- RFK has endorsed Bitcoin as a hedge against inflation.

- The Polish presidential candidate promised to follow in Donald Trump’s footsteps.

Now that the dust has settled after the recent US elections, cryptocurrency has proven to be more than a financial instrument; it has become a political statement.

This election season, candidates from both sides of the aisle took strong stances on digital currencies. The latest comes from Robert F. Kennedy Jr, Donald Trump’s pick for US Secretary of Health.

In the last post on X (formerly Twitter), Kennedy declared,

“Bitcoin is the currency of freedom, a hedge against inflation.”

He emphasized its importance for the American middle class as protection against the declining global position of the dollar and as a possible solution to the country’s mounting debts.

RFK’s longstanding Bitcoin advocacy

It’s worth noting that this isn’t the first time Kennedy has defended Bitcoin [BTC]. In a recently surfaced video, he reaffirmed his commitment to the cryptocurrency, calling himself a “huge supporter.”

He added that after attending the Bitcoin conference,

“I put most of my assets in Bitcoin, so I’m going all in.”

Kennedy’s support of Bitcoin underscores its evolving role not only as a financial instrument, but also as a cornerstone of his policy advocacy.

Another Bitcoin President?

Kennedy is not the only global political figure to embrace cryptocurrency. Polish presidential candidate Slawomir Mentzen has also expressed his support for Bitcoin.

In one after on X, Mentzen declared his intention to transform Poland into a global crypto hub, noting:

“If I become the president of Poland, our country will become a cryptocurrency haven.”

He detailed the plans to realize this vision, promising low taxes, crypto-friendly regulations and support from banks. Mentzen’s commitment to cryptocurrency is both personal and political: he owns more than $3 million worth of BTC.

Interestingly, his proposal to create a strategic Bitcoin reserve mirrors a similar policy being discussed in the US, demonstrating the growing appeal of crypto as a geopolitical asset.

