- With ETH/BTC hitting its lowest point since 2021, investors, especially from Korea and the US, are starting to pile in.

- Derivatives traders are also taking positions and placing long bets on ETH.

Ethereum [ETH] has remained above the $3,000 mark over the past month, with a gain of 19.84%. However, over the past week, ETH has seen a decline of 2.15%.

Nevertheless, market sentiment appears to be changing, as evidenced by a modest 0.19% increase in recent trading.

AMBCrypto investigates why investors see this price movement as an attractive buying opportunity.

What the ETH/BTC pair signals for Ethereum

The ETH/BTC pair, which reflects the value of one ETH in terms of BTC, recently fell to its lowest level since 2021, below 0.03221, as reported by Degen News.

Source:

This suggests that market participants are receiving less BTC for each ETH as Bitcoin’s price has risen to a lifetime high and is now trading above $97,000.

Two primary interpretations can be drawn from this move: First, Bitcoin’s growing dominance could lead to liquidity flowing out of ETH into BTC as investor confidence shifts.

Alternatively, some investors could see this as an opportunity to accumulate more ETH as they believe it is currently undervalued.

Analysis by AMBCrypto indicated that the latter scenario was more likely, with statistics showing an increase in buying activity as investors take advantage of ETH’s perceived price decline.

Investors continue to accumulate

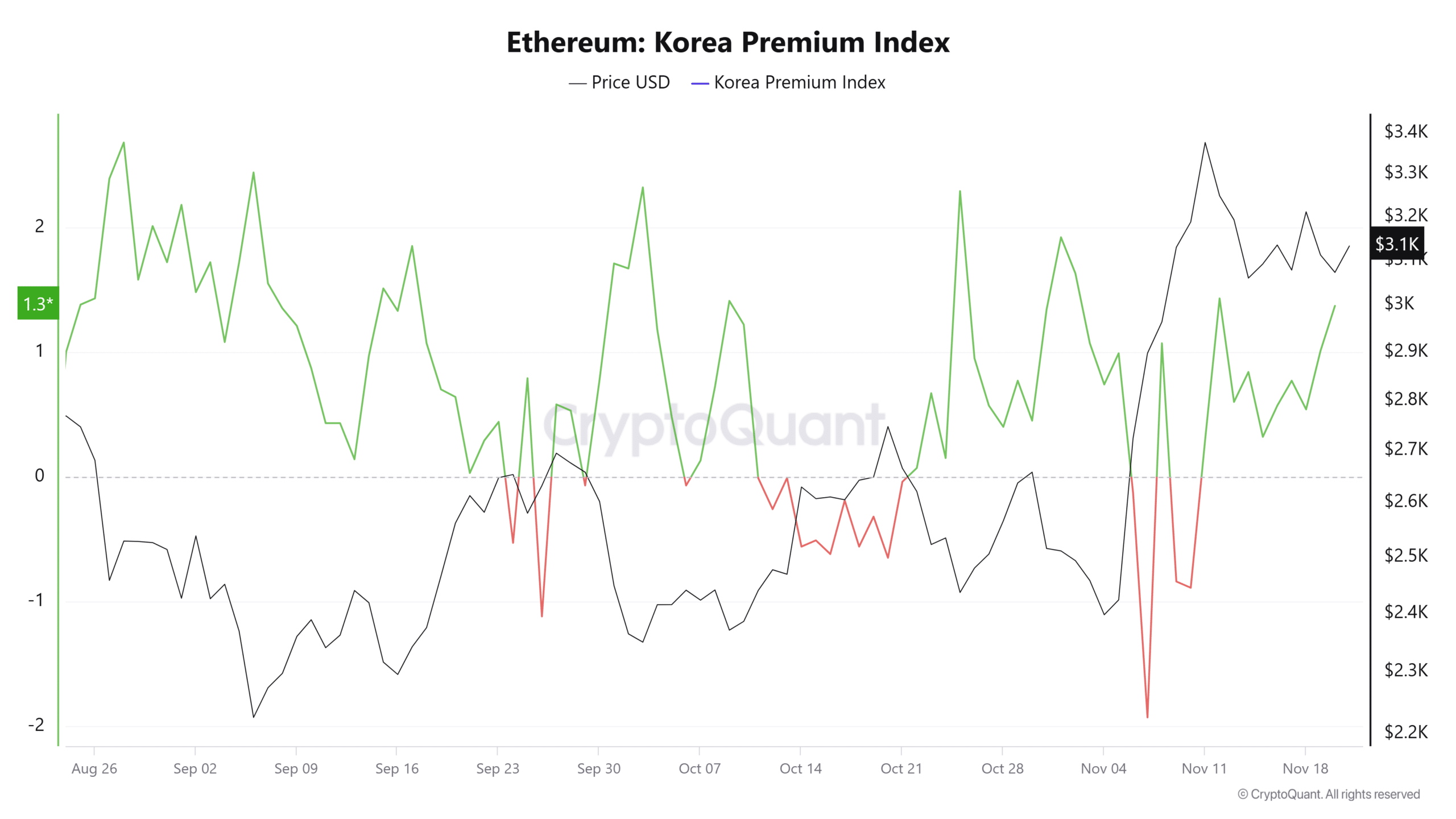

Despite the recent decline in the ETH/BTC pair, AMBCrypto found that investors from both Korea and the US were actively accumulating ETH.

