A leading crypto analytics firm says one of the key cohorts of Bitcoin investors is rapidly phasing out BTC.

Santiment says on social media platform

While Bitcoin miners are heavily emptying their BTC piles, Santiment notes that other deep-pocketed investors are picking up the slack.

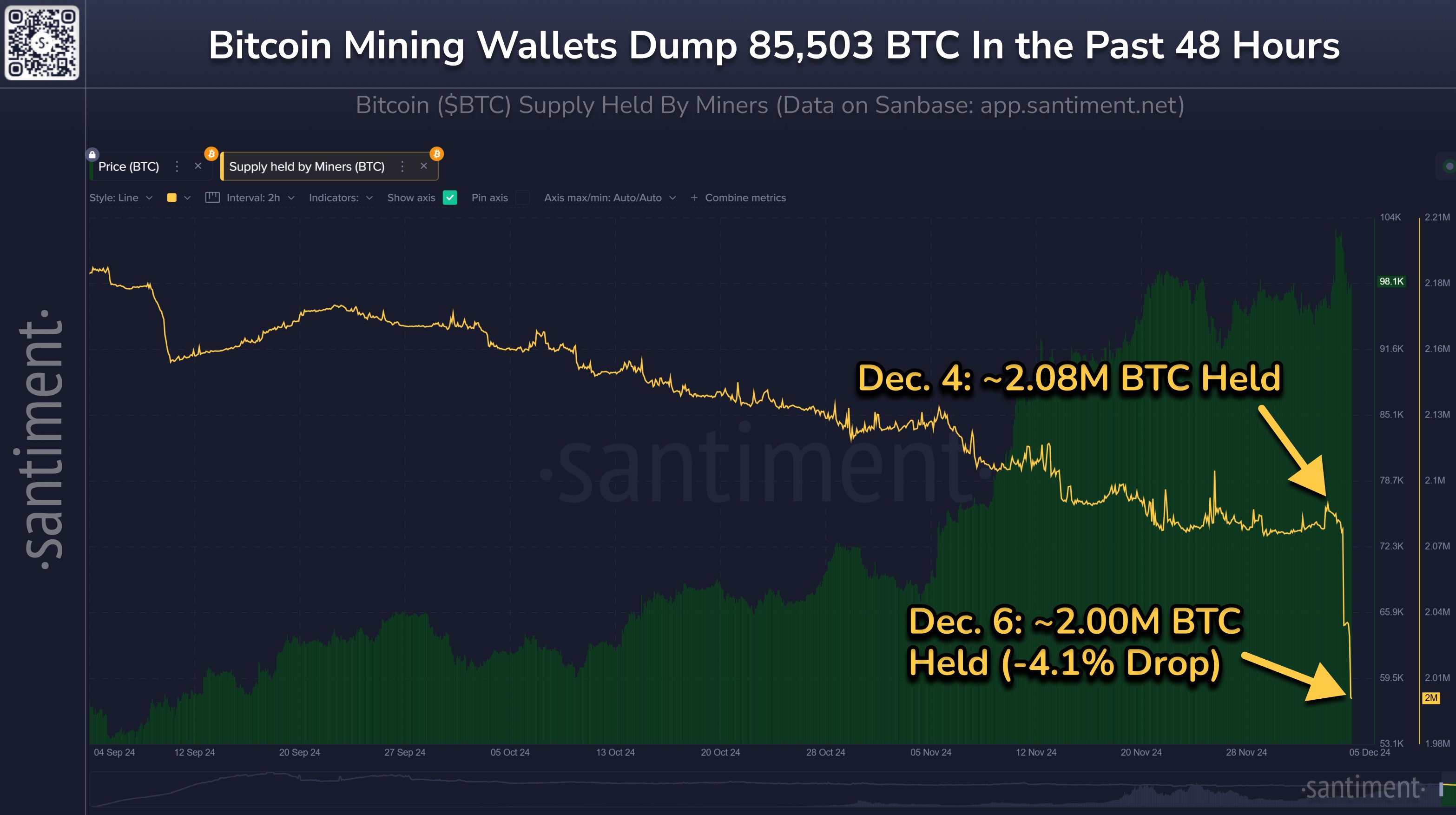

“Bitcoin collective mining balances have been declining since April 2024.

However, this latest drop of 85,503 BTC in just 48 hours is the most extreme we’ve seen since late February (two weeks before the then all-time high of $73,000).

Keep in mind that these portfolios did NOT correlate with price for most of this year. Overall, non-mining whales and sharks are still piling up. For now, consider this a net-neutral signal.”

Looking at Bitcoin’s current price action, the analytics firm says BTC appears to be trading along with the S&P 500 (SPX). According to Santiment, breaking the price correlation between stocks and Bitcoin will bode well for BTC.

“After crypto’s ‘Trump Pump’ calmed down over the past two weeks, Bitcoin is starting to correlate closely with the S&P 500.

In fact, there has been a fairly close relationship between the two for most of the year, with BTC often remembered by cryptocurrency traders as a “highly indebted technology stock.”

Either way, watch for a mid- to long-term break between crypto and stocks. If this correlation starts to weaken, it would be a bullish signal.

Historically, crypto has flourished when there has been little to no dependence on global equity markets.”

At the time of writing, Bitcoin is trading at $99,856.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3