Bitcoin Overtakes Saudi Aramco

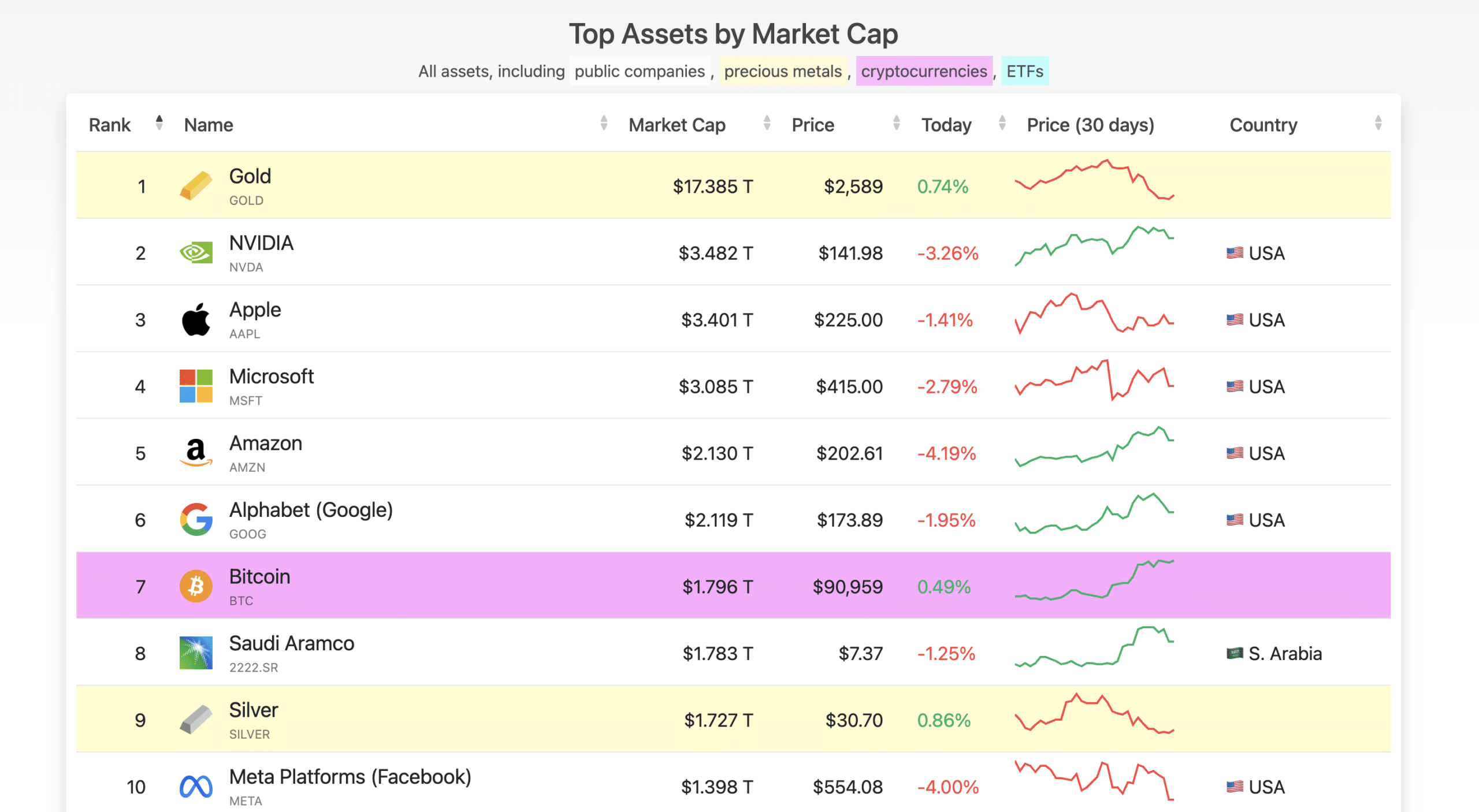

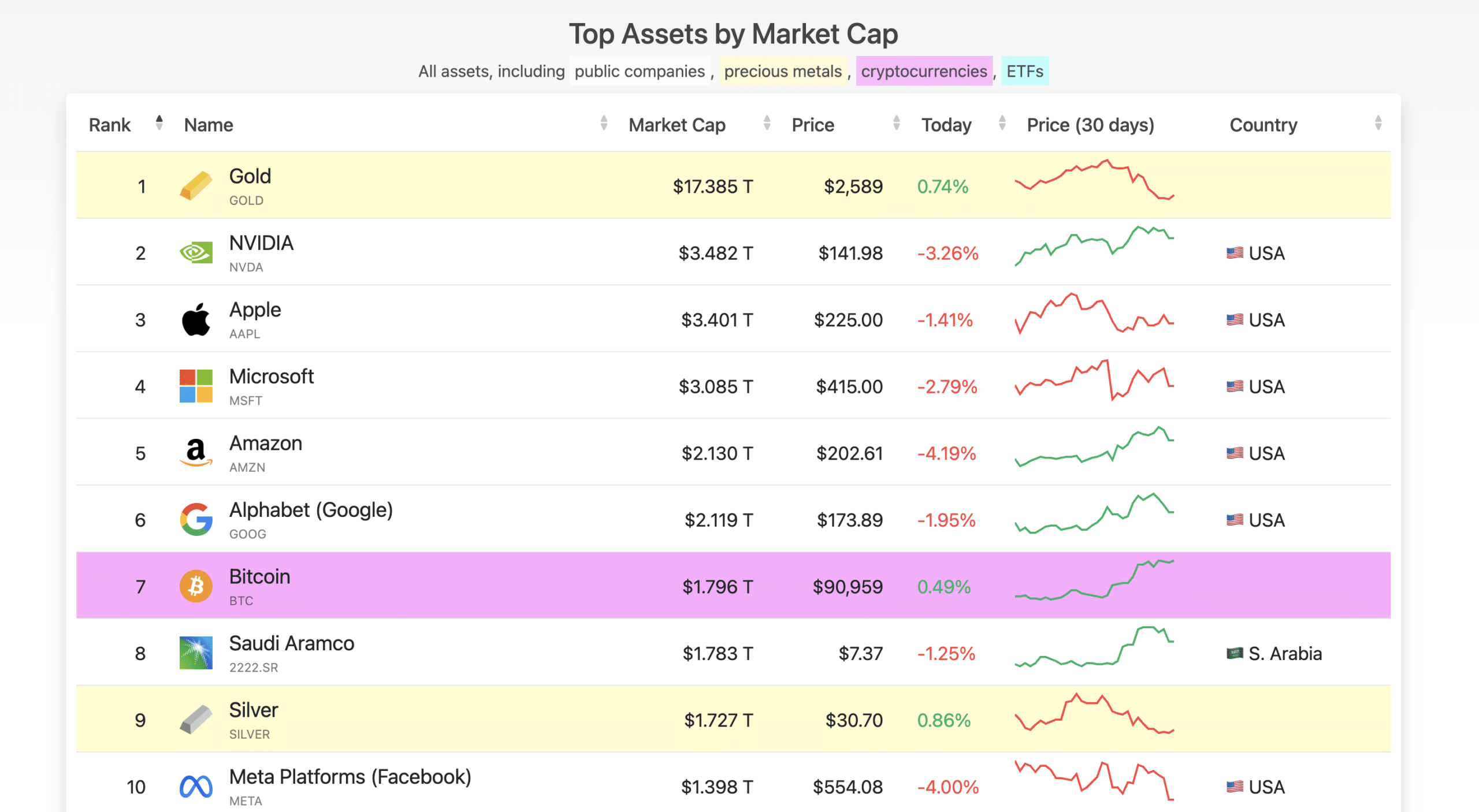

Meanwhile, Bitcoin has continued its rapid rise, recently crossing the $90,000 mark. This increase in value has now made it the seventh largest asset in the world by market capitalization.

According to facts from CompaniesMarketCap dethroned Bitcoin with a market cap of $1.79 trillion oil giant Saudi Aramco to take its place, which had a market cap of $1.78 trillion at the time of writing.

This achievement follows Bitcoin’s recent milestones of surpassing Meta and Silver.

Ergo the question: how long will it take for Bitcoin to overtake Alphabet, Google’s parent company?

Source: CompaniesMarketCap

AMBCrypto used the Crypto Market Cap Calculatorto find out that Bitcoin would need an average price of $110,000 to reach a market cap of $2.17 trillion, surpassing Alphabet.

Whether that will happen so soon or never remains uncertain.

However, its rising value and increasing political influence mean that Bitcoin is no longer just a cryptocurrency; it is evolving into a major force on the world stage.