The Korean Premium Index and Coinbase Premium Index, which track price differences between Korean exchanges, Coinbase and other platforms, show that both metrics are currently above 1 and 0 respectively.

This indicates strong buying pressure from these investor groups.

Source: CryptoQuant

At the time of writing, the Korean Premium Index is at 1.37 and the Coinbase Premium Index is at 0.0073, indicating that these investors are increasing their ETH holdings. If this trend continues, it could take the token to new highs.

Should buying activity continue among these cohorts, ETH’s modest gains over the past 24 hours could see a significant boost.

Derivatives traders are joining the buying trend

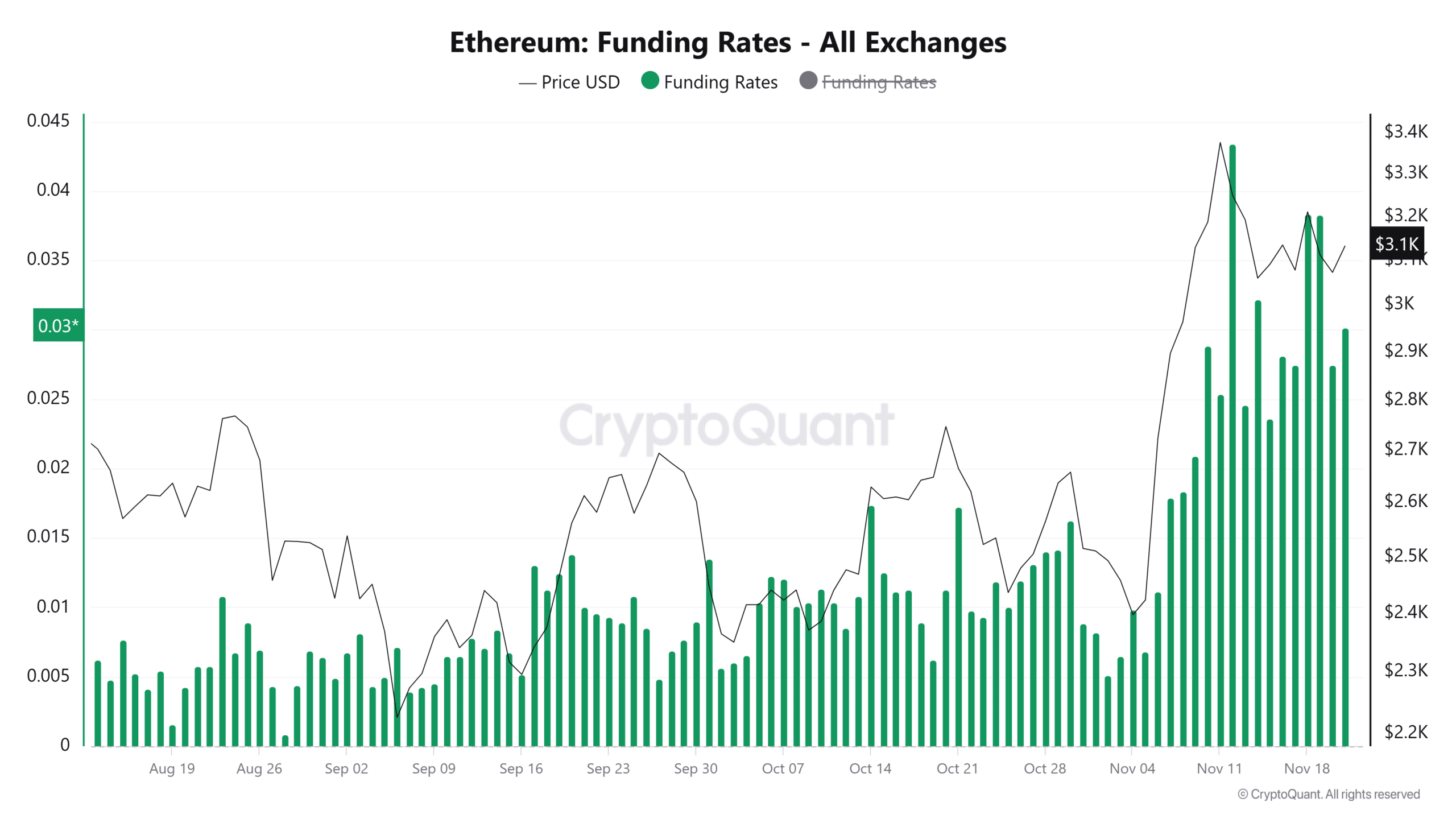

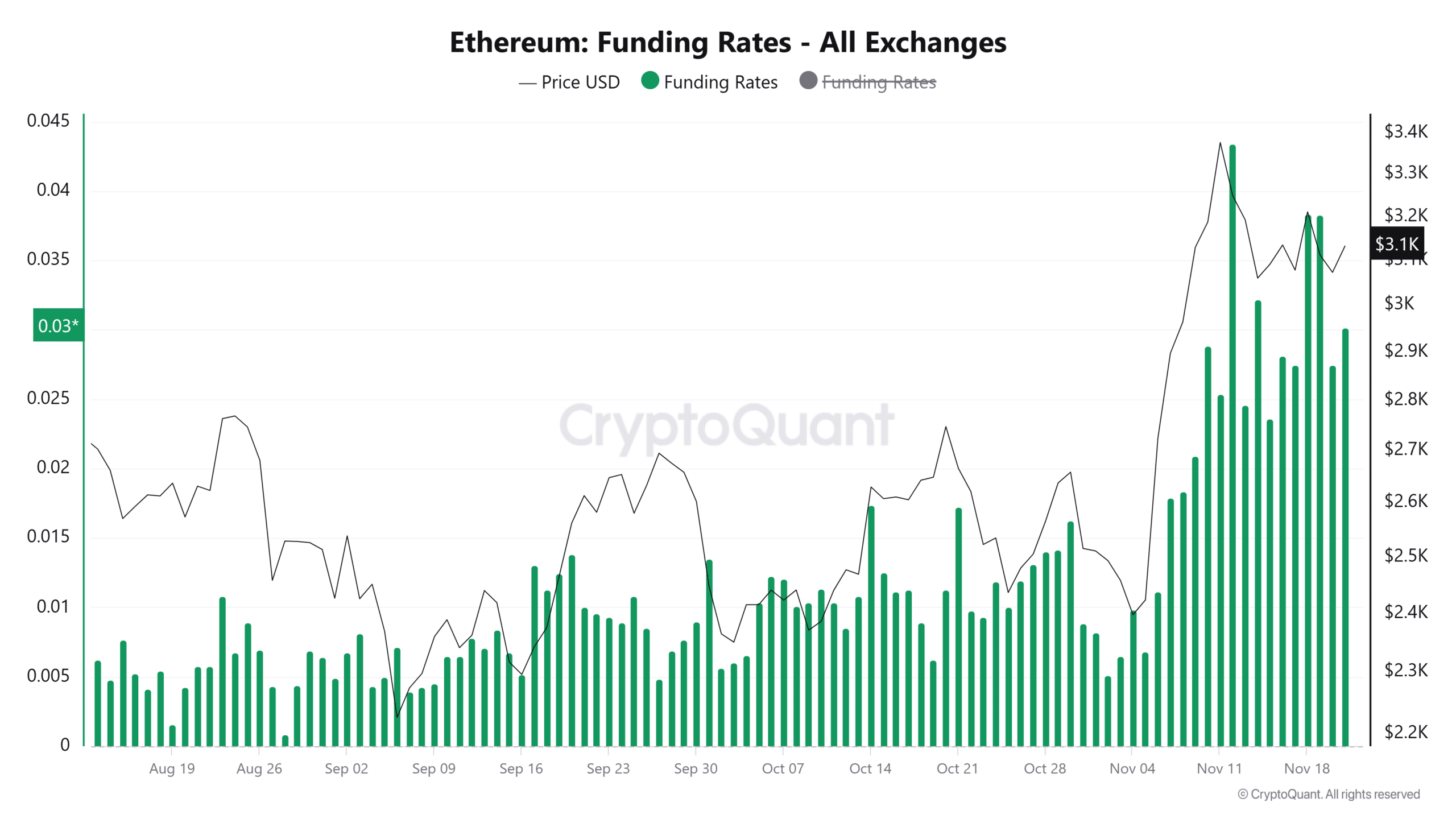

Recent data from CryptoQuant of derivatives traders in the ETH market revealed buying trends, especially regarding the Funding Rate and Taker Buy/Sell Ratio.

The Funding Rate, which reflects the balance between long and short positions in the futures markets, favored long positions at the time of writing.

This indicated a bullish outlook, with traders expecting ETH to rise from its current price level.

Source: CryptoQuant

Furthermore, the Taker Buy/Sell Ratio (which measures the volume of buy orders versus sell orders among market takers) has surpassed 1 and reached its highest level in November, above the previous peak of 1.0486.

Read Ethereum’s [ETH] Price forecast 2024–2025

This indicated strong buying activity and a market trending toward upward momentum.

If these trends continue, they could push ETH higher, further strengthening the bullish sentiment in the market.