This article is available in Spanish.

Bitcoin’s price has cooled somewhat and is struggling to reach the coveted $100,000 mark after an intense bullish run all week. However, investors appear undeterred by the key cryptocurrency’s sluggish price action in recent days.

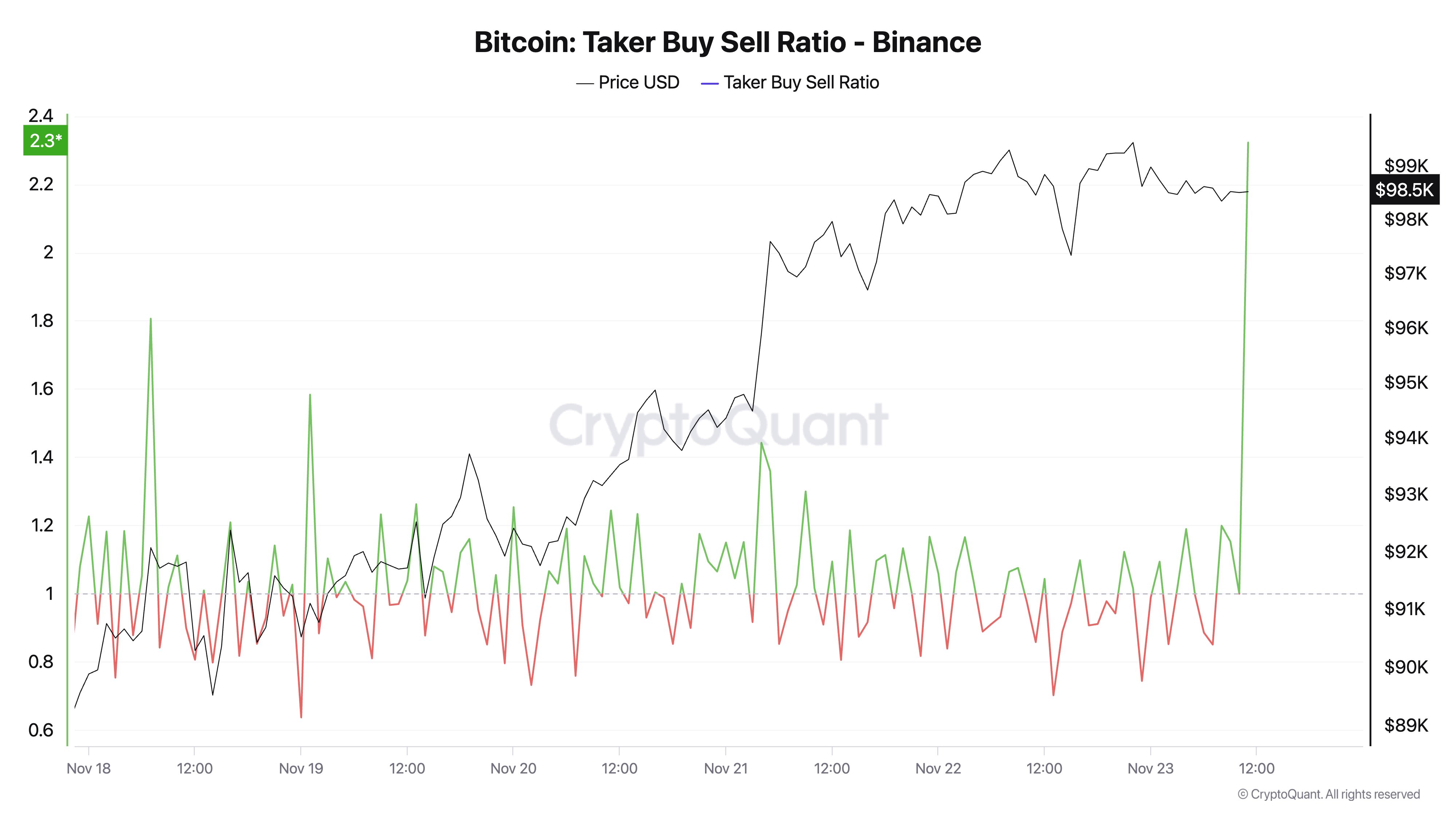

Bitcoin Taker buy/sell ratio increases – impact on price

In a November 23 post on the X platform, prominent crypto analyst Ali Martinez said shared that traders have been loading their coffers with Bitcoin in recent days. This on-chain observation is based on the ‘taker buy/sell ratio’, which tracks the taker buy and taker sell volumes for a specific cryptocurrency.

