This article is available in Spanish.

Dogecoin finally rose above the crucial resistance level at $0.48, briefly reaching $0.484 before pulling back slightly. This marks a significant development for the meme coin, as it struggled to break this level for weeks. This move has led to renewed optimism among traders and investors who see potential for further upside.

Related reading

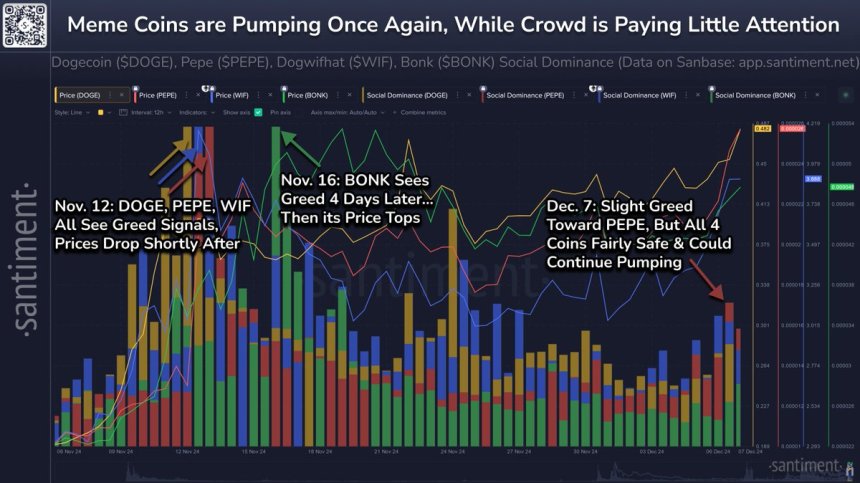

Key data from blockchain analytics firm Santiment highlights that Dogecoin, along with other meme coins, are experiencing mini outbreaks this weekend. This trend suggests increasing bullish momentum in the meme coin sector, often seen as a precursor to broader market rallies. The data indicates rising trading volumes and increased on-chain activity, both of which indicate continued interest in Dogecoin.

If this momentum continues, Dogecoin could be poised to extend its recent gains, with many market participants seeing the psychological $0.50 level as the next target. A successful break above $0.50 could pave the way for even higher levels, further fueling the ongoing rally. However, if the upward trajectory is not continued, it could lead to a period of consolidation.

Dogecoin sets the stage for new highs

Dogecoin is positioning itself for higher prices as it continues its upward trajectory, but the latest breakout lacked the explosive momentum many had anticipated. Despite crossing critical levels, Dogecoin has failed to maintain its price above the previous high, indicating the need for greater buying pressure to continue its rally.

Blockchain analytics platform Santiment has shed light on recent activityshowing that meme coins such as Dogecoin, Pepe, Dogewithhat and Bonk are experiencing mini outbreaks this weekend.

According to their data, larger wallets, often referred to as “whales,” have played a major role in driving up the market capitalization for these coins. This trend is expected to continue until retail FOMO (fear of missing out) resurfaces, potentially pushing prices higher in the short term.

However, the dynamics of the meme coin markets suggest caution. Santiment’s analysis shows that when social dominance for these tokens rises significantly, it is often a signal of a market top. Whales typically take advantage of the increased retail enthusiasm and sell their assets at high prices. This pattern often results in a sharp pullback as prices correct after the sell-off.

Related reading

Santiment also shared a comparison chart tracking the social dominance of these meme coins, highlighting past examples where spikes in attention preceded withdrawals. For Dogecoin, maintaining current momentum and avoiding overbought conditions will be key to continuing the rally.

Price testing of fresh supply

Dogecoin (DOGE) is currently trading at $0.46, after failing to break decisively above the $0.48 level. The price is still in a consolidation phase and is struggling to build enough momentum to break past the psychological barrier of $0.50. Despite this, broader market sentiment remains bullish, providing a supportive backdrop for potential price gains.

The current environment suggests that Dogecoin is likely to remain below $0.50 in the near term. However, if bulls can muster the strength to move above this critical level and sustain it for a few days, a massive breakout could be in store. Breaking and holding above $0.50 would likely signal renewed buying interest, paving the way for a strong rally.

The bullish market conditions driving other major cryptocurrencies could also work in Dogecoin’s favor, provided overall sentiment continues to improve. Still, traders should look for clear confirmation of a breakout before expecting significant price movements.

Related reading

Failure to break through and hold above the $0.50 level could result in prolonged consolidation, delaying any meaningful upside momentum. For now, all eyes are on whether DOGE can capitalize on the broader market’s optimism and make a decisive move toward higher price targets.

Featured image of Dall-E, chart from TradingView