- Quant’s breakout from a falling wedge and a 28% rise indicated bullish momentum, targeting $103.20.

- Market sentiment improved as foreign exchange reserves fell.

Quantitative [QNT] has stolen the spotlight with a stunning 28% price increase in the last 24 hours, reaching $83.76 at the time of writing.

This increase was accompanied by a massive 523% spike in trading volume, pushing the market cap to over $1.01 billion. As the crypto markets showed mixed trends, QNT’s price action gained momentum.

The question now is whether this breakout marks the start of a sustained bull run.

Quant: What’s driving the rally?

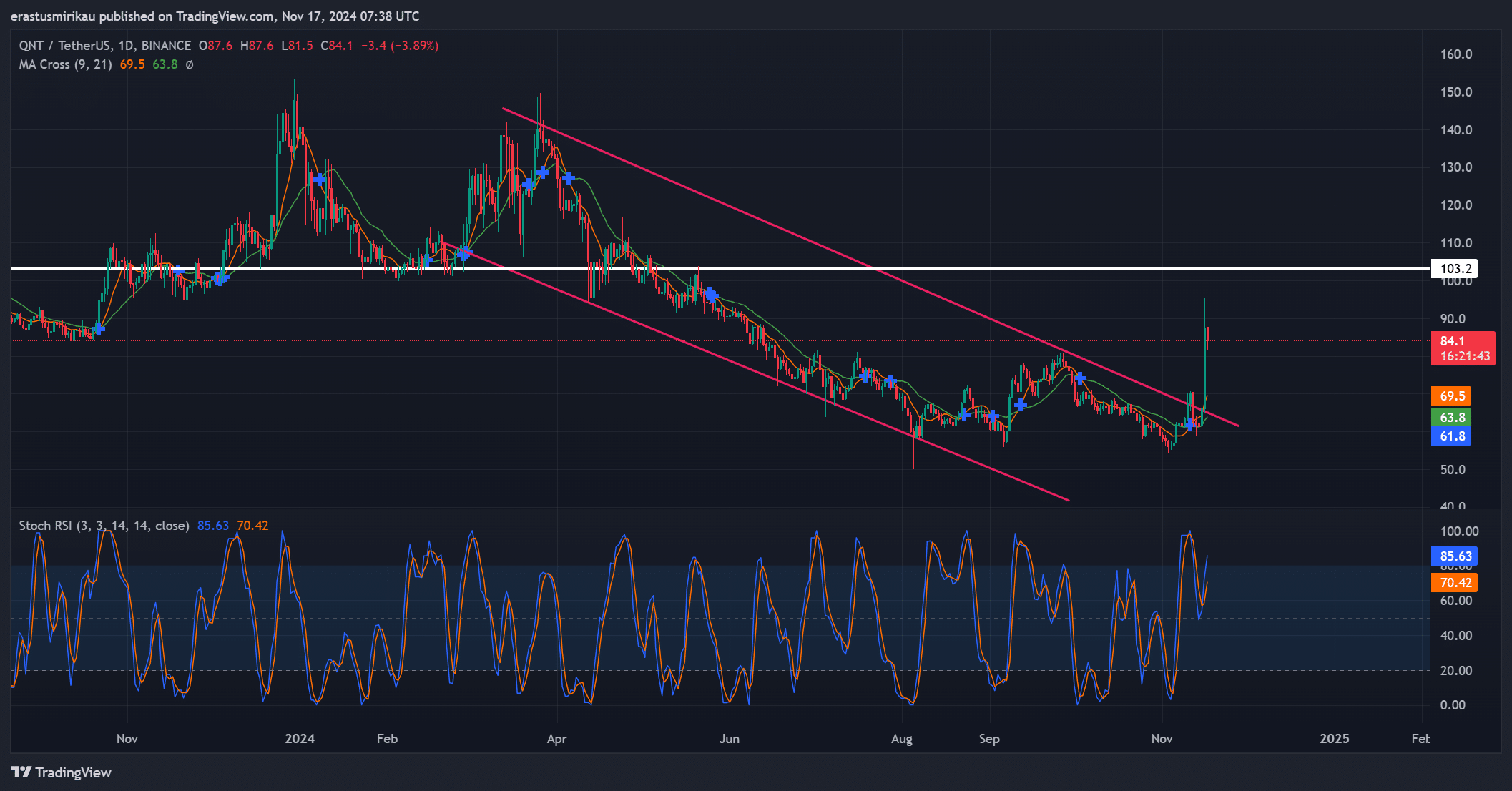

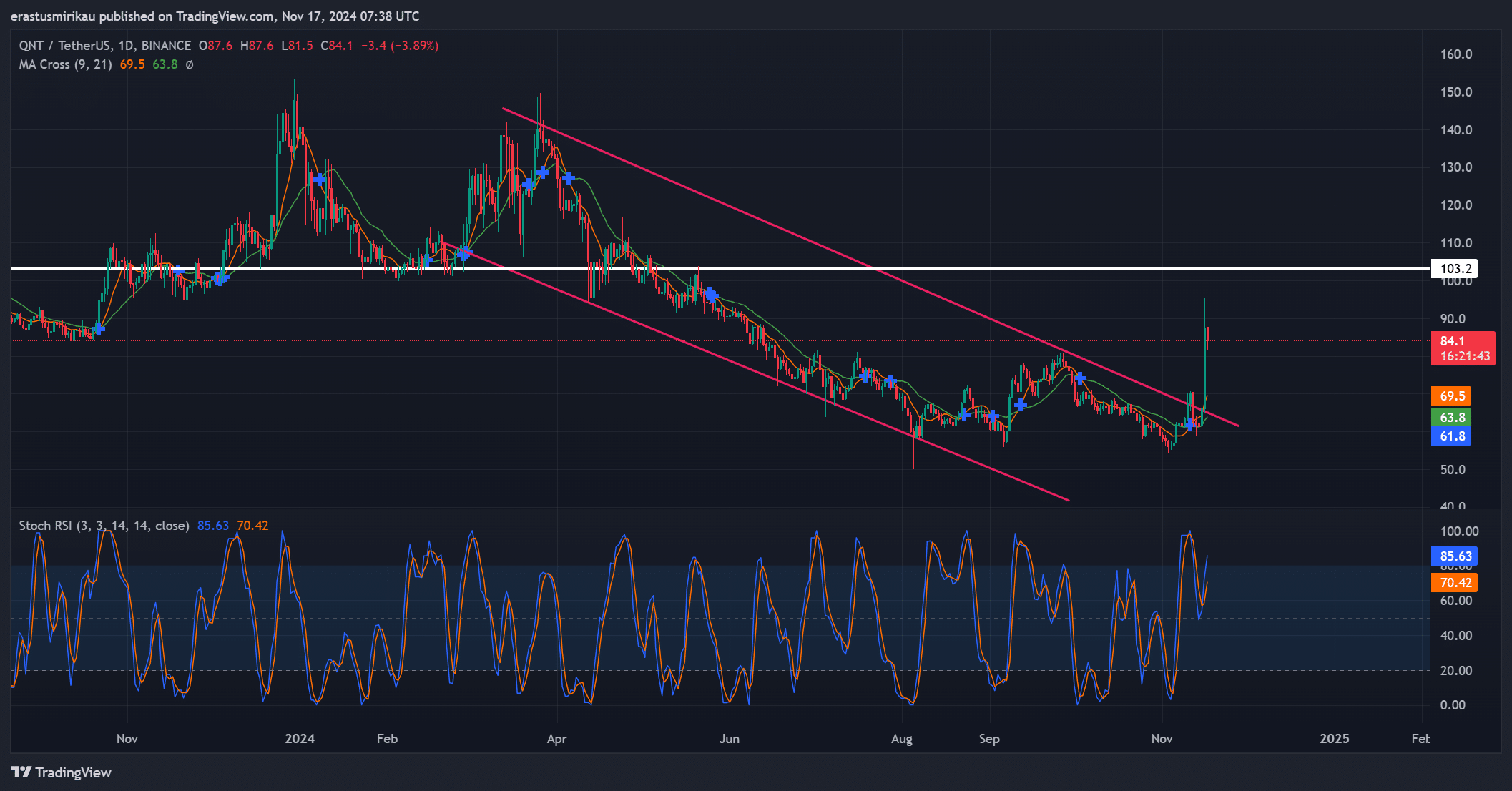

QNT’s breakout from a long-term bearish wedge pattern signaled a potential shift in market sentiment.

