- PNUT’s breakout from a symmetrical triangle and strong MACD and RSI signals indicate a bullish setup.

- Balanced liquidation data and whale accumulation support the case for a continued rally.

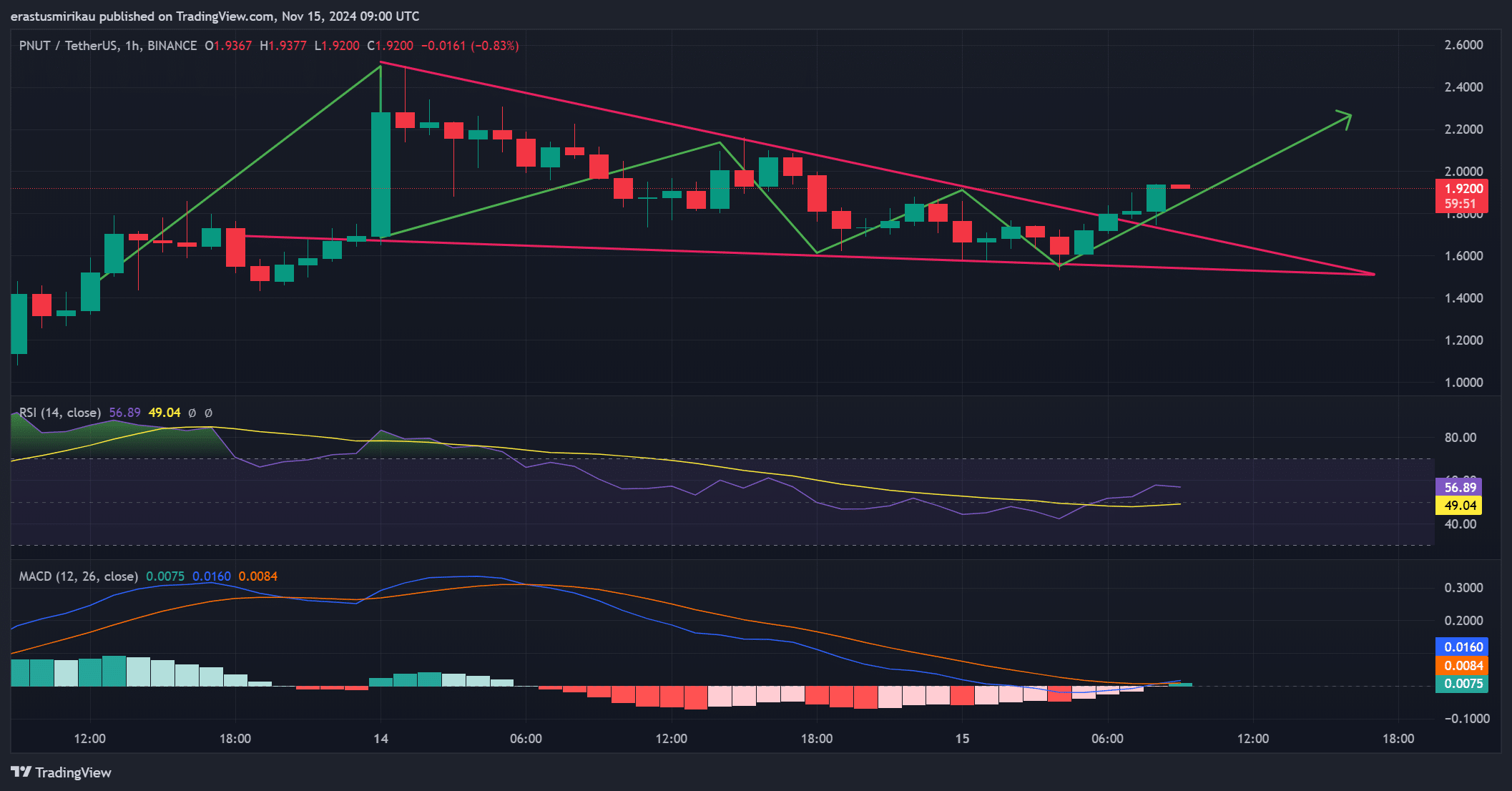

