- Bitcoin remains stuck below $100,000 despite an 81% chance of reaching this.

- Bears have shown that reaching this milestone will not be easy; patience will be tested.

Bitcoin [BTC] investors have had a rollercoaster week, with high hopes for the cryptocurrency’s historic $100,000 milestone. Despite top analysts assign Although there was an 81% chance that BTC would achieve this goal, the weekend ended without the expected breakout, leaving the market tense.

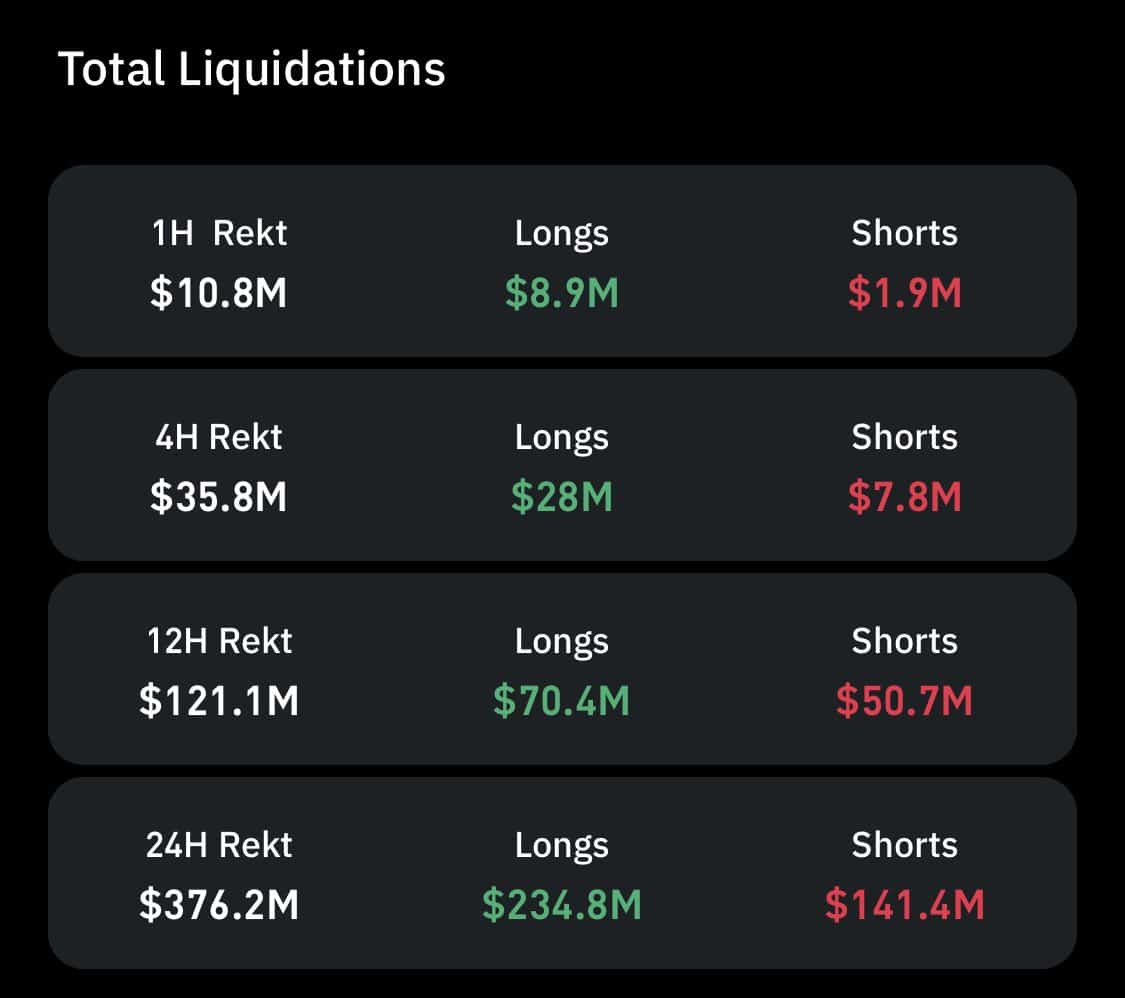

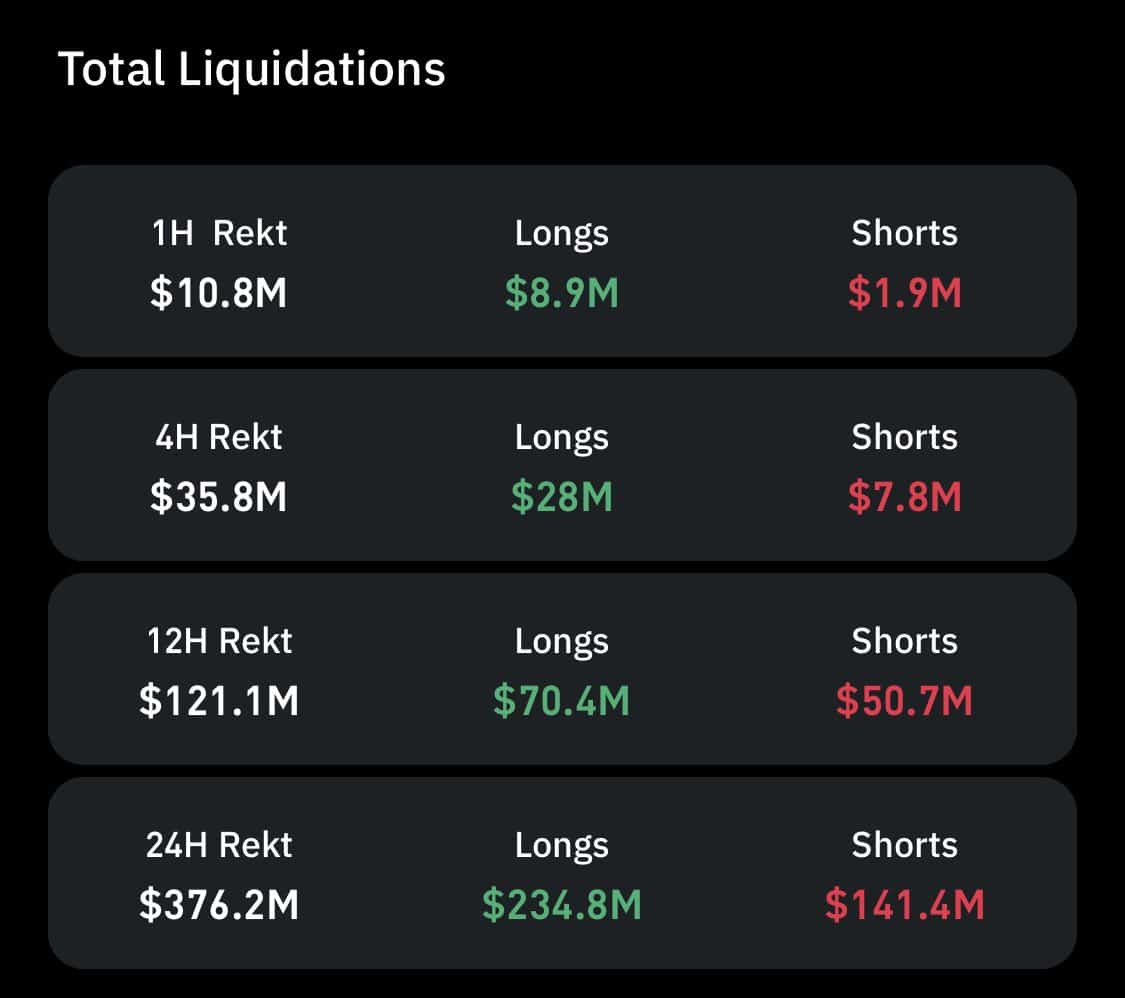

The past 24 hours have only increased the drama. As many as 160,527 traders were liquidated, accounting for $376.22 million in losses, as volatile price movements disrupted both long and short positions.

This increase in liquidations highlights the intense volatility gripping the derivatives market. Is this a warning of a bigger market shift ahead?

Long squeeze is activated as the bear strategy plays out

Current long/short proportions reveal a bearish tilt, with traders heavily shorting Bitcoin.

This imbalance comes with a warning: Excessive leverage in the derivatives market could lead to sudden corrections or even a long-term squeeze – a hidden catalyst that may be driving Bitcoin’s recent turnaround.

Over $234 million in long positions were liquidated in the last 24 hours – a staggering 65.96% increase compared to $141 million in short liquidations.

Source: Coinglass

This wide disparity underlines the volatility in the game, as “longs” (bets on price rises) were forced to close their positions following Bitcoin’s dip from its all-time high of $99,317 just two days ago.

In simple terms, when Bitcoin experienced a small downturn, traders to leave their positions to minimize losses – a rational move given the high stakes at current price levels. Bears seized this opportunity, likely triggering a cascade of long-term liquidations.

