- Bitcoin is forming a bearish divergence after an impressive rally that topped $100,000.

- It is assessed whether BTC selling pressure is increasing, possibly indicating profit taking.

It’s an interesting day for Bitcoin [BTC] community as the cryptocurrency reaches one of its most notable milestones. For the first time in history, the price rose above $100,000. But what’s next for the king of cryptocurrencies?

Bullish December is unfolding well for Bitcoin as price action has risen to $103,620 over the past 24 hours. But what next for BTC after this impressive milestone? Well, the price action could provide insight into the next possible move.

Source: TradingView

While Bitcoin has made higher highs, the RSI has formed lower highs. As a result, the cryptocurrency is forming a bearish divergence. This suggests that a wave of selling pressure could erupt soon.

There are no signs of Bitcoin bears yet

There is a significant chance that Bitcoin will remain above the $100,000 price level and possibly increase its upside potential in the coming days.

However, a pullback is inevitable, especially as selling pressure begins to build. That may already be happening, as evidenced by BTC exchange flows.

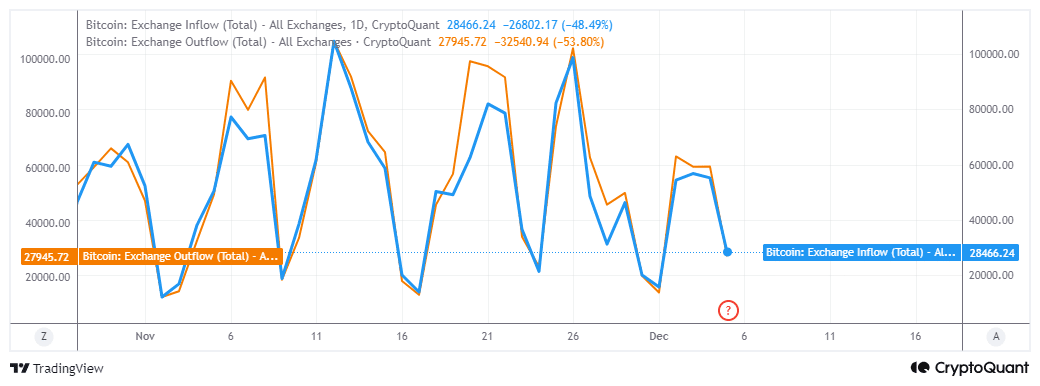

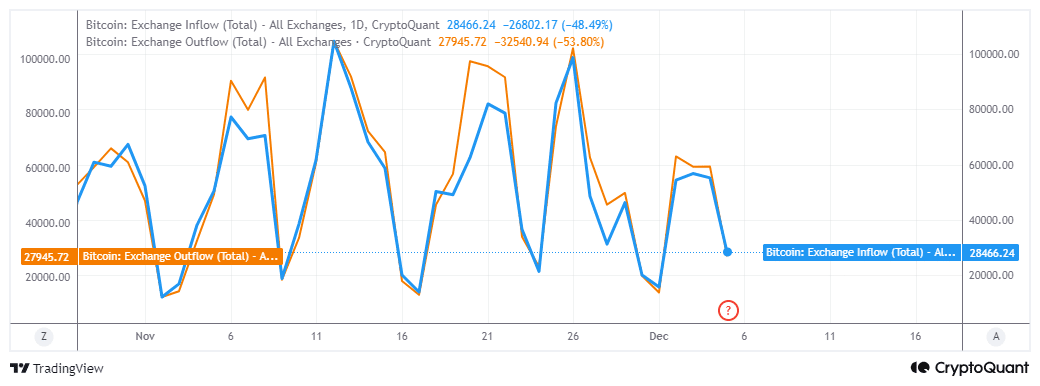

CryptoQuant revealed that exchange flows have dropped significantly over the past 24 hours, indicating a slowdown in momentum. More specifically, on December 5, foreign exchange inflows peaked at 28,466 BTC, compared to 27,945 BTC of foreign exchange outflows.

Source: CryptoQuant

A greater inflow than outflow could indicate an increase in selling pressure. However, Bitcoin continued to expand its upside potential and this could also be explained by on-chain data.

Demand from the derivatives segment remained strong, as evidenced by the increase in open interest. The latter clocked a new ATH of $65.23 billion at the time of writing.

Source: Coinglass

Bitcoin funding rates remained positive and rose to a new two-week high reflecting strong bullish demand. This confirmed that derivatives demand significantly contributed to BTC’s rise above $100,000.

Open interest and positive financing rates also confirmed that there was no significant increase in selling pressure. Perhaps an indication that the market remains bullish, with expectations of more upside potential.

While BTC’s latest historic rally is an exciting development, it is worth keeping in mind that it represents a bearish divergence.

Read Bitcoin’s [BTC] Price forecast 2024-25

Consumer behavior during the holidays can also cause many holders to take some profits off the table.

Quite a large number of Bitcoin holders, especially those who bought at significantly lower prices, could be incentivized to take profits. An outcome that could potentially cause a significant rebound from BTC’s current price level.