- Bitcoin rose to $93,477 before a slight dip; Major withdrawals from Binance reflect investor sentiment.

- Key metrics, including the MVRV ratio and open interest, show strong market engagement during the price increase.

Bitcoins [BTC] The bullish momentum has continued to push the asset into uncharted territory. The leading cryptocurrency hit its latest all-time high of $93,477 on November 13, capping off a string of new peaks.

Despite this record performance, Bitcoin has suffered a modest correction and is currently trading at $90,031 – down 3.4% from its high, but still up 4.1% over the past 24 hours.

The rally, while notable, has also put a spotlight on investor behavior and market dynamics as activity around stock market signals possible shifts in sentiment and strategy.

Big steps on Binance

A CryptoQuant analyst known as Darkfost has done just that marked a major trend that occurred alongside Bitcoin’s recent all-time high.

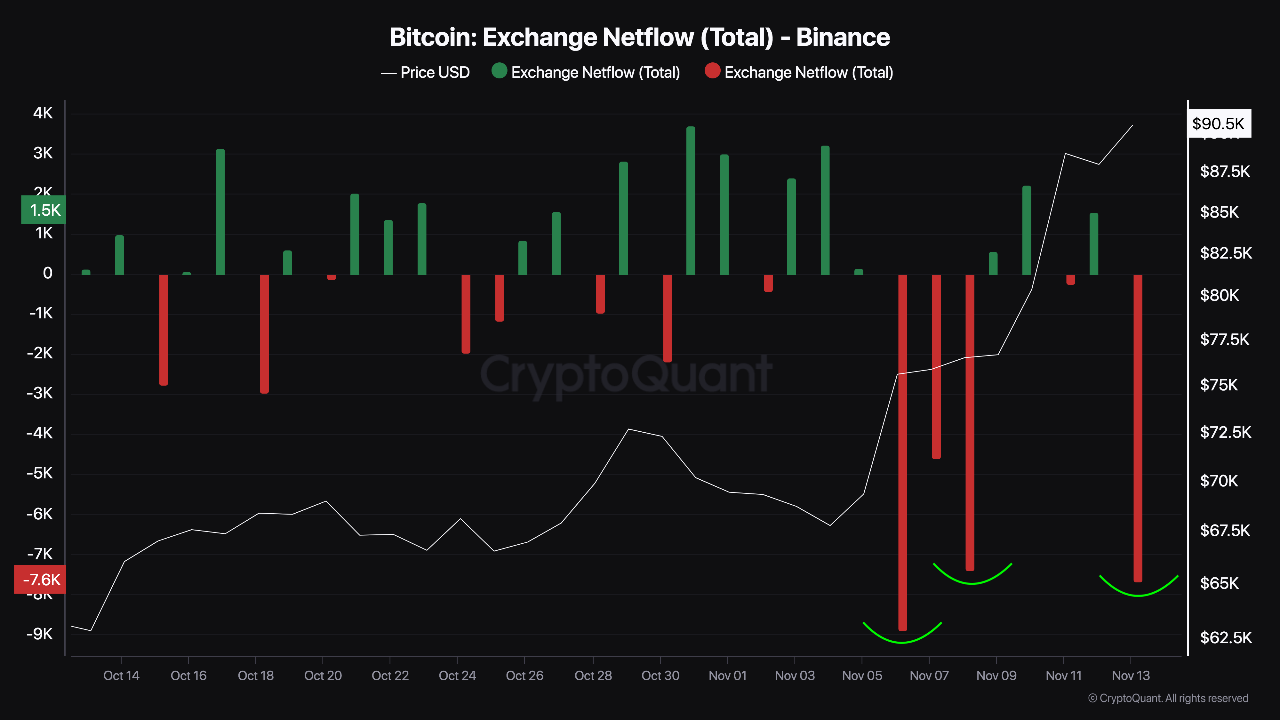

According to Darkfost, investors have withdrawn significant amounts of Bitcoin from Binance, one of the world’s largest cryptocurrency exchanges. Specifically, more than 7,500 BTC were withdrawn, which is the second largest such move this year.

Source: CryptoQuant

According to the analyst, this activity could indicate a shift in investor sentiment, indicating confidence in the long-term value of the asset and possibly signaling a move towards safer long-term investing rather than active trading.

By moving Bitcoin out of exchanges and into private wallets, investors can position themselves for future gains or greater market stability, indicating positive sentiment within the market.

How is Bitcoin doing fundamentally?