This is consistent with the current bull cycle, where BTC, despite rapid gains, has avoided overheating speculation due to the dominance of long positions.

However, even a small deviation from the bullish path provided an opening for bears to apply pressure. The result? A long-term pressure that forced traders to liquidate their positions, leading to a nearly 2% drop in Bitcoin’s price.

While a breakout to $100,000 could still happen, market volatility is becoming increasingly apparent.

As BTC approaches a historic milestone, investors are adjusting their portfolios – either shifting attention to other highly capitalized assets or cashing out with impressive gains.

If this trend continues, bears will likely benefit from the resulting volatility every time BTC posts a new ATH, causing long price increases. This could push BTC into a long-term loop unless an external catalyst disrupts this pattern and causes a breakout.

The $100,000 dream could be on hold for now

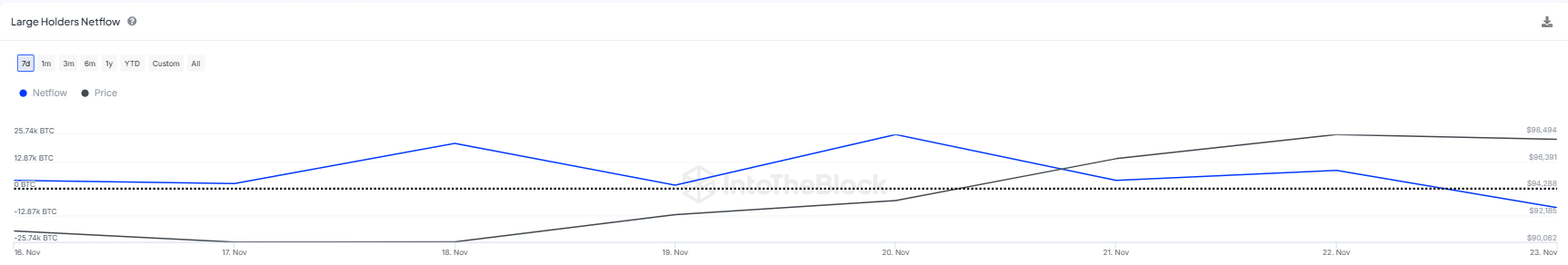

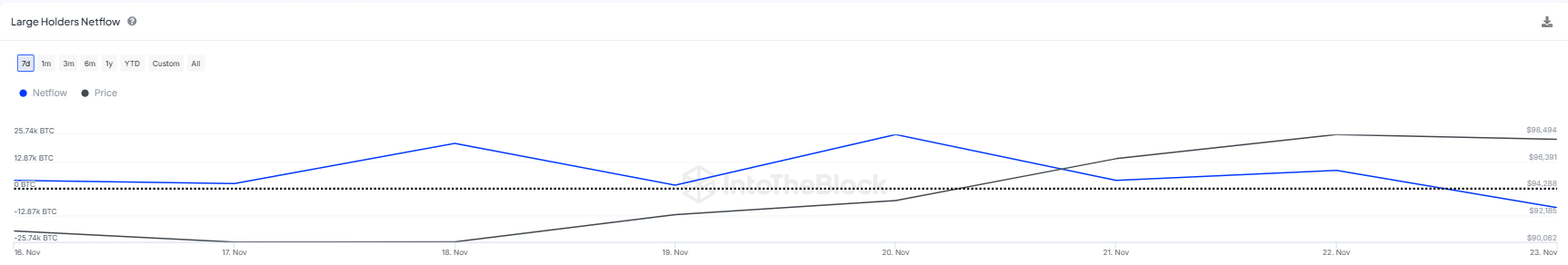

Interestingly, Whales have deposited approximately 10,000 Bitcoins over the past two days at a price of $98,121, which amounts to a significant total of approximately $981 million.

Source: IntoTheBlock

More specifically, this reinforces AMBCrypto’s previous analysis highlighting how bears benefited from the seismic shift as whales lost their assets.

The maneuver caused a price drop, allowing short sellers to take control. This forced long positions to be liquidated in an attempt to minimize risk.

Read Bitcoin’s [BTC] Price forecast 2024-25

So while anticipation for the $100,000 milestone is growing, it won’t be an easy journey.

Every time Bitcoin approaches that price target, a wave of departures – from big HODLers, swing traders or miners – creates the perfect environment for bears to take control. This cycle keeps Bitcoin trapped in a perpetual loop, preventing a smooth climb to its historic milestone.