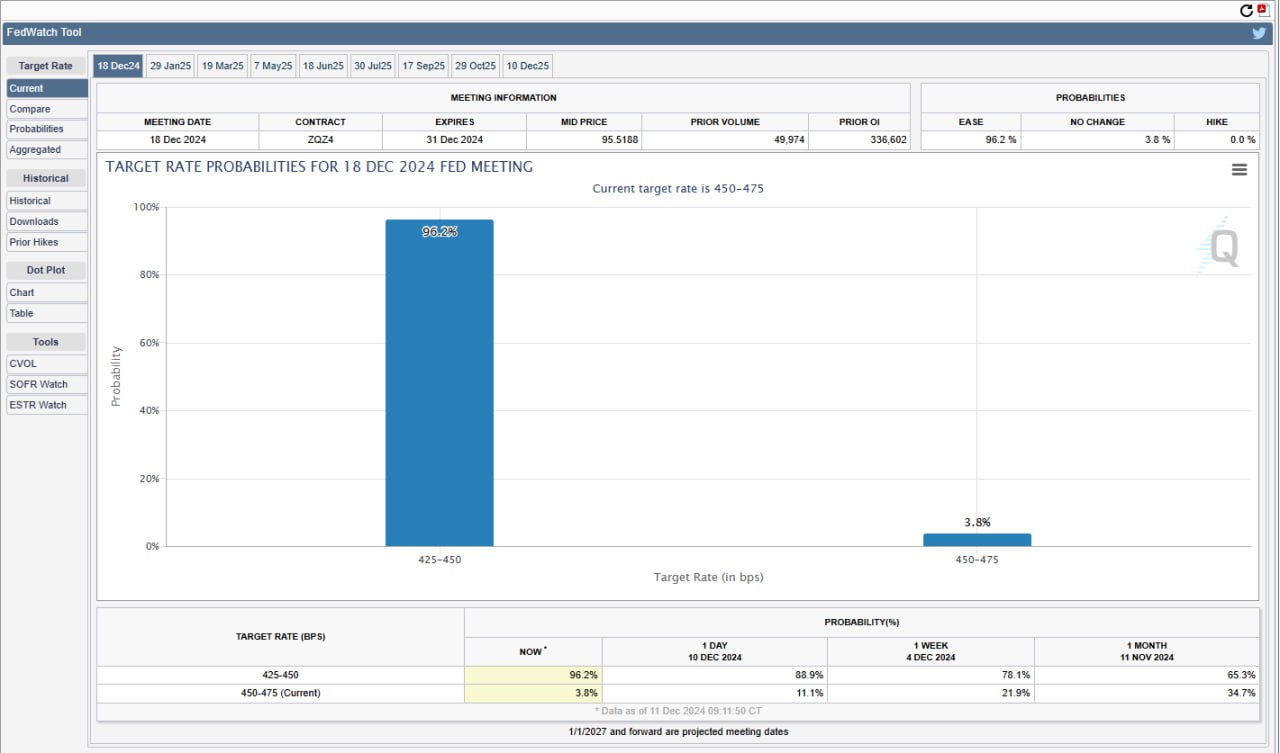

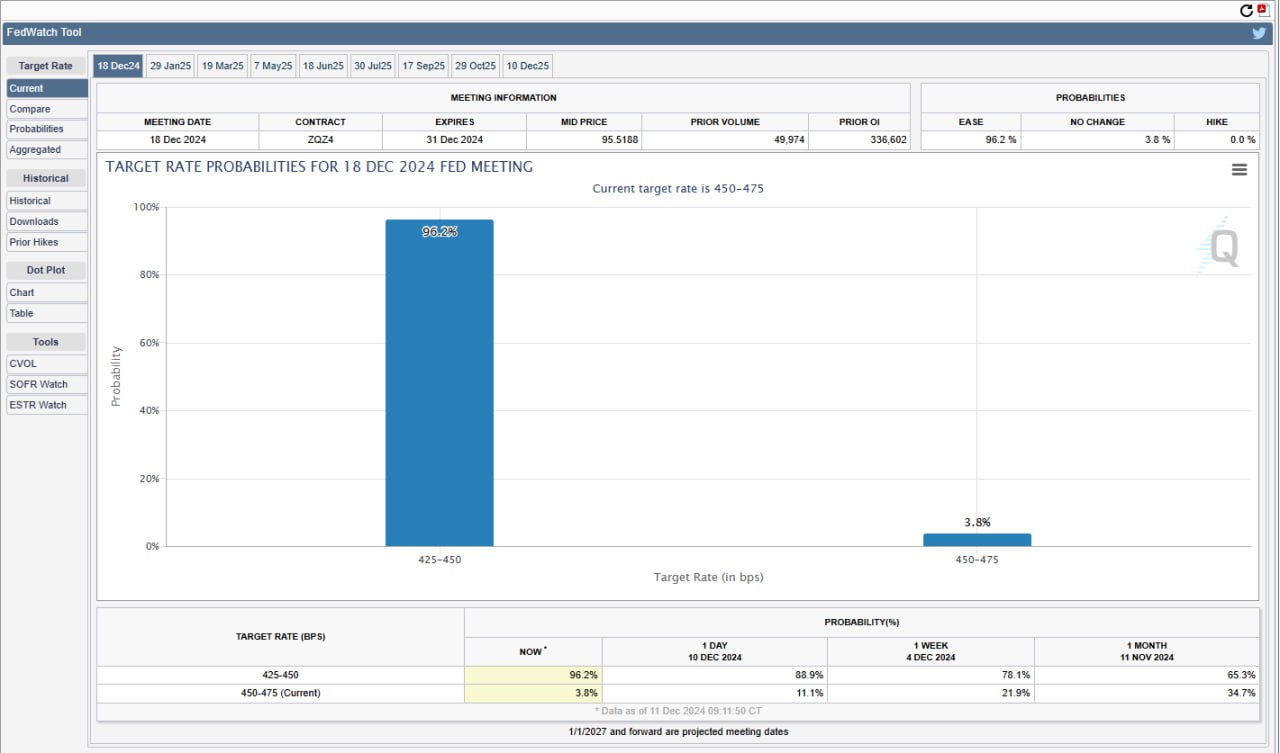

- The CME’s Fed Watch noted a 96% probability of a 25 basis point cut next week.

- Price action, liquidation zones and MVRV all indicate a potential continuation of the rally.

The Federal Reserve’s December interest rate decision coincided with a 96% probability of cutting rates by 25 basis points (bps)This is evident from the CME’s Fed Watch.

This was up from 89% in the last 24 hours, at the time of writing, and 65% a month ago.

The probability of zero basis points had only a 5% probability, while that of more than 25 basis points was 1%, highlighting the minimal expectations for these outcomes.

Given lower non-housing inflation rates and headline inflation just above target due to housing costs, a Fed rate cut could boost non-traditional investments like Bitcoin. [BTC].

Source:

Historically, lower interest rates made cryptos more attractive by reducing the appeal of yield-bearing assets and allowing greater liquidity and institutional lending at lower costs.

Thus, a possible rate cut indicated a bullish outlook for Bitcoin, suggesting that the price could continue to rise as capital flows into the asset increase.