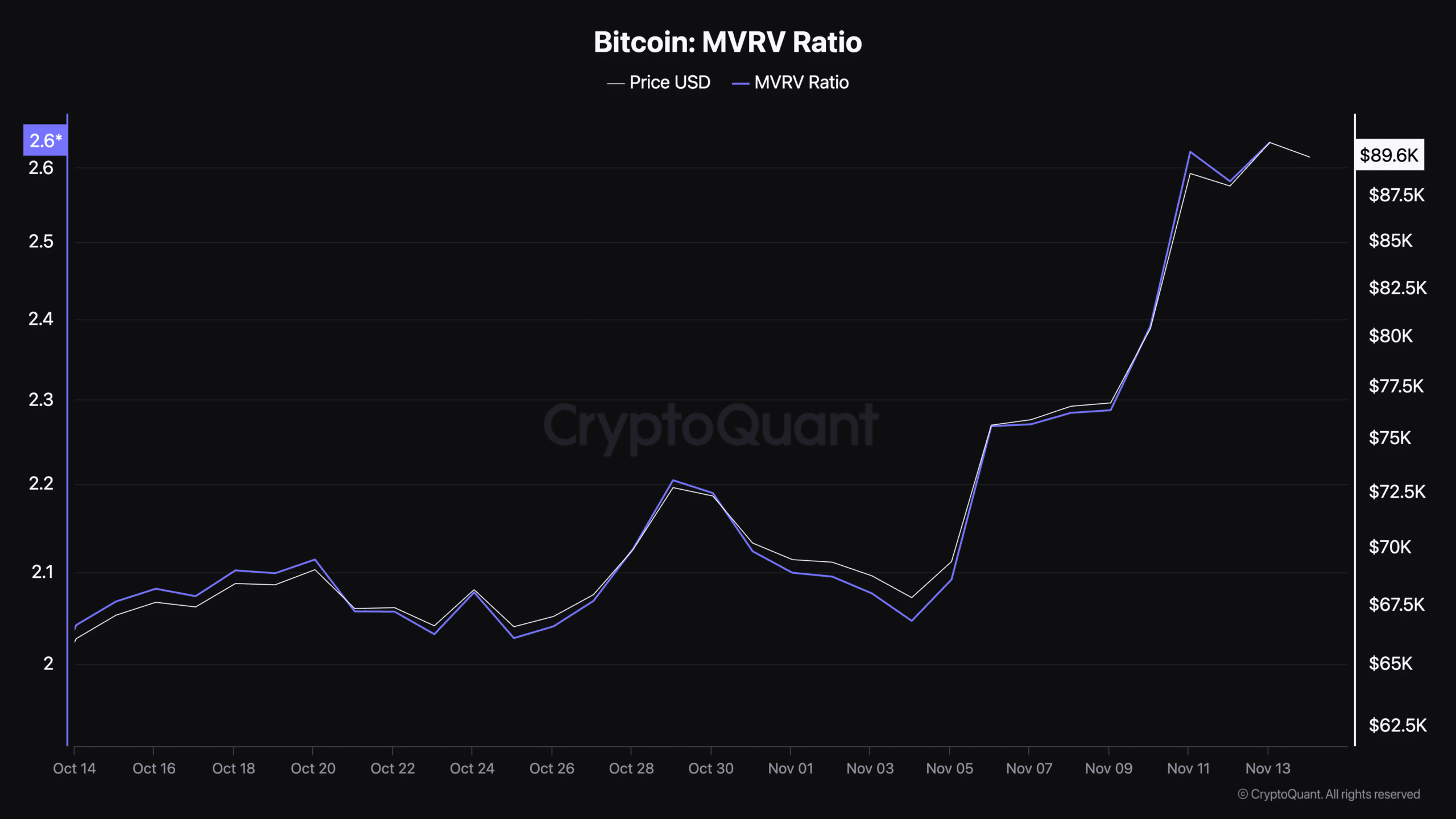

In addition to stock market activity, Bitcoin’s fundamental metrics provide additional insight into its performance during the ongoing rally. A key metric is the market value to realized value ratio (MVRV), which reflects Bitcoin’s market capitalization relative to the realized value of its assets.

This measure can indicate whether Bitcoin is overvalued or undervalued relative to historical price developments.

An MVRV ratio of greater than 1 indicates that the asset is trading above its total cost basis, indicating potential profit-taking behavior. Currently, Bitcoin’s MVRV ratio is the same got up to 2.58, indicating that a significant portion of investors are making notable gains.

Source: CryptoQuant

Historically, such levels have often coincided with increased interest and, in some cases, market corrections. The increased MVRV ratio indicates strong profitability, but also calls for caution among investors as the potential for volatility remains.

