- Bitcoin could soar to $139,000 if it repeats its past performance during US election cycles.

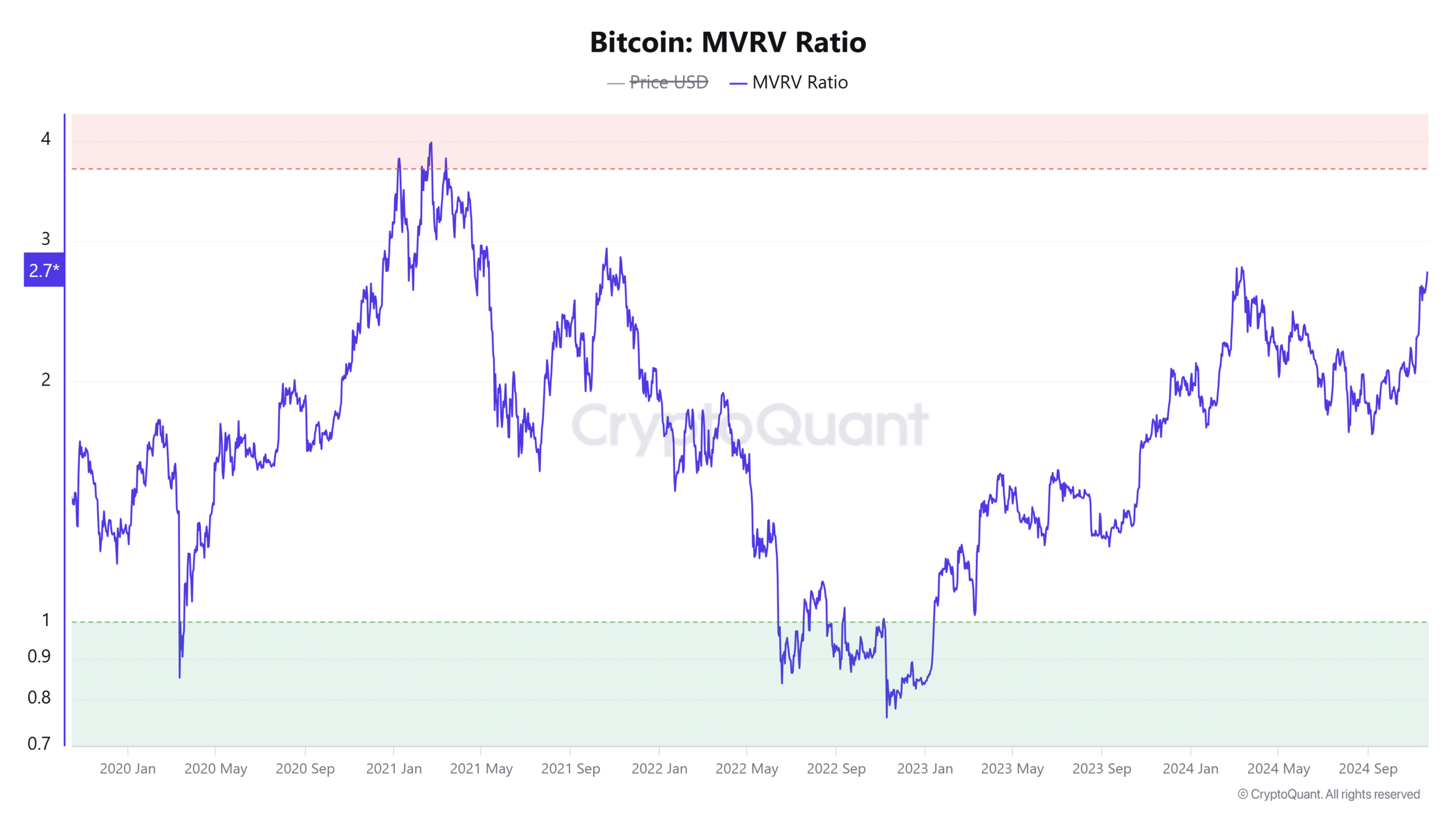

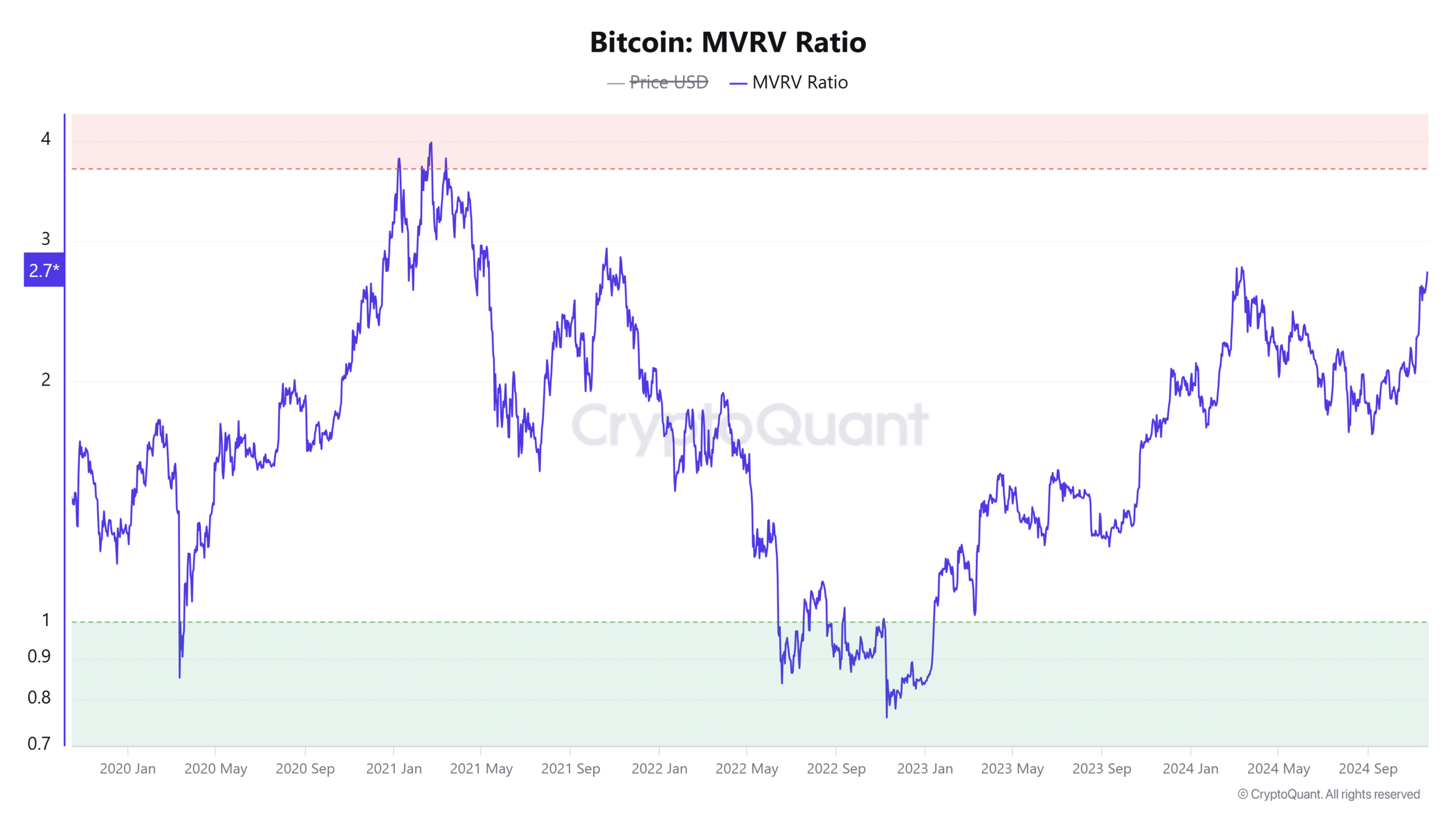

- The MVRV ratio also indicated a further increase as it shows that Bitcoin is not yet overvalued.

Bitcoin [BTC] repeats historical price patterns with impressive performance since the US presidential election on November 5. Historically, US elections have produced significant gains for BTC, and a repeat of this trend could see the rally extend to $139,000.

This is according to analyst TechDev on X (formerly Twitter). He noted that BTC was trading at $69,400 on Election Day. Based on the gains made during the 2012, 2016, and 2020 elections, the price could post a 4.51x gain to $139,180 by 2025.

Bitcoin was trading at $98,800 at the time of writing, having gained 42% since Election Day. The market cap is also inching closer to $2 trillion. As bullish sentiment grows, will Bitcoin follow past cycles, or will it derail?

Is Bitcoin repeating previous cycles?

An analysis of Bitcoin’s weekly chart suggests that the rally, which started during election week, could continue. After the November 2020 elections, BTC began an uptrend, rising from around $13,700 to the 2021 ATH of $64,800 in less than six months.

Source: TradingView

A similar rally, which started during the 2024 election week, is currently underway, and if bullish momentum continues, the price could rise above $120,000 by April 2025.

The Relative Strength Index (RSI) supports this outlook. This indicator had a value of 77 at the time of writing, which indicates that BTC is not yet overbought. Therefore, Bitcoin has yet to find its top despite the recent surge, leaving room for more growth.

MVRV indicator shows THIS

Bitcoin’s market value to realized value (MVRV) ratio also points to further gains. This metric had a value of 2.7 at the time of writing, indicating that BTC is not yet overvalued.

An MVRV ratio of 2.7 also shows that Bitcoin is still in the early stages of a bull run and has not yet found a local top despite consecutive ATH records.

Source: CryptoQuant

Traders should beware of an MVRV climb above 3.7 as it will indicate that the coin is overvalued. The last time the MVRV ratio showed that Bitcoin was overvalued was in early 2021, a few months after the 2020 election.

