- Bitcoin LTHs sold 366,000 BTC, the highest level since April.

- BTC fell 4.47% in the past 24 hours.

Since reaching an ATH of $99,800, Bitcoin [BTC] has experienced a decline, reaching a local low of $92584. In fact, at the time of writing, Bitcoin was trading at $94972. This represented a decline of 3.47% over the past day.

Before this, Bitcoin had been on an upward trend, rising 3.44% on the weekly charts and 41.61% on the monthly charts.

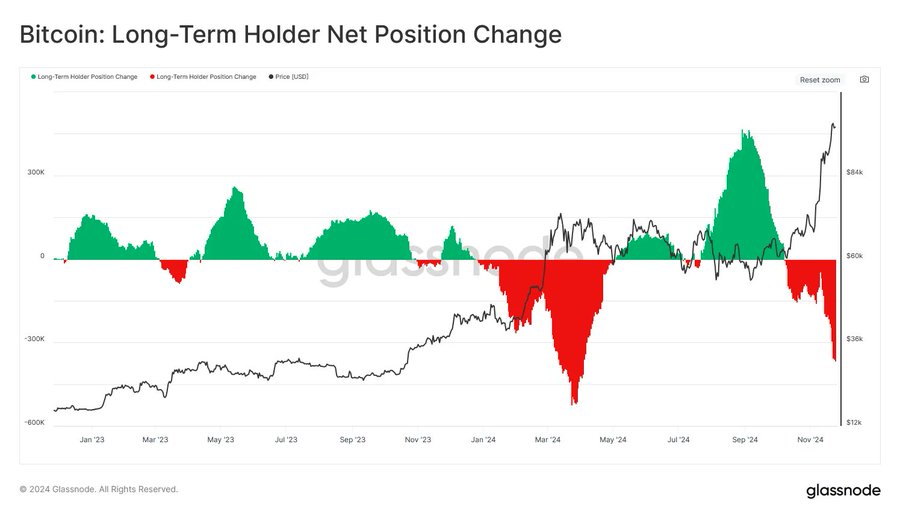

That’s why this sharp decline after a historic rally raises questions about what’s driving it. According to Glassnode, Long-Term Holders (LTHs) could be the reason.

Who sells Bitcoin?

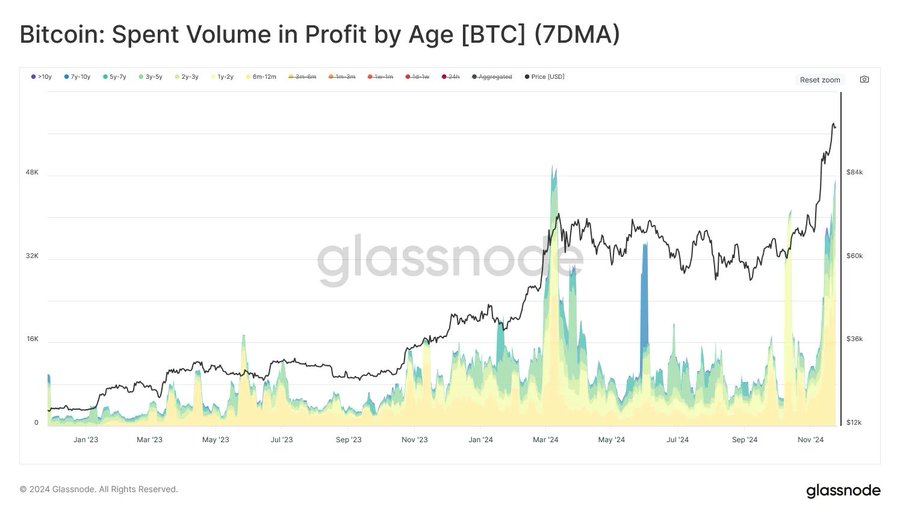

In their analysis Glass junction stated that Bitcoin LTHs have come up for sale. As such, they have sold 366,000 BTC tokens, which is the highest level since April. This may have caused selling pressure, leading to a market pullback.

