- Excessive positions in the futures market made it more difficult for a BTC breakout.

- The reset and liquidation cascades are necessary for a healthy long-term uptrend.

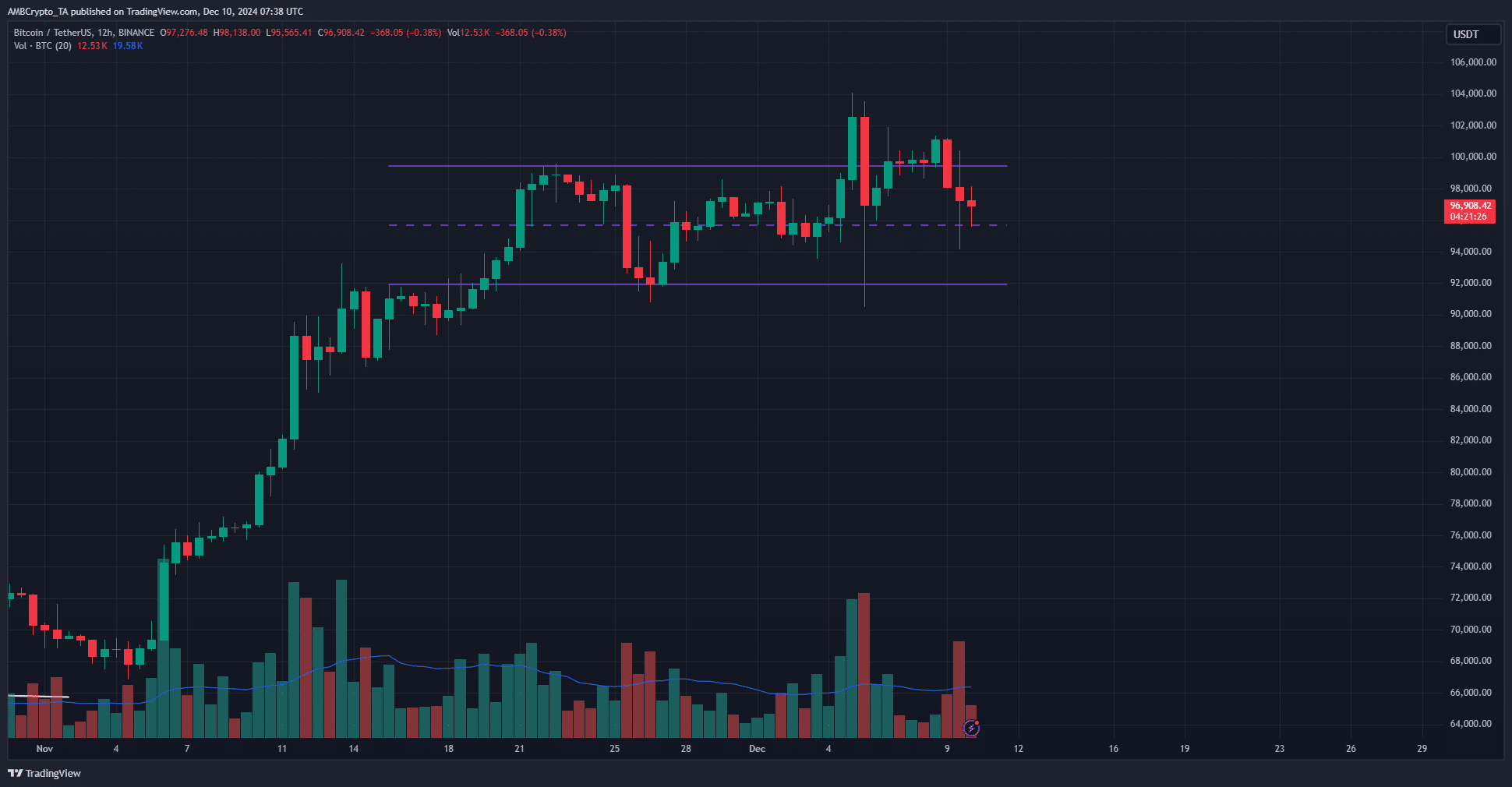

Bitcoin [BTC] struggled to break past the $100,000 level even as it poked its head above the psychological level several times in the past week.

