This article is available in Spanish.

A recent report from research firm Messari provided an overview of the performance of the NEAR (NEAR) protocol during the turbulent third quarter (Q3) of 2024, when the broader cryptocurrency market experienced significant volatility.

NEAR Protocol Q3 Performance

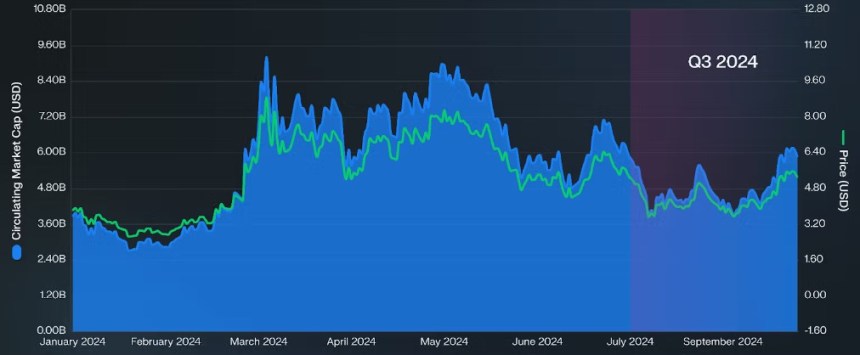

During the second quarter of 2024, the crypto market experienced a downturn that continued into the third quarter for NEAR. The protocol the circulating market capitalization fell to approximately $5.16 billion, reflecting a significant quarter-over-quarter (QoQ) decline of approximately 27.52%.

NEAR’s token price also fell slightly, closing the quarter at around $5.29, a marginal decline of 0.21% quarter-over-quarter. Despite these challenges, NEAR managed to maintain its position as the 17th largest cryptocurrency by market capitalization, indicating relative stability among the leading digital assets.

However, over the past three weeks, the market cap has risen 54% to $7.99 billion amid the broader market cap. market rally led by Bitcoin (BTC) and the catalyst that was the election of Donald Trump.

Related reading

One of the standout aspects of NEAR’s third-quarter performance was revenue, which measures network transaction costs, excluding storage deployment. Revenue fell to approximately $1.64 million, down 30.13% quarter-over-quarter.

This dip is particularly significant because it represents the first quarter of last year where sales ended lower than they started. The report attributes this to a decline in numbers transaction volumeresulting in lower transaction costs – down approximately 10.48% quarter-over-quarter and 34.23% year-over-year.

At the end of the third quarter of 2024, approximately 93.46% of NEAR’s total token supply was in circulation, with 52.36% of that supply deployed. The nominal annualized return from staking was approximately 8.60%, while the real annualized return was 4.09%.

Despite transaction volume challenges, NEAR has seen an upswing address activity. Average daily active returning addresses increased 7.27% quarter-over-quarter, and average daily new addresses increased 11.06%.

TVL rises, liquid stakes rise

The report also highlighted a worrying trend in developer involvement. NEAR saw a significant drop in the number of weekly active core developers, by 41.28% from 177 to 104. Similarly, the number of weekly active ecosystem developers fell by 19.70%, from 286 to 230.

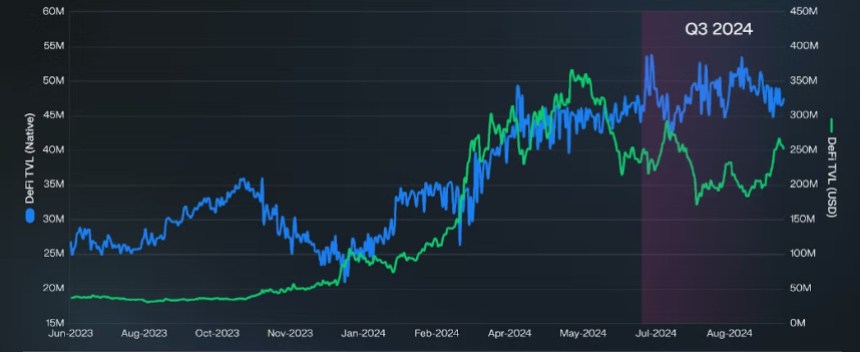

In terms of decentralized finance (DeFi), NEARs Total value locked (TVL) posted a modest increase, ending the third quarter at approximately $251.44 million, which is an increase of 7.63% from the previous quarter.

Related reading

Notably, NEAR’s TVL with liquid stakes also grew 9.85% quarter-over-quarter, to approximately $279.66 million. The LiNEAR Protocol had a TVL of approximately $145.14 million, while the Meta Pool saw a 12.70% increase for a total of approximately $126.61 million.

At the time of writing, the NEAR token is trading at $6,745 and has posted significant gains of 27% and 46% in the fourteen and thirty day time frames respectively, while posting a massive 266% year-over-year gain. golf.

Featured image of DALL-E, chart from TradingView.com