- Coinbase’s CEO considered BTC a better hedge against inflation.

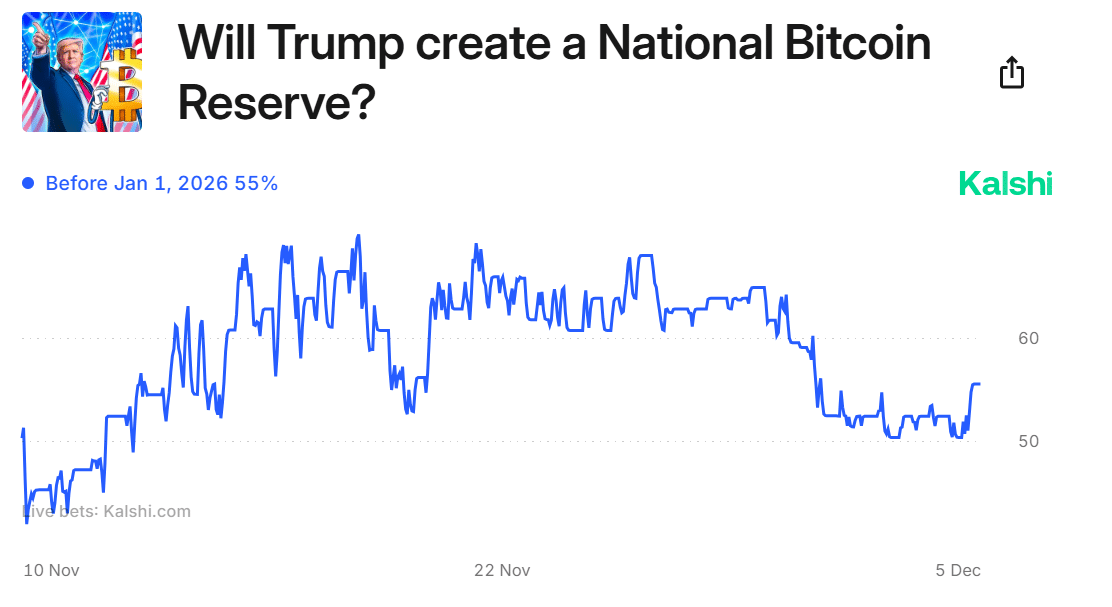

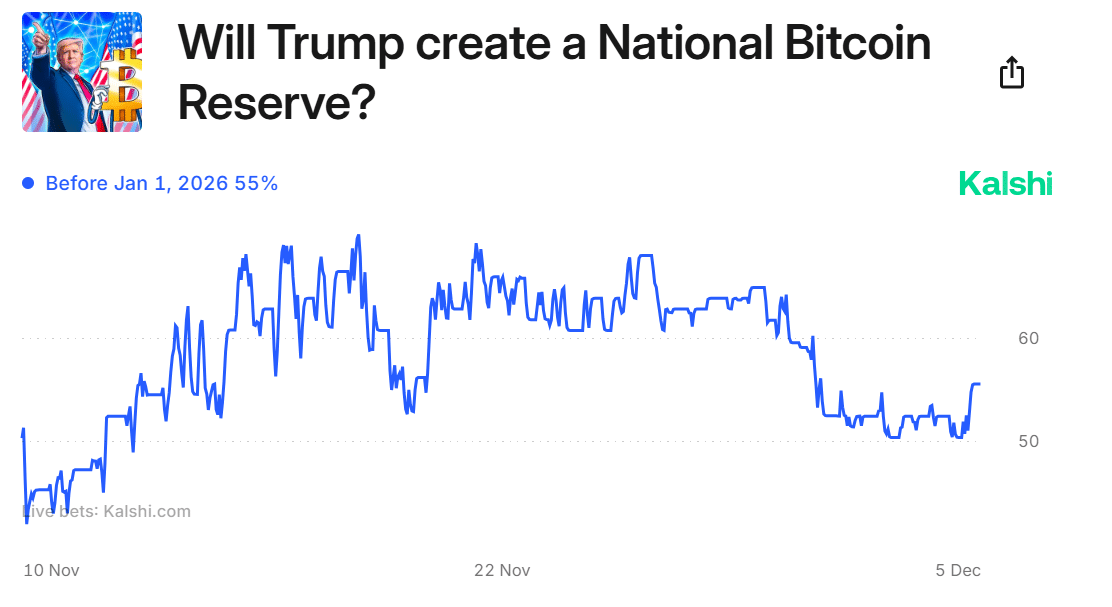

- Markets were optimistic about a US BTC reserve before 2026.

Several countries, including the US, face unsustainable federal debt and high inflation, eroding prosperity. Could there be a better way to protect wealth from inflation or economic instability?

According to Coinbase CEO Brian Armstrong, Bitcoin [BTC] is a better hedging alternative, especially after the cryptocurrency reaches the $100,000 mark.

Citing BTC’s twelve-year growth, Armstrong noted that $100 in 2021 would now be worth $17. However, in BTC terms, that $100 would translate into $1.5 million. He urged governments to consider BTC reserves to preserve wealth. He said,

“Bitcoin is the best performing asset of the last twelve years, and it is still in its infancy. Every government, especially those looking to hedge against inflation, should create a strategic Bitcoin reserve.”

Outlook for US Bitcoin Reserves

Armstrong’s support for a BTC reserve is significant, given his influence in electing pro-crypto candidates in the 2024 US elections.

President-elect Donald Trump has promised to make the US the “world crypto capital” and create a national BTC reserve.

Will he keep his promise? The US government recently moved $2 billion worth of BTC, some of which is earmarked for the reserve.

As of now, the market is less optimistic that Trump will form the reserve within the first 100 days of his administration.

According to the prediction market site Polymarktthere is only a 24% chance that the national BTC reserve will be formed.

However, Kalshi estimates a 55% chance of creating a US BTC reserve before 2026.

Source: Kalshi

That said, other countries, like Brazilhave suggested the BTC reserve idea. Market experts believe that an approved US BTC reserve would trigger a game theory and force other countries to follow suit.

The end goal would push the BTC price higher, as some analysts predict the coin’s value could rise to seven figures. At the time of writing, BTC was valued at $102.5K, up 6% in the past 24 hours.