- Mantra crypto rose 65%; Will the uptrend continue this week?

- Whales have not reduced their exposure despite OM’s triple-digit rally last week.

Mantra crypto led the RWA (real-world asset) tokenization sector at the weekend pump. The original token, TOrose about 65% on November 17, bringing its weekly gain to a whopping 194%.

Interestingly, the whales held their positions despite the triple-digit rally, indicating bullish conviction for likely additional gains. Can late bulls still enjoy the party?

Mantra crypto key re-entry levels

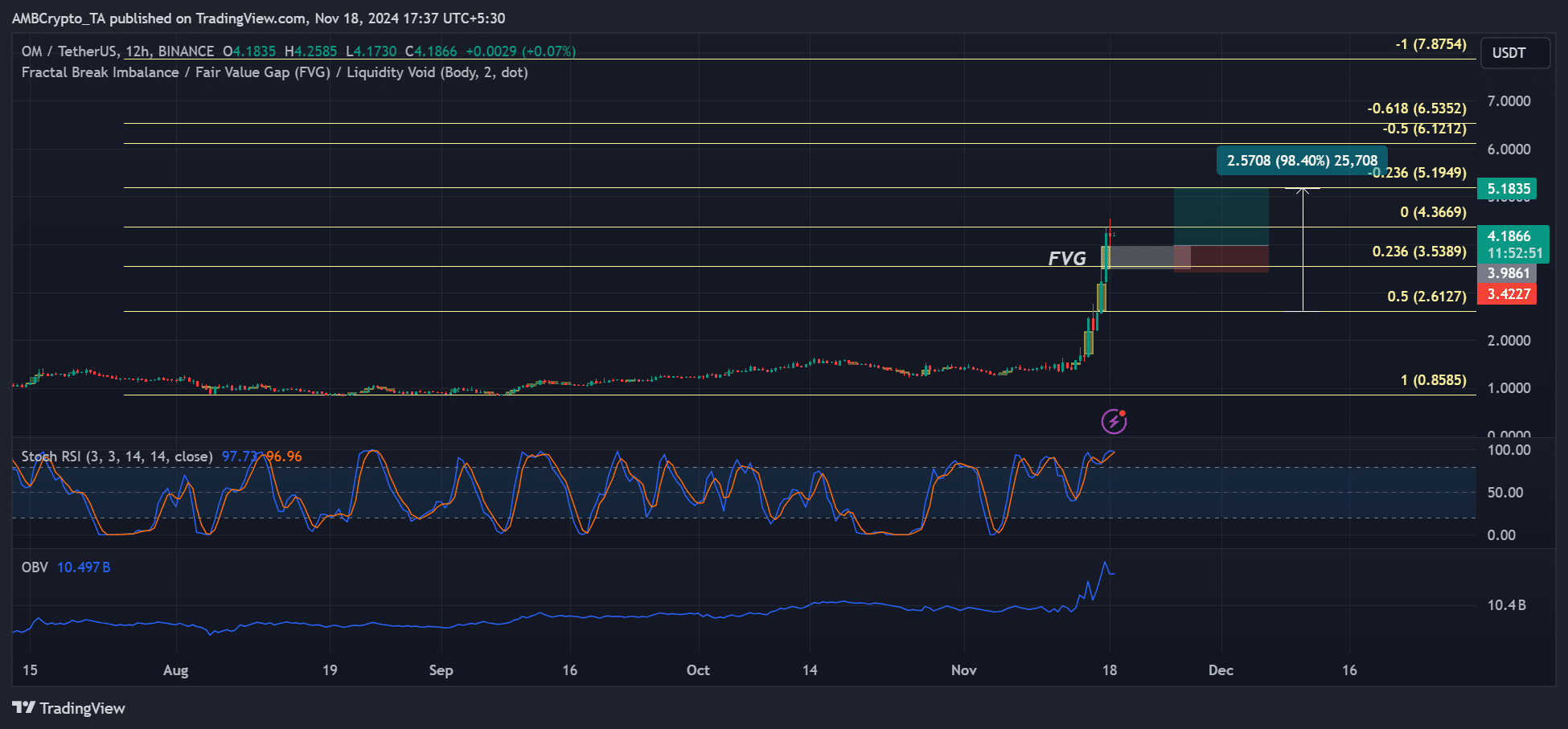

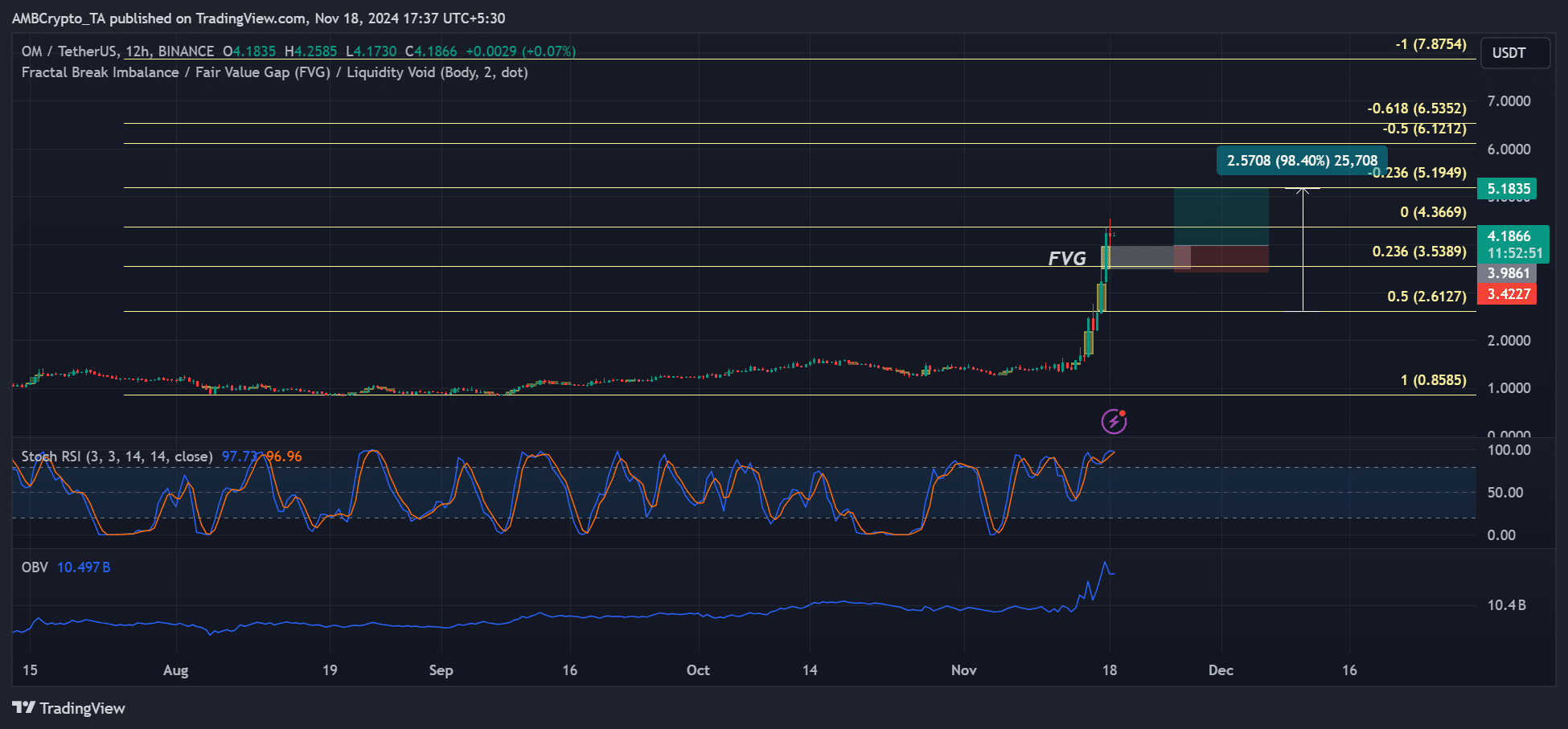

Source: OM/USDT, TradingView

On the 12-hour chart, the recent uptrend has led to a massive market reversal via price imbalances (FVG).

Theoretically, price tends to revert to these imbalances (yellow zones on candlesticks), allowing scalp traders to enter the market.

If the trend continues, traders can keep an eye on FVG above $3.5 or $2.6 with bullish targets at $5.2 or $6.

