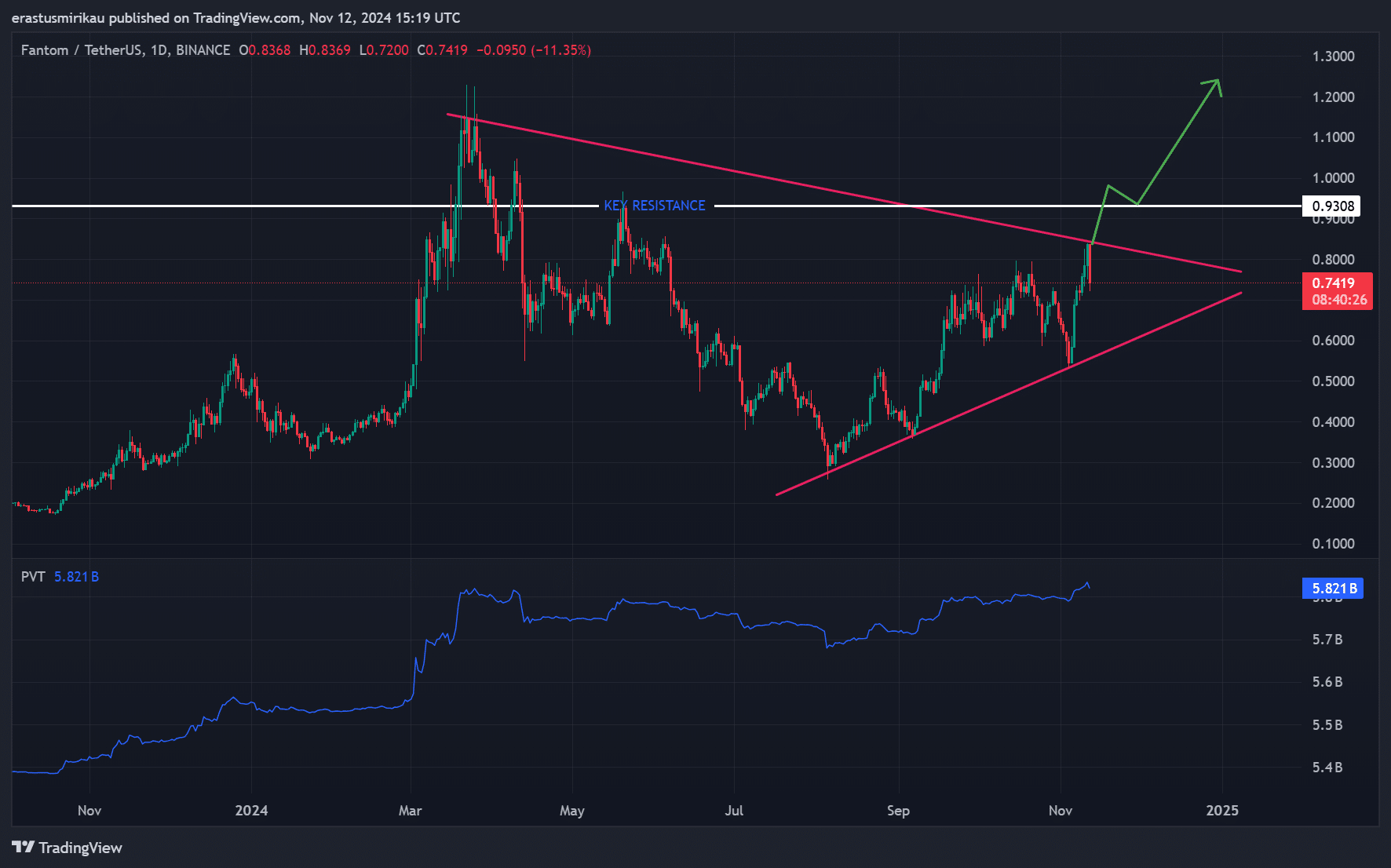

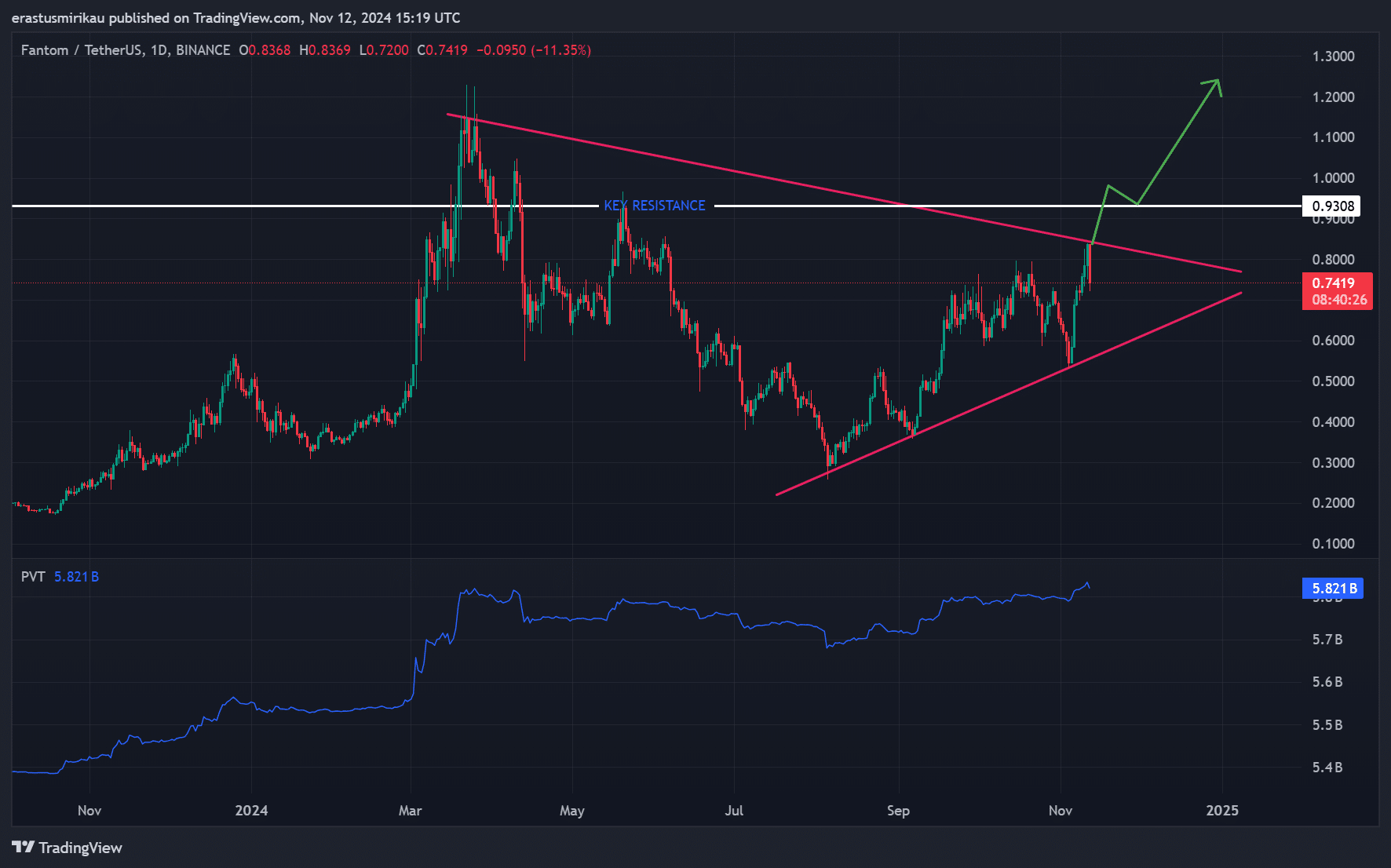

- FTM’s symmetrical triangle pattern indicated a possible breakout, with $0.93 as the key resistance

- On-chain metrics were largely bullish, although low active address growth suggested caution

Phantom [FTM]at the time of writing, was it shows promising signs of a possible breakout from a symmetrical triangle pattern, supported by strong on-chain metrics and technical indicators. In fact, recent data shows a ‘mostly bullish’ sentiment, with four key signals in the chain – net network growth, in the money market, concentration and large trades – all pointing to a positive outlook.

With a press time price of $0.7459 after a 5.26% decline, FTM’s performance now depends on whether it can overcome critical resistance levels. However, not all indicators fully supported an impending outbreak, creating some uncertainty.

Technical Analysis – Is FTM ready for a breakthrough?

FTM’s price action appeared to form a symmetrical triangle pattern – often a sign of an impending breakout. This pattern, characterized by converging trend lines, suggested that FTM could soon make a major move. If this triangle breaks to the upside, it could confirm bullish momentum. However, breaking established resistance levels will be crucial to validate this move.

FTM is facing a significant resistance level at $0.93, which has historically served as a ceiling for upside movement. A decisive break above this level could encourage further gains, with a potential target around $1.20 based on previous price action. If this resistance is not removed, FTM may become stuck in the current consolidation phase.

The price volume trend (PVT) showed steady growth, indicating an increase in purchasing interest. This measure pointed to underlying bullish sentiment, suggesting that a breakout could gain momentum if accompanied by an increase in trading volume. However, without a large volume spike, the breakout may not have the momentum needed for sustainability.