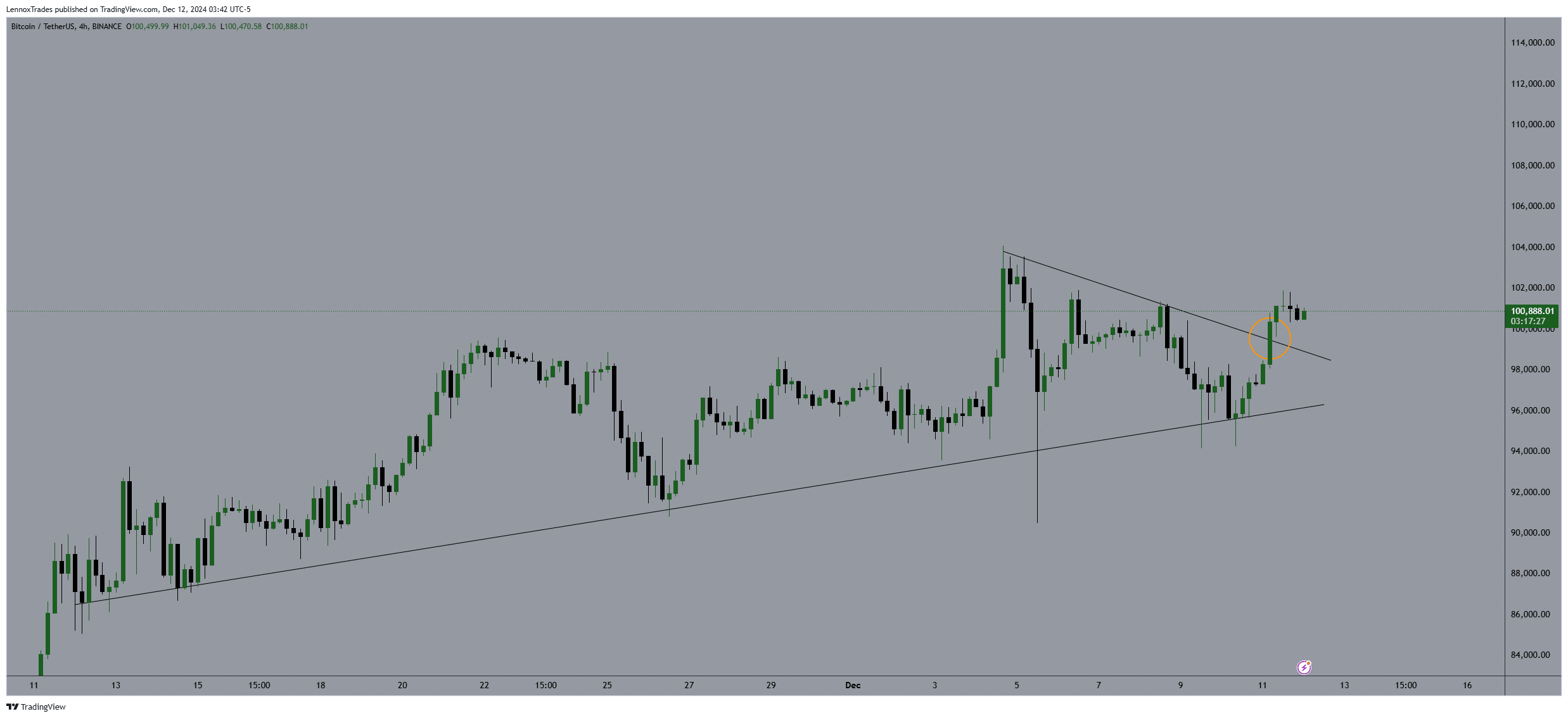

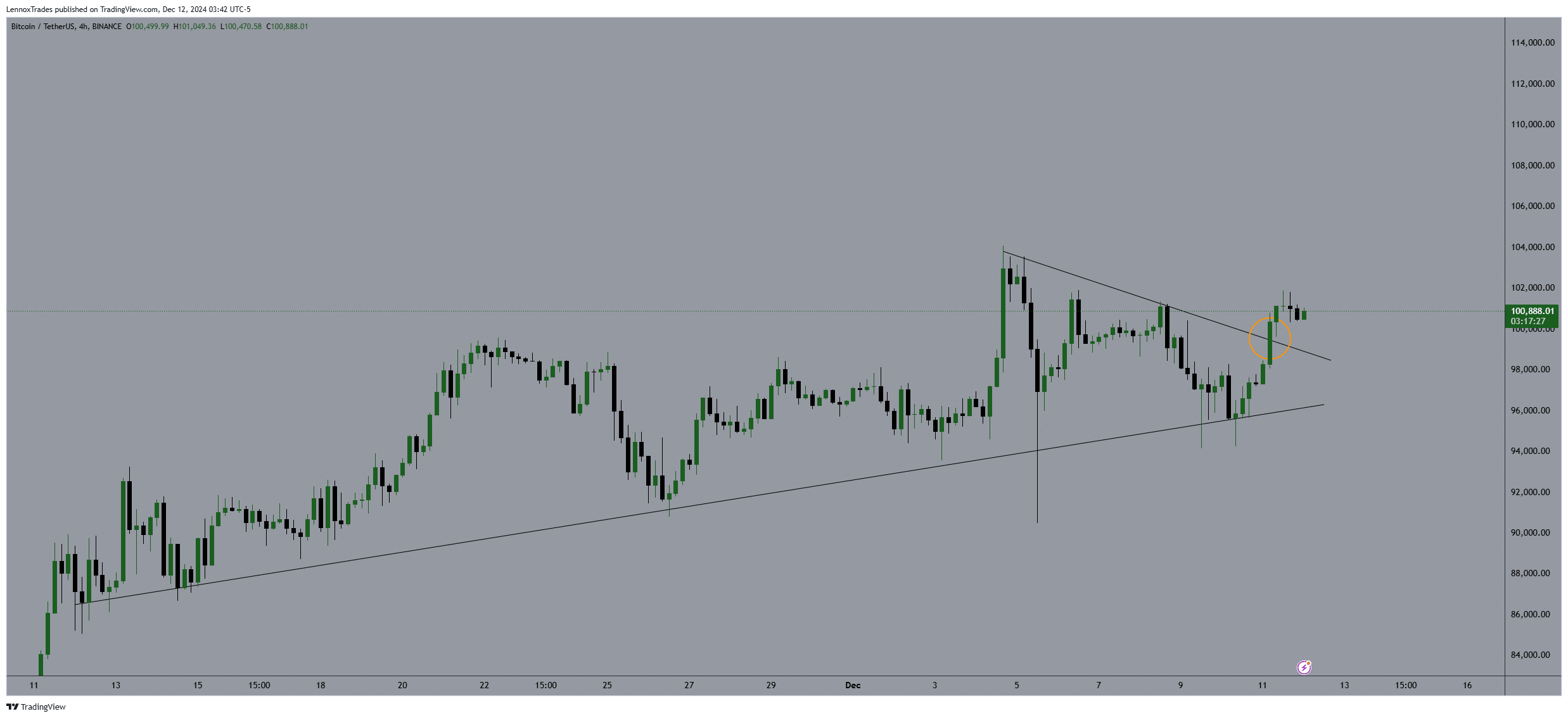

Price breaks from continuation pattern

Looking at the 4-hour chart of BTC, it consolidated into a symmetrical triangle pattern, a continuation pattern, supporting the continuation of the rally.

Bitcoin’s recent trend aligned with expectations that upcoming Fed rate cuts could fuel further rallies.

The price moved in smaller and smaller swings between the two converging trend lines, indicating consolidation before a breakout. The breakout to the upside suggested a bullish continuation.

Source: trading view

With the Fed expecting rate cuts that are bearish for the dollar, Bitcoin could become more attractive in pursuit of higher yields, potentially pushing up the price of BTC further if the rate cut materializes as expected.

Liquidations and BTC MVRV

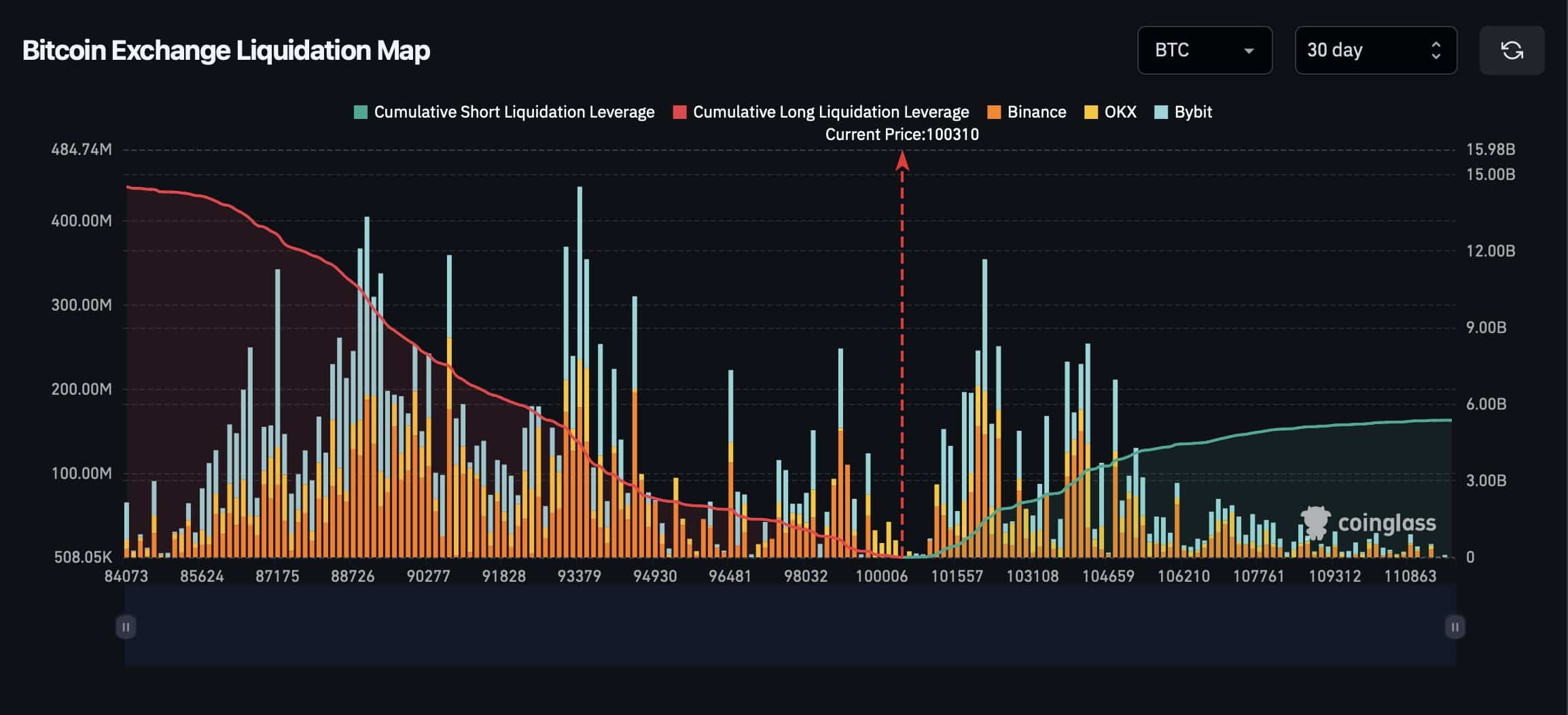

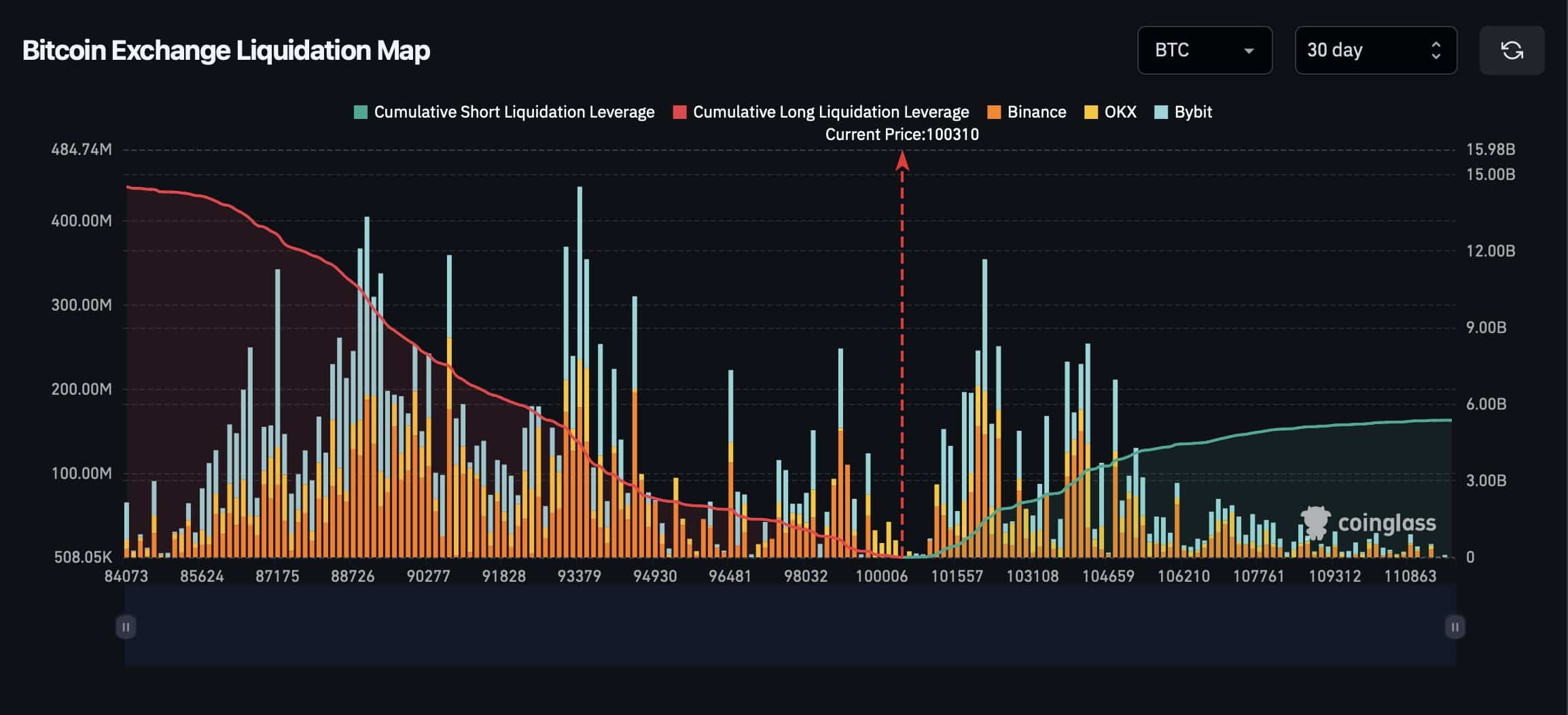

Once again, Coinglass data showed a huge concentration of leveraged orders, risking liquidation around the current price of BTC on several exchanges such as Binance, OKX, and Bybit.

If Bitcoin were to cross $105,000, BTC shorts worth $4.1 billion could be ready for liquidation, which could strengthen the uptrend due to forced coverings by short sellers.

The cumulative long liquidation leverage for Bitcoin increased steadily, reflecting the growing momentum.

Source: Coinglass

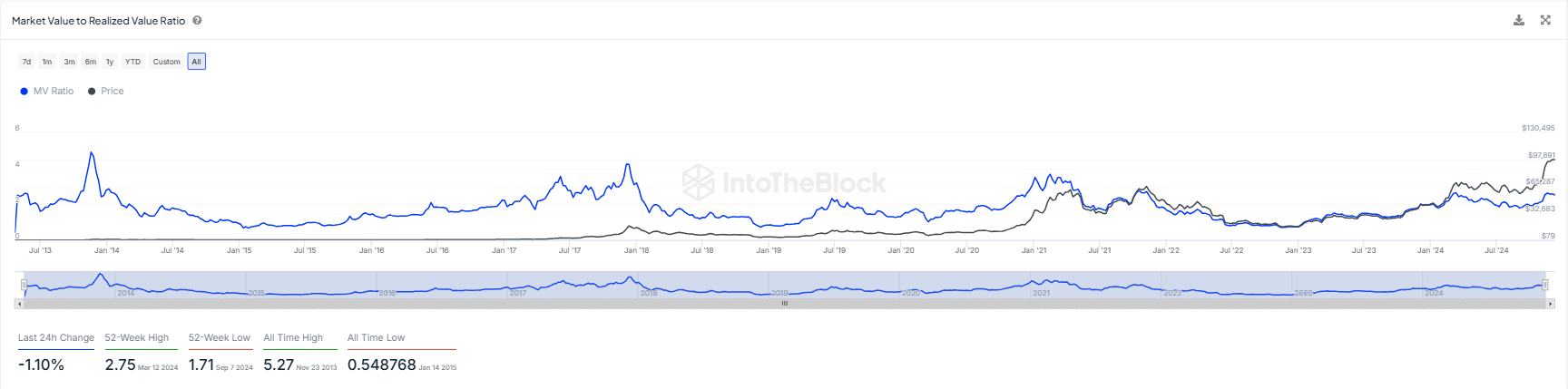

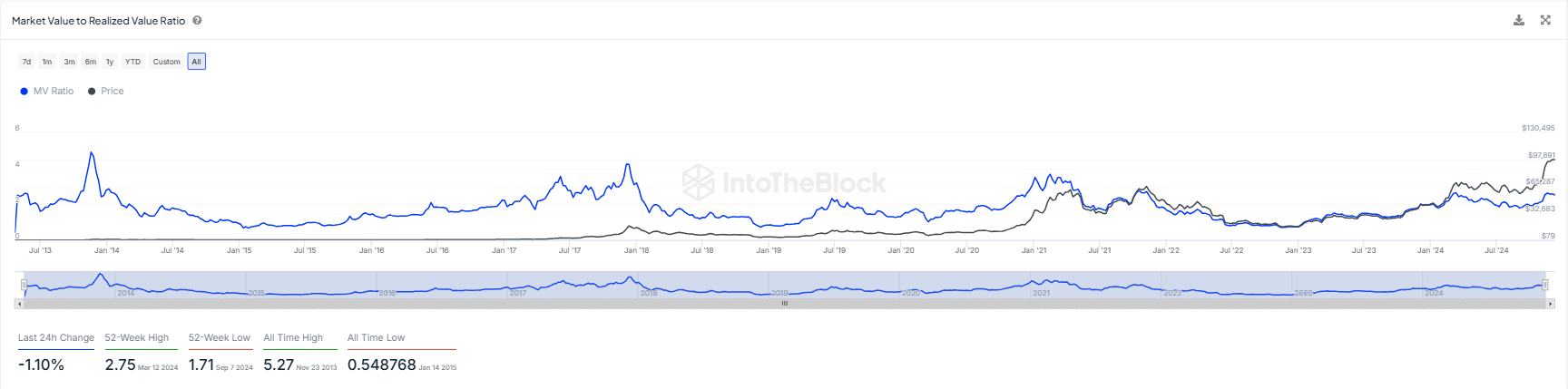

Further analysis of the MVRV ratio showed that the value was 2.53, indicating that Bitcoin’s market price was approximately 2.53 times higher than its realized value.

This ratio has fluctuated, peaking during periods of high market optimism and then normalizing or declining during corrections.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024-25

Notably, the MVRV ratio has not reached the extreme peaks seen in previous cycles, indicating that Bitcoin may not be at a market peak.

If the Federal Reserve cuts interest rates, it could increase interest in Bitcoin. This could potentially increase both the price and the MVRV ratio as more capital flows in. This reflects a bullish outlook with no immediate signs of a peak.