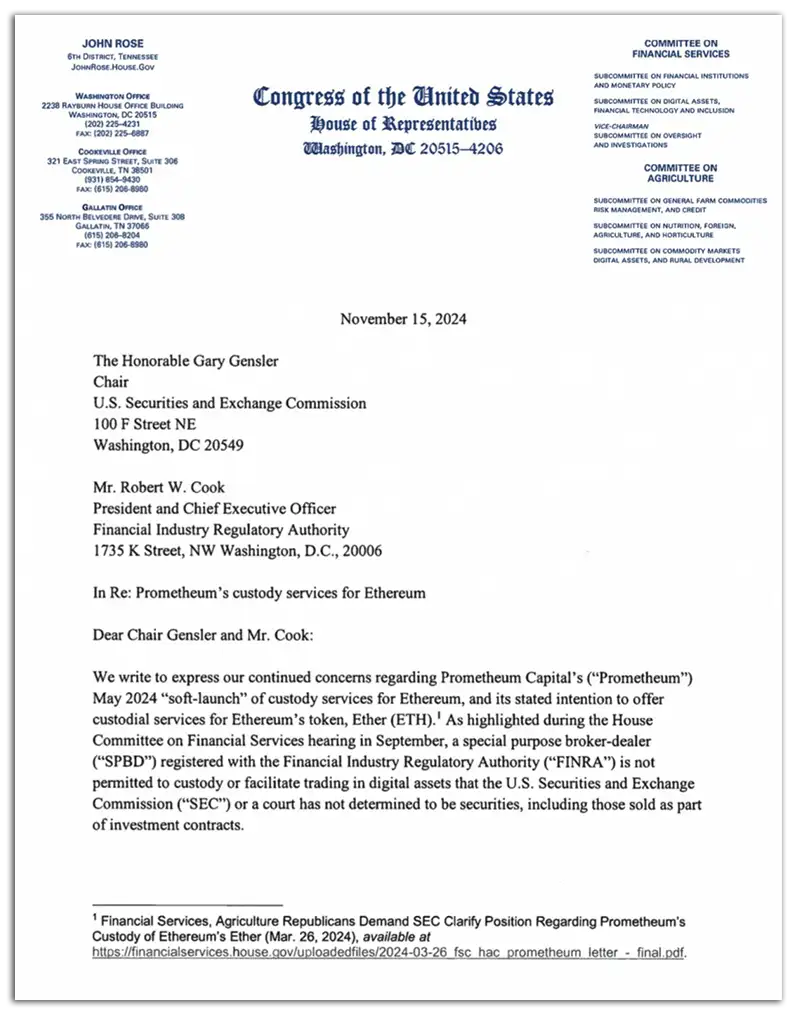

Regulatory uncertainty in the crypto world is increasing and the latest controversy has put Ethereum (ETH) in the spotlight. A recent letter from Republican lawmakers to SEC Chairman Gary Gensler and FINRA CEO Robert Cook raises questions about Prometheum Capital’s custody services for ETH. The twist? While the SEC previously suggested that ETH is not a security, Prometheum classified it as one, causing a firestorm of confusion. Is this a regulatory failure, or something bigger? Trump, on the other hand, plans to put pro-crypto leaders in power at the SEC and CFTC.

Prometheum’s ETH Custody: Bold Move or Regulatory Mess?

In May 2024, Prometheus launched custodial services for ETH, calling it a “crypto asset security.” This bold claim clashes directly with the SEC’s approval of Ethereum ETFs, which did not treat ETH as a security. Lawmakers argue that this contradiction is a symptom of deeper regulatory gaps.

Adding to the confusion, Prometheum’s ability to offer these services takes advantage of unclear SEC guidelines for Special Purpose Broker-Dealers (SPBDs). According to the rules, SPBDs can only handle securities. By publicly declaring ETH a security, Prometheum essentially muddied the waters. Critics say this risks stifling innovation and leaving investors unsure of how to navigate the market.

Republicans are focusing on: Who’s behind the push?

The letter, led by Rep. John Rose and co-signed by Republican lawmakers like French Hill, Mike Flood, Dusty Johnson and William Timmons, doesn’t hold back. It accuses Gensler’s leadership of creating “chaos and confusion” in the digital asset space. As John Rose put it bluntly, “Digital asset players deserve certainty.”

Adding to the drama, journalist Eleanor Terrett shared insights on leadership changes at the SEC. Charles Gasparino has reported that Dan Gallagher, one of the names floated as a potential Gensler replacement during the Trump administration, has privately indicated that he is unlikely to take on the role, although this could change depending on political shifts . Another name in the mix is Matthew Stebbins, who reportedly has close ties to former SEC Chairman Jay Clayton. Rumors suggest Clayton lobbied for Stebbins’ nomination.

Meanwhile, speculation about Gensler’s future is growing. Some think he could resign in January 2025, frustrated by mounting criticism. If he steps down, names like Dan Gallagher, Brad Bondi and Paul Atkins – known for their pro-crypto slant – are being floated as potential successors. Trump will be inaugurated on January 20, 2025, and Gary will likely resign around this date.

What to expect

This letter is more than just a call for answers: it is part of a broader effort to shift crypto regulation in a more pro-innovation direction. There is even talk of moving oversight from the SEC to the CFTC, a move supported by the Trump administration. Such a shift could mean clearer rules for projects like Ethereum, but it would require significant funding and political will.

For now, the market waits. Prometheum’s actions have raised urgent questions and Ethereum’s legal status remains unclear. Whether Gensler stays or goes, one thing is certain: the crypto world is hungry for clarity, and the stakes couldn’t be higher.