The first scenario could offer a potential gain of 30%, while the second long position could offer a return of almost 100% if the price returns to the re-entry level and targets $5.2.

That said, the stochastic RSI was already in overbought territory, while OBV (volume on balance) reached an all-time high. This meant that OM saw strong buying pressure despite a potential price turnaround.

Whales remain bullish

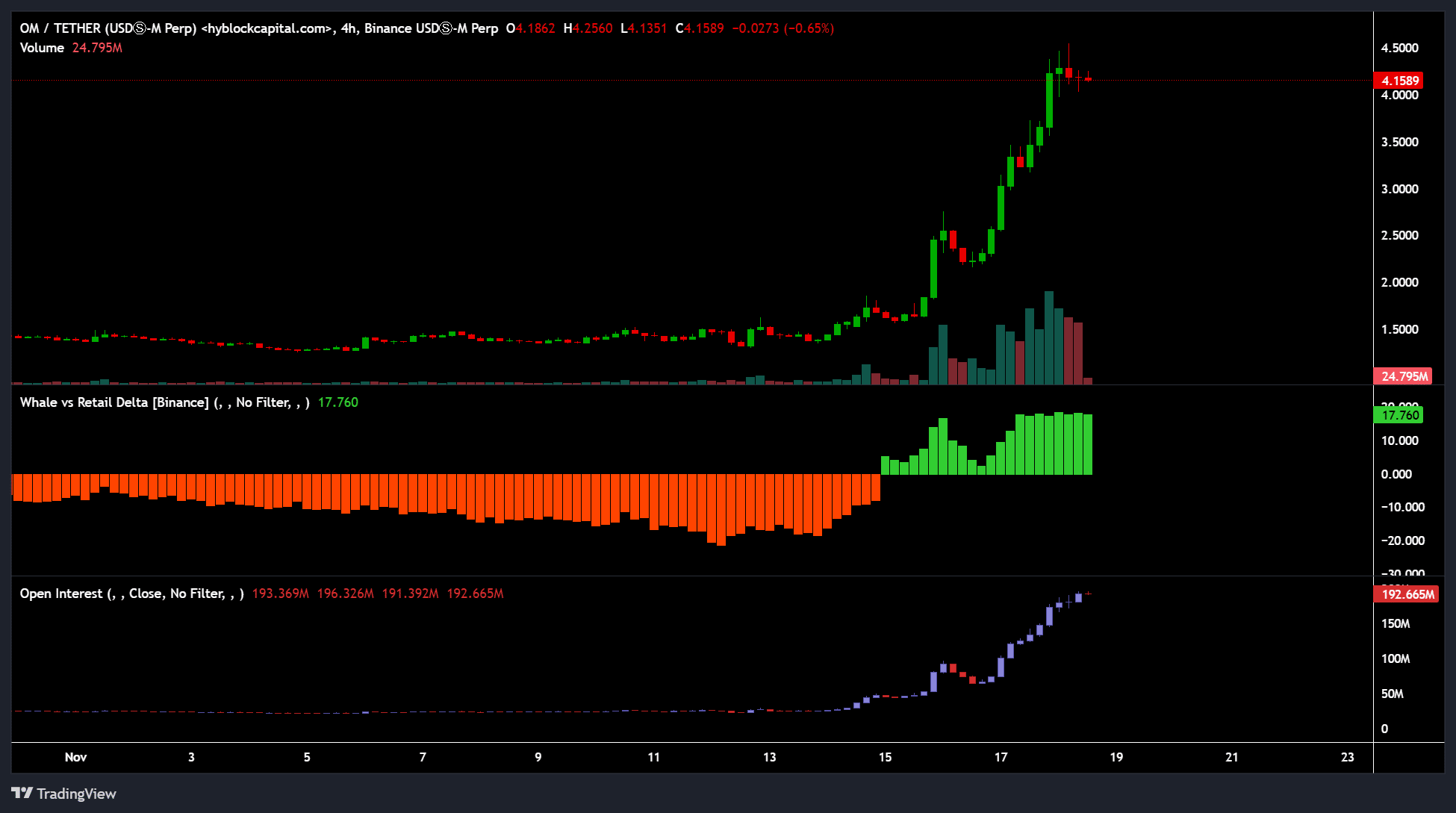

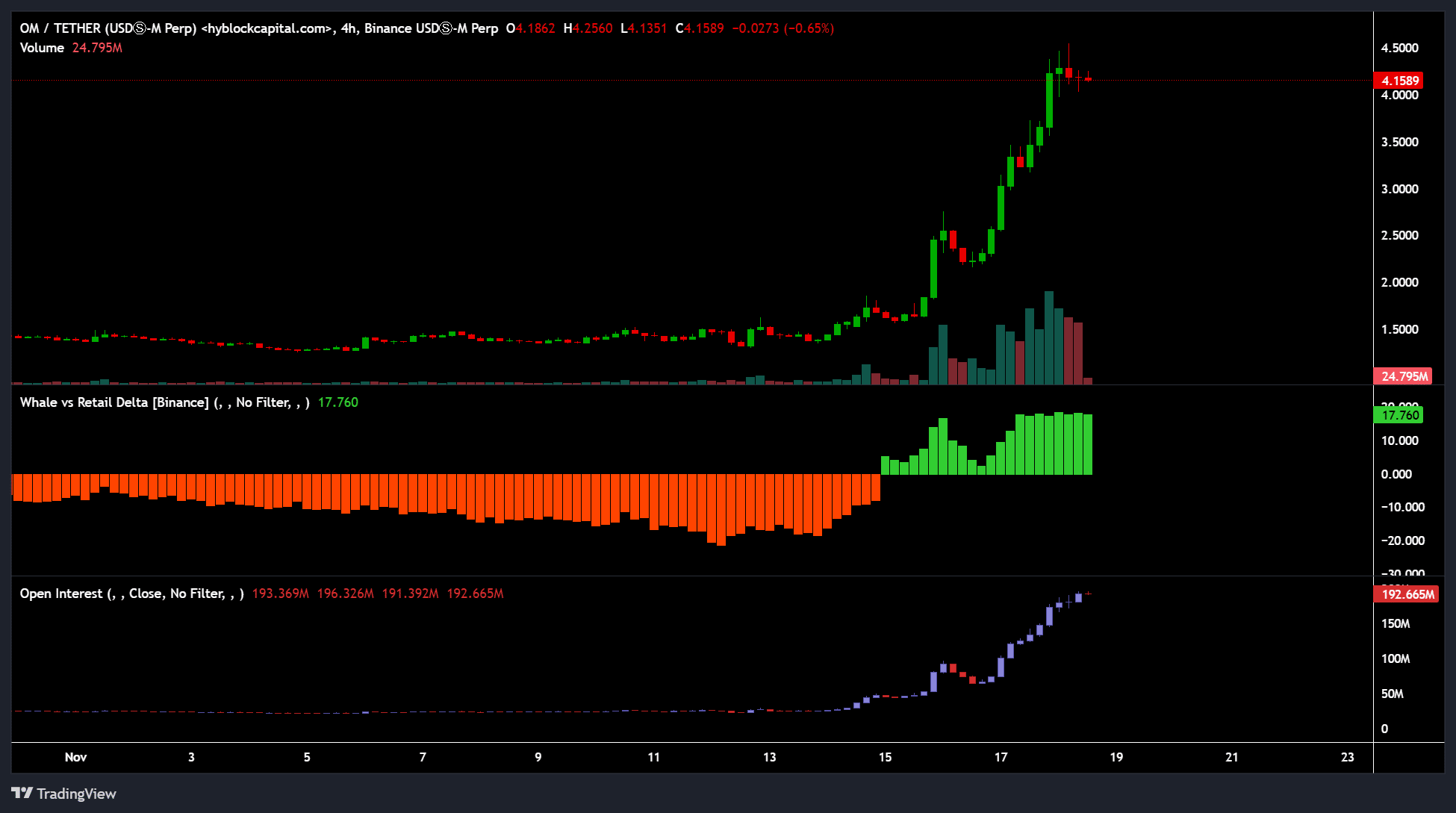

Source: Hyblock

Whales’ long positions on OM supported the bullish belief and long position ideas mentioned above.

Notably, whale positions (green bars on Whales vs. Retail Delta) remained unchanged despite the weekend’s huge triple-digit gains.