Source: TradingView

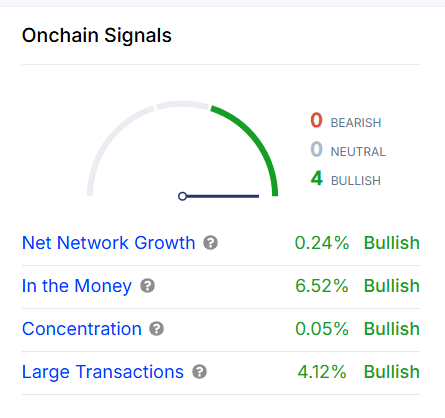

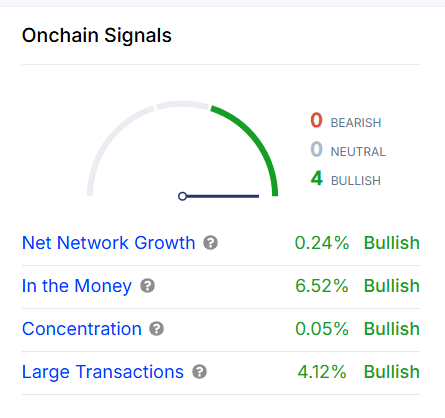

FTM on-chain metrics support cautiously bullish sentiment

The on-chain metrics largely supported a bullish outlook, albeit with some caution. Net network growth increased by 0.24%, indicating a steady influx of new users. Additionally, 6.52% of FTM addresses remain ‘In the Money’, reducing the likelihood of selling pressure from profitable holders, which often supports price stability.

The large trades benchmark rose 4.12%, highlighting interest from institutional and high-net-worth investors – a positive sign for future price action. The concentration among large holders of 0.05% also implied that whales have maintained their positions, underscoring confidence in FTM’s long-term potential.

Source: IntoTheBlock

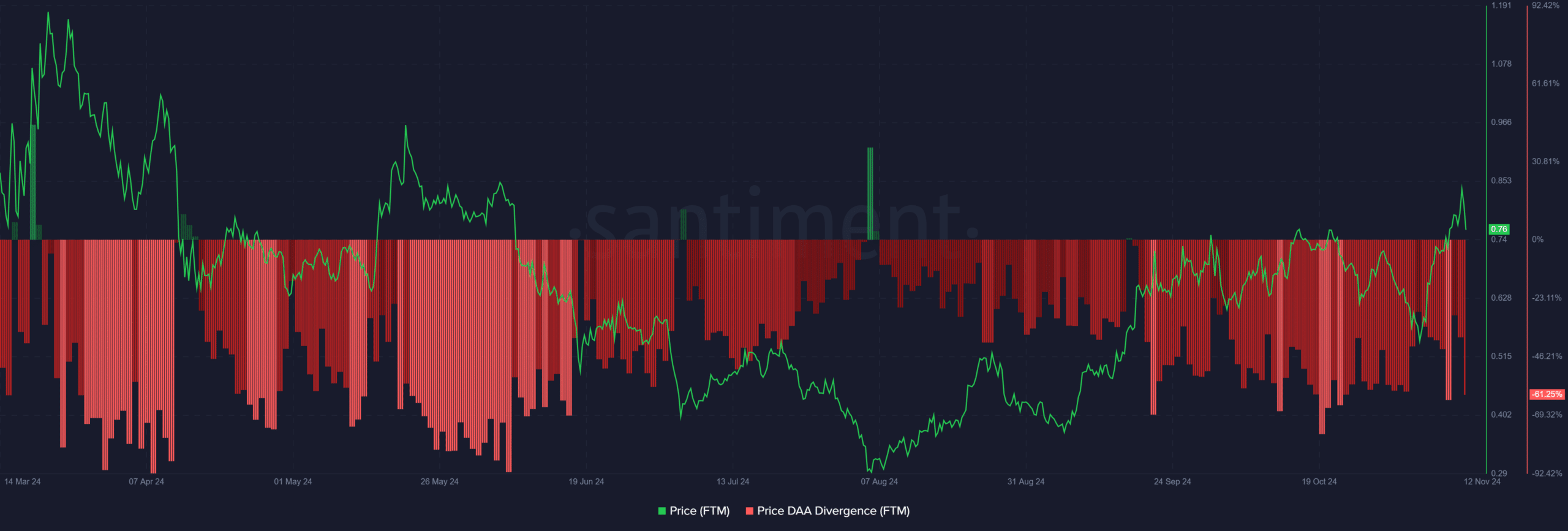

