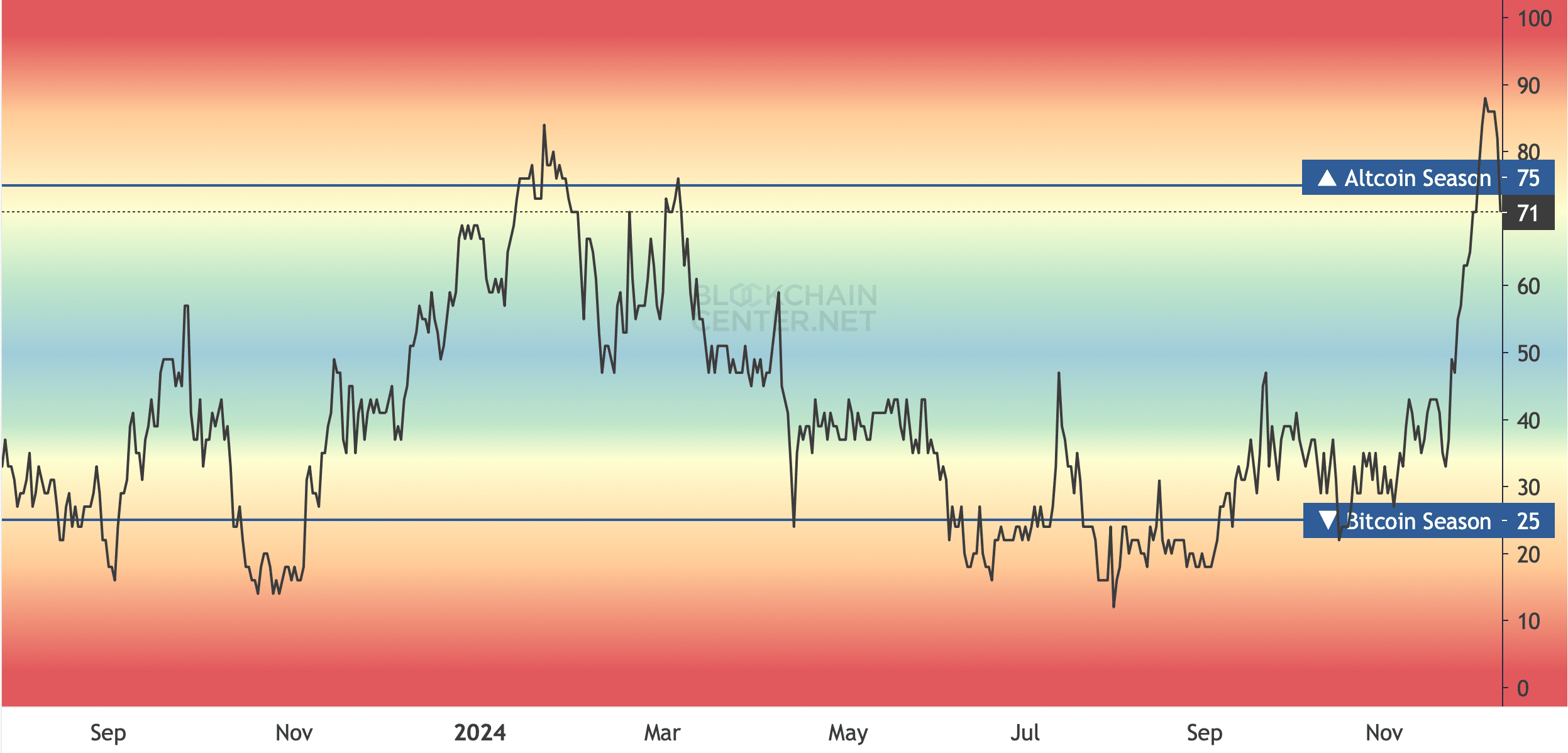

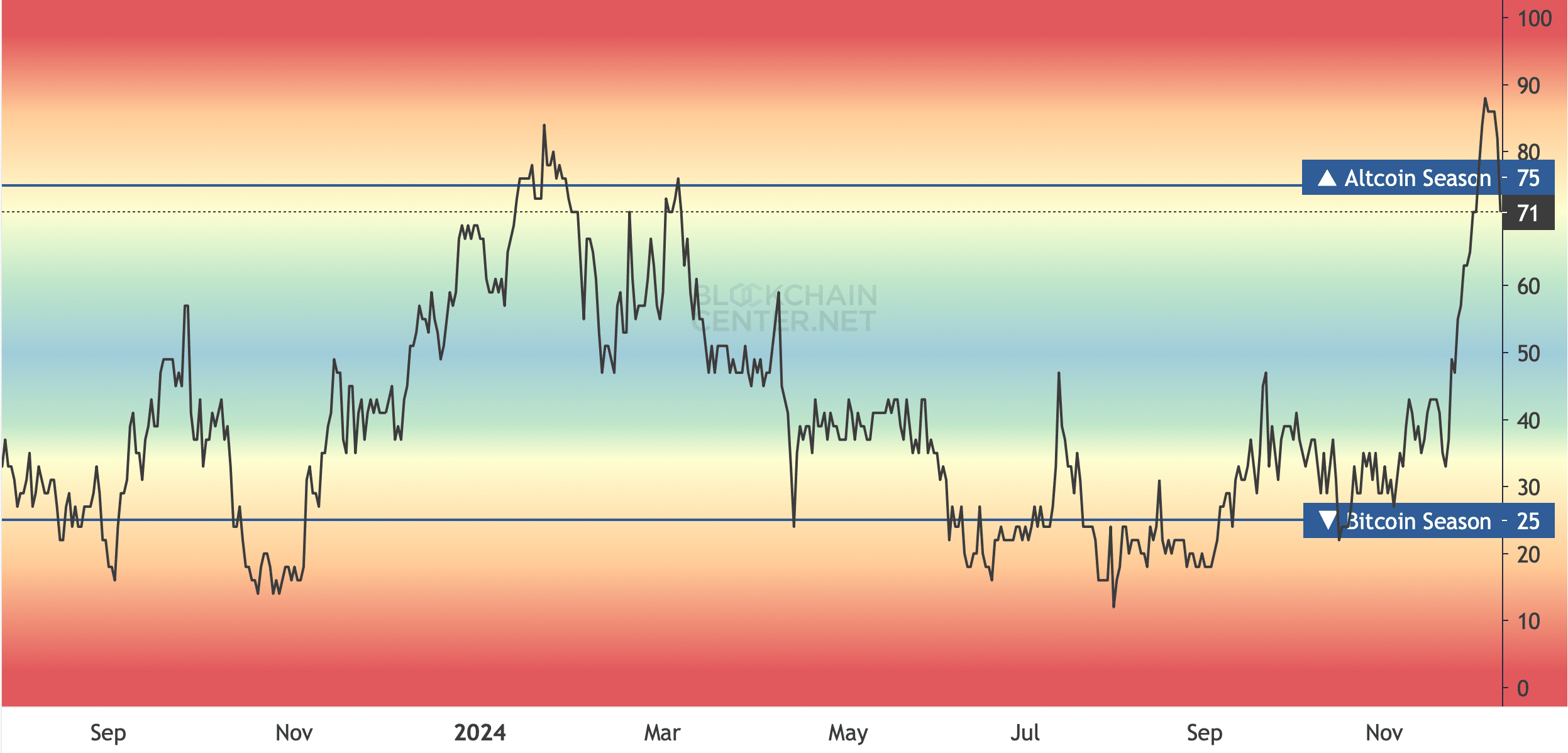

- The altcoin seasonal index fell from 88 to 71.

