- Bitcoin bulls have defended the short-term medium-term support.

- There has been an increase in spot sales in recent days, but this may not be enough to reduce prices.

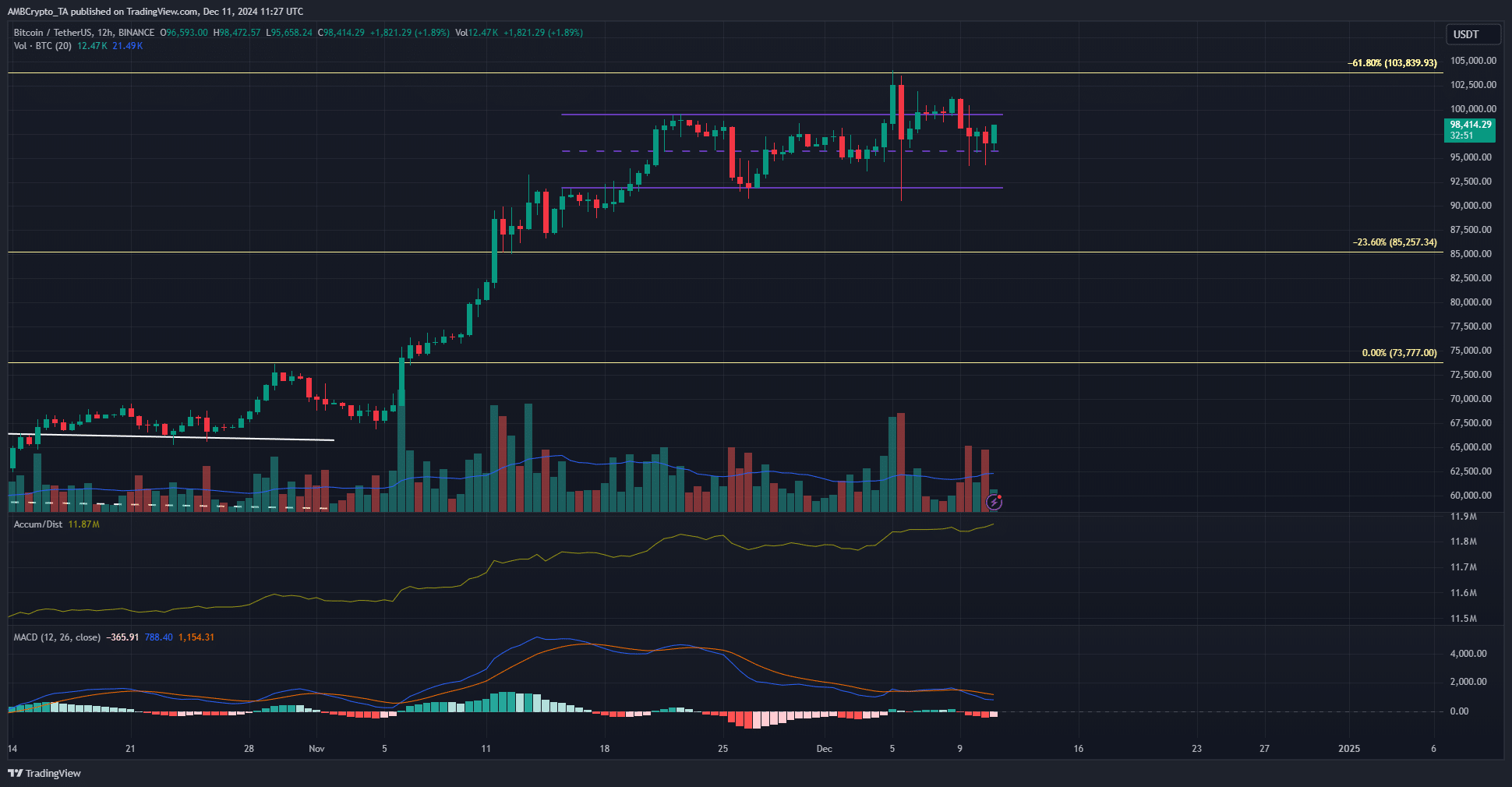

Bitcoin [BTC] has formed a range below $100,000 and has struggled to break the key psychological level. This range extended from $92.1k to $99.5k.

Support for Bitcoin’s mid-range has been defended despite repeated tests over the past three days, and a recovery seemed likely.