Source: Glassnode

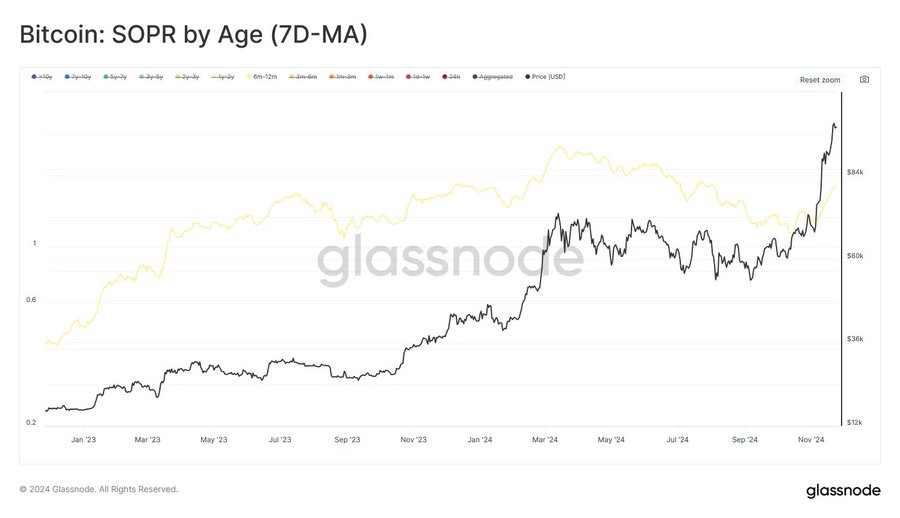

Therefore, with profit margins rising in recent weeks, LTHs have turned to profit taking.

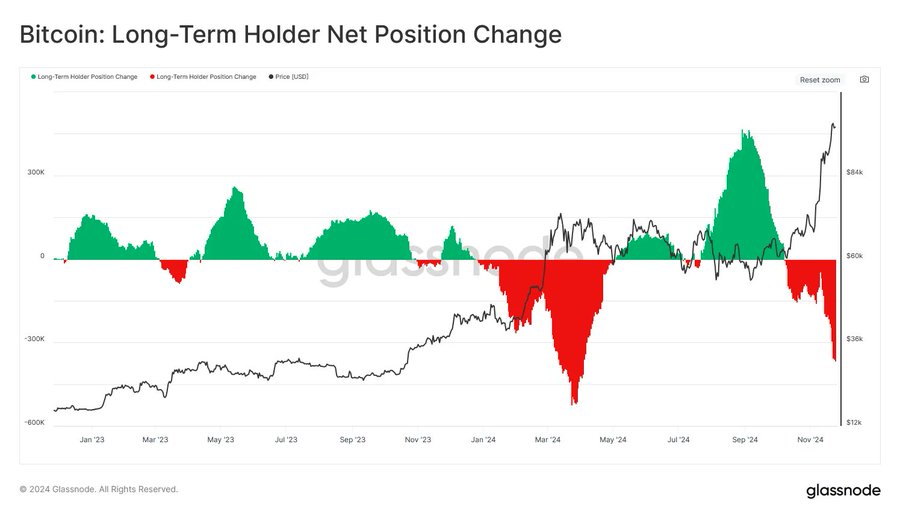

These LTHs include the 6 million to 12 million cohorts. They have taken the lead and are issuing at least 25.6k BTC tokens in profits every day.

Source: Glassnode

So this group issued BTC with an average cost basis 71% lower than the average price of $57.9k. And with BTC hitting an all-time high of $99,000, these LTHs benefited significantly from the rally.

Source: Glassnode

Based on this observation, the recent market correction stems from increased LTH sales activity.

Impact on BTC charts?

