- A crypto VC predicted a positive long-term outlook for ETH.

- Major players expected price swings of $2.7,000 to $4,000 before the end of 2024.

Chris Burniske, partner at Placeholder, has reiterated his positive outlook Ethereum [ETH] despite the current challenges and FUD.

According to the VC, Ethereum has lagged behind Solana [SOL] And Bitcoin [BTC] but still had a formidable lead in disrupting the traditional financial sector (TradFi). He said,

“Solana and others will also come for the IFS (they already are), but Ethereum has solid foundations as it is already over a decade old, with brand awareness second only to #Bitcoin, deep liquidity and implementations like @base that attract the attention of the business community. ”

Burniske urged the Ethereum community to learn and strengthen the network as the center of the next IFS (Internet Finance System) in the next five years.

New ETH/BTC annual low

Burniske’s comment followed recent mixed views on the network’s 2029 roadmap, which proposed significant changes to the consensus layer to increase competitiveness against Solana and other layer 1 solutions.

However, opponents felt the 2029 target was too long to bring about fundamental changes on Ethereum.

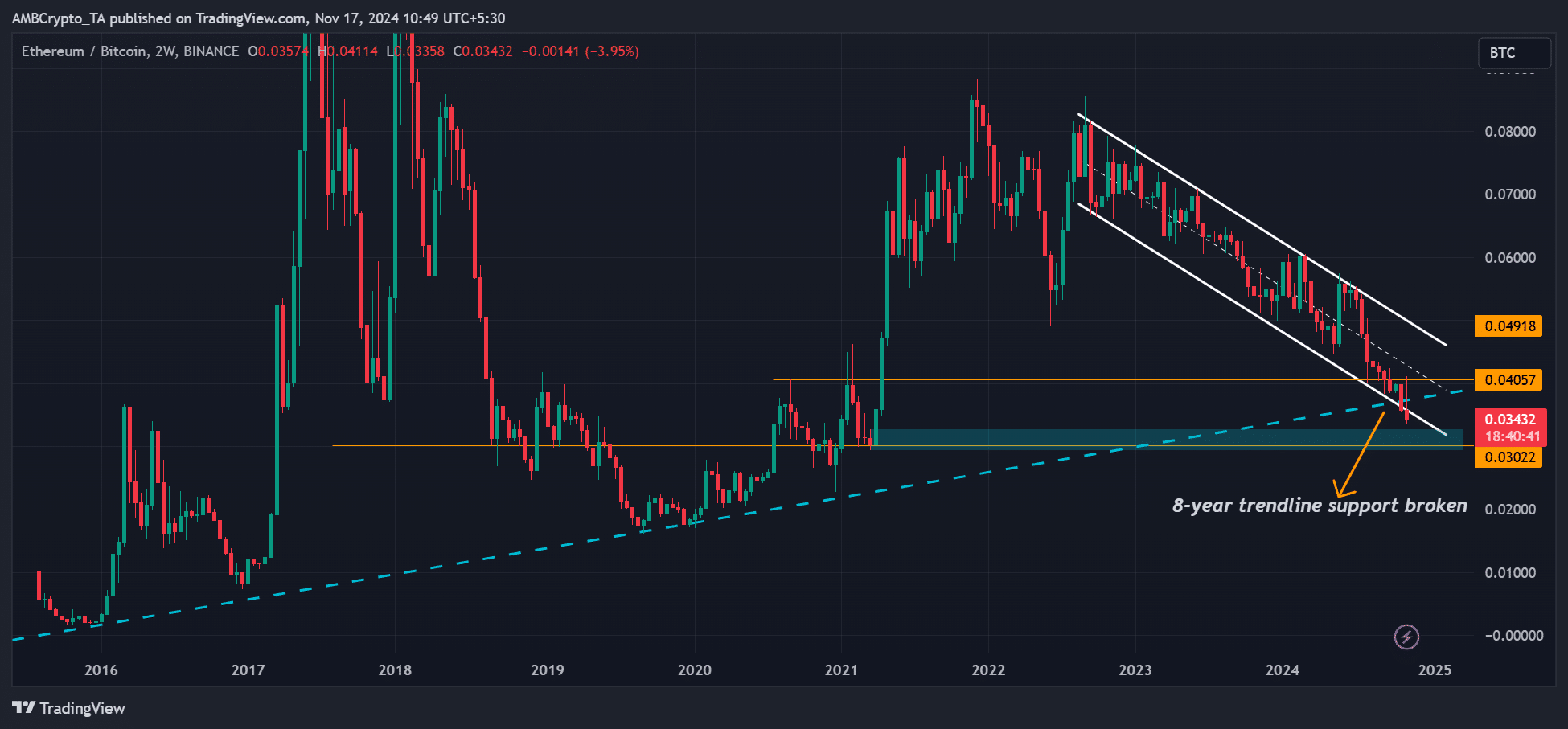

This lack of consensus has pushed ETH’s market sentiment to a yearly low against BTC. In fact, the ratio, which tracks the relative performance of ETH versus BTC, fell below an 8-year trendline support.

Source: ETH/BTC, TradingView

Commenting the same on this, Lyn Aldena renowned macro analyst, expressed her reservations about ETH.

“A government that is open to crypto securities wins the elections. ETHBTC jumps and then falls. New lows after good news. Phew!!”

What does this mean for traders and short-term investors watching ETH returns after the US elections?