Read Bitcoin’s [BTC] Price forecast 2024-25

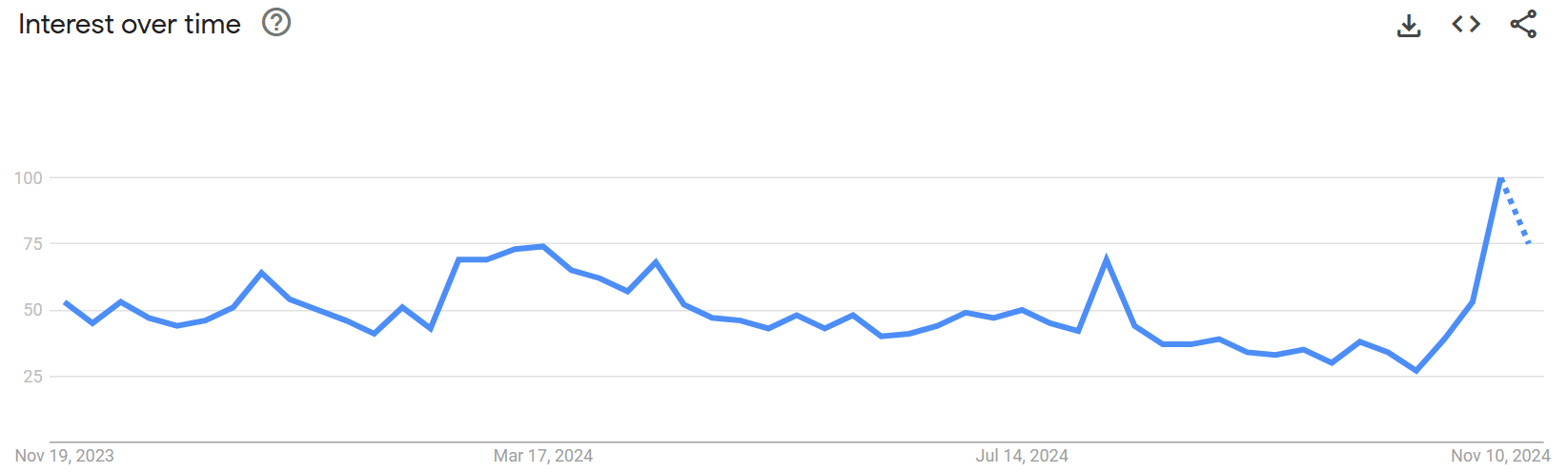

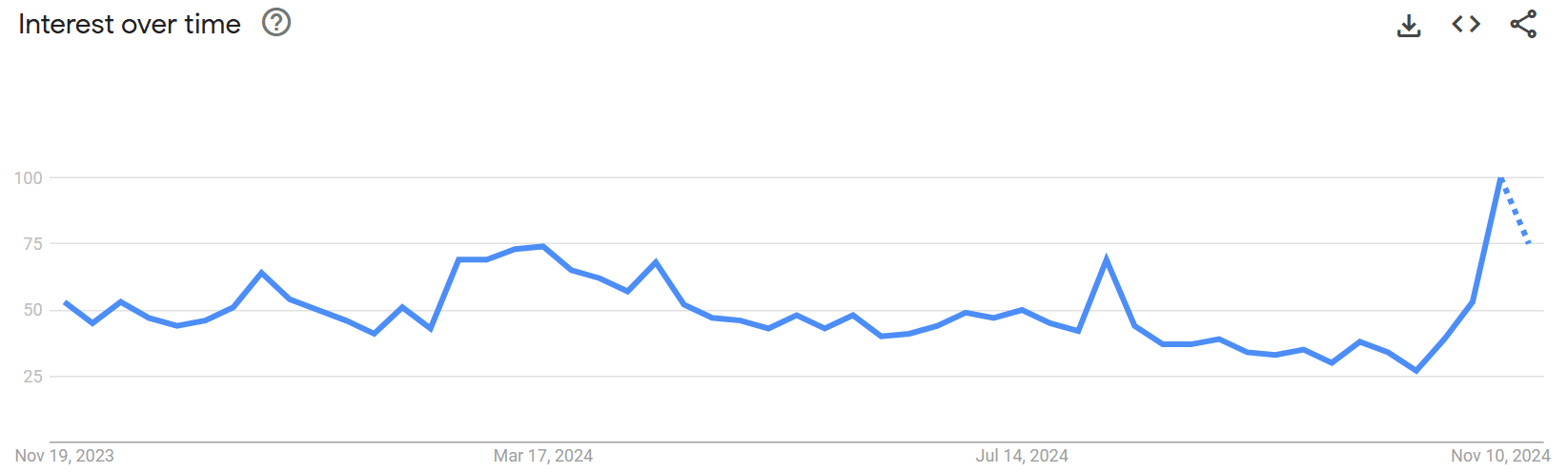

Google Trends suggests FOMO for retail

As Bitcoin approaches a new ATH above $100,000, Google Trends shows that fear of missing out (FOMO) among retail traders is significantly high. Search activity for the term “Bitcoin” is at its highest level in more than a year.

Source: Google Trends

A score of 100 on Google Trends shows that interest in Bitcoin is at its peak. It could also indicate that the retail market is in euphoria.

However, with Bitcoin’s rally showing signs of an early bull market, this score could indicate increasing adoption.