Bitcoin bulls are pushing prices above the $95.8k support

Source: BTC/USDT on TradingView

Bitcoin has been defending mid-range support at $95.8k over the past three days. Not a twelve-hour session below the mid-level has been completed yet. Moreover, the A/D indicator is trending higher this week.

This was a strong sign that buyers were eager to add Bitcoin to their holdings near the mid-range support. It is possible that volatility could take BTC to the short-term low of $94.5k. This could come about as a result of a liquidity chase.

The MACD was bearish over the 12-hour time frame. Even though it was above zero, it indicated waning bullish momentum. Trading volume has slowly trended downward during BTC’s consolidation within this three-week range.

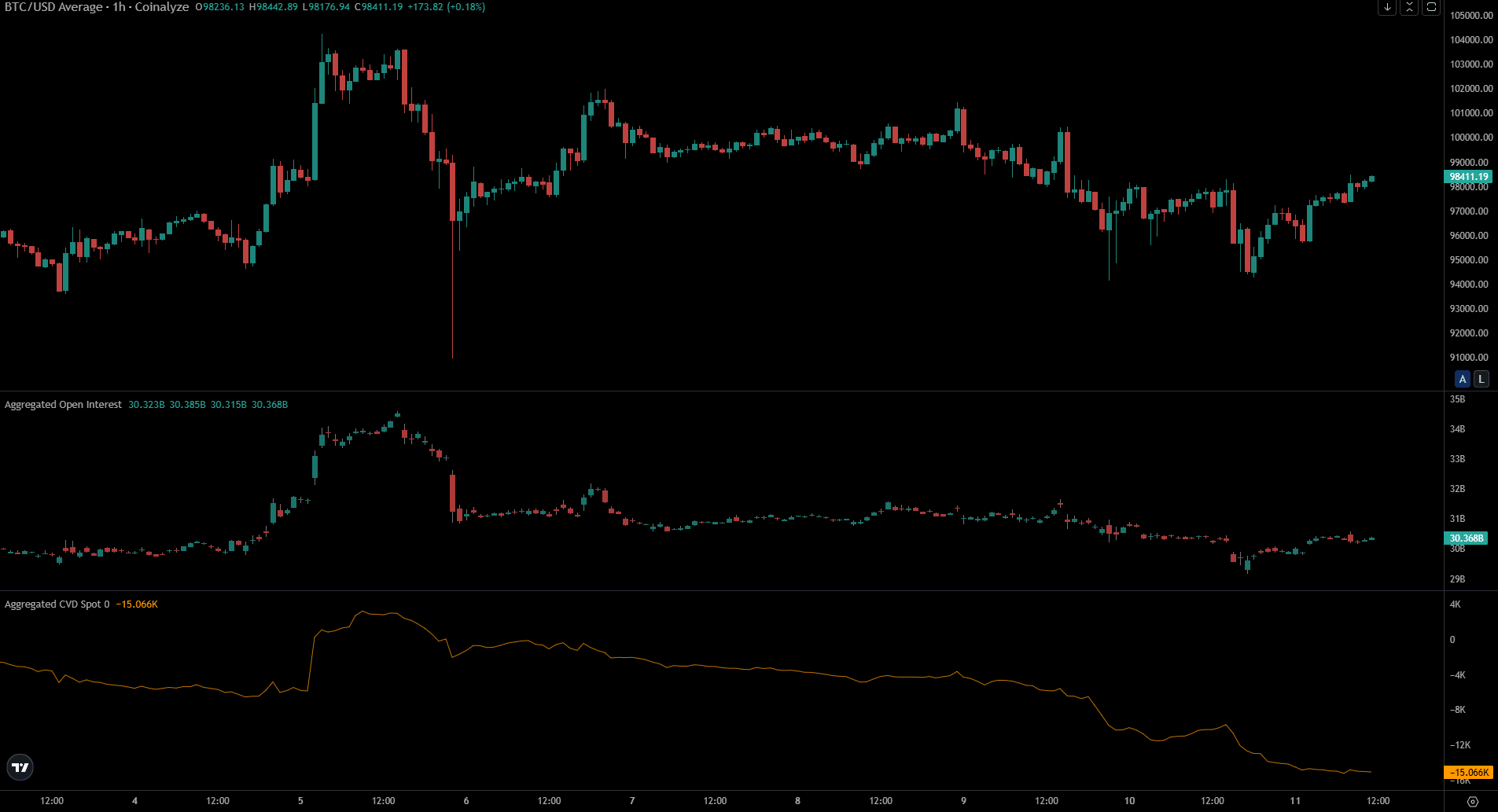

The declining open interest showed that sentiment was lukewarm

Spot CVD was in a downtrend even as bulls defended mid-range support. Although this contradicted the findings of the A/D indicator, the time frames were different. Sales have increased in recent days, but buyers have been stronger this past week.