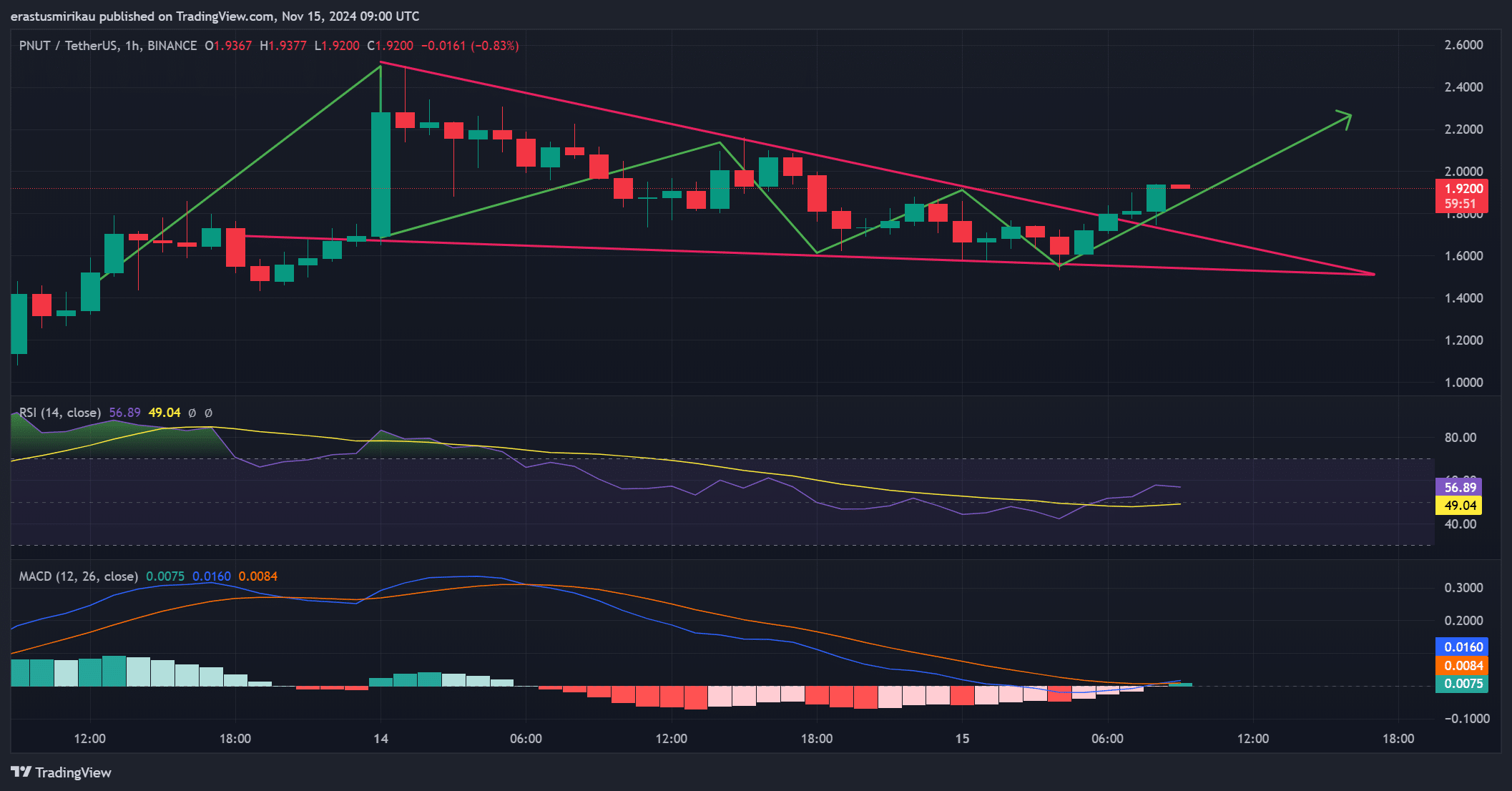

Peanut the squirrel [PNUT] recently broke out of a symmetrical triangle pattern on the 1-hour chart, a move that often signals a bullish continuation. PNUT was in a crucial retest phase around $2.1389 at the time of writing.

