- Sell-offs by miners could indicate bearish sentiment or short-term liquidity problems.

- Bitcoin’s price may experience volatility depending on continued miner behavior and outflows.

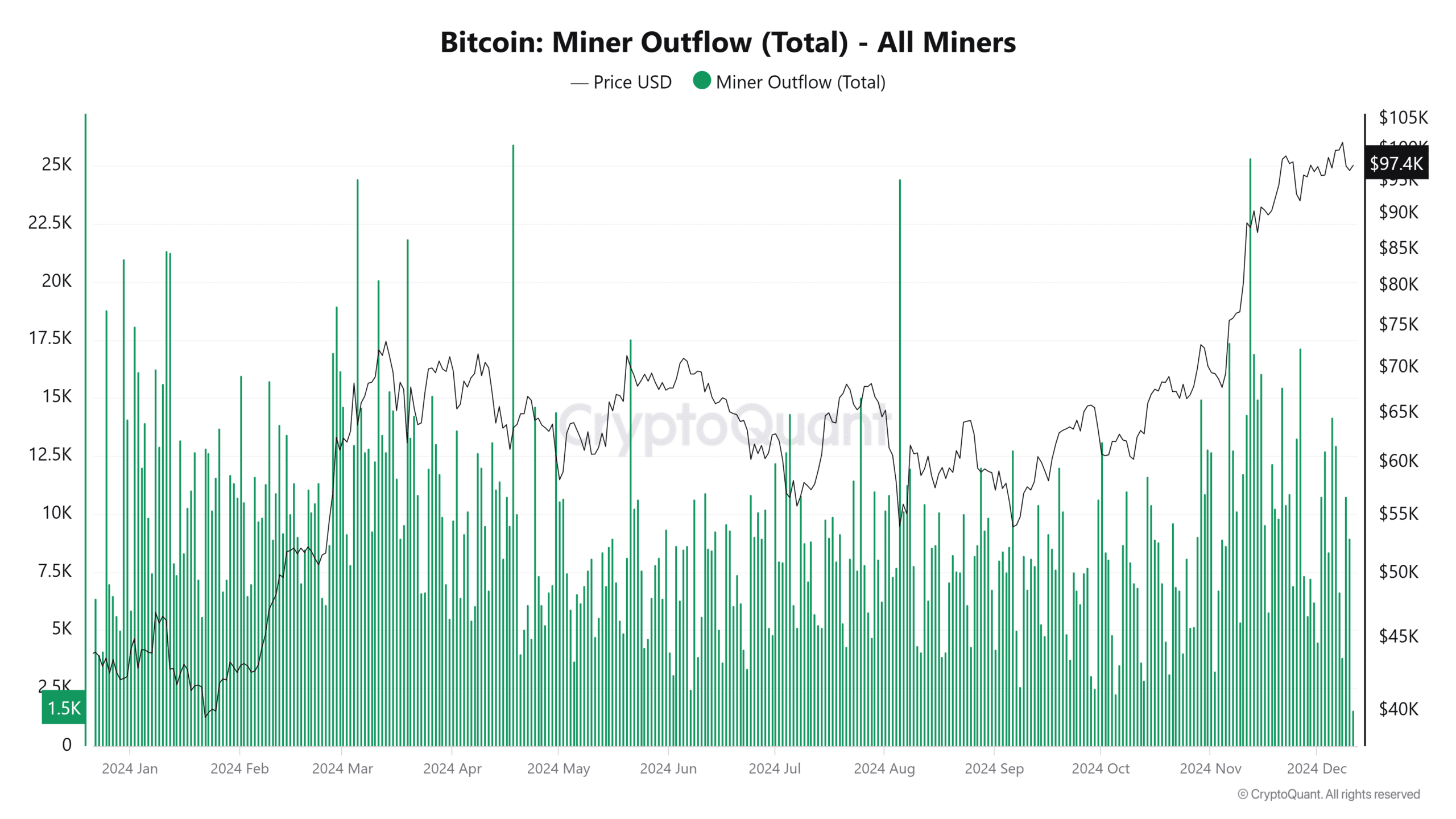

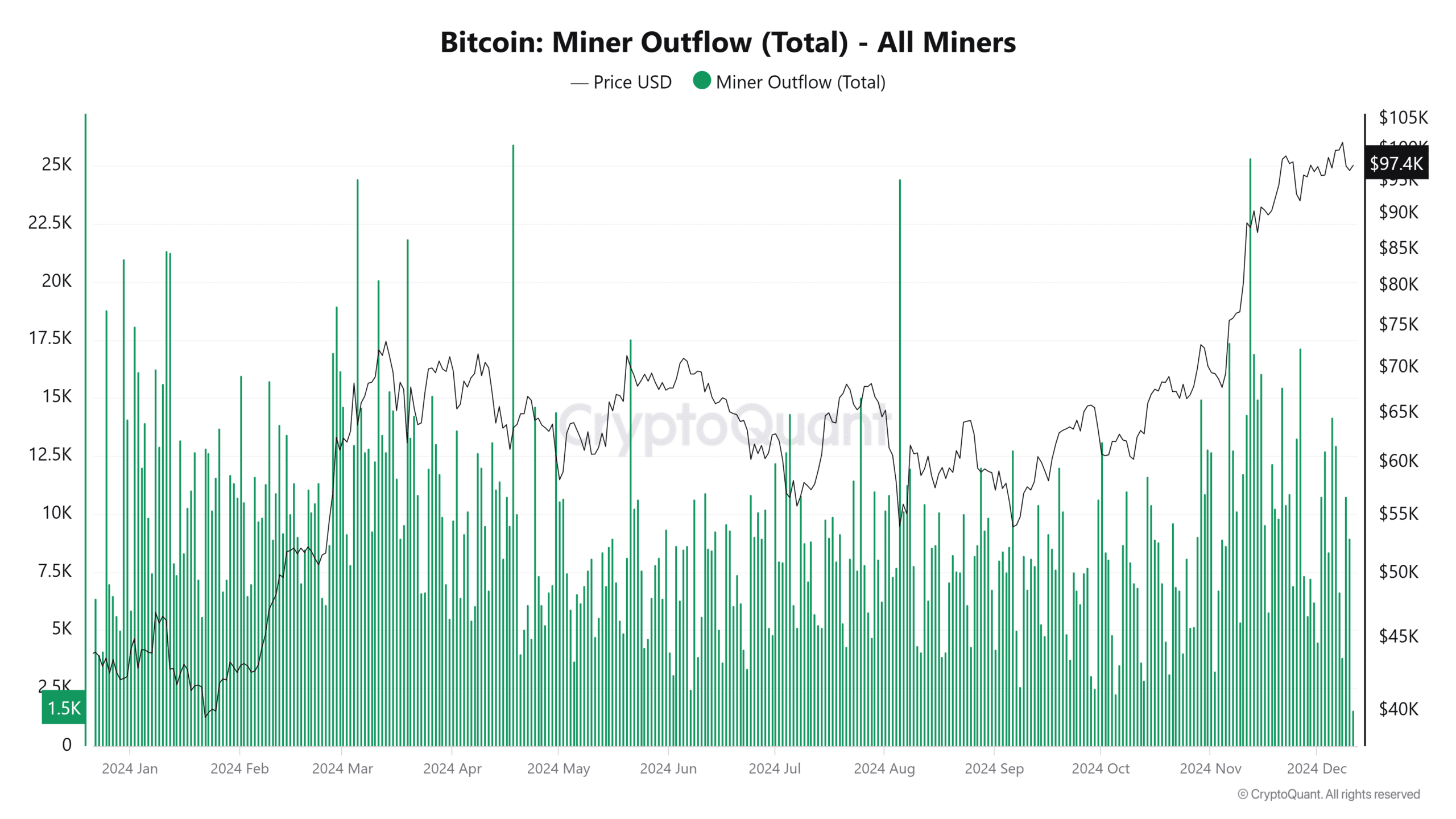

Bitcoin [BTC] Miners have sold 771 BTC in the past 24 hours, totaling around $76 million, raising concerns about its potential impact on the price. Such significant sell-offs often create supply-side pressures, which can impact market sentiment, especially during volatile periods.

As Bitcoin hovers near critical price levels, questions arise as to whether this move signals short-term bearishness or reflects miners’ struggle to cover rising operating costs.

With the market in flux, all eyes are on miners’ behavior as a key indicator for the days ahead.

Outflow of Bitcoin Miners

The recent surge in Bitcoin miner outflows coincides with rising operational costs and a market correction.

In particular, large outflows often indicate a shift in sentiment among miners, often reflecting the need to liquidate assets, either for immediate cash flow or to hedge against volatile conditions.

During periods of high volatility, such as the one we are currently experiencing, miners may release larger amounts of BTC to cover energy costs or pay off debt, especially as the price fluctuates around key levels.

Source: CryptoQuant

This trend of escalating outflows can be seen as a short-term bearish indicator, especially when combined with declining miner profitability.

However, it is also crucial to consider that such behavior could indicate an over-indebted mining sector, which could exacerbate price corrections if liquidity pressures increase further in the coming days.

The sell-off signals increasing pressure on the market. JPMorgan raised price targets for miners like Riot and CleanSpark, taking into account their BTC holdings and energy assets.

While the near-term sell-off suggests a bearish trend, these miners can hedge against operating pressures and position themselves for future gains despite the volatility.

The role of miners in the Bitcoin ecosystem

Bitcoin miners are crucial for maintaining the security of the network and validating transactions. However, their sell-off has historically exerted a significant influence on price dynamics.

When miners liquidate large amounts of BTC, it increases market supply, potentially putting downward pressure on prices.

This is especially evident when sentiment among miners turns bearish, often linked to rising operating costs or declining profitability. In previous cycles, substantial sell-offs by miners have marked local tops or signal periods of consolidation.

While these selloffs are not always indicative of a long-term bear market, they are a crucial market signal to keep an eye on.

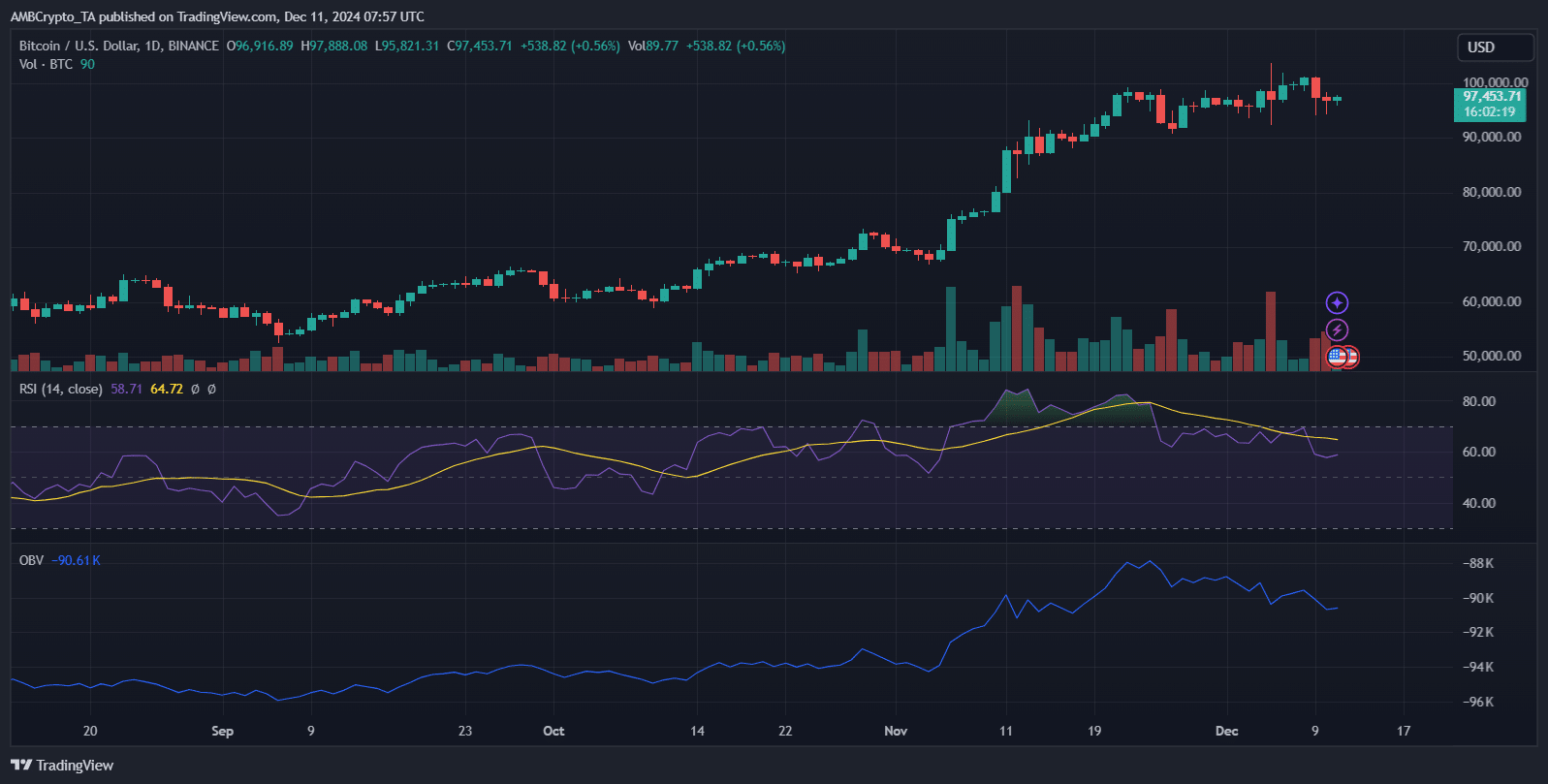

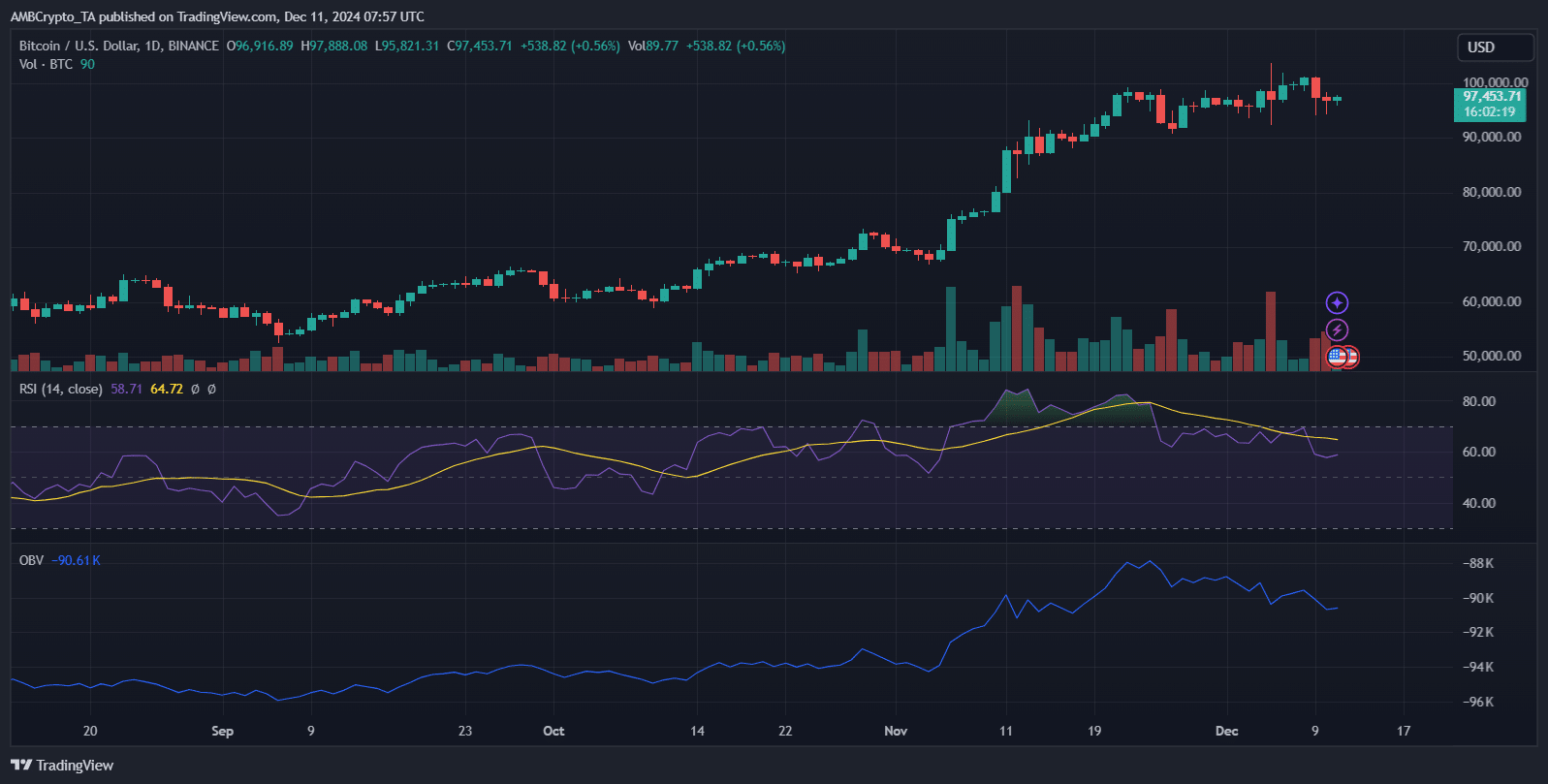

Impact on BTC price performance

The sell-off by the miners, coupled with current Bitcoin price trends, highlights a potential challenge to the market’s bullish momentum. Bitcoin is showing strong upward movement, but miners’ behavior indicates caution.

The outflows could create temporary downward pressure, especially if miners continue to liquidate large positions due to rising operating costs.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024–2025

Given Bitcoin’s proximity to key psychological levels, selloffs by miners could lead to greater volatility.

With market sentiment at a crossroads, Bitcoin’s ability to maintain its upward momentum will depend on whether miners decide to scale back their outflows or further intensify selling.