Such breakouts have historically signaled the start of bullish trends, and QNT appeared to be following that trajectory. However, critical resistance at $103.20 loomed.

Breaking this level could trigger stronger buying momentum, while rejection could lead to a retest of lower support levels around $70.

Technical indicators reflect this positive sentiment. The stochastic RSI stood at 85.63 at the time of writing and is firmly in overbought territory, indicating strong buying activity but also raising the possibility of short-term corrections.

Additionally, the moving average (MA) at $69.50 and $63.80 confirmed bullish momentum as the shorter-term MA (9 days) has crossed above the longer-term MA (21 days).

These numbers underline the strengthening momentum, but caution remains necessary after such rapid gains.

Source: TradingView

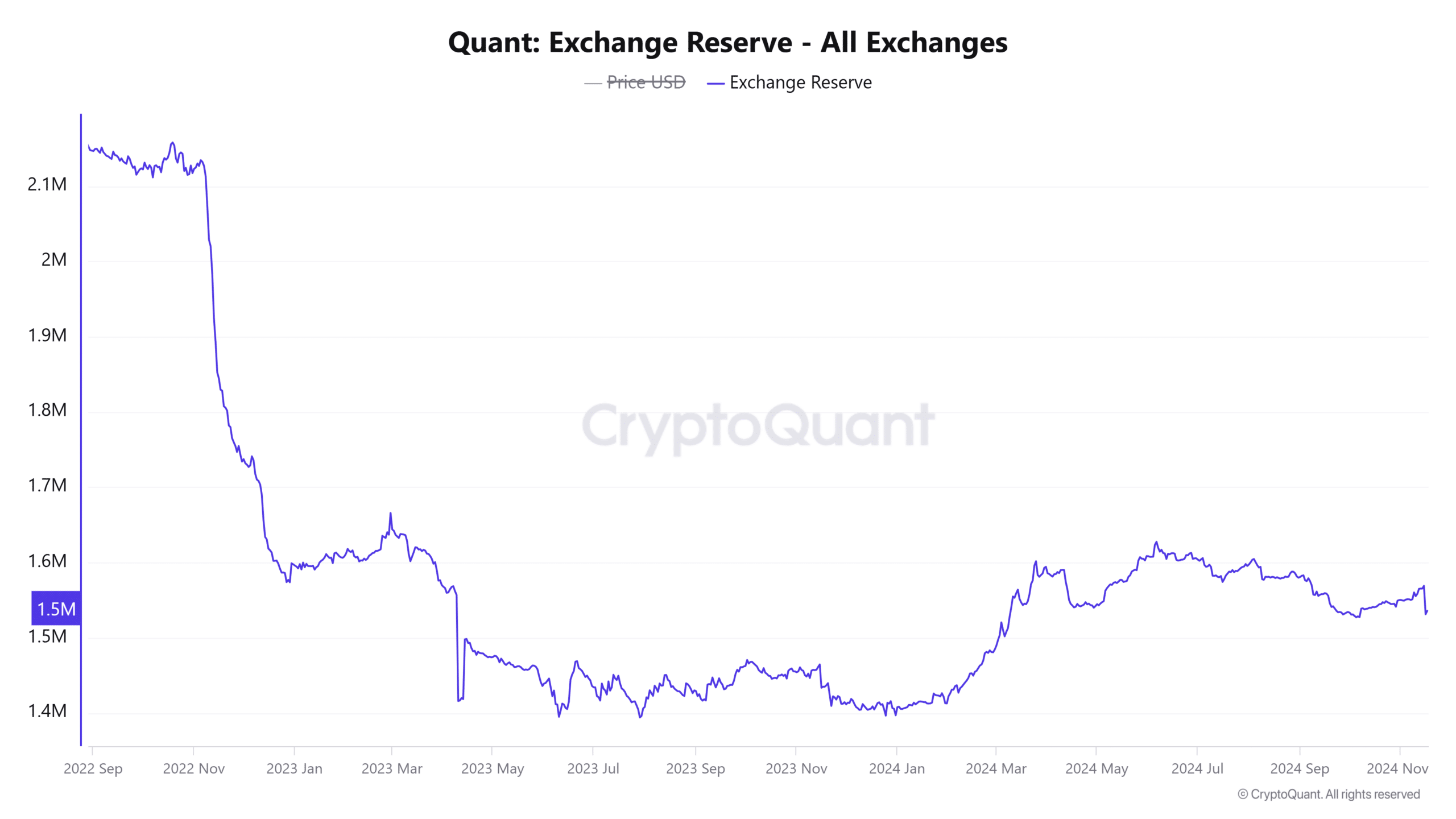

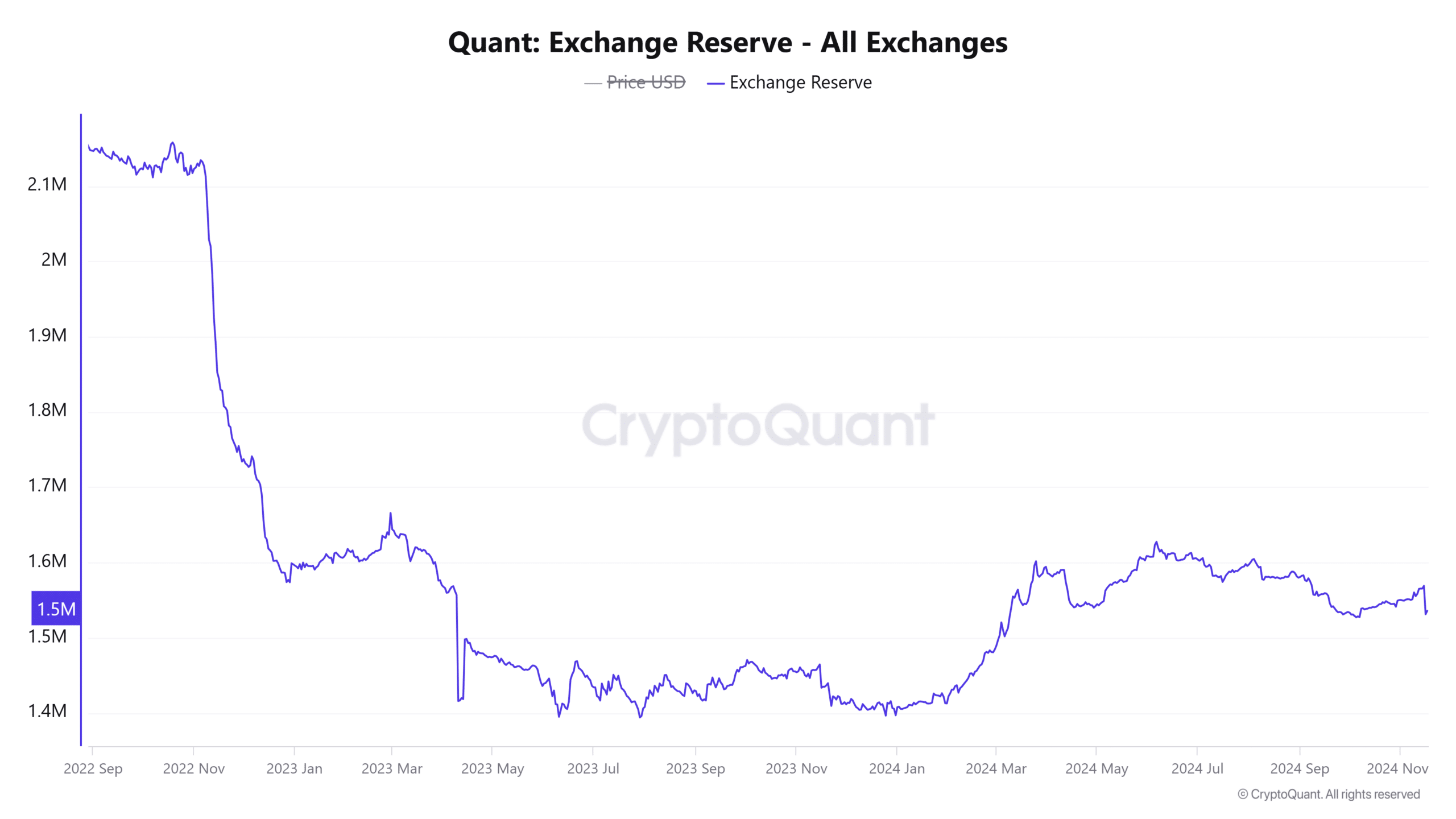

QNT Exchange Reserves: A Major Bullish Signal

Currency reserves have decreased by 2.27% in the last 24 hours and stood at 1.5357 million tokens at the time of writing. Reduced availability on stock exchanges often indicates lower selling pressure and increasing investor confidence.