If this retest holds successfully, it could confirm the breakout and pave the way for renewed upward movement. This level of retesting is critical. Therefore, any successful hold here would likely attract more buyers, reinforcing bullish sentiment.

Looking at the MACD, a positive signal is emerging as the MACD line has moved above the signal line, confirming growing bullish momentum.

Moreover, the RSI is hovering around 56.89, which indicates that PNUT is still within a comfortable range and not yet overbought. These technical indicators support the possibility of further gains, especially if buyers respond positively to the new breakout test.

Source: TradingView

Whaling activity: major players support PNUT

On-chain data shows significant whale interest in PNUT, with the largest holder controlling approximately 27 million tokens worth more than $51 million, according to Lookonchain analytics.

This major trader has actively participated in 39 token transactions, with PNUT standing out as a particularly successful investment.

This whale’s high stakes reflect confidence in PNUT’s potential, as substantial holdings from high-profile investors often add stability to a token.

Consequently, continued whale involvement could give PNUT more momentum, creating an enabling environment for further gains.

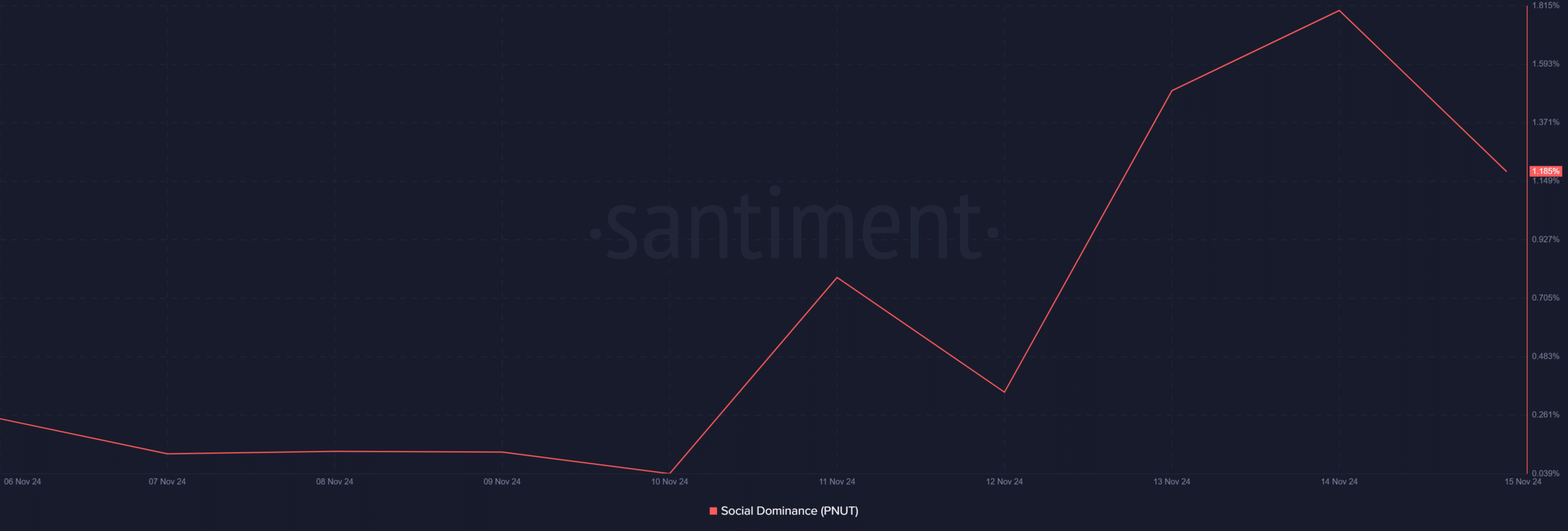

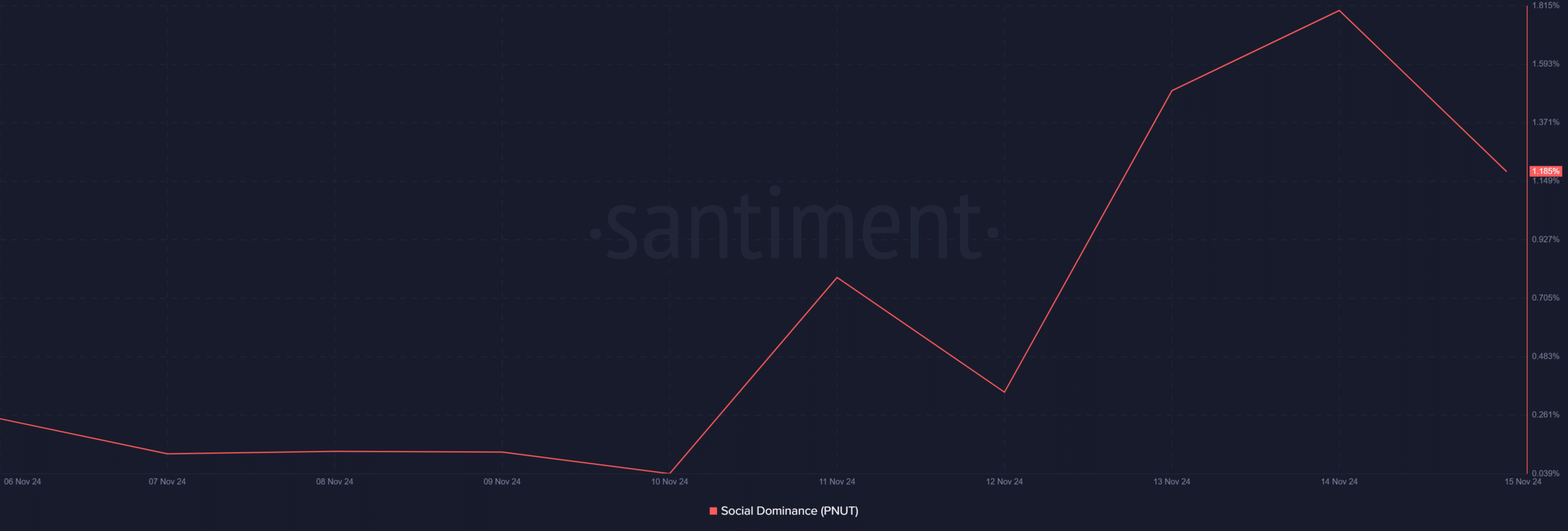

Social dominance: slight dip or shift in focus?

Social dominance has decreased from 1.8% to 1.19%, indicating a possible dip in retail attention.

However, this decline may be temporary, as a confirmed outbreak could quickly reignite social interest. Lower social dominance could mean traders are closely monitoring the retest before fully committing.

Therefore, a strong rally after the retest could draw back attention and push social numbers higher, which could further increase momentum.

