- Bitcoin ETFs saw inflows of $1 billion, close to Satoshi’s holdings and gold ETFs.

- Bitcoin’s 160% rise by 2024, now worth $1.91 trillion, tested the gold market’s dominance.

Following the aftermath of the US presidential election, Bitcoin’s [BTC] The market has seen a significant rise, with spot Bitcoin ETFs seeing a huge influx of capital.

As the price of BTC moves closer to the $100,000 mark, the momentum is even being reflected in the ETF market.

Bitcoin ETFs Update

According to Farside InvestorsBitcoin ETFs saw an impressive inflow of $490.3 million on November 22, marking a notable continuation of the uptrend.

Cumulatively, BTC ETFs had attracted more than $1 billion in new investments as of November 21. This indicated robust investor appetite for exposure to the leading cryptocurrency, amid a wave of bullish sentiment.

Amid the flurry of Bitcoin ETF inflows, BlackRock’s IBIT has emerged as the frontrunner, with an impressive $513.2 million on November 22 and $608.4 million on November 21.

Closely followed by Fidelity’s FBTc, which is strengthening its position in the market. Not all Bitcoin ETFs are seeing growth, however, as Grayscale’s GBTC saw outflows, losing $67.1 million on November 22.

Will they surpass Satoshi Nakamoto’s assets?

Nevertheless, the collective influx into spot Bitcoin ETFs is making headlines, with discussions increasing about these funds approaching a major milestone and becoming the largest holders of Bitcoin globally.

Data suggested it could potentially surpass even the legendary Satoshi Nakamoto, while also approaching gold ETFs in total net assets.

In the same comment, Bloomberg’s Senior ETF Analyst said: Eric Balchunas noted,

“US spot ETFs are now 98% on track to overtake Satoshi as the world’s largest holder. My Thanksgiving over/under date is looking good.

He added:

“If the next three days are similar in terms of power to the last three days, it’s a done deal. Also with an aum of $107 billion, they trail gold ETFs by just $23 billion, a good chance to surpass by Christmas.”

Journey so far

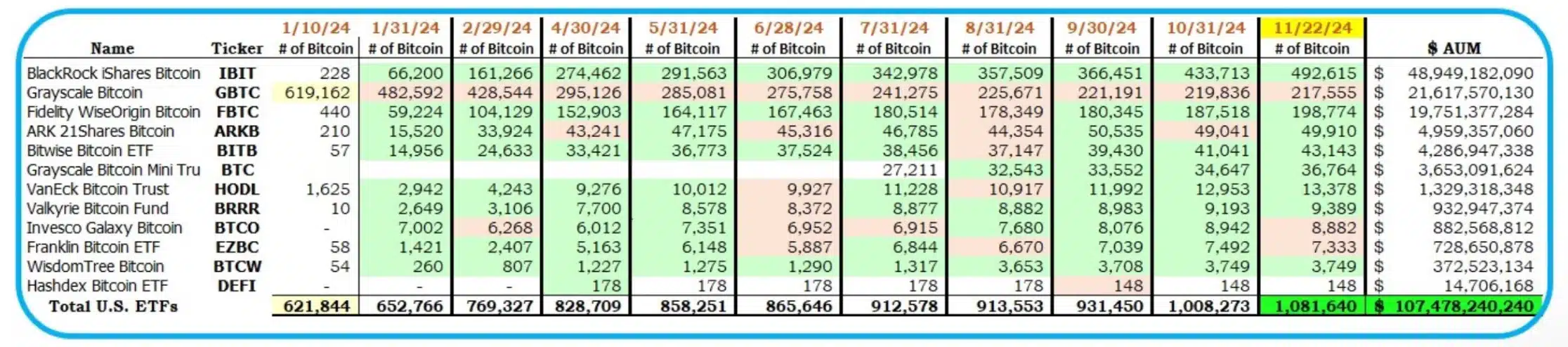

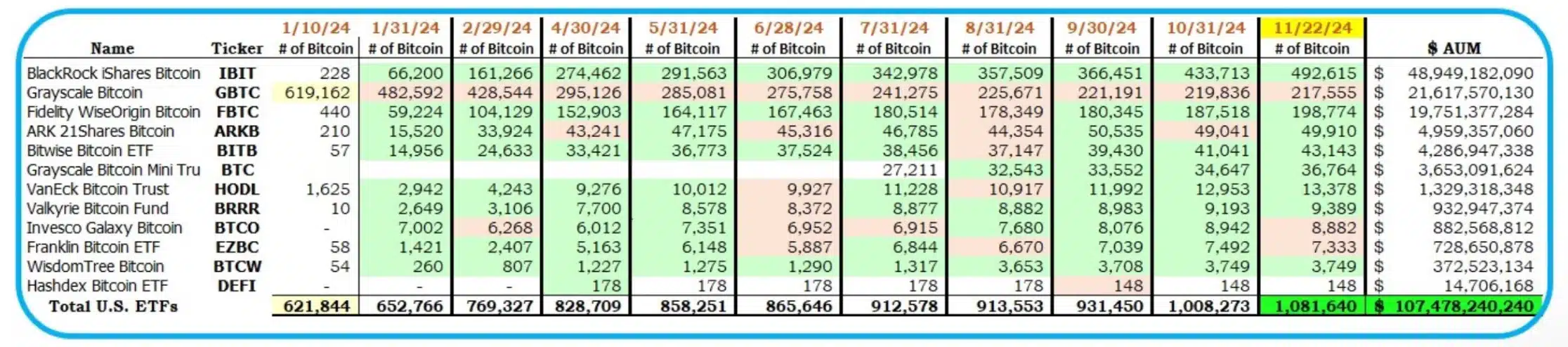

Well, since their debut in January, US spot Bitcoin ETFs have experienced rapid growth.

According to recent estimates from crypto analyst HODL15Capital, these funds collectively held approximately 1.081 million BTC, putting them tantalizingly close to Satoshi Nakamoto’s alleged 1.1 million Bitcoin holdings.

Source: HODL15Capital/X

Nakamoto, the elusive creator of Bitcoin, is said to own approximately 5.68% of the total Bitcoin supply, worth more than $100 billion.

Therefore, if Nakamoto were a living, single individual, these vast assets would place them among the richest people in the world.

The year 2024 and Bitcoin

Needless to say, Bitcoin’s remarkable performance in 2024 has cemented its position as the dominant force in the financial landscape.

Up 160% since January, BTC is now approaching the $100,000 mark, while its market cap of $1.91 trillion surpasses that of silver and industry giants like Saudi Aramco.

Despite this impressive growth, Bitcoin still lags behind gold, the world’s largest asset, with a market capitalization of over $18 trillion.

These trends highlight Bitcoin’s growing prominence, but also underscore its continued journey to challenge traditional assets like gold for the top spot.