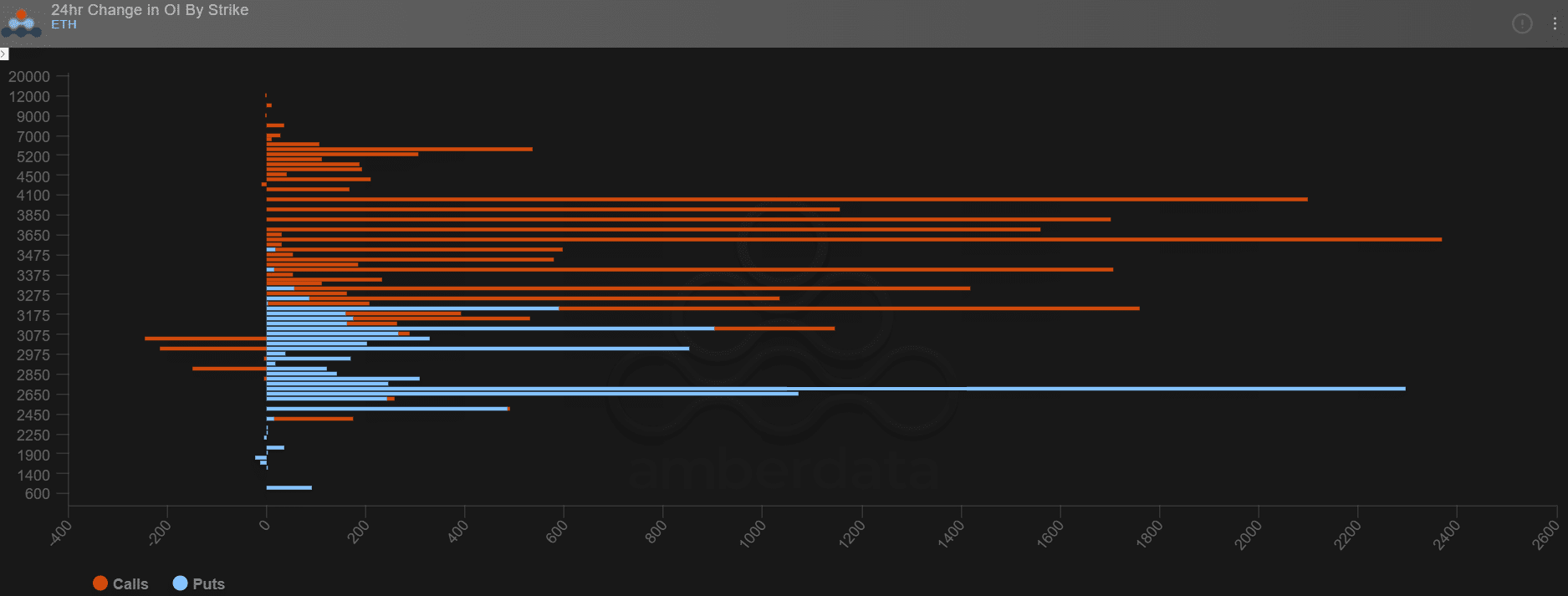

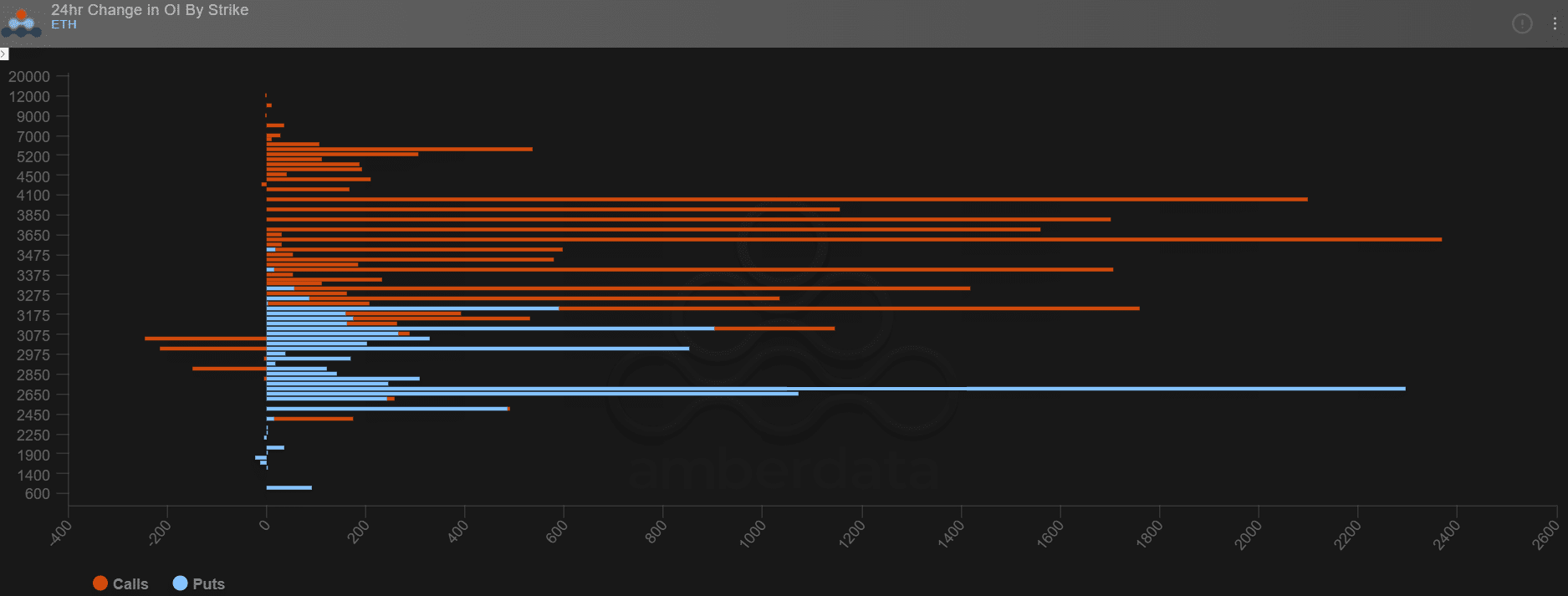

A look at the options market showed that major ETH players were cautiously optimistic.

According to Amber datesthe most significant change in OI (open interest) rates over the past 24 hours was concentrated on calls (bullish bets, orange lines) at $3.6K and $4K targets.

On the other hand, there were also huge puts (bearish bets, blue lines) on the $2.7K and $3K targets. In short, large funds expected a wild price swing between $2.7k and $4k, but with a bullish bias.

Source: Amberdata

Read Ethereum [ETH] Price forecast 2024-2025

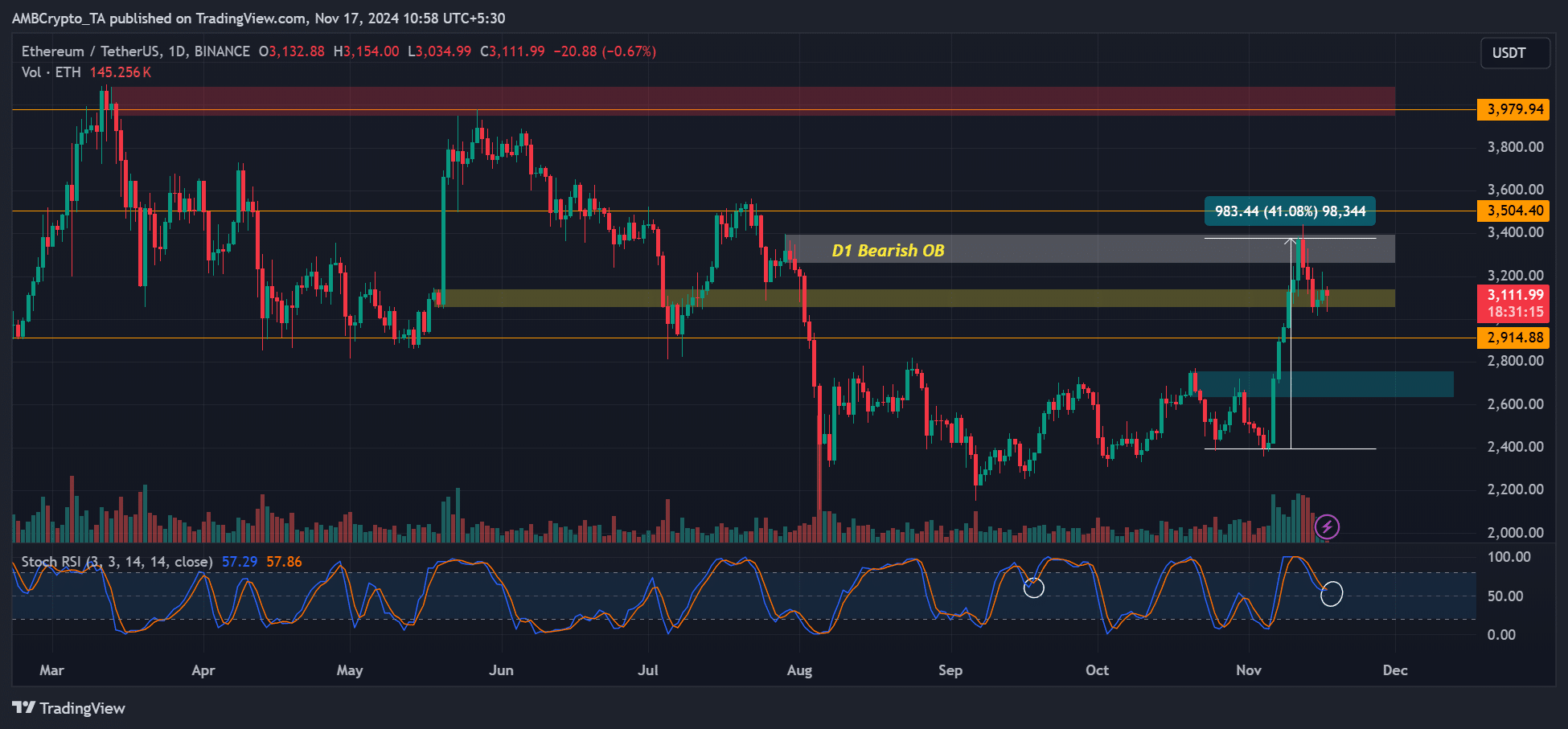

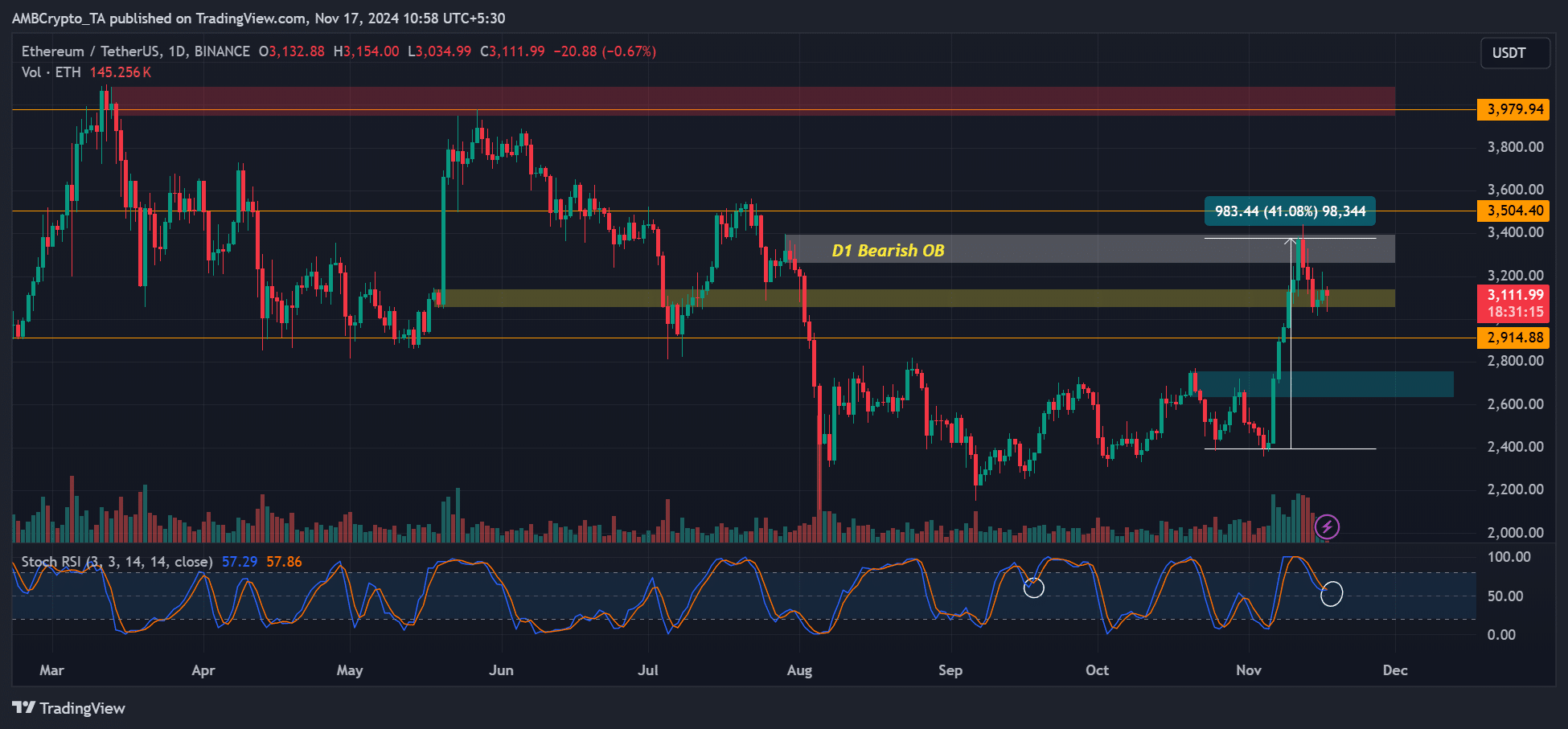

Daily charts revealed a similar story and goals. After rising over 40% since October, ETH faced a price rejection and $3.3K cool-off. At the time of writing, the price was struggling to stay above the psychological level of $3,000.

Source: ETH/USDT, TradingView

Should the altcoin fall lower, the $2.9K and $2.7K levels will be the next major support. On the upside, however, $3.5K and $4K were bullish targets to watch.