On Monday, December 9, a BTC correction to $94.2k was observed. What could next mean for Bitcoin traders?

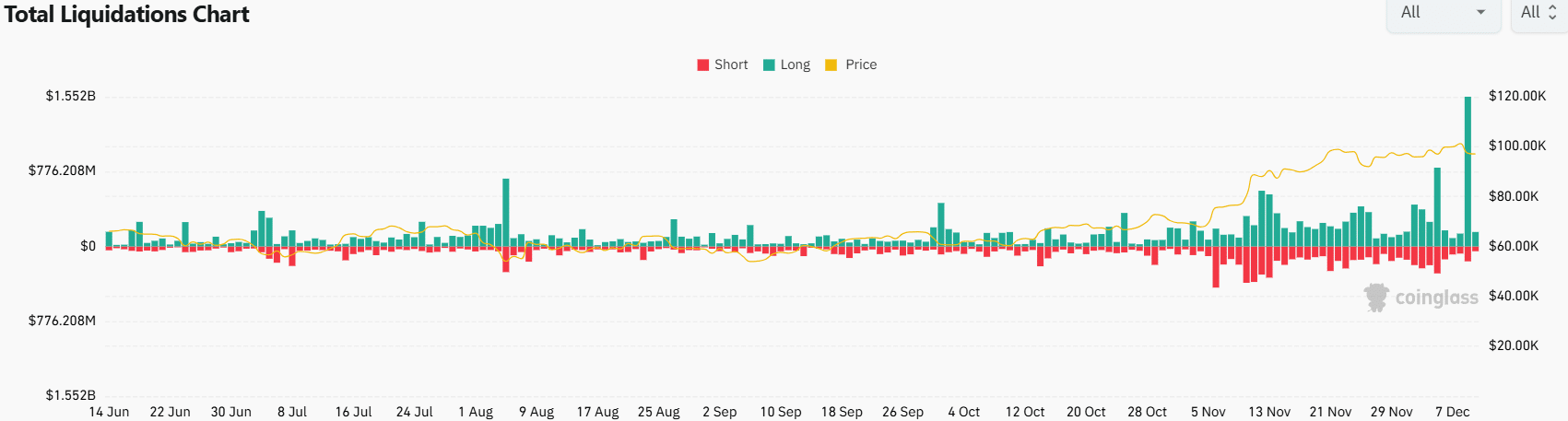

The liquidations amount to $1.7 billion

In one day, total liquidations reached a whopping $1.7 billion for Bitcoin pairs alone. This was likely the result of an intense tug-of-war in the futures market. Longs and shorts with over-indebtedness around $100,000 were wiped out.

