- Why Bitcoin is rising today is a question many investors are asking as its value continually reaches new all-time highs

- The growing adoption and increased number of active addresses are driving BTC’s price momentum during the market expansion.

Bitcoins [BTC] The recent surge continues to capture the market’s attention as unprecedented price levels are reached. The leading cryptocurrency has maintained strong bullish momentum over the past week, surging 21.7% and repeatedly breaching its all-time high.

Bitcoin peaked at $93,477 on November 13 before a minor correction occurred. The stock, which was trading at $91,079 at the time of writing, marks a decline of 2.8% from its high. Despite this slight decline, Bitcoin continues to rise 4.4% on the day.

This price increase has significantly increased Bitcoin’s market capitalization, pushing it to a valuation of around $1.80 trillion and solidifying its position. position among the world’s largest assets.

The broader crypto market has also benefited, with global market capitalization rising 3.6% to above $3.15 trillion.

Another notable aspect of Bitcoin’s recent rise is its daily trading volume, which has increased from less than $80 billion last week to more than $124 billion at the time of writing.

The increased volume indicates increased activity and interest from investors around the world, which raises many questions.

Why did Bitcoin rise today?

One of the driving forces behind Bitcoin’s price rise is the belief that a new bull run cycle is underway. This sentiment has been reinforced by the recent victory of Donald Trump as the 47th President of the United States.

As a supporter of Bitcoin, Trump has made several campaign promises in support of cryptocurrency, including the possible creation of a national reserve of BTC. His perceived support for the crypto sector has generated optimism within the community, leading to an increase in investment activity.

This expectation of more favorable crypto policies and regulatory clarity under Trump’s leadership has attracted both institutional and retail investors to BTC, contributing to its recent gains.

Moreover, wider adoption in the crypto market has also played a role.

This is a remarkable development BlackRock’s expansion into the crypto space through its BUIDL Fund, which now includes five different blockchains including Aptos, Arbitrum, Avalanche, OP Mainnet (formerly Optimism) and Polygon.

This move from one of the world’s largest asset managers further validates the growth and adoption of digital assets, including Bitcoin. It reflects increasing mainstream confidence in cryptocurrencies, strengthening market momentum and attracting additional investments.

Market statistics

Several key Bitcoin metrics have also shown positive trends, supporting the recent price increase while answering the question “why did Bitcoin rise today.”

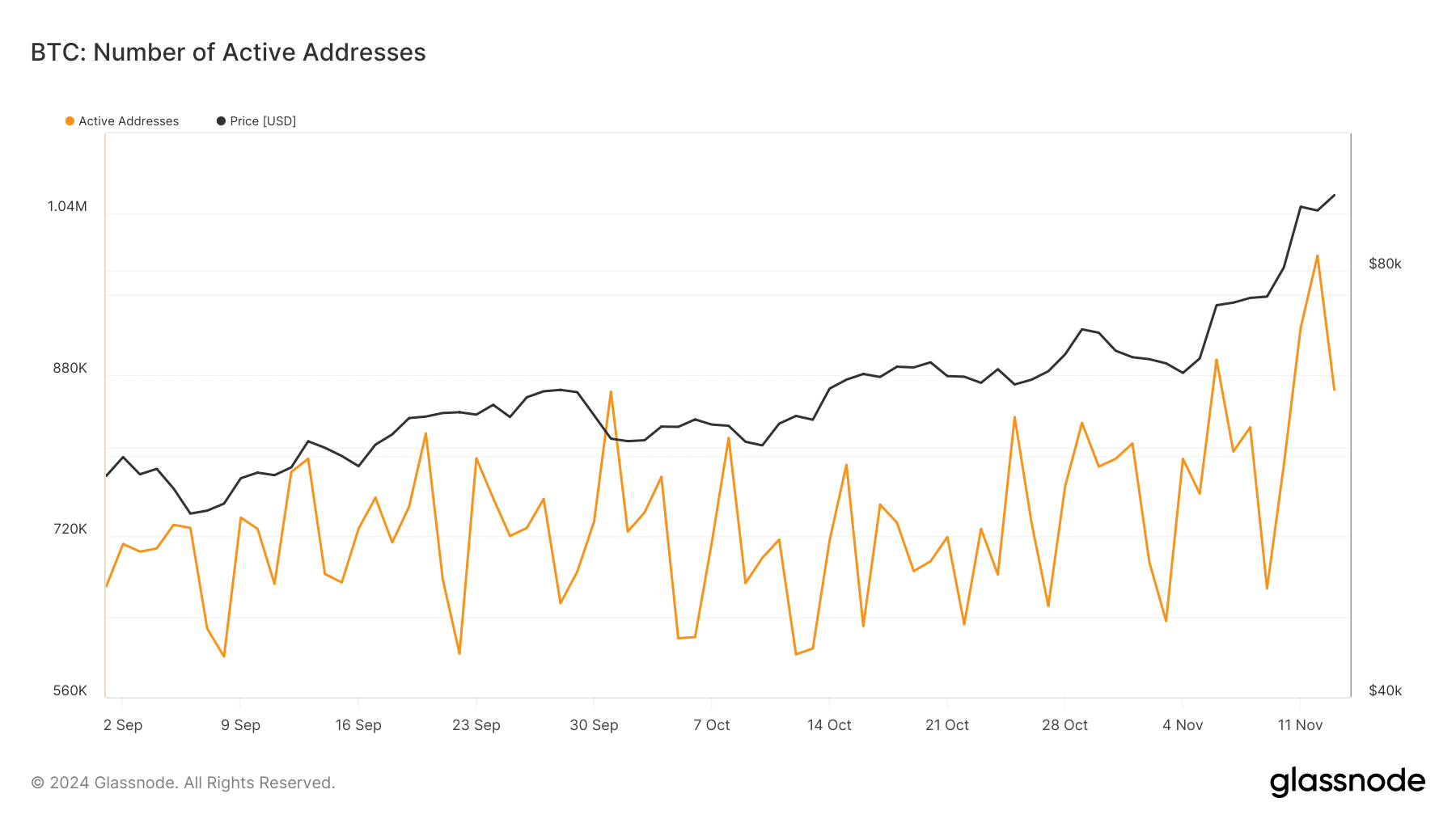

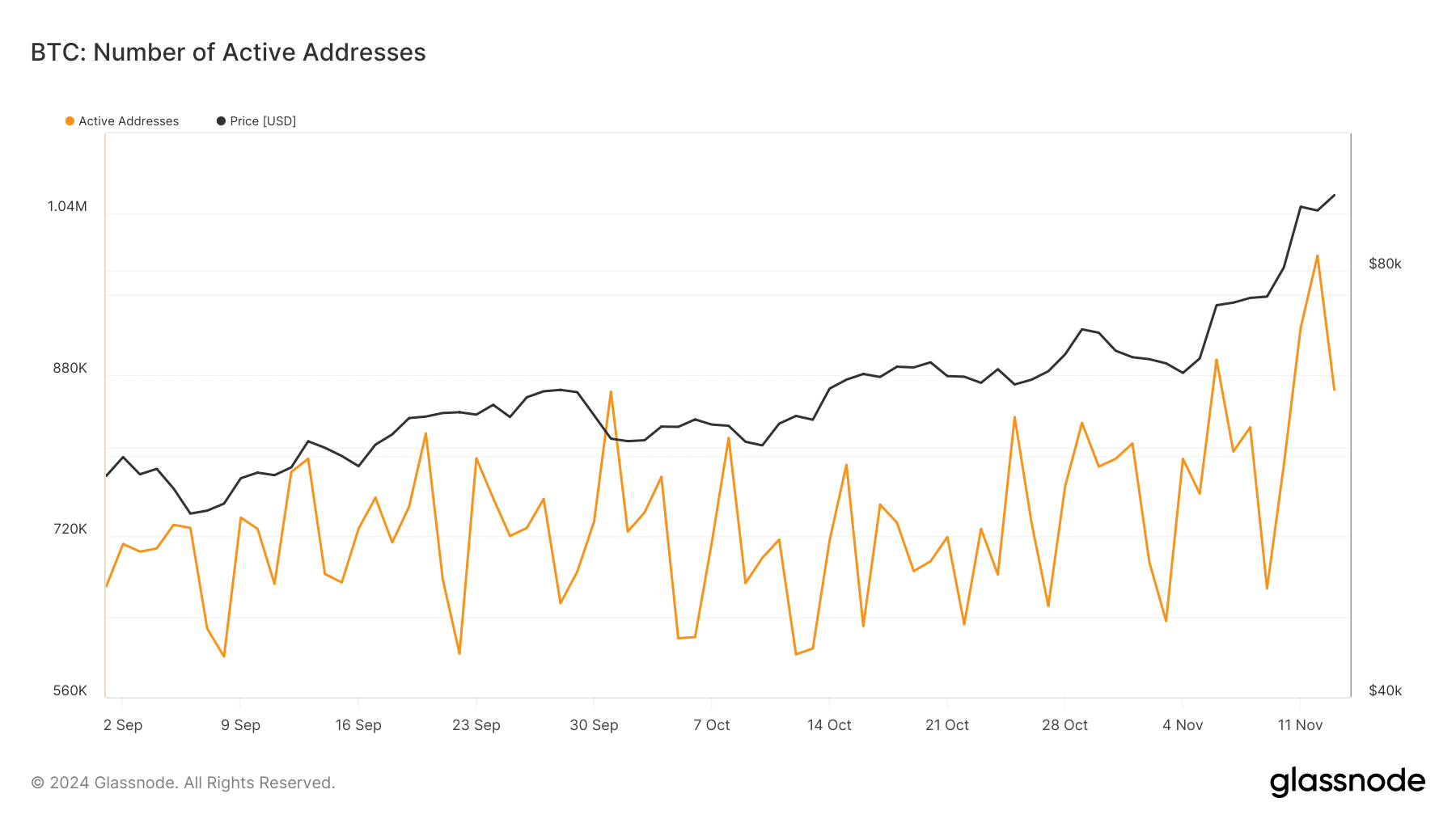

Facts from Glassnode reveals a rise in Bitcoin’s active addresses, which serves as a benchmark for retail interest and market activity.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2024–2025

On November 12, active addresses peaked at 998,000 before declining slightly to 865,000 on November 13. This represents a significant increase from last month’s levels, when the number of active addresses fell below 700,000.

The increase in the number of active addresses indicates growing participation from private individuals, indicating increased interest and demand for BTC.