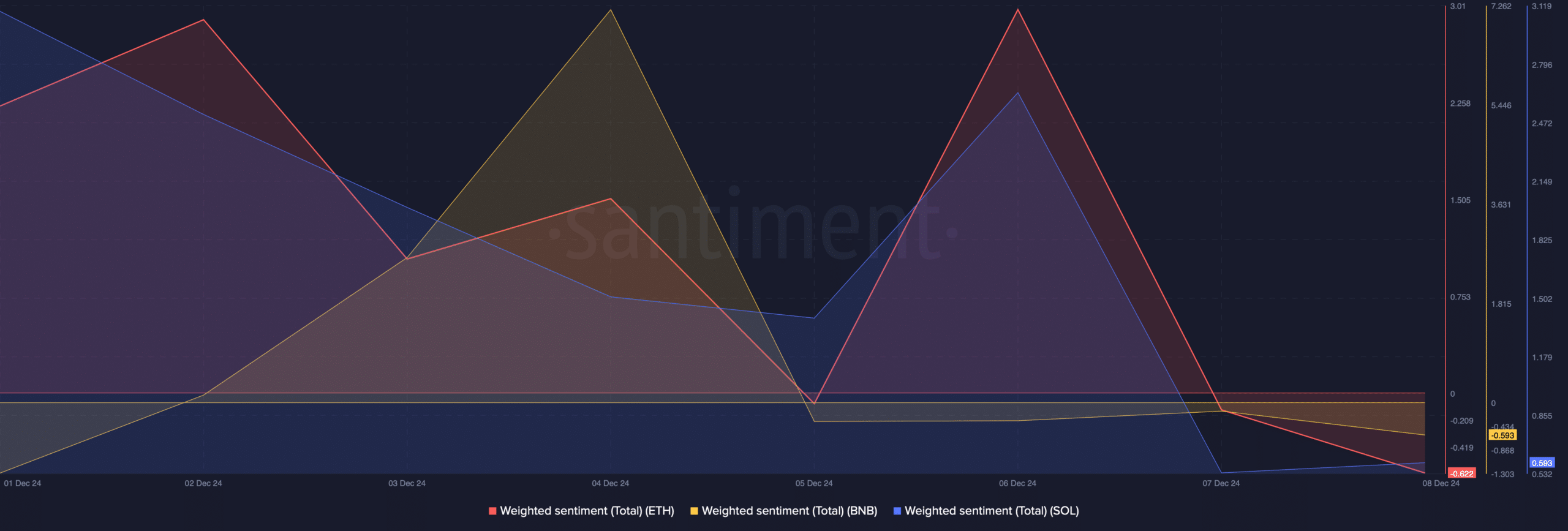

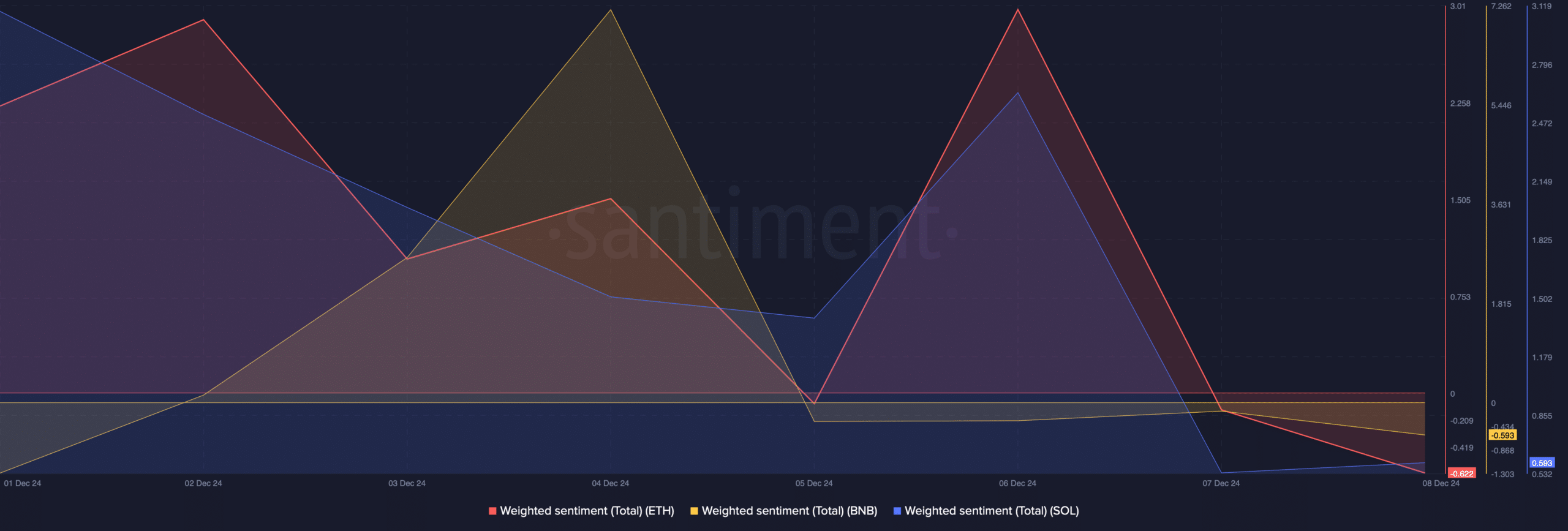

- Bearish sentiment around ETH, SOL and BNB rose.

After comfortable rallies, altcoins seemed to have faded into the background over the past 24 hours. However, the possibility of the arrival of an altcoin season cannot yet be ruled out.

