- Bitcoin’s volatility increases as liquidations cause sharp price swings, wiping out $337 million.

- Liquidations amplify Bitcoin’s volatility, creating opportunities and risks as the price tests key levels.

Bitcoins [BTC] The recent surge to $100,000 has caused massive market volatility, with more than $337 million in long-term liquidations in 24 hours.

With the price dipping below $93,000, the threat of further sell-off remains high, especially with $772 million in short positions at risk. With a potential recovery to $98,000 on the horizon, traders should be alert to the possibility of a liquidation cascade that will push prices even higher.

Here’s a look at the factors behind Bitcoin’s wild price swings.

Testing the $100,000 threshold

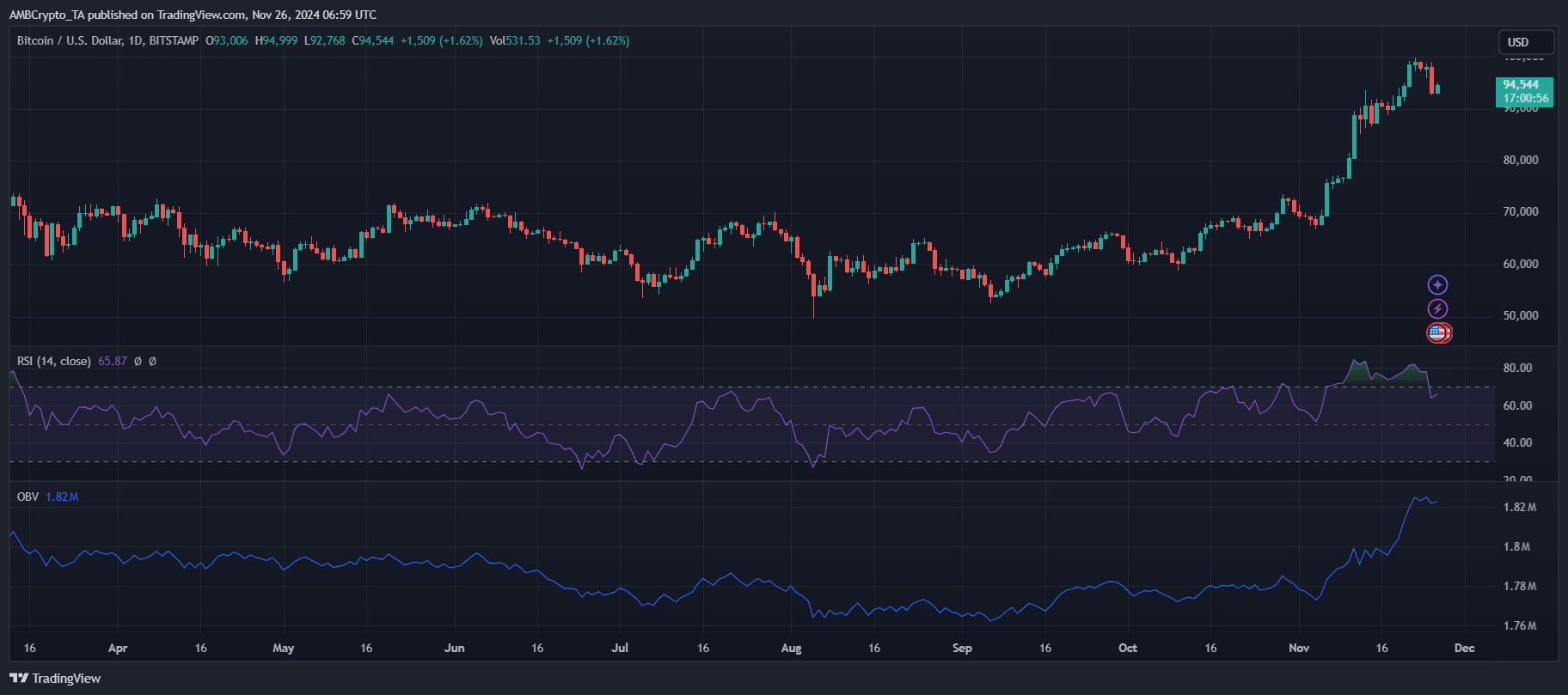

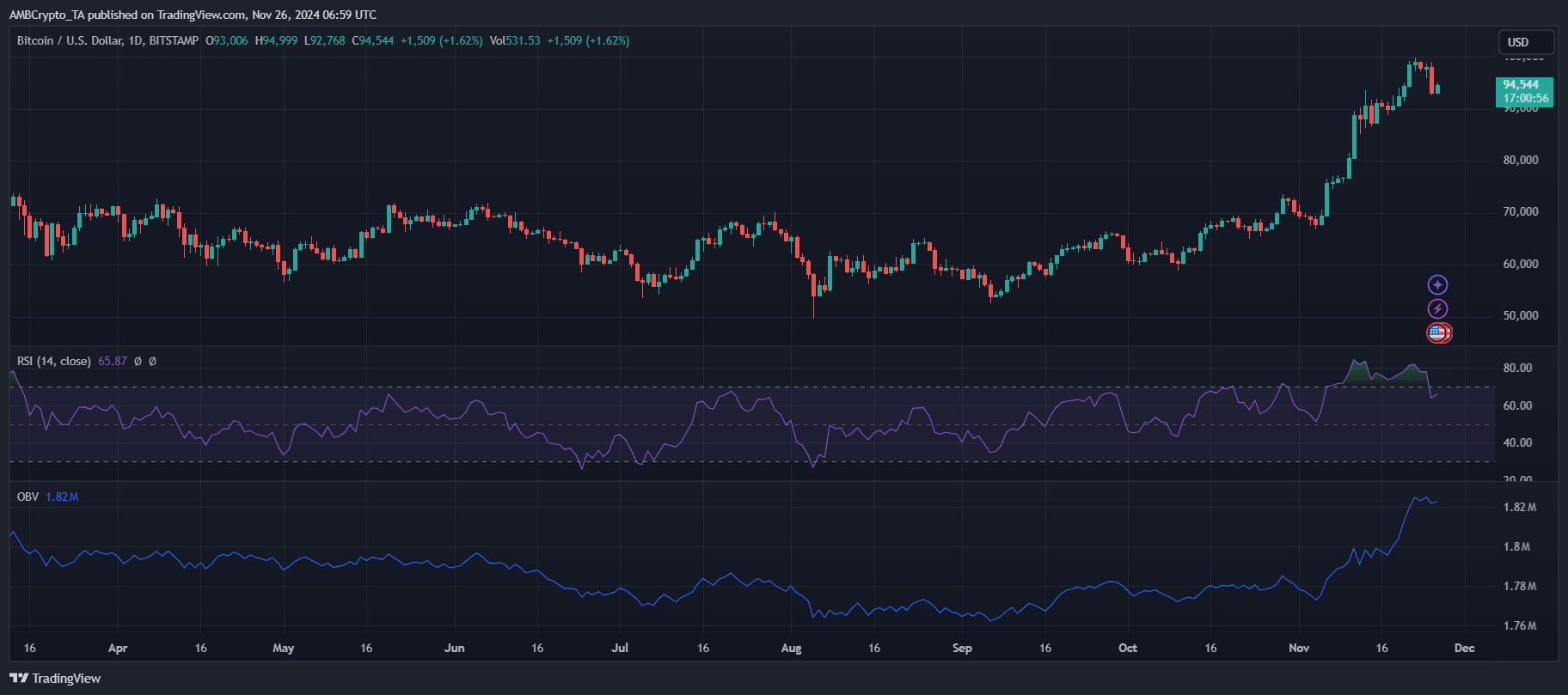

Source: TradingView

Bitcoin’s climb to the $100,000 mark has dominated market conversations, with recent price action highlighting both bullish momentum and increasing caution. The cryptocurrency briefly reached $94,999 before retreating to $94,577.

The RSI at 65.91 indicates that Bitcoin is in a bullish zone, just shy of overbought conditions. OBV, currently at 1.82 million, reflects strong buying interest but signals slowing momentum from previous peaks.

Volatility continues as Bitcoin’s trading range narrows, signaling a possible consolidation phase before another breakout attempt.

While the bullish trend remains intact, the inability to hold support above $93,000 could lead to a sell-off, especially given the increased risk of liquidation-induced price shifts.

Conversely, continued buying pressure could push BTC to $98,000 or higher, keeping traders on edge at this crucial stage.

The role of liquidation in market volatility

Liquidations have been a major driver of Bitcoin’s recent market volatility, amplifying price movements as positions are forcibly closed. Over $337 million in long positions were liquidated in the past 24 hours, causing sharp downward price movements.