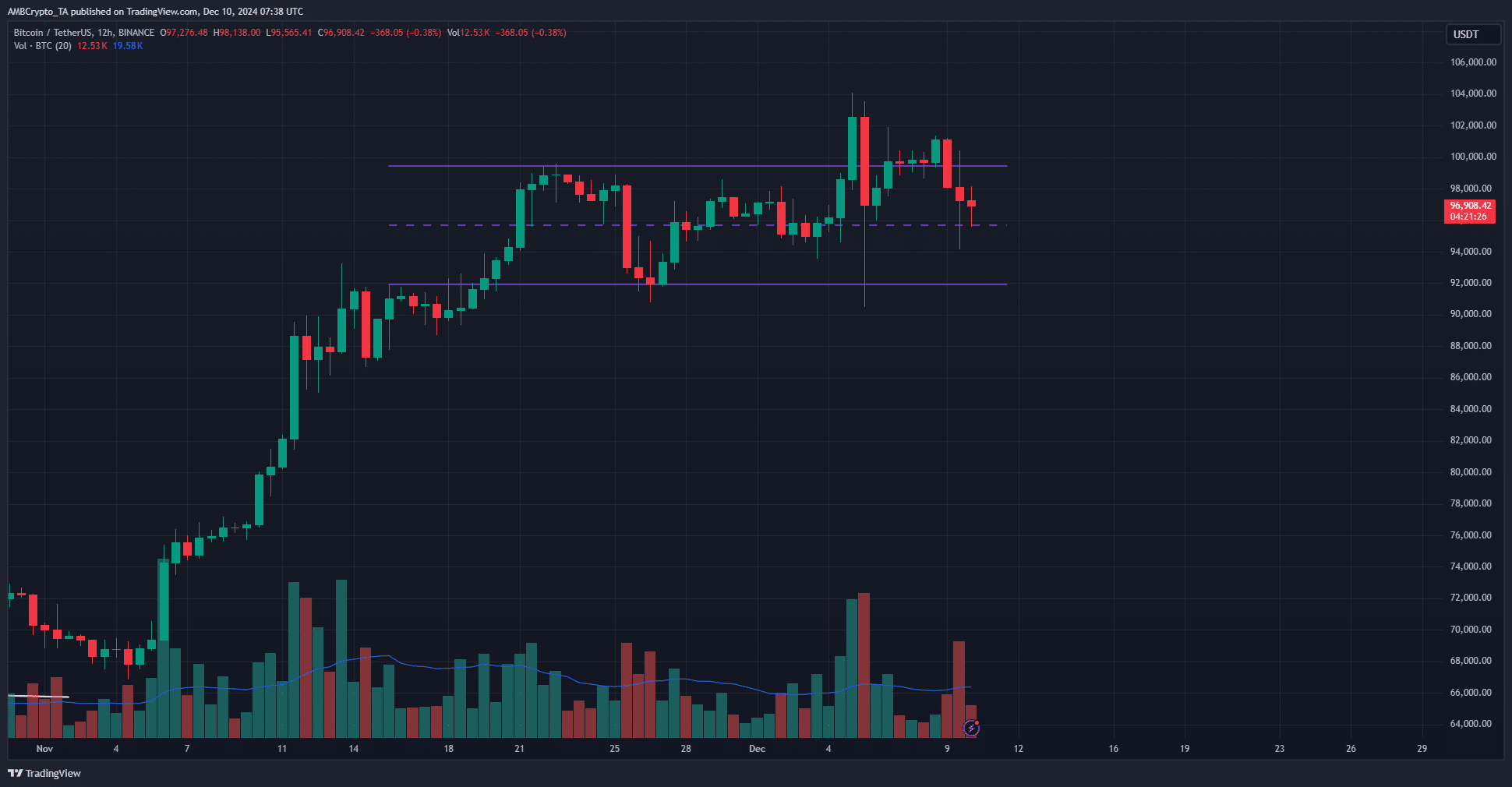

Source: BTC/USDT on TradingView

December 5 also saw increased volatility as the price bounced between key liquidity pockets. On that day, nearly $1.1 billion worth of positions in the BTC market were liquidated.

The 12-hour price chart showed the king of crypto back near the mid-support level at $95.8k. It could drop to the $94,000 level or even $90,000 before the bulls can regain control.