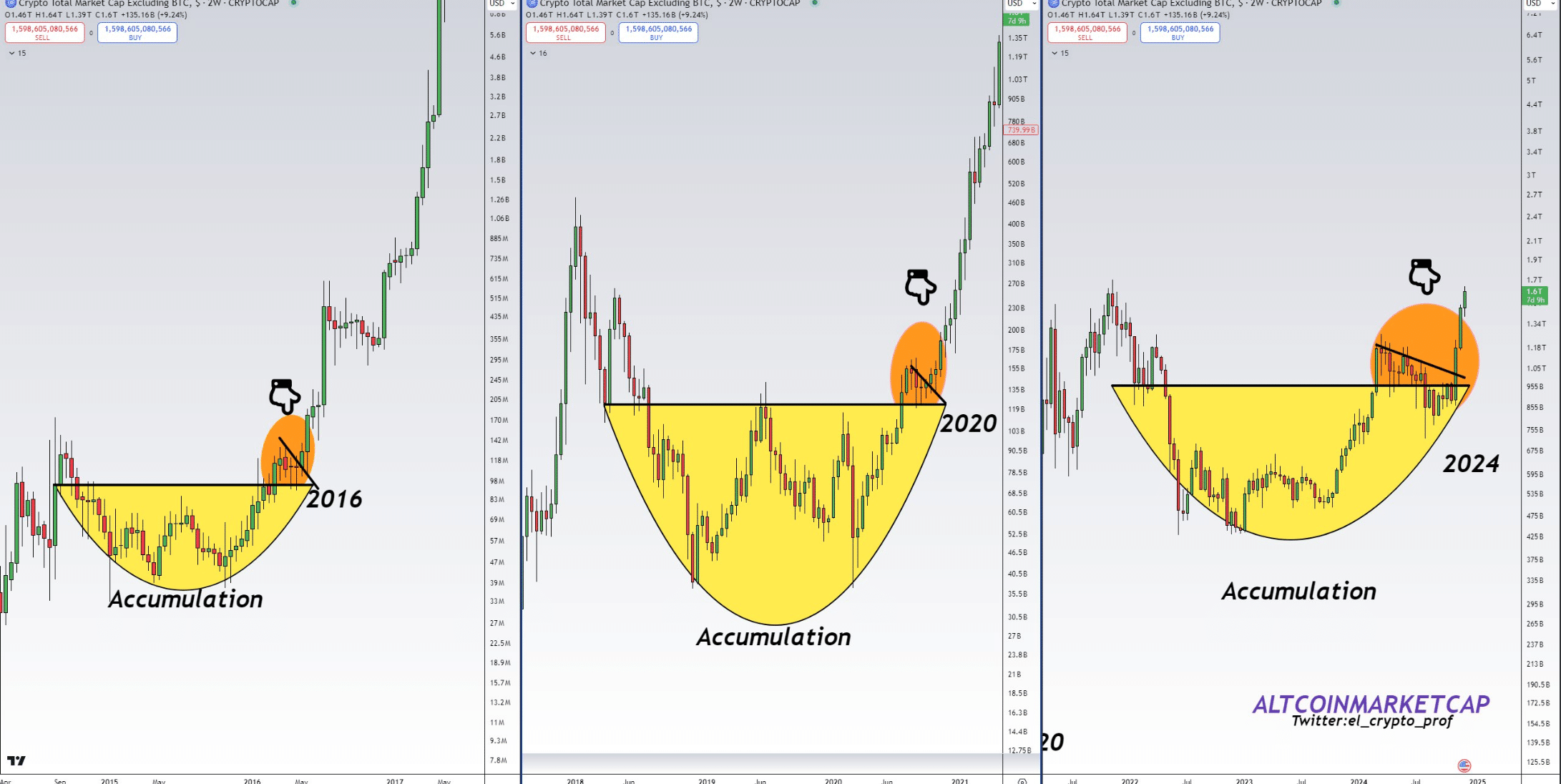

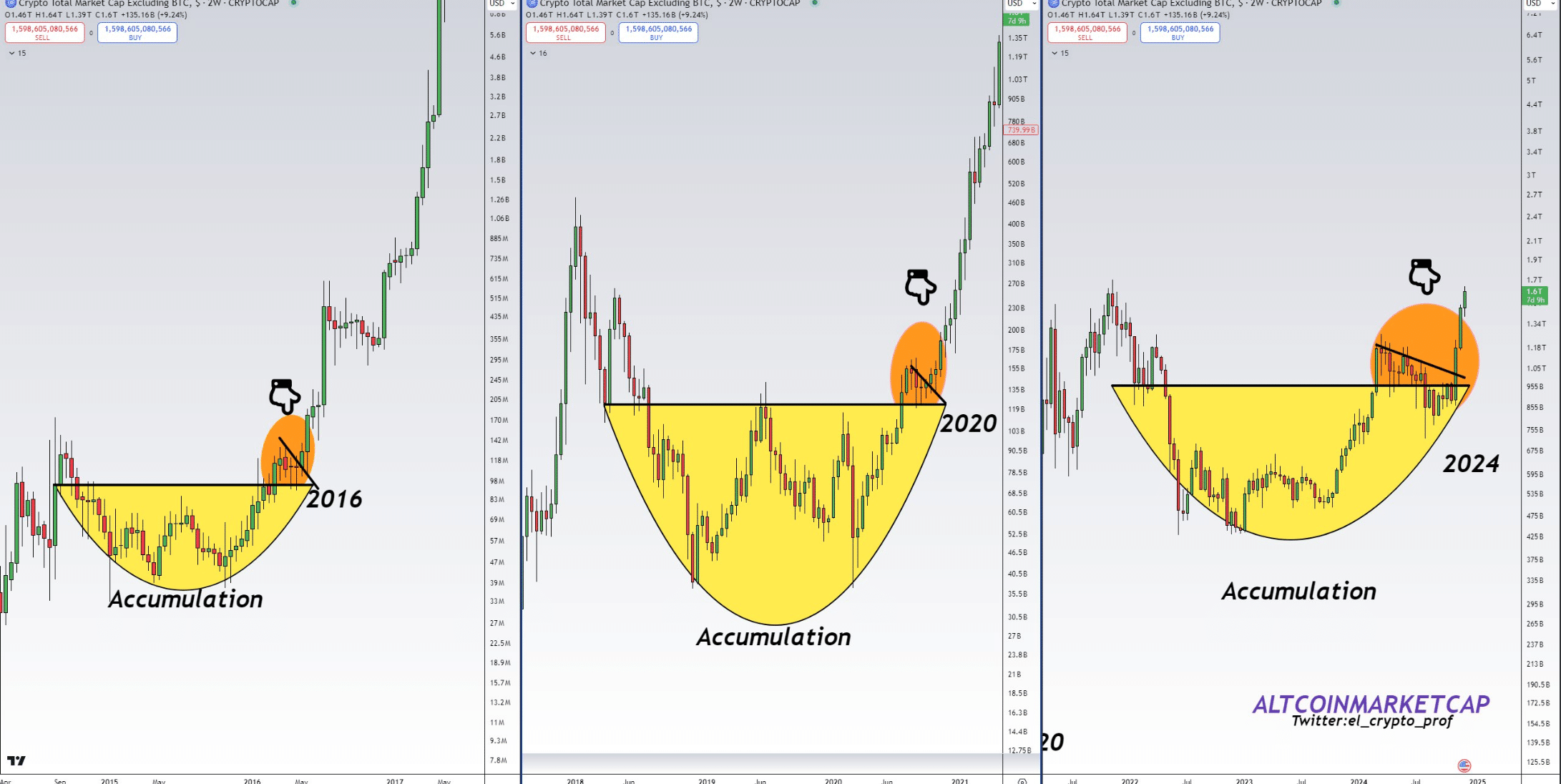

This was the case because the altcoin market cap chart followed a similar pattern as during previous cycles.

What are altcoins up to?

Top altcoins like Ethereum [ETH], Binance coin [BNB]And Solana [SOL] have witnessed price corrections in the last 24 hours. Per CoinMarketCapthe prices of these coins fell by 2.5%, 3.5% and 4% respectively over the past day.

Even memecoins were not spared as their fate was also similar. Dogecoin [DOGE]the value of the world’s largest memecoin, fell by more than 5% in the same period.

It was interesting to note that not only altcoins, but the king of crypto, Bitcoin [BTC] also showed signs of a correction.

AMBCrypto had previously reported that BTC’s MVRV ratio reached historic levels, followed by price declines in previous cases.

But this latest trend could be a red herring and a great opportunity for investors to purchase coins at a lower price. Mustache, a popular crypto analyst, recently posted a tweet highlighting an intriguing pattern.

According to the tweetThe market cap chart of altcoins followed a similar trend previously observed during the 2016 and 2020 altcoin seasons.

On each occasion, altcoins have risen sharply after mimicking this pattern. Therefore, there was a good chance that history would repeat itself.

Source:

Mustache also mentioned in the tweet that altcoins could quickly gain momentum in the coming weeks or months.

The altcoin seasonal index registered a decline after reaching 88. At that time the indicator had a value of 71.

Since this number is still close to 75, the possibility of an alt season coming soon cannot be ruled out yet, given the trend of 2016 and 2020.

Source: Blockchaincenter

The future path of ETH, SOL and BNB mapped out

Although past trends showed the arrival of an altcoin season, the top alts did not respond accordingly, as mentioned above. The recent price drops have also taken a toll on their social metrics.

ETH, SOL and BNB witnessed large declines in their weighted sentiment. This clearly meant that bearish sentiment was rising around them in the market.

Source: Santiment

Mint glass’ facts revealed another bearish benchmark for all these cryptos. Their long/short ratios fell sharply in the 24-hour time frame. When the benchmark falls, it means there are more short positions in the market than long positions – a sign of a price decline.

Read Ethereums [ETH] Price prediction 2024–2025

While these statistics suggested continued price declines, nothing can be said with absolute certainty.

Past trends and the unpredictability of the crypto market may as well surprise investors and allow altcoins to rise in the coming weeks.