The CEO of crypto intelligence firm CryptoQuant identifies one catalyst that could send Bitcoin (BTC) to a $1 million price tag.

In a new thread on the social media platform X, Ki Young Ju say that by the time the top crypto asset by market cap reaches $1 million, it will have overtaken gold.

According to Ju, the crypto king reaching nine figures is inevitable as investor demand shifts from gold to BTC.

“In 2004, before gold ETFs were approved, the market cap of gold was $1 trillion. Today that is $17.8 trillion. If we assume that the intrinsic value of gold as a precious metal is $1 trillion, approximately $16.8 trillion represents its demand as a safe haven and as a hedge against inflation.

Bitcoin’s current market cap is $2 trillion, and it could increase by 750% if gold demand shifts to BTC. Considering inflation, reaching $1 million isn’t about if it will happen – it’s about when. Within five years, people will start talking about flipping gold.”

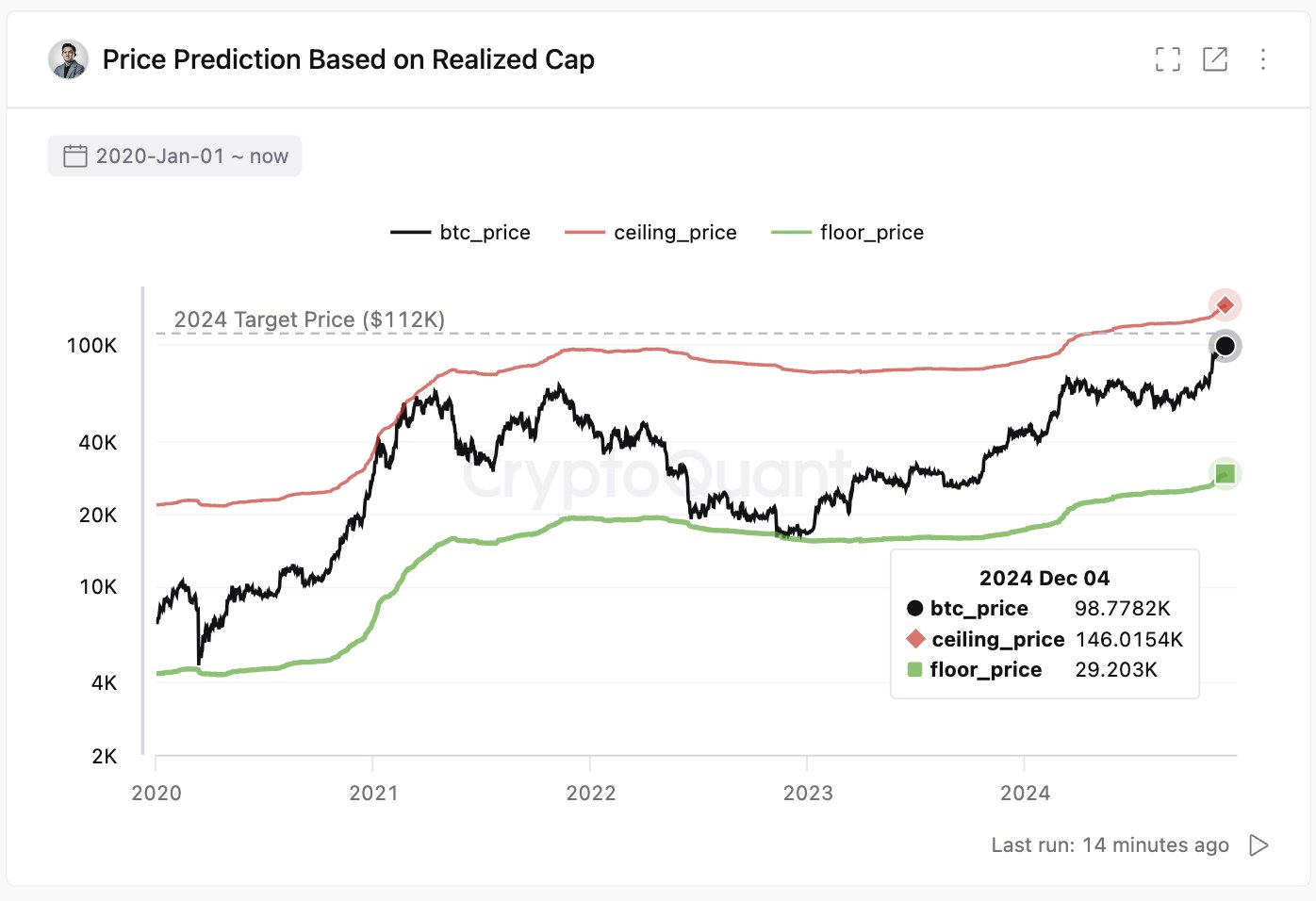

Ju continues remark that BTC has not yet formed a bubble, despite hitting the $100,000 mark for the first time earlier this week.

“Fresh capital fuels Bitcoin. As the realized cap grew, the ceiling price rose from $129,000 to $146,000 in 30 days. At $102,000, it’s far from a bubble; it would take a 43% increase to reach the threshold often considered a bubble.”

Bitcoin is trading at $99,069 at the time of writing, down 1.8% over the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/DM7/3D graphic design