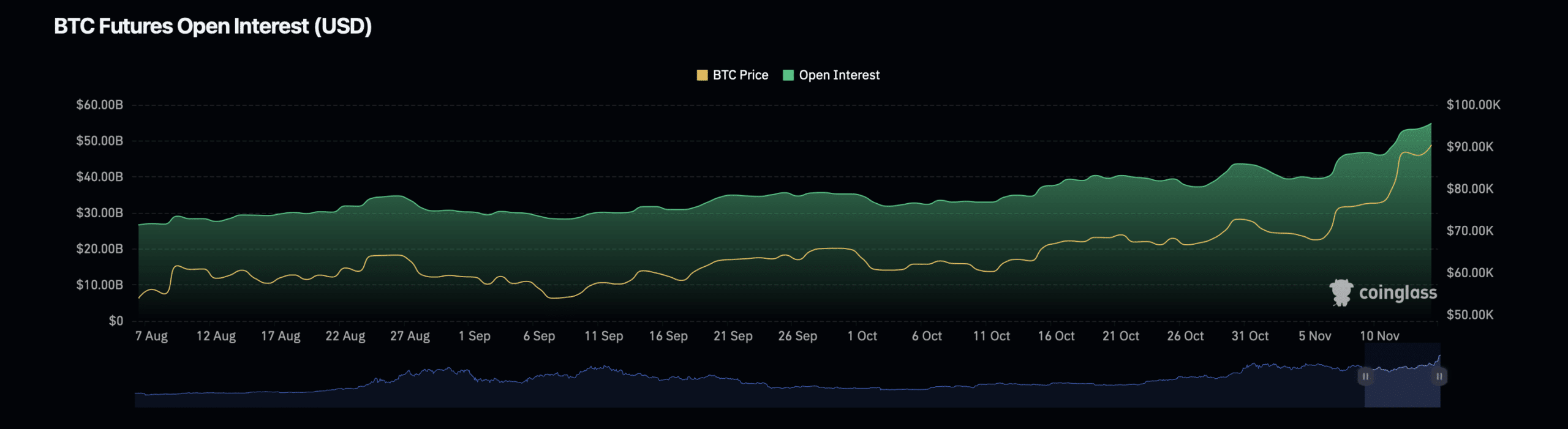

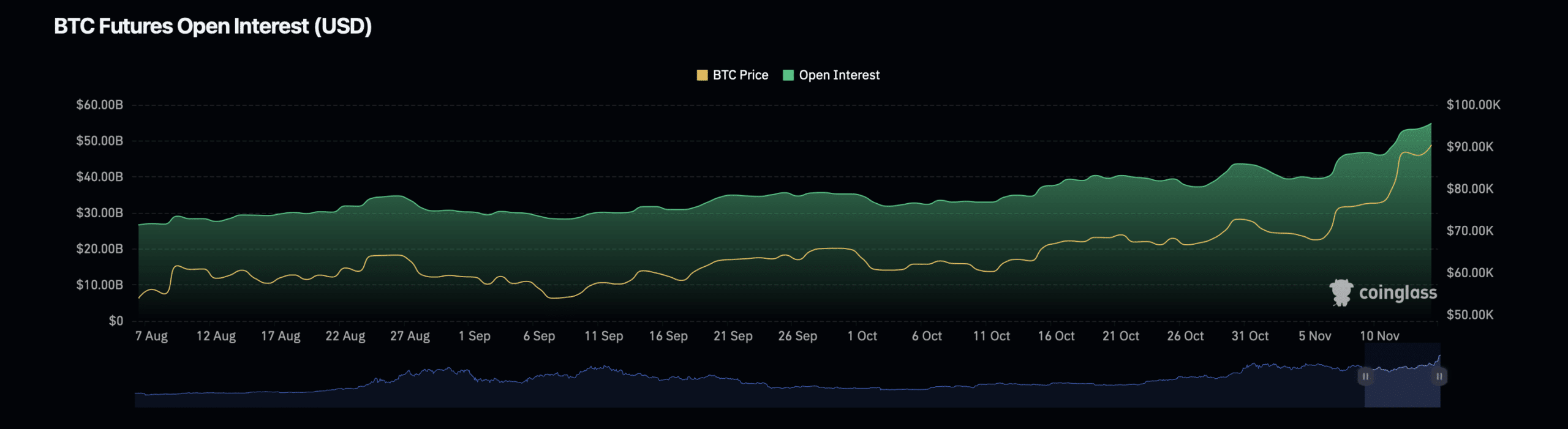

Another crucial metric worth monitoring is Bitcoin’s open interest, which refers to the total number of outstanding derivative contracts, such as futures or options.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Facts from Coinglass revealed that Bitcoin open interest rose 4.23% to reach a valuation of $54.85 billion. This increase reflects growing speculative interest and may indicate increased trading activity or market confidence.

Source: Coinglass

However, Bitcoin’s open interest volume fell slightly by 1.51%, reaching $182.70 billion. A decline in open interest volume could imply consolidation or a shift in market dynamics as participants reassess their positions following the recent rally.