A value of more than one of the taker’s buy/sell ratio suggests that the taker’s buying volume is higher than the taker’s selling volume. This is typically considered a bullish signal, suggesting investors’ willingness to pay a higher price for a particular cryptocurrency (Bitcoin in this case).

Related reading

On the other hand, when the value of the statistic is less than 1, it means that more sellers are willing to sell their assets at a lower price. This generally indicates bearish sentiment among investors, as selling pressure overshadows buying pressure in the specific market.

Martinez highlighted in his post on As shown in the chart below, the metric spiked to a value of over 28 on Binance, the world’s largest exchange.

Likewise, Bitcoin takers’ buy/sell ratio climbed well above the threshold of 1, demonstrating increasing buying pressure in the open market. This level of intense buying activity could see the leading cryptocurrency continue its rally towards the $100,000 mark.

At the time of writing, the price of BTC stands at around $97,800, reflecting a decline of 1.1% in the past 24 hours. Nevertheless, the flagship’s performance on the weekly time frame is still impressive. According to CoinGecko data, BTC has risen almost 8% over the past week.

Who’s buying?

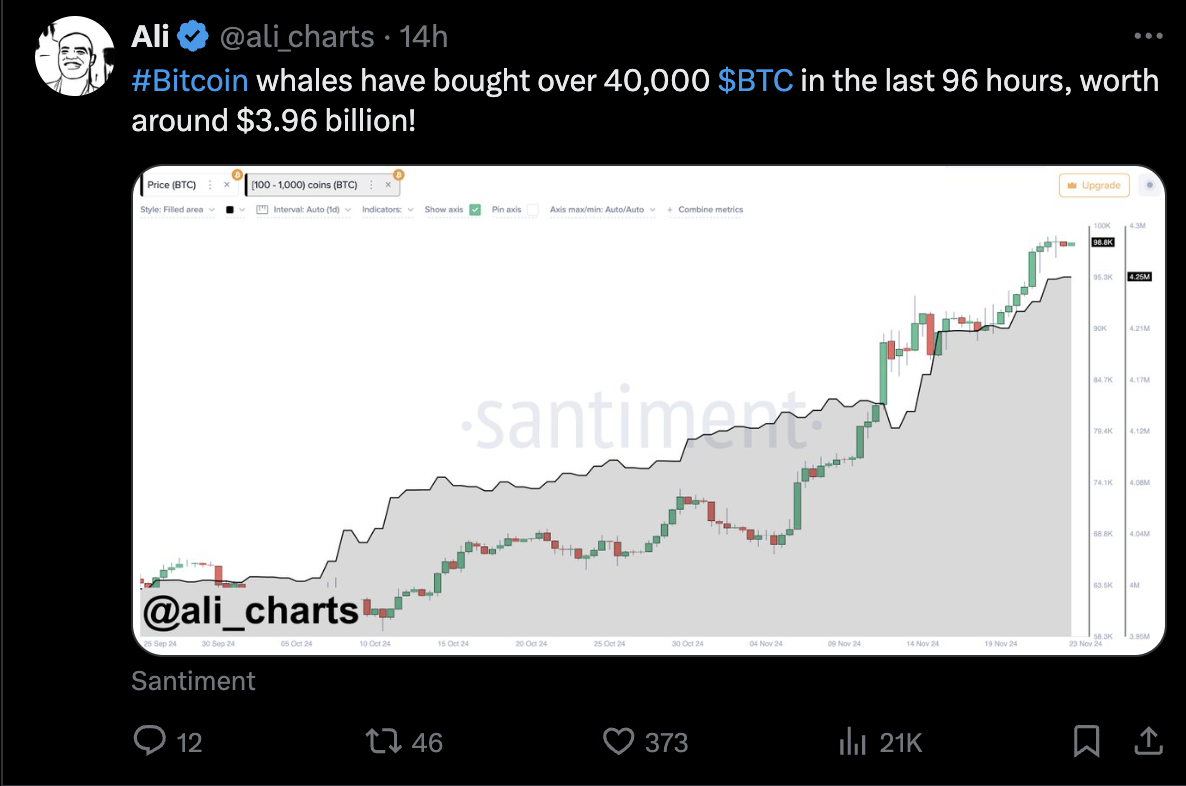

In another post on the X platform, Martinez revealed that a notable group of large investors (also known as whales) have been active in the Bitcoin market in recent days. This class of whales involved here are those who own between 100 and 1,000 coins.

According to data from Santiment, whales have purchased more than 40,000 BTC (equivalent to approximately $3.96 billion) in the past four days. Given their influence on market dynamics, this buying activity from the Bitcoin whales could be bullish in terms of price.

Related reading

Featured image from iStock, chart from TradingView