With the price of Bitcoin falling below $93,000, the risk of further sell-off increases, with $772 million in short positions at stake.

If Bitcoin rebounds to $98,000, it could trigger a cascade of liquidations, driving the price further higher.

This liquidation cycle creates increased volatility, making it crucial for traders to remain vigilant and keep an eye on key price levels to avoid getting caught in a sudden market shift.

Strong bullish momentum for BTC

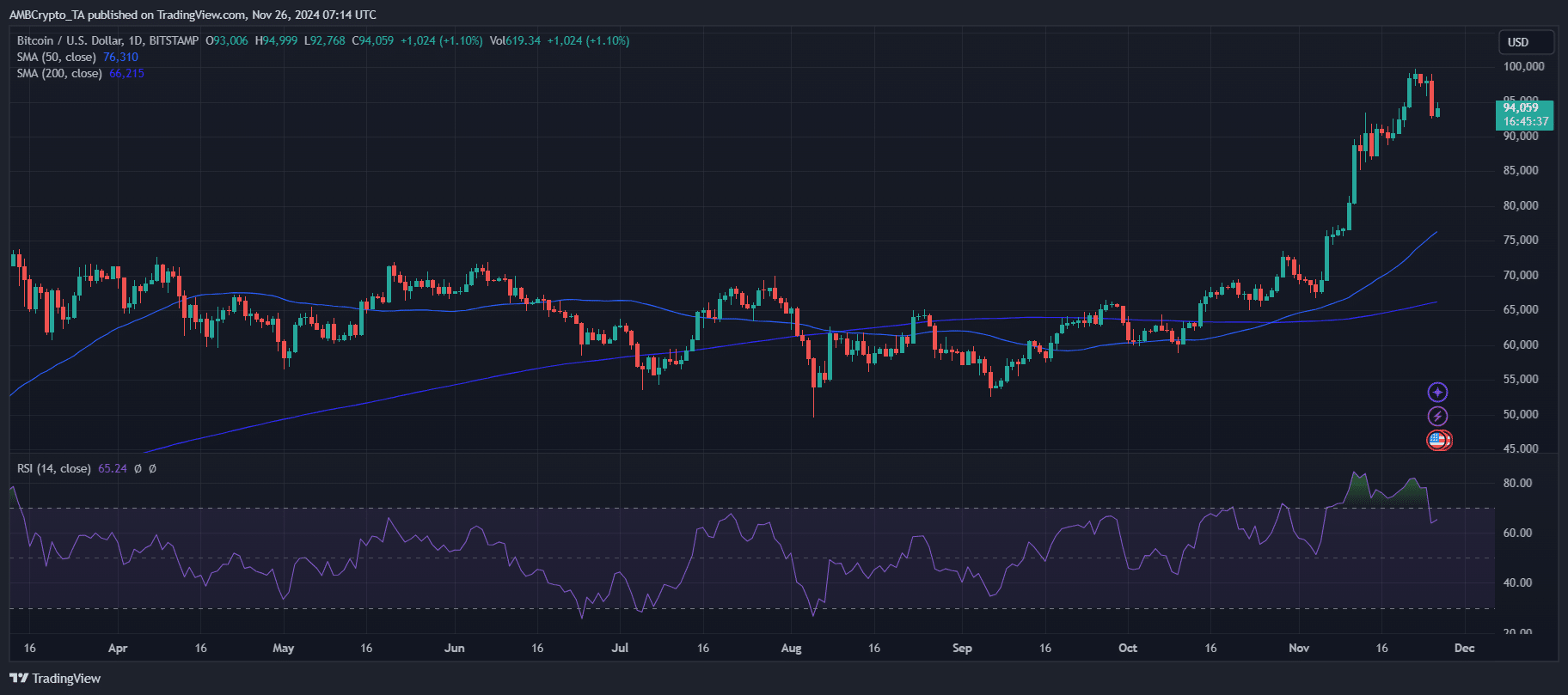

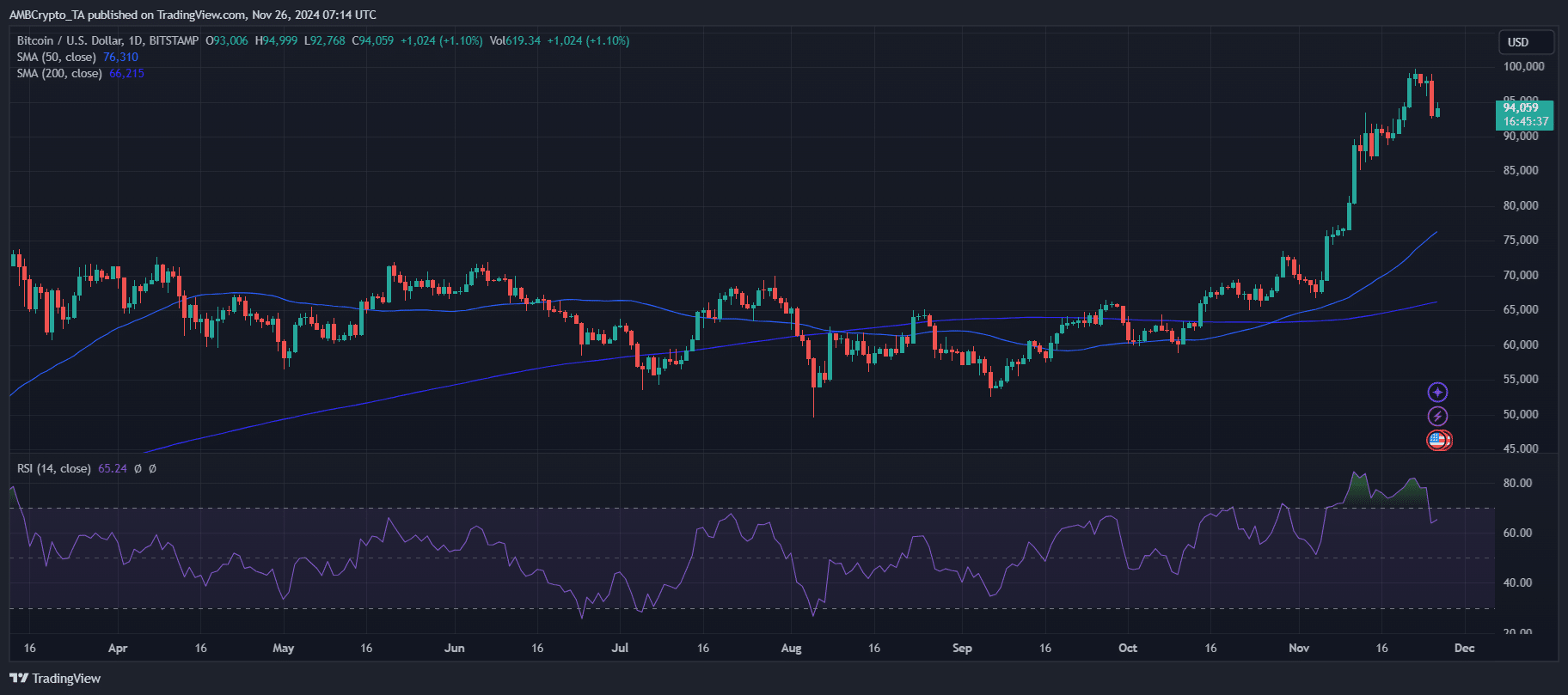

Source: TradingView

Bitcoin’s price remains well above the 50-day SMA ($76,311) and 200-day SMA ($66,215), reinforcing the long-term bullish trend. The large gap between these moving averages underlines the strong upside momentum, with the 50-day SMA acting as a key support level.

Trading volume is showing consistent activity, but a decline from recent highs signals a cooling phase in buying pressure. The RSI at 65.29 maintains a bullish stance, in line with the current price action.

These indicators suggest the market is still primed for upward moves, but caution is advised as reduced volume could limit immediate breakouts or increase volatility at retracements.

Short-term forecasts

As Bitcoin navigates through this volatile phase, short-term forecasts depend on key support and resistance levels. If the cryptocurrency can maintain support above $93,000, a recovery to $98,000 seems likely, potentially triggering a liquidation cascade that could push prices even higher.

However, a break below $93,000 could lead to further sell-off, with $88,000 or lower becoming the next critical support area.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Traders should watch for signs of continued buying pressure or a shift in volume as these could indicate the next direction.

While the long-term bullish outlook remains intact, short-term price action can be unpredictable, and caution is advised for those looking to take positions.