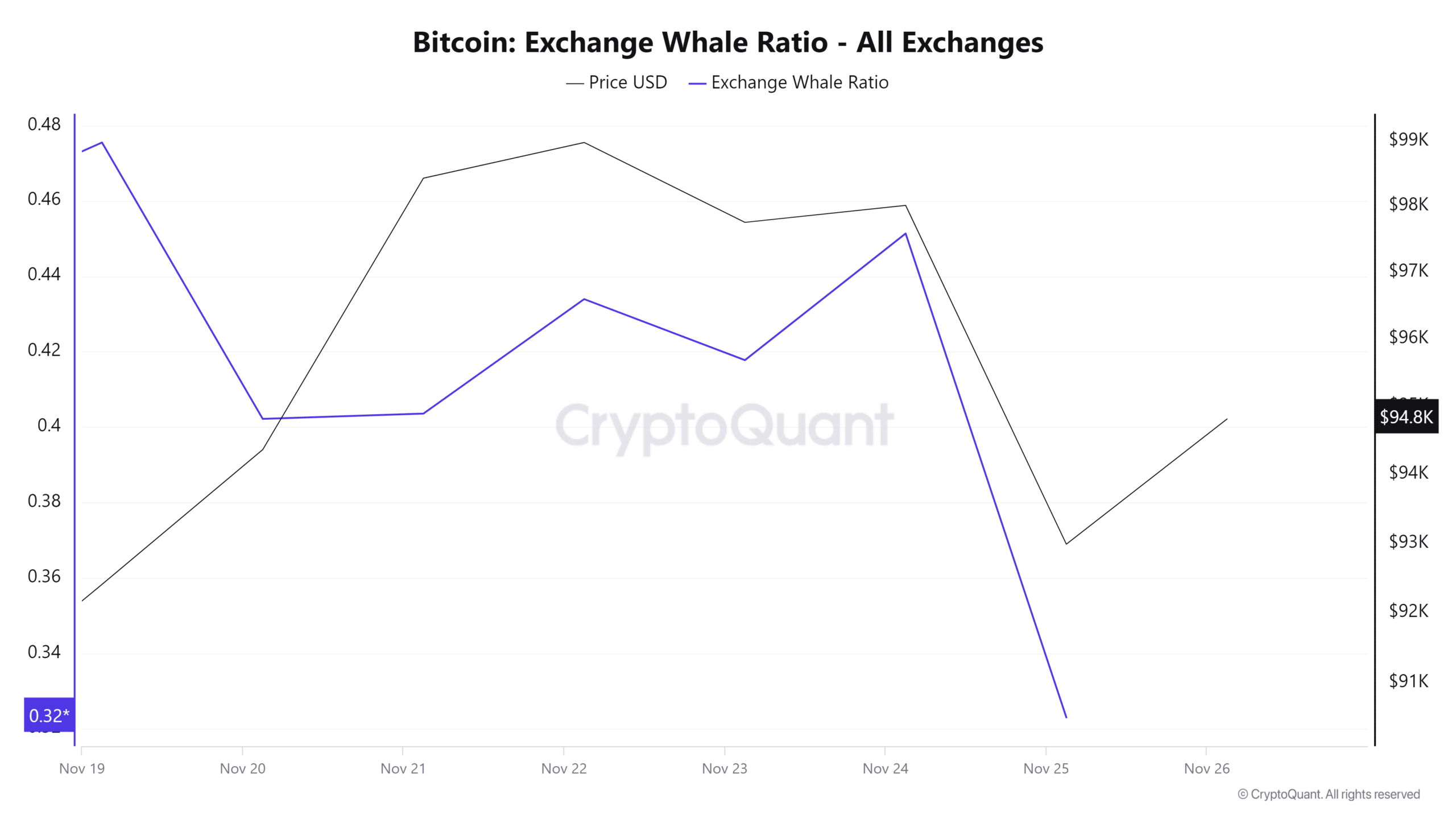

According to AMBCrypto’s analysis, although BTC declined on the daily charts, it remained in a bullish phase. This recent downturn has allowed whales and retailers to accumulate.