With less QNT available for immediate sale, the potential for upward price movement increases, provided demand remains robust.

Source: CryptoQuant

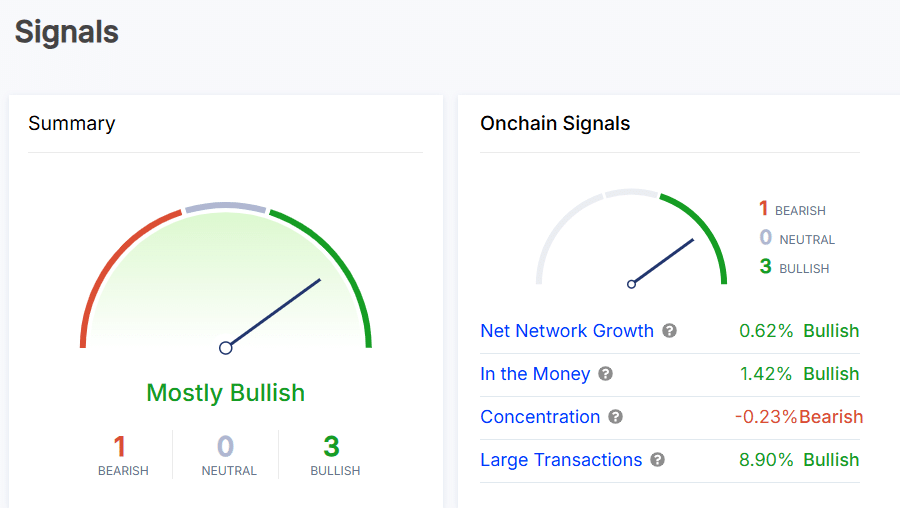

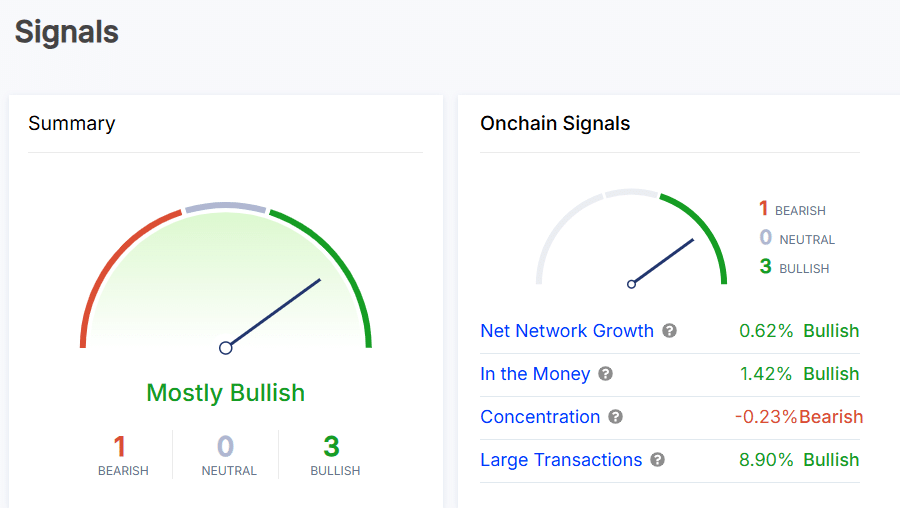

Signals within the chain indicate growing confidence

Statistics about the chain further underlined QNT’s strong position. Notably, large transactions increased by 8.90% and net network growth increased by 0.62%, indicating increased adoption and activity among large holders.

Additionally, 1.42% of QNT portfolios were now in the money, reflecting higher profitability. Although concentration among the top holders has decreased slightly (-0.23%), broader sentiment remained largely bullish.

Source: IntoTheBlock

Read Quants [QNT] Price forecast 2024–2025

Will QNT maintain its bullish momentum?

Quant’s break above its falling wedge, accompanied by a 28% price increase and a 523% increase in trading volume, indicated strong bullish momentum.

However, resistance at $103.20 remained a decisive hurdle. If QNT can break above this level in the coming days, it will likely confirm a broader bullish reversal and potentially lead to further gains.