data showed that WLD’s high transaction volume increased by 252%, indicating growing confidence from whales and institutions.

However, this significant increase in trading volume was observed during a period when market sentiment in the cryptocurrency landscape was unpredictable due to notable fluctuations in asset prices.

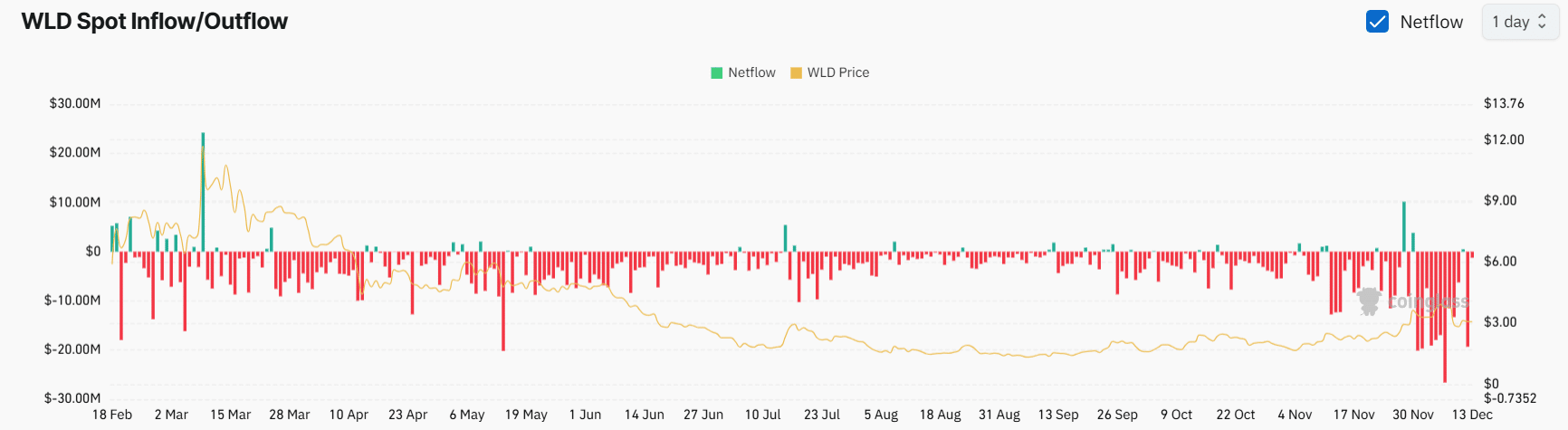

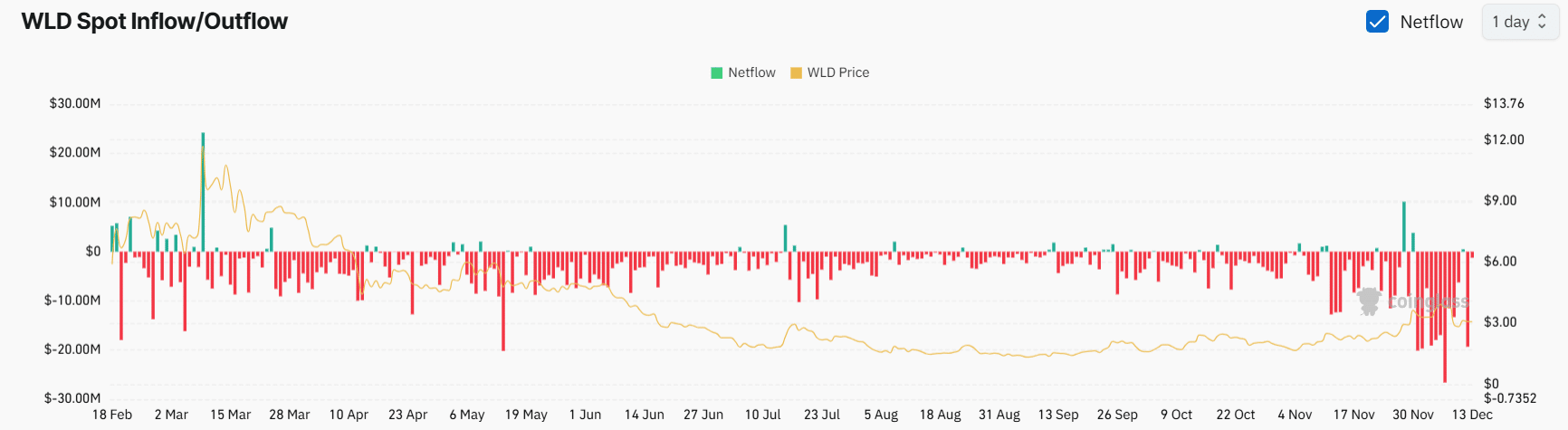

Furthermore, Coinglass’ WLD spot inflows/outflows data showed that the exchanges have consistently experienced significant WLD outflows. Over the past 48 hours, the exchanges have recorded significant outflows of WLD worth $20.20 million.

Source: Coinglass

The term “outflow” refers to the transfer of assets from exchanges to wallets, indicating that long-term holders are withdrawing the token. These continued outflows from the stock markets indicate a bullish trend, indicating potential upside momentum and providing a favorable buying opportunity.

In addition to increasing interest from whales and institutions, traders also appear bullish, as reported by Coinglass. WLD’s long/short ratio currently stands at 1.05, indicating strong bullish sentiment among traders.

At the time of writing, 51.25% of the top traders in the WLD were long positions, while 48.75% were short positions.

Technical analysis and key levels of Worldcoin

However, this notable interest from industrial giants appears to be following the bullish price action pattern.

According to AMBCrypto’s technical analysis, WLD appears bullish, having recently cleared the $2.5 support level and formed a bullish engulfing candlestick pattern on the daily time frame.

Source: TradingView

With the recent price action, there is a high chance that WLD could rise 30% to reach the $4 level in the coming days. However, this bullish thesis will only remain valid as long as the token trades above the $2.5 level, otherwise it could falter.

Realistic or not, here is the market cap of WLD in terms of BTC

On the upside, WLD’s Relative Strength Index (RSI) currently stands at 52, below overbought territory, indicating that the token has plenty of room to rise significantly in the coming days.

At the time of writing, WLD was trading around $3.08 and has registered a 3.3% decline in the last 24 hours. During the same period, trading volume fell by 30%, indicating lower participation from traders and investors compared to the day before.