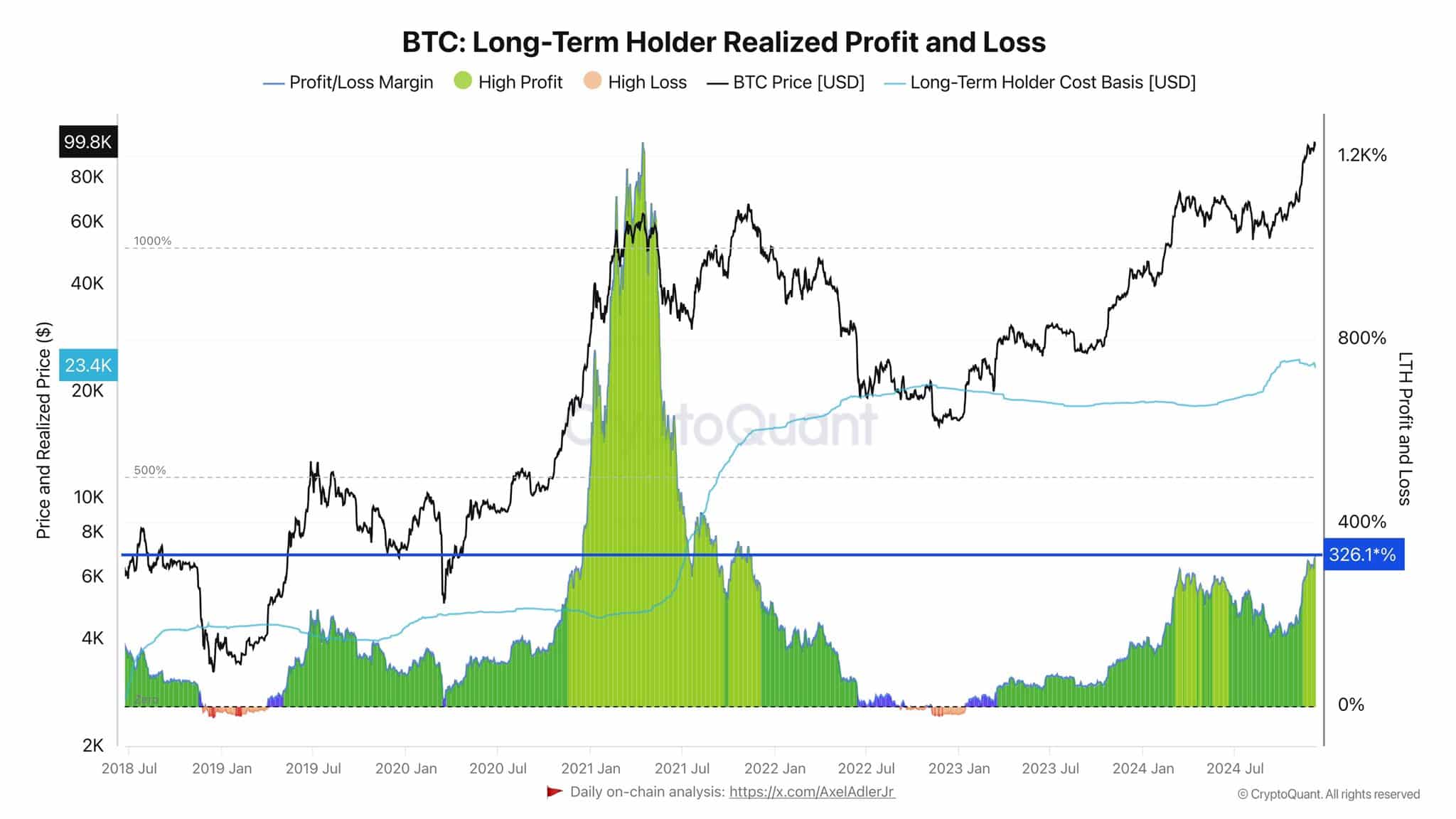

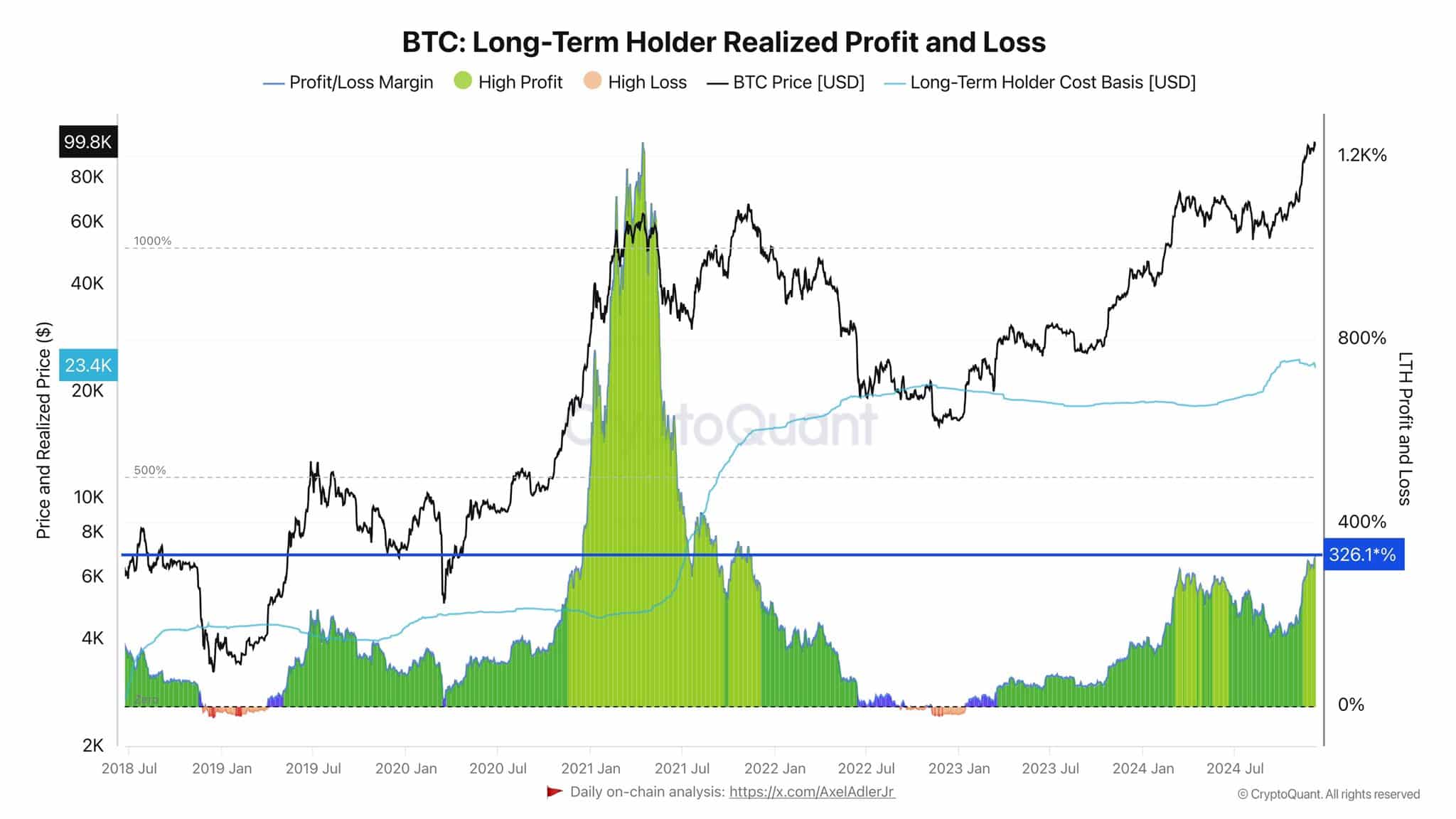

Strategic profit taking or market pessimism?

Long-term BTC holders are benefiting from the current rally, realizing an average gain of 326% with an entry cost of $23.4K. This behavior is consistent with historical patterns in which significant price increases often lead to profit taking.

However, this selling wave appears to be more strategic than reactive. With BTC trading well above its LTH cost basis, many are choosing to de-risk amid macroeconomic uncertainties, including potential interest rate shifts and market liquidity concerns.

Source:

Additionally, the cyclical nature of Bitcoin’s halving events may come into play, with some LTHs anticipating a plateau or temporary downturn.

Despite this selling pressure, Bitcoin’s resilience – buoyed by strong demand from newer market entrants – is showing a robust redistribution phase rather than an alarming sell-off. This shift in market dynamics could redefine BTC’s trajectory in the near term.

Role of new investors in absorbing supply

BTC’s recent price increase reflects a shift where demand, not just supply constraints, is driving growth. New investors, especially those using institutional-quality financial instruments such as Bitcoin ETFs, have played a crucial role in absorbing the available supply.

For example, BlackRock’s iShares Bitcoin Trust has amassed $10 billion in assets under management in seven weeks, accounting for more than 40% of spot ETF volumes. This rapid adoption has led to predictions that Bitcoin ETFs could surpass gold ETFs in total assets in the near future.

With ETFs now channeling 75% of new Bitcoin investments, their influence could grow even further, especially as the halving has increased scarcity. Anticipating reduced supply coupled with increasing demand positions new investors as key drivers of Bitcoin’s price momentum.

BTC’s next steps

As Bitcoin faces increased selling pressure from long-term holders, the path ahead appears to be shaped by pivotal developments. The halving event has tightened the supply of BTC, causing scarcity premiums to rise.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Institutional interests, especially through spot Bitcoin ETFs, can stabilize demand and drive adoption. However, regulatory clarity remains crucial for the general recognition of BTC.

Bitcoin’s growing link to macroeconomic trends and traditional assets positions it as both speculative and mature. The bank’s ability to sustain growth or deal with volatility depends on the balance between innovation, adoption and the ongoing tension between scarcity and liquidity.