Source: Santiment

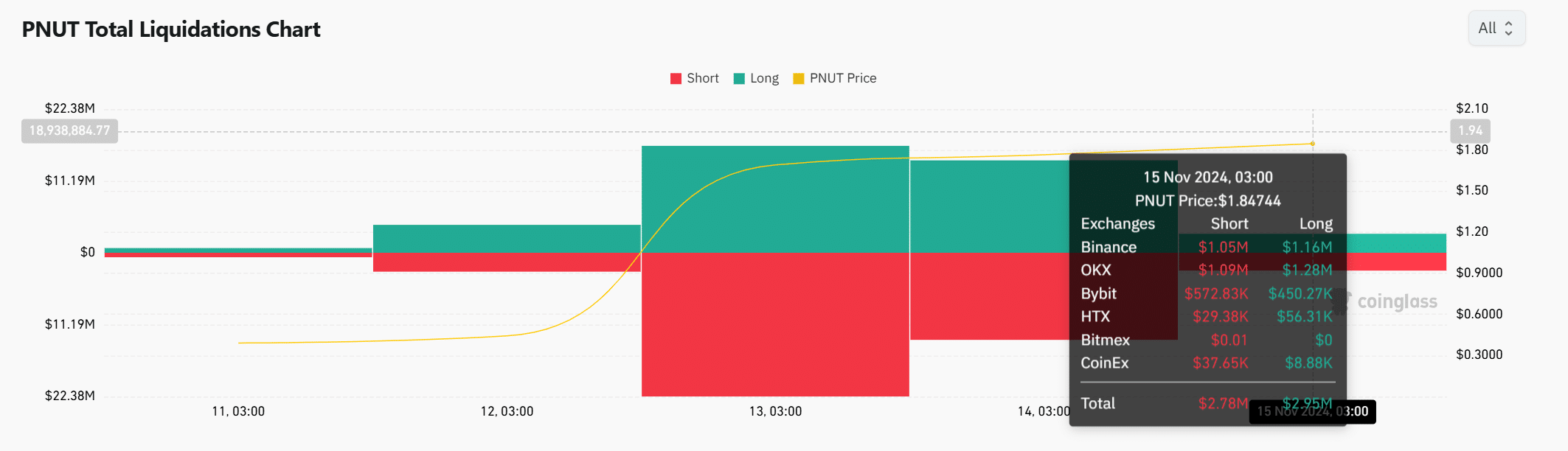

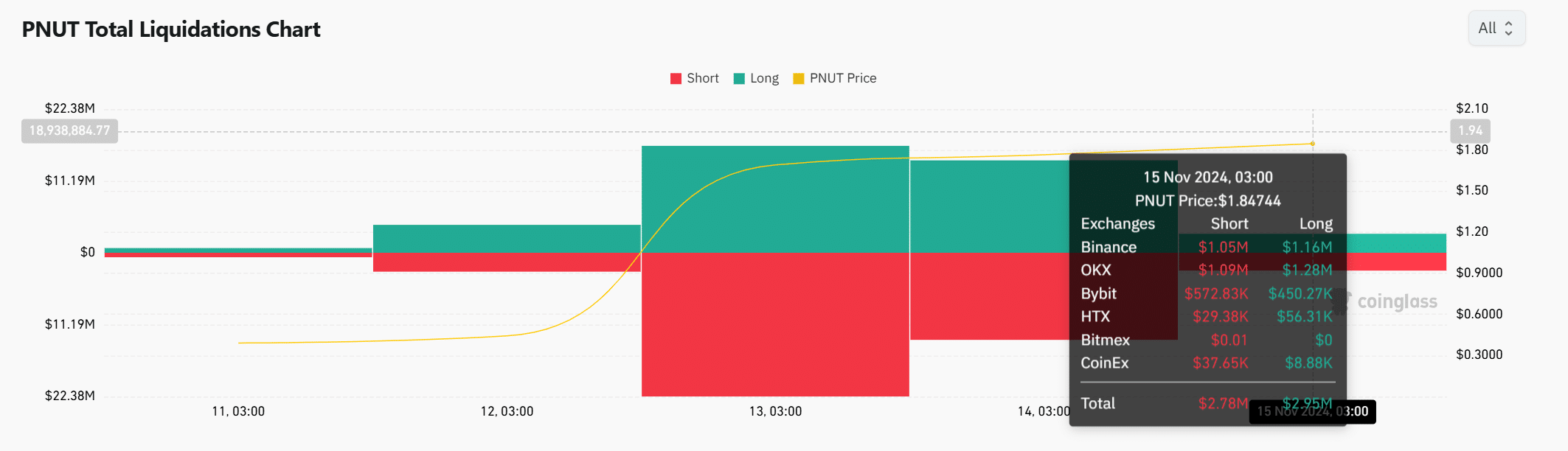

Liquidations: Longs and shorts are almost in balance

Recent liquidation data shows a close balance between long and short positions, with $2.95 million in long positions and $2.78 million in short positions. This balanced liquidation environment suggests that while there is optimism about PNUT’s price, caution remains.

If the breakout retest holds, increasing long liquidations could add fuel to a potential rally, amplifying the upward move.

Source: Coinglass

PNUT poised for further gains

PNUT’s breakout from the triangle pattern, supported by bullish technical indicators and strong whale activity, creates a promising bullish outlook.

Although its social dominance has seen a small dip, its technical strength and balanced liquidation ratio indicate that PNUT is poised for further gains. If the retest holds, PNUT appears well positioned for a sustained rally in the near term.