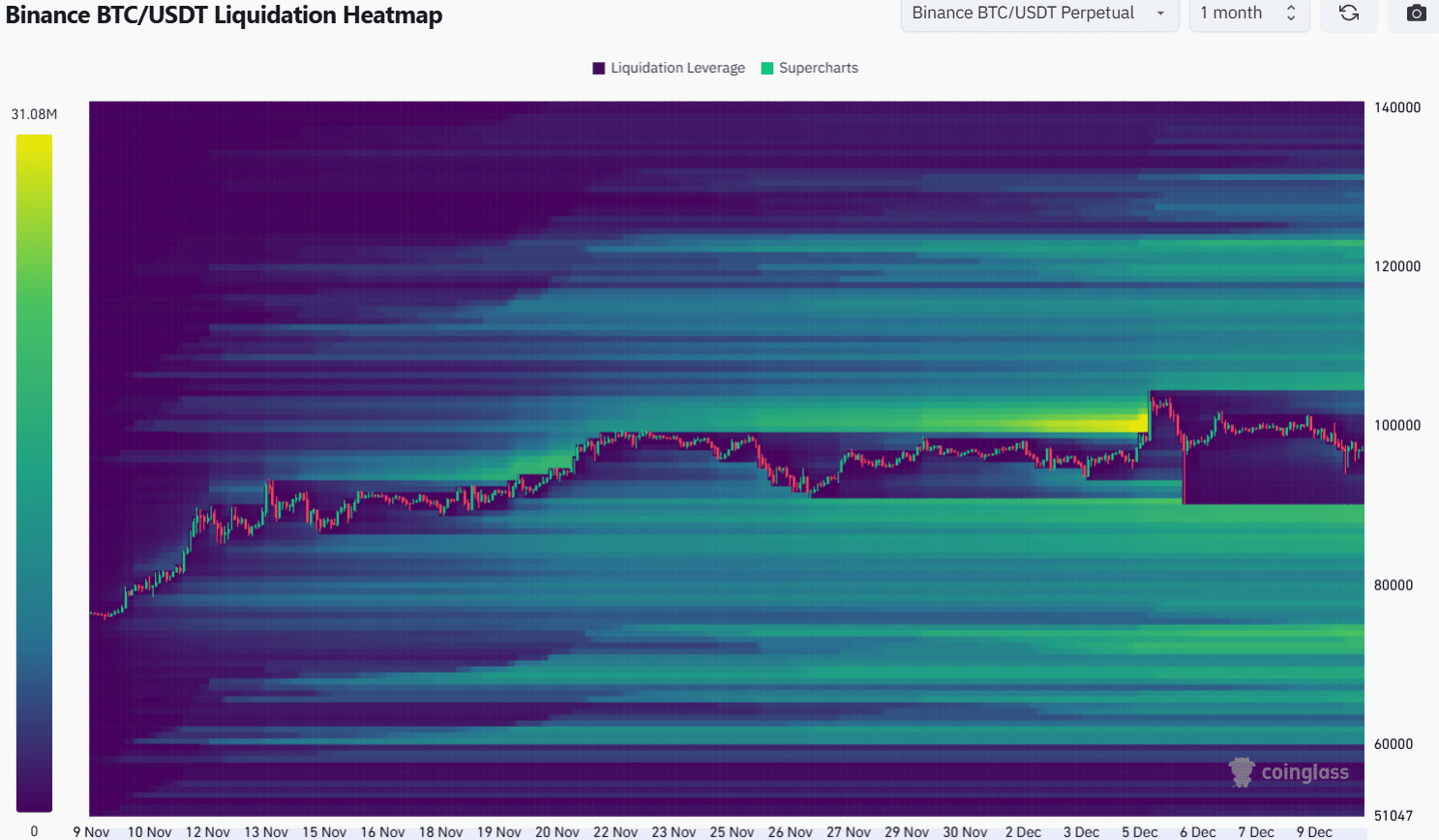

The Bitcoin liquidation heatmap shows that higher is more likely

AMBCrypto’s analysis of the one-month liquidation heatmap showed that clusters with high liquidity have been efficiently built and wiped out over the past ten days.

In late November and early December, the tantalizing approach to the $100,000 mark set off a liquidity chase that reached $104,000.

Hours later, a return to the $90.5k support of November 26 reached another key liquidity area.