This suggested that whales were confident of more upside potential and did not choose to take profits early enough.

If so, there is another uptrend for Mantra [OM] was likely, and the shared long position ideas could be validated in such a scenario.

Read Mantra [OM] Price prediction 2024-2025

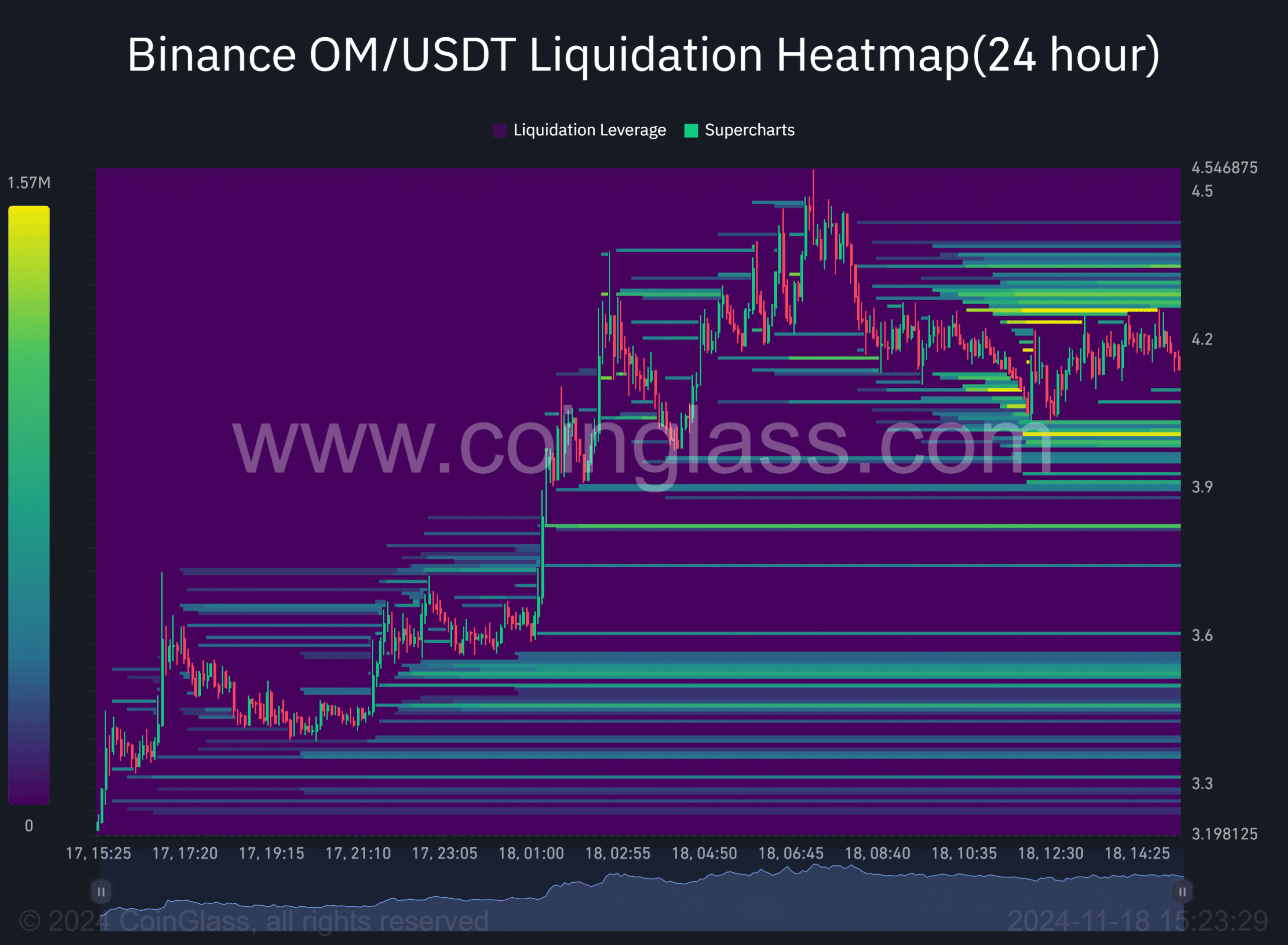

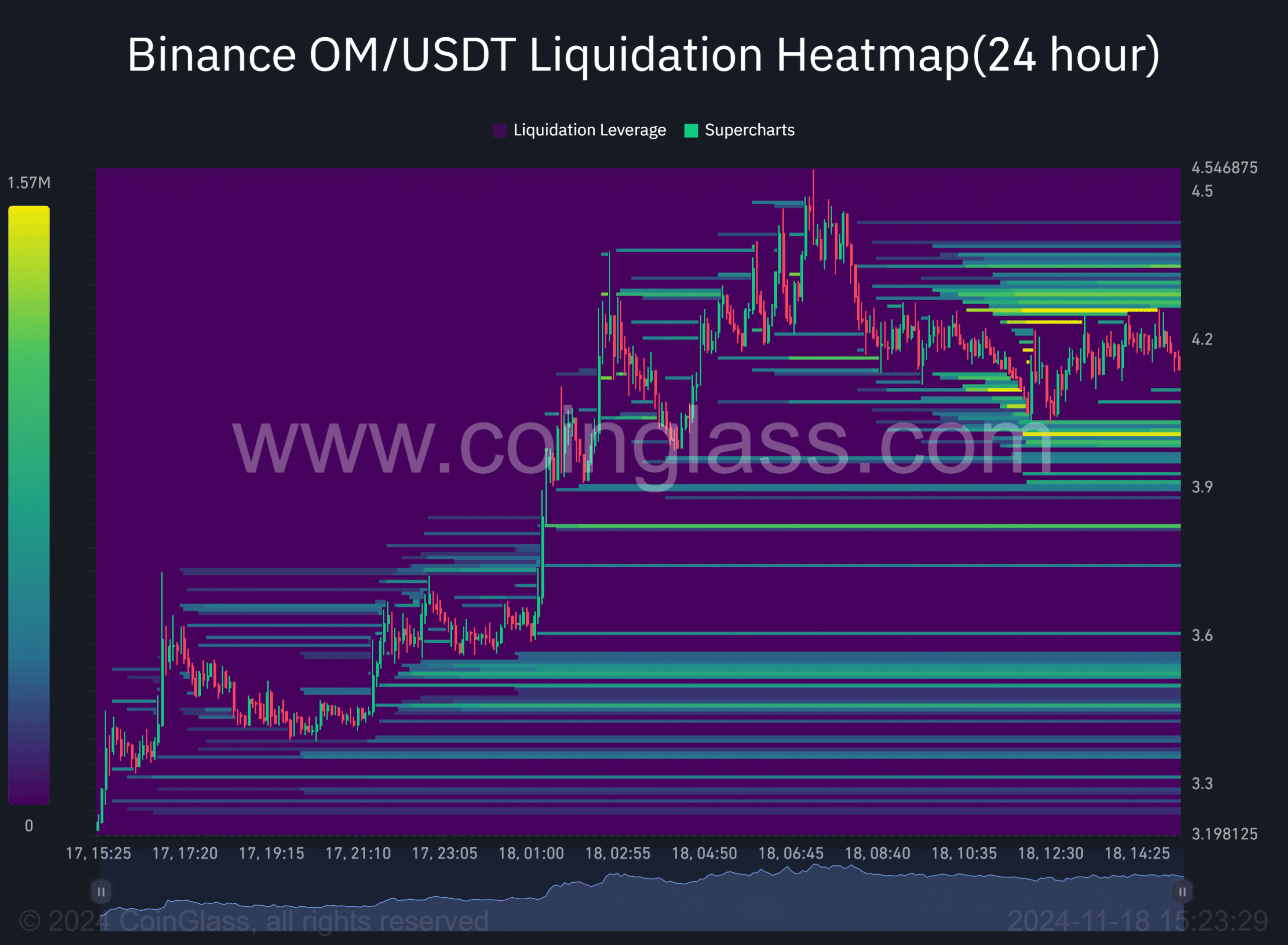

Furthermore, a significant liquidity cluster at $4 (bright yellow on the other side of the price action) could prompt market makers to opt for a liquidity hold, which could provide an even better return for the scalp.

However, an extended pullback below $2.6 could negate the bullish outlook and potential long positions.

Source: Coinglass