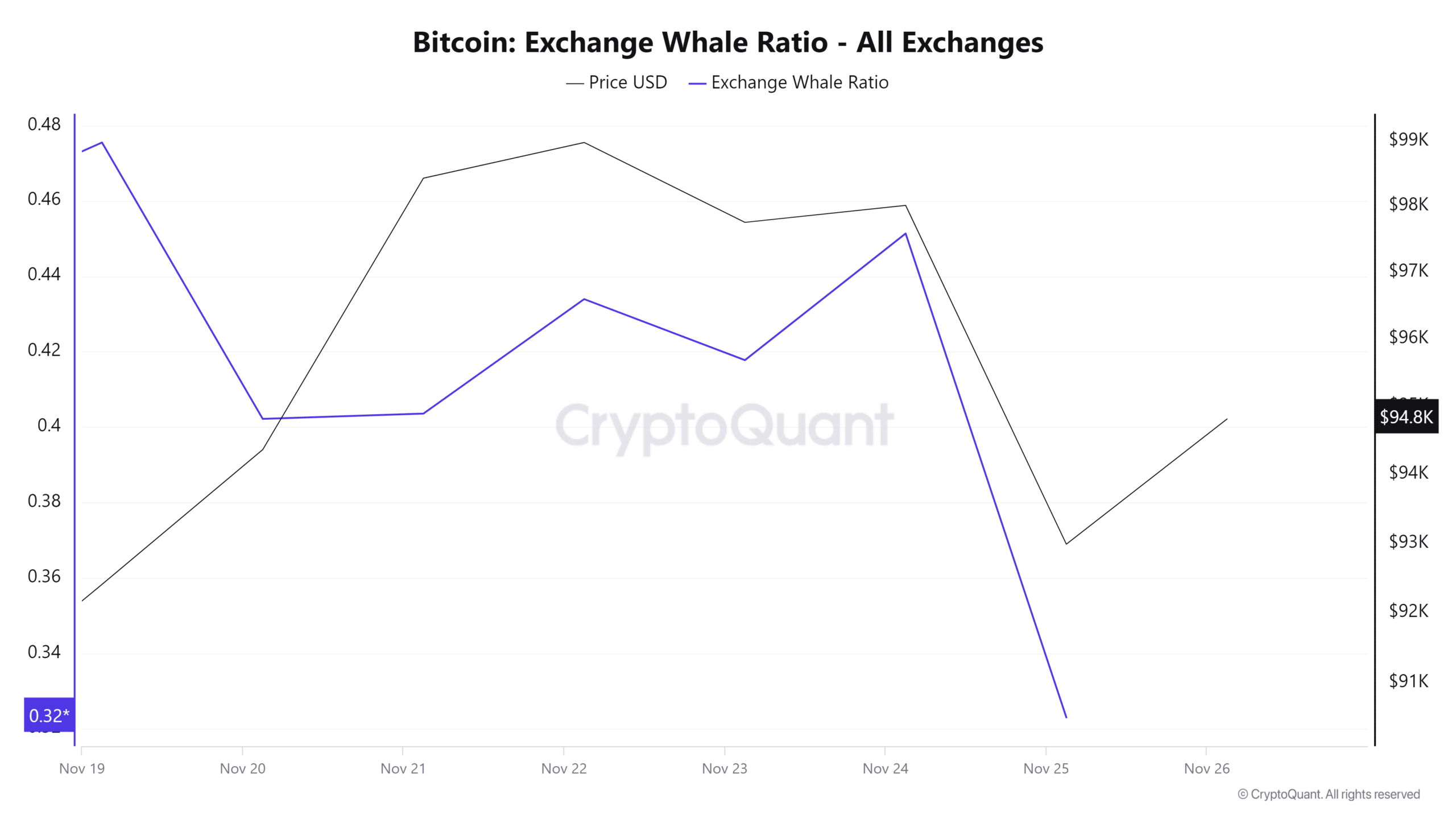

Source: CryptoQuant

For starters, Bitcoin’s Whale Exchange Ratio has fallen from 0.4 to 0.32 over the past week. This shows that even though LTHs have been sold, whales continue to accumulate BTC.

Therefore, whales do not actively transfer their BTC holdings to exchanges, which is often a precursor to selling. This indicates a bullish view among the whales as they look to lock in gains for the long term.

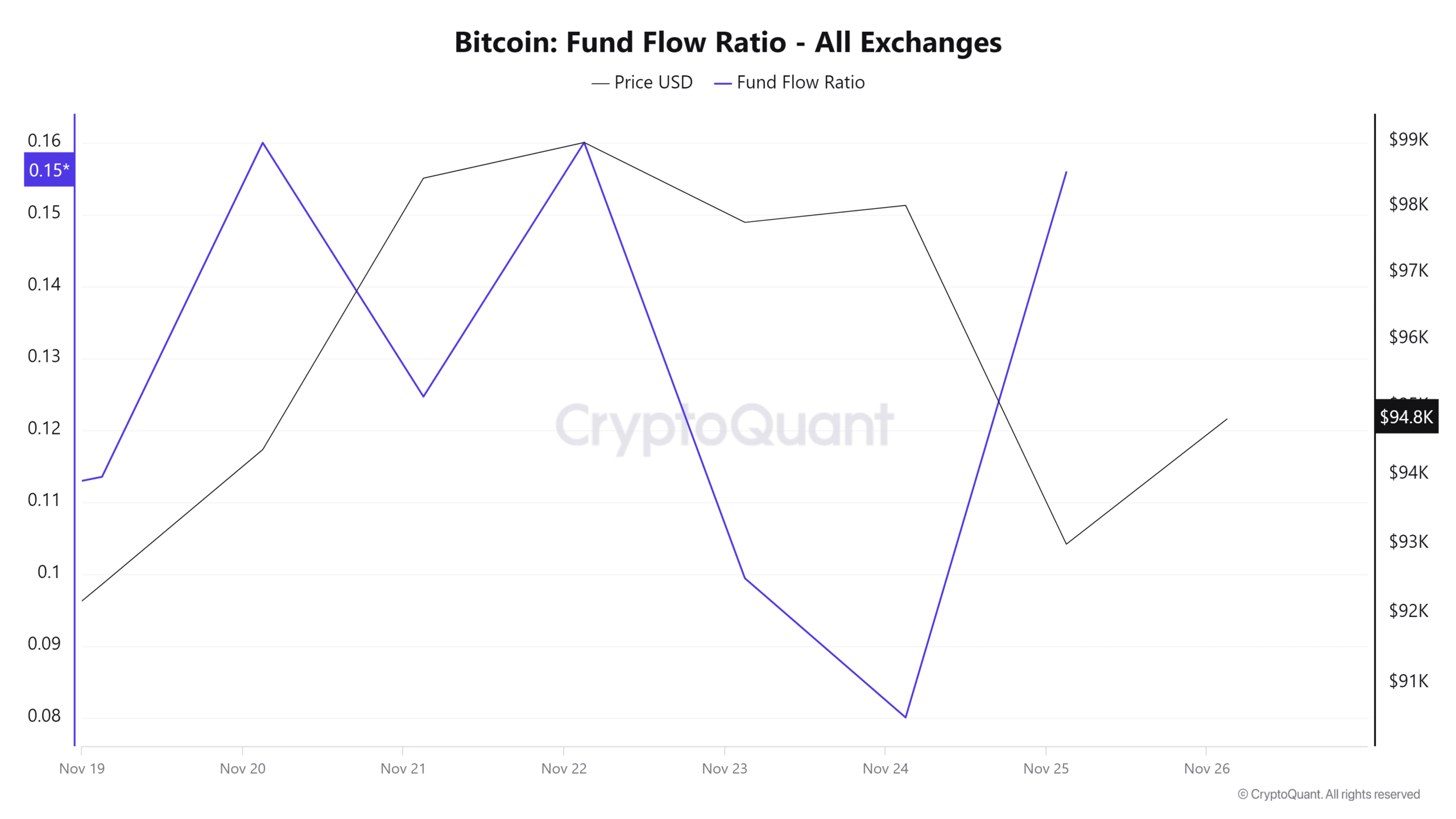

Source: CryptoQuant

Furthermore, Bitcoin’s fund flow ratio has increased from 0.08 to 0.15, indicating increased buying pressure as there are more money inflows than outflows.

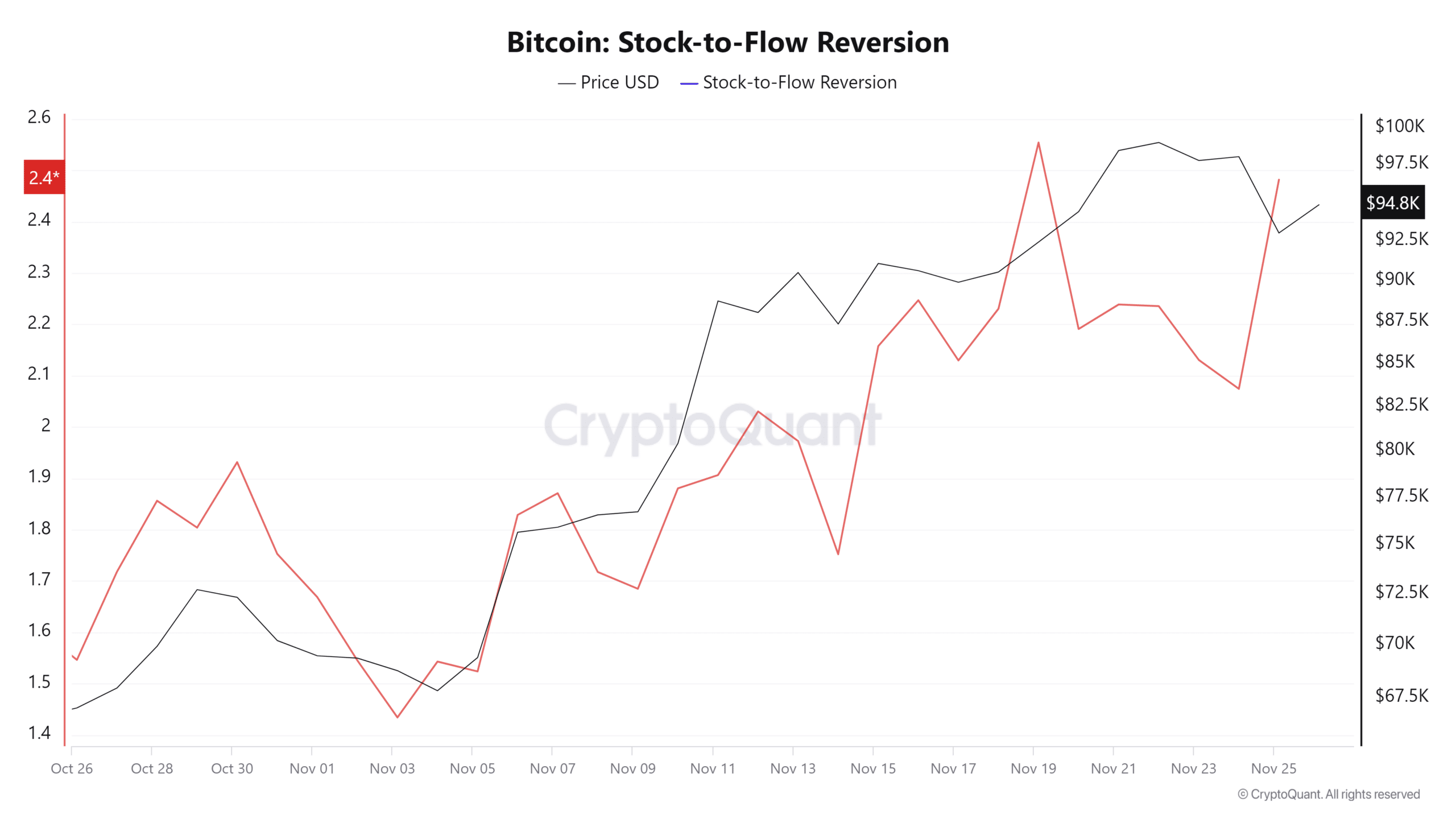

Source: Cryptoquant

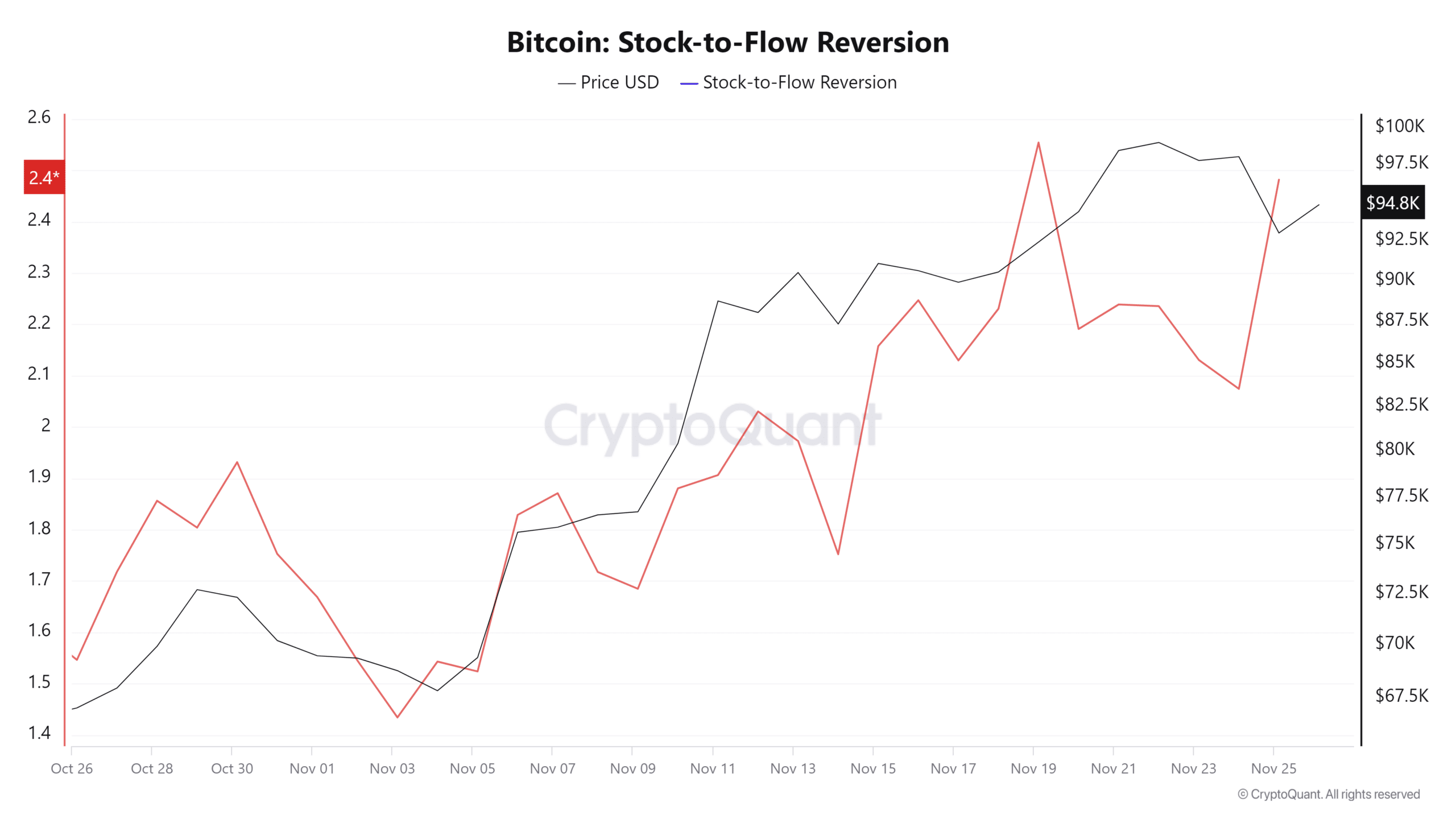

Finally, we can see this bullishness through the rising Stock-to-Flow (SFR) reversal. When the SFR reversion increases, it indicates growing market confidence in the value of BTC, often due to increased demand and adoption.

Simply put, while Bitcoin LTHs have turned to profit-taking over the past week, BTC remains in a bullish phase. Therefore, we can see that despite the selling activity of this LTH, the number of whales is piling up, while the inflow of funds remains high.

Read Bitcoins [BTC] Price prediction 2024-25

Under these circumstances, BTC could make more profits. As such, BTC will reclaim the $99,000 resistance where it has had three rejections. Above these levels, there is no significant resistance and the crypto could make another ATH.