Bitcoin’s price sensitivity to economic events

Bitcoin investors are on edge as the market braces for two key economic data appears this week. The CPI, a critical gauge of inflation, is due tonight, December 11, while tomorrow’s unemployment data will shed light on the state of the US labor market.

Historically, such macroeconomic events have influenced Bitcoin’s price dynamics, often through their impact on Federal Reserve policy decisions.

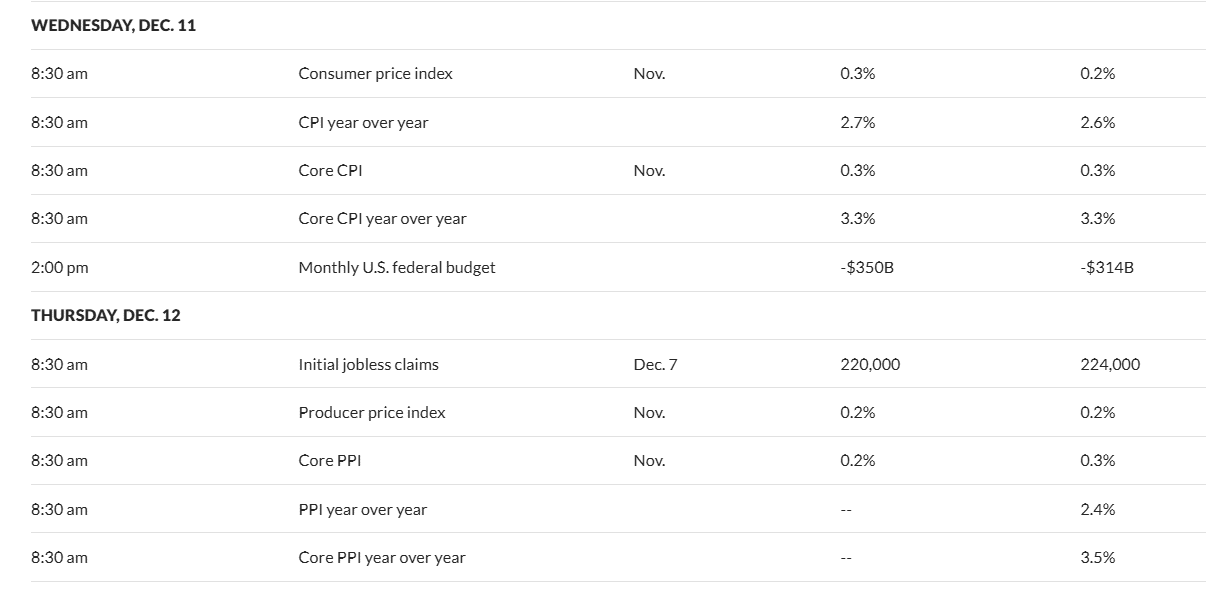

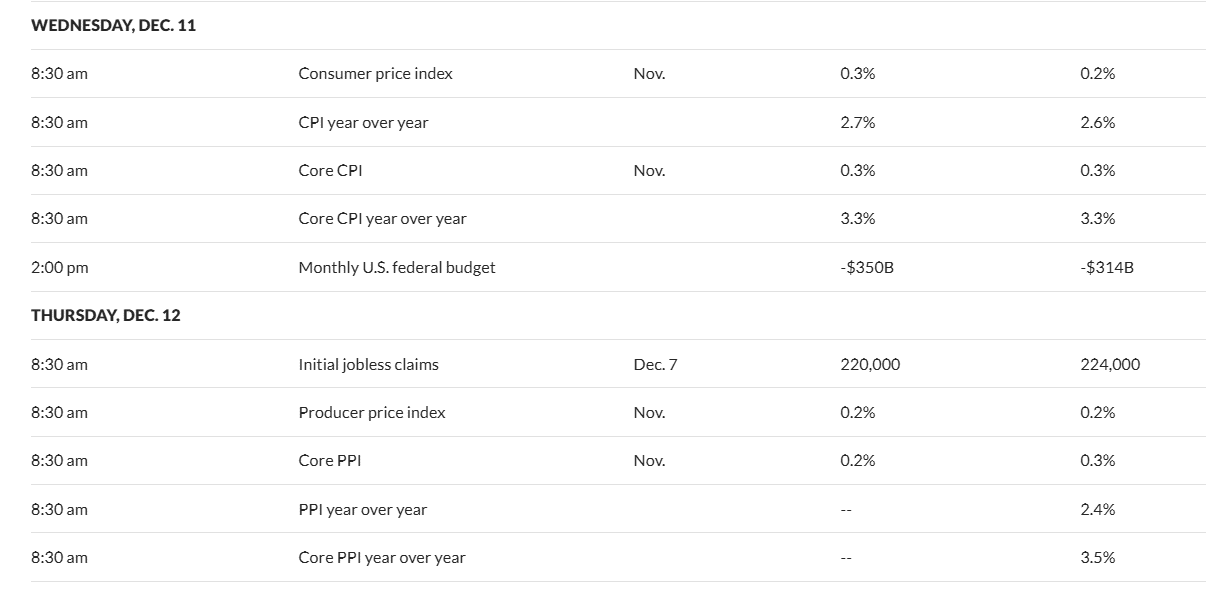

Source: Marketwatch

Inflation data, especially the core CPI, is critical because it excludes volatile components such as food and energy. A rise in the CPI could indicate continued inflationary pressures, potentially strengthening Bitcoin’s appeal as a hedge against inflation.

Likewise, unemployment data can influence market sentiment by providing insight into economic stability or distress, which often influences demand for alternative assets such as Bitcoin.

Unemployment data: can labor market conditions influence risk sentiment?

Read Bitcoin’s [BTC] Price forecast 2024–2025

Potential scenarios

This week’s economic data could impact Bitcoin’s price movement in the short term. A higher CPI or weaker labor market data could fuel inflation fears, giving Bitcoin a boost as a hedge against currency devaluation.

Conversely, a lower CPI or strong employment numbers could favor risky assets like stocks, reducing immediate demand for BTC. Mixed outcomes could increase market volatility as investors assess the implications for Federal Reserve policy.

With Bitcoin nearing a critical psychological level, these data releases are critical in determining direction and broader market sentiment.