In addition to the declining demand for short-term spots, the Open Interest (OI) has also fallen. This usually happens when an asset stops its strong trend, which Bitcoin has done by forming a range.

The falling OI indicated that speculators were waiting for the market to make up its mind and break the range.

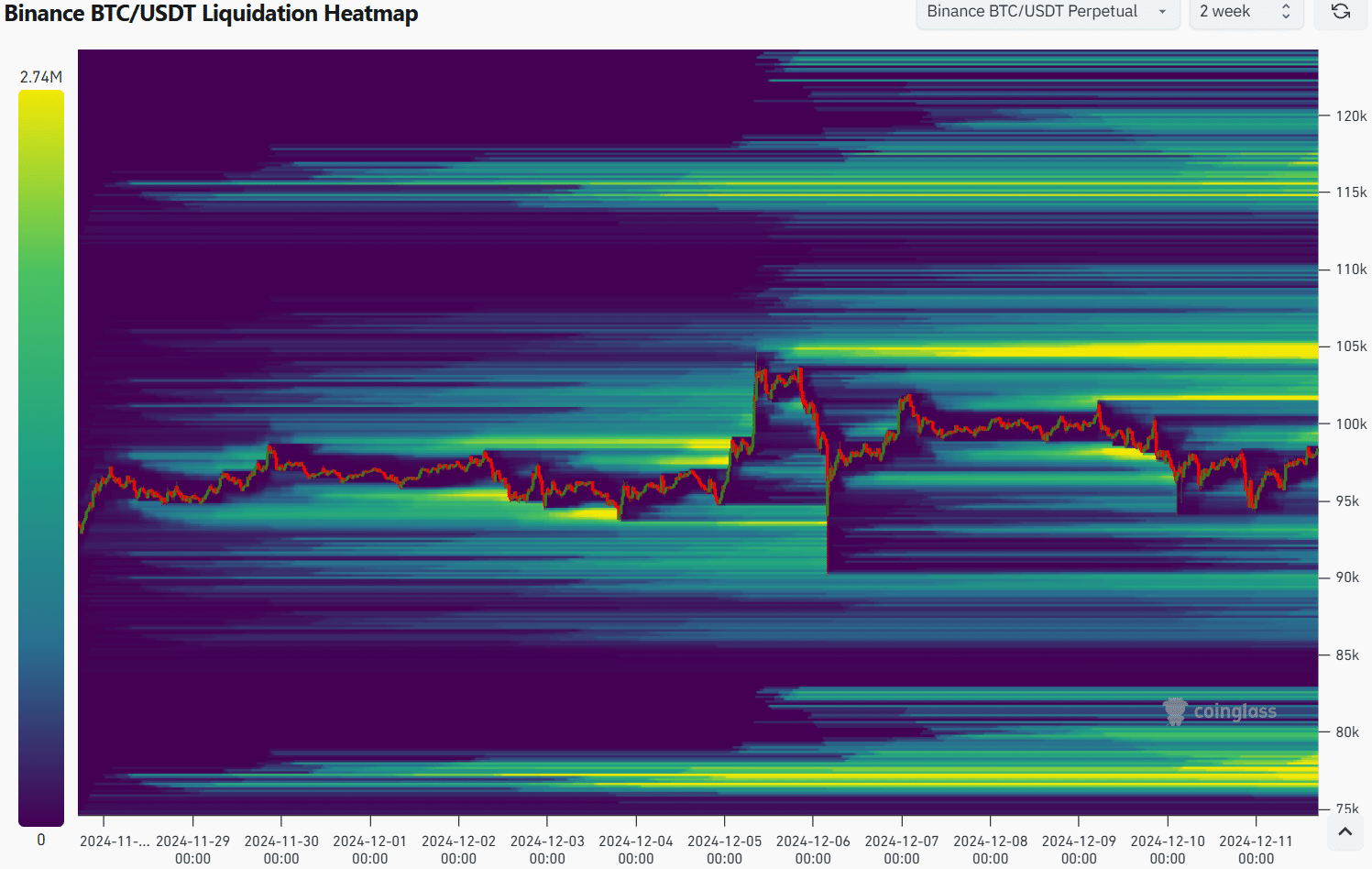

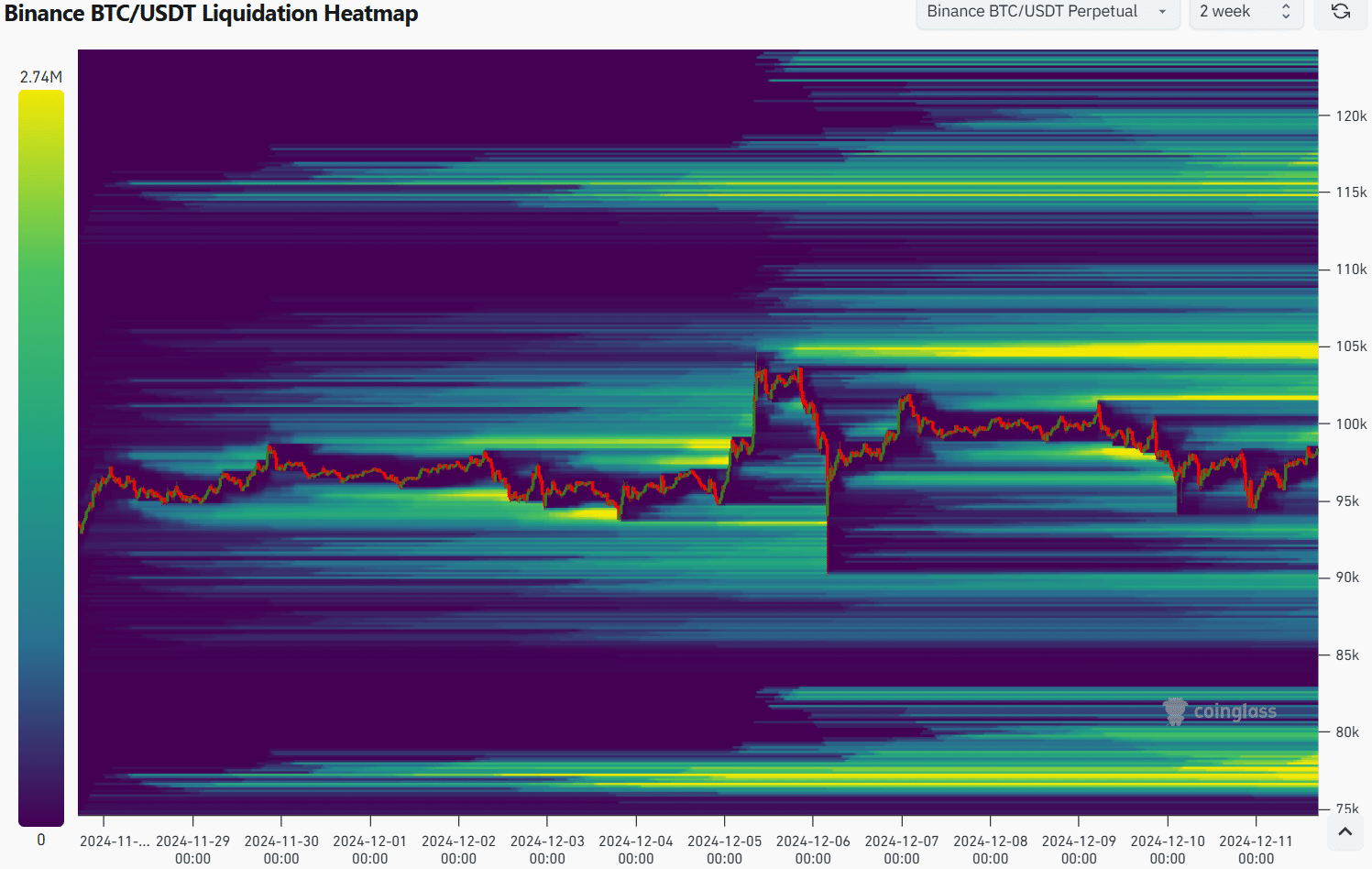

Source: Coinglass

It was previously mentioned that a liquidity chase could push Bitcoin towards the $94.5k support. The liquidation chart showed that while this was possible, a price increase to $105,000 was much more likely.

Read Bitcoin’s [BTC] Price forecast 2024-25

The liquidity cluster at $105,000 was intense, and the BTC consolidation around $100,000 provided this liquidity. It is very likely that Bitcoin will reach these highs in the coming days and possibly break further.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer