- LINK’s Open Interest (OI) rose 9.5%, indicating growing interest from traders in the asset

- The key liquidation levels were at $13.55 and $14.40, with traders over-leveraged at these levels

The prevailing sentiment in the crypto market currently seems quite unpredictable thanks to the high volatility. Amid this uncertainty, Chainlink (LINK) formed a bullish price action pattern on the daily chart, with the altcoin now poised for a notable upward rally.

In addition to the crypto’s bullish price action, on-chain metrics and positive market sentiment further supported LINK’s bullish outlook.

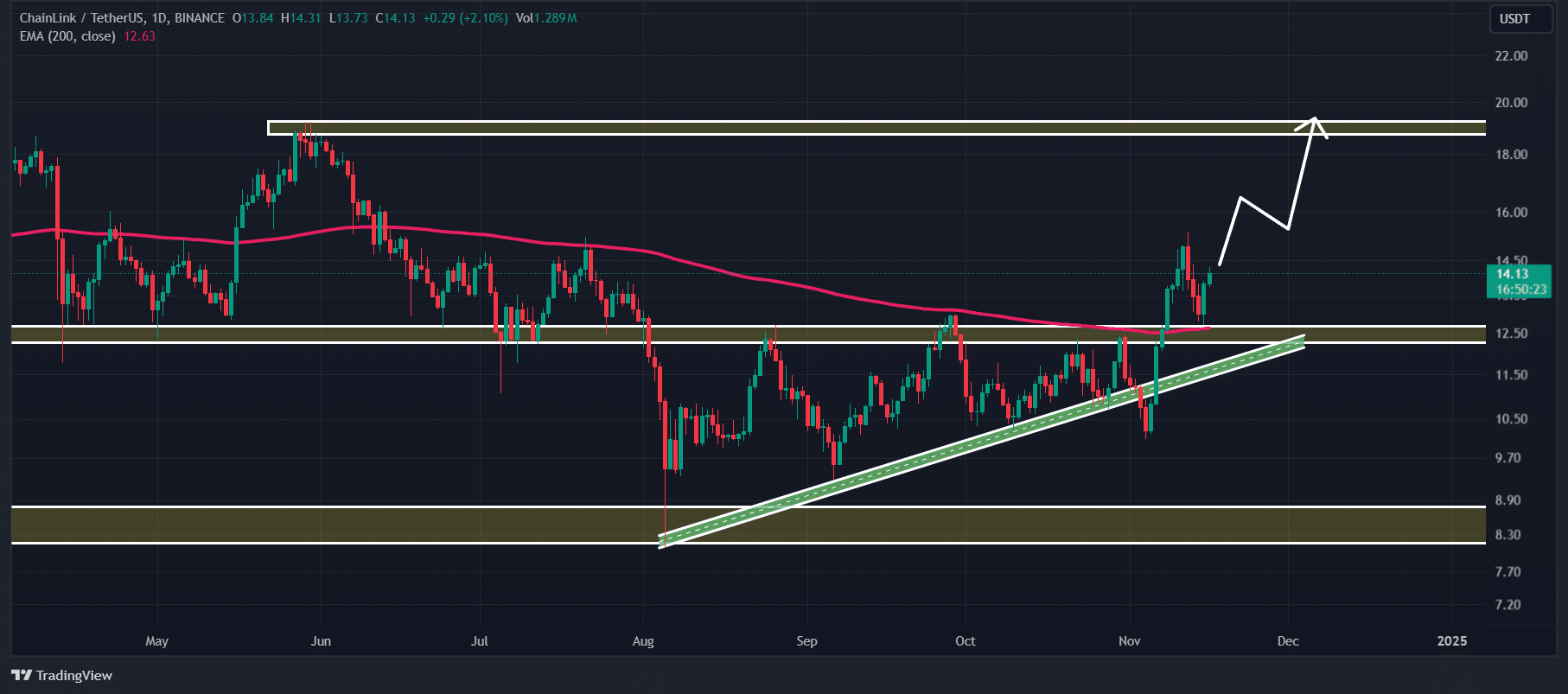

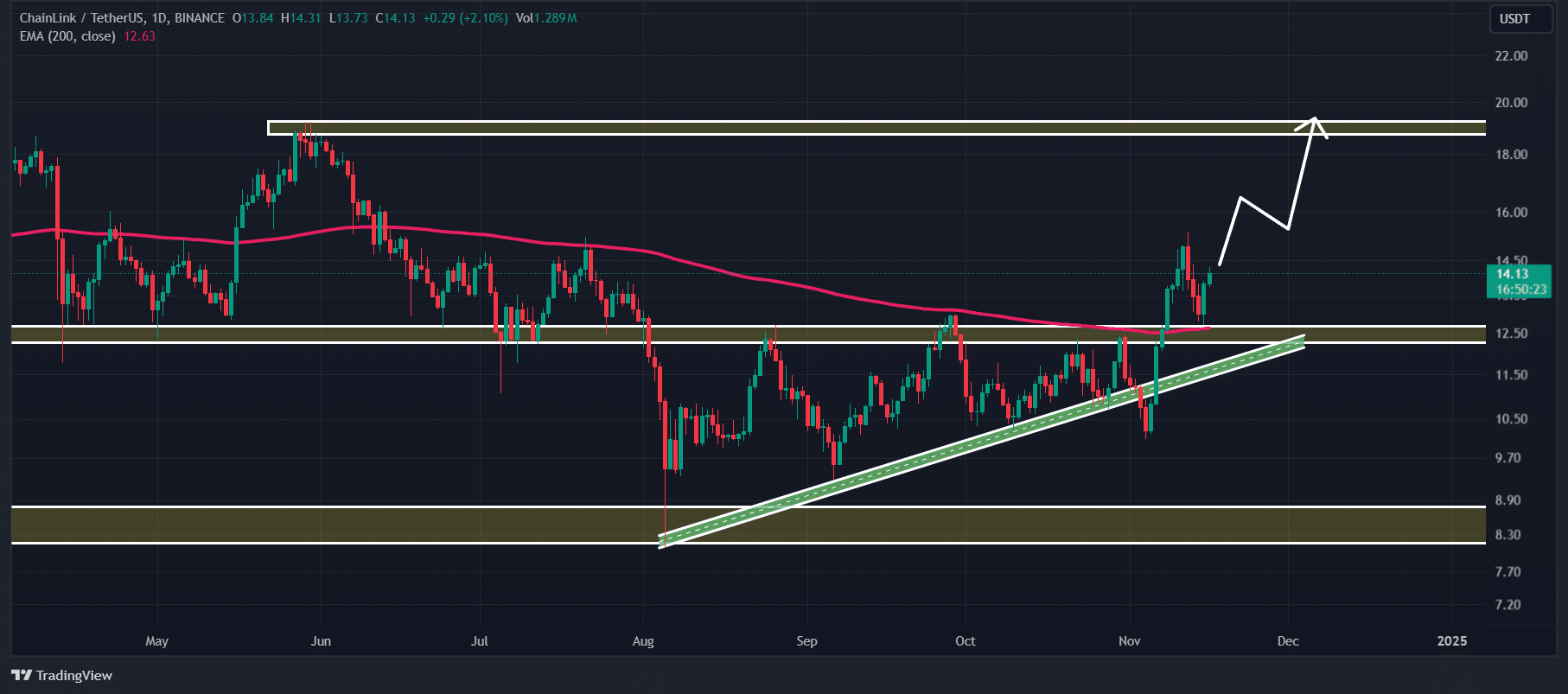

Technical analysis and key levels

According to AMBCrypto’s assessment, LINK has successfully retested the breakout level of the ascending triangle price action pattern. At the time of writing, it seemed to be moving in an upward direction.

Based on the recent price action and historical momentum, there could be a strong possibility that LINK could rise 35% in the coming days to reach the $19 level.

Source: TradingView

At the time of writing, LINK was trading above the 200-day exponential moving average (EMA) on a daily basis, indicating an uptrend. Furthermore, the assets’ Relative Strength Index (RSI) pointed to potential upside momentum in the coming days.

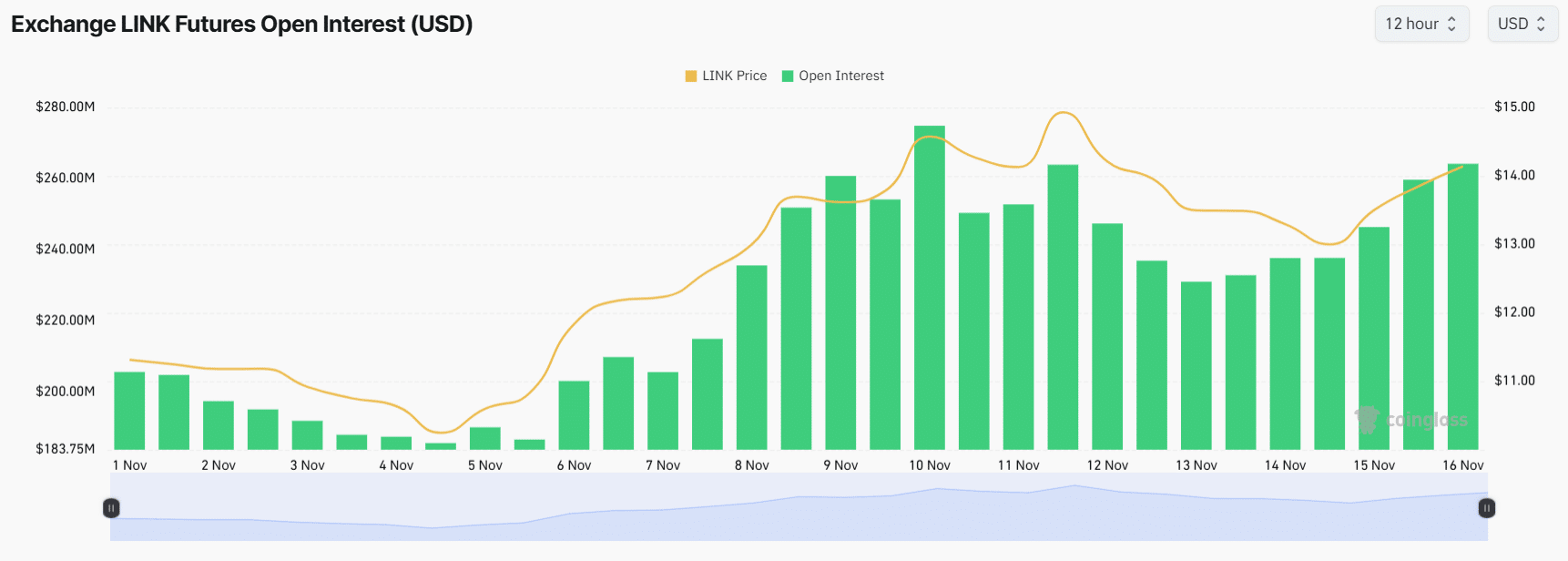

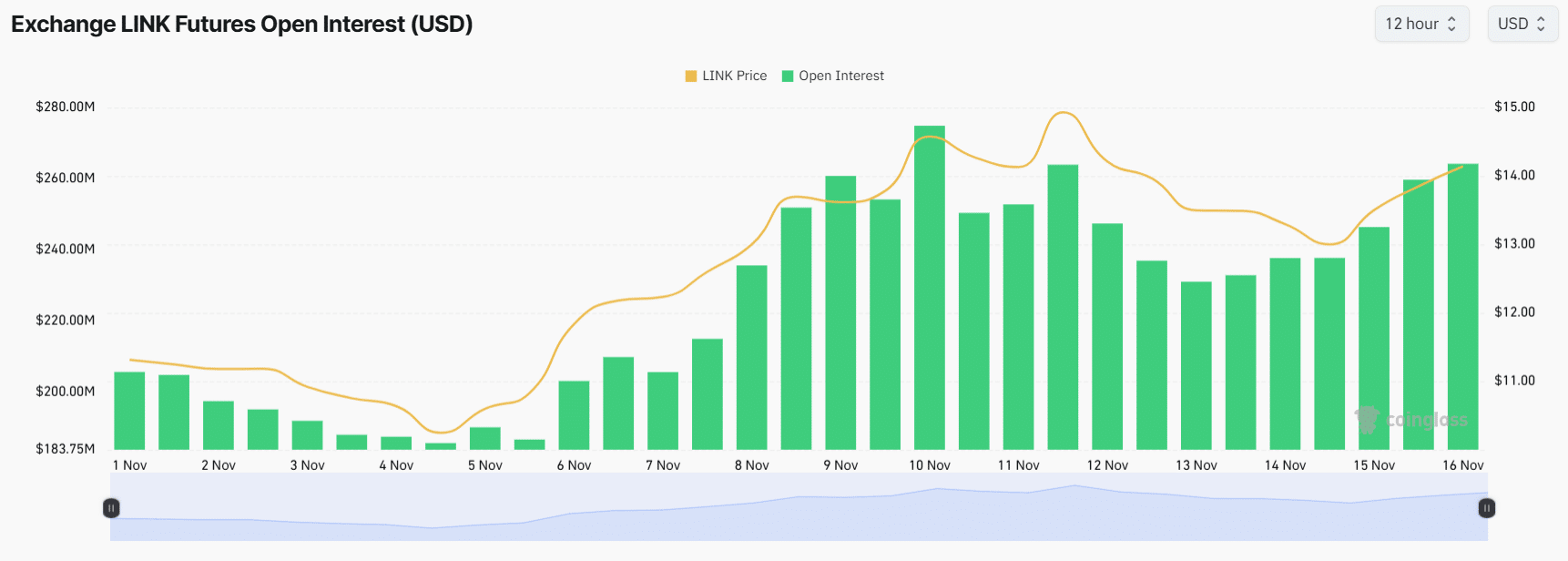

Bullish statistics in the chain

In addition to technical analysis, on-chain metrics further supported LINK’s bullish outlook. In fact, according to on-chain analytics firm Coinglass, LINK’s Open Interest (OI) has increased by 9.5% over the past 24 hours, while also continuing to rise at the same rate.

Source: Coinglass

The rising OI can be interpreted as a sign of growing interest from traders in the asset and an increase in the number of open positions.

High liquidation levels

At the time of writing, key liquidation levels were $13.55 at the lower end and $14.40 at the top end, with traders over-indebted at these levels.

If sentiment remains unchanged and the price rises to the $14.40 level, almost $2.44 million worth of short positions will be liquidated. Conversely, if sentiment changes and the price falls to the $13.55 level, long positions worth almost $5.10 million will be liquidated.

A combination of these on-chain metrics and technical analysis suggested that bulls were dominating the asset. This could help LINK reach expected levels in the coming days.