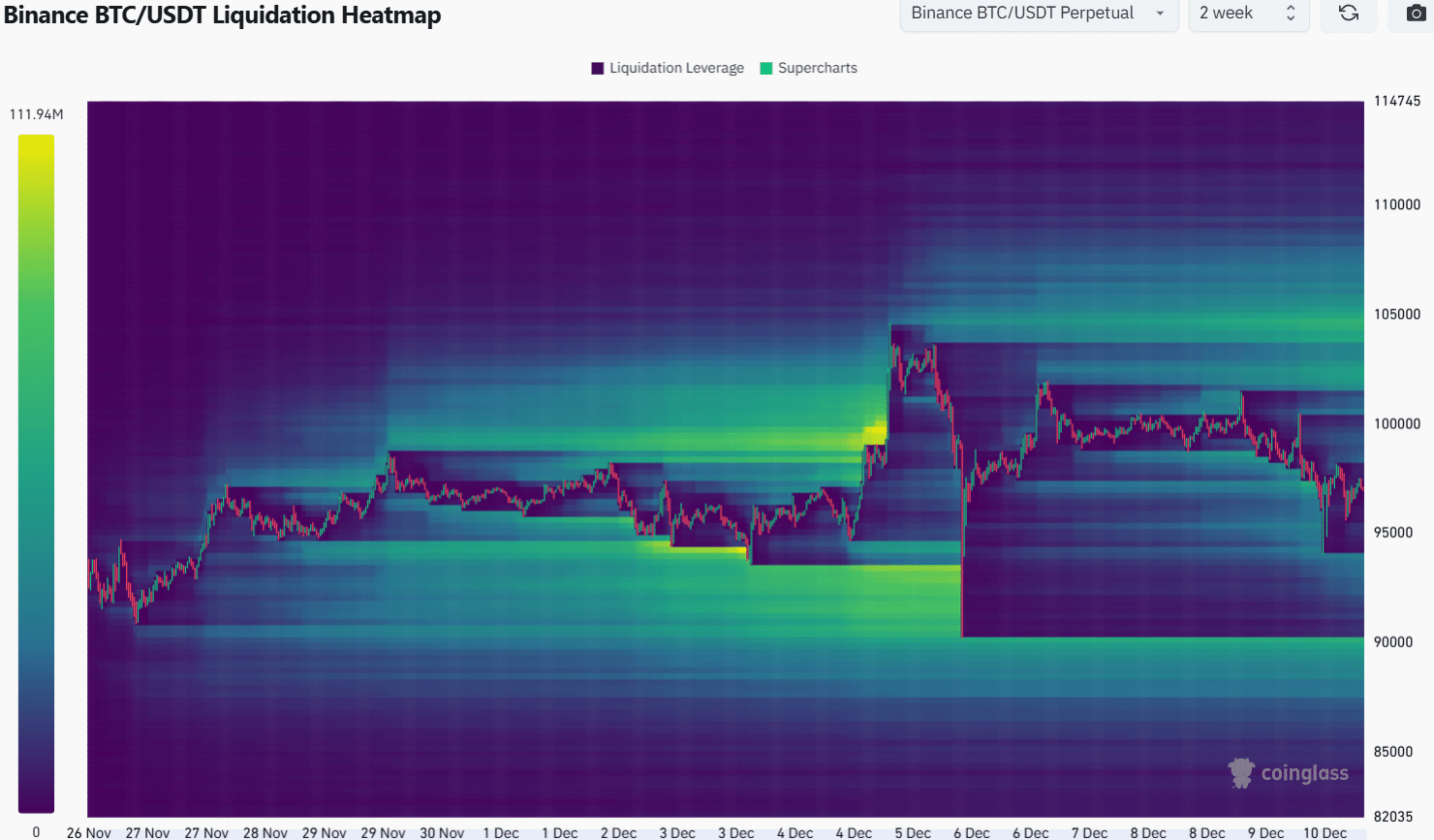

The one-month lookback period showed that a new retracement towards $90,000 or lower was possible. Zooming in on the two-week heatmap, the liquidity buildup around $105,000 was stronger than what was present around $90,000.

Read Bitcoin’s [BTC] Price forecast 2024-25

The liquidity of $102,000 was also an attractive target. Therefore, a move north to $102,000 and $105,000 was slightly more likely. Despite this view, traders should be prepared for a drop to $89,000 and manage their risk accordingly.

Breaking the short-term support to $94,000 could portend a deeper decline.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer