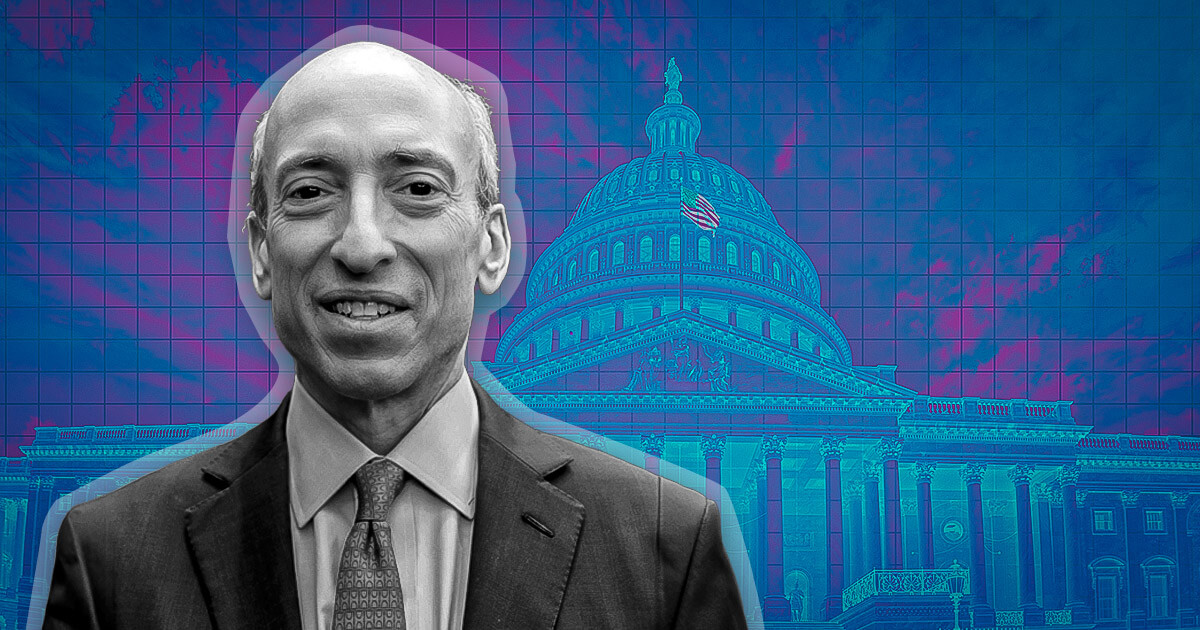

The actions of US Securities and Exchange Commission (SEC) Chairman Gary Gensler cannot be “explained away” as “good faith mistakes,” wrote former Olympic rower and co-founder of crypto exchange Gemini, Tyler Winklevoss, Saturday in a post on X. He added:

“It [Gensler’s actions] was completely thoughtful, deliberate and purposeful to fulfill his personal, political agenda at any cost.

Gensler carried out his actions regardless of the consequences, Winklevoss said, calling Gensler “evil.” Gensler didn’t care if his actions meant “destroying an industry, tens of thousands of jobs, people’s livelihoods, billions of invested capital and more.”

Winklevoss further stated that Gensler has caused irrevocable damage to the crypto industry and the country, which no “amount of apologies can undo.”

Winklevoss vented his frustration, writing:

“Americans are fed up with their tax dollars going to a government that should be protecting them, but instead being used against them by politicians looking to advance their careers.”

Winklevoss believes Gensler should not hold any position at “any institution, large or small.” He added that Gensler “should never again hold a position of influence, power or consequence.”

In fact, Winklevoss said that any institution, whether corporate or university, that hires Gensler or works with him after his stint at the SEC “betrays the crypto industry and should be aggressively boycotted.”

According to Winklevoss, stopping Gensler from regaining any power is the “only way” to prevent abuse of government power in the future. Winklevoss has long been an outspoken critic of the SEC and Gensler, which he says employs the “regulation by enforcement” doctrine.

Winklevoss is far from the only one accusing the SEC of abusing its powers. Earlier this week, 18 US states filed a lawsuit against the SEC and Gensler, alleging “gross government overreach.”

Newly elected Republican President Donald Trump promised to fire Gensler on his first day in the White House during his election campaign. The Winklevoss brothers donated the maximum amount allowed per individual to Trump’s campaign.

The SEC is an independent agency, meaning the president does not have the authority to fire Gensler. However, Gensler’s term ends in July 2025.

Trump transition team officials are preparing a short list of key heads of financial institutions that they will soon present to the president-elect, Reuters reported earlier this month, citing people familiar with the matter. So far there are three contenders for the list: Dan Gallagher, former SEC commissioner and current Chief Legal and Compliance Officer at Robinhood; Paul Atkins, former SEC commissioner and CEO of consulting firm Patomak Global Partners; and Robert Stebbins, a partner at law firm Willkie Farr & Gallagher, who served as general counsel of the SEC during Trump’s first presidency.

Although nothing has been finalized yet, according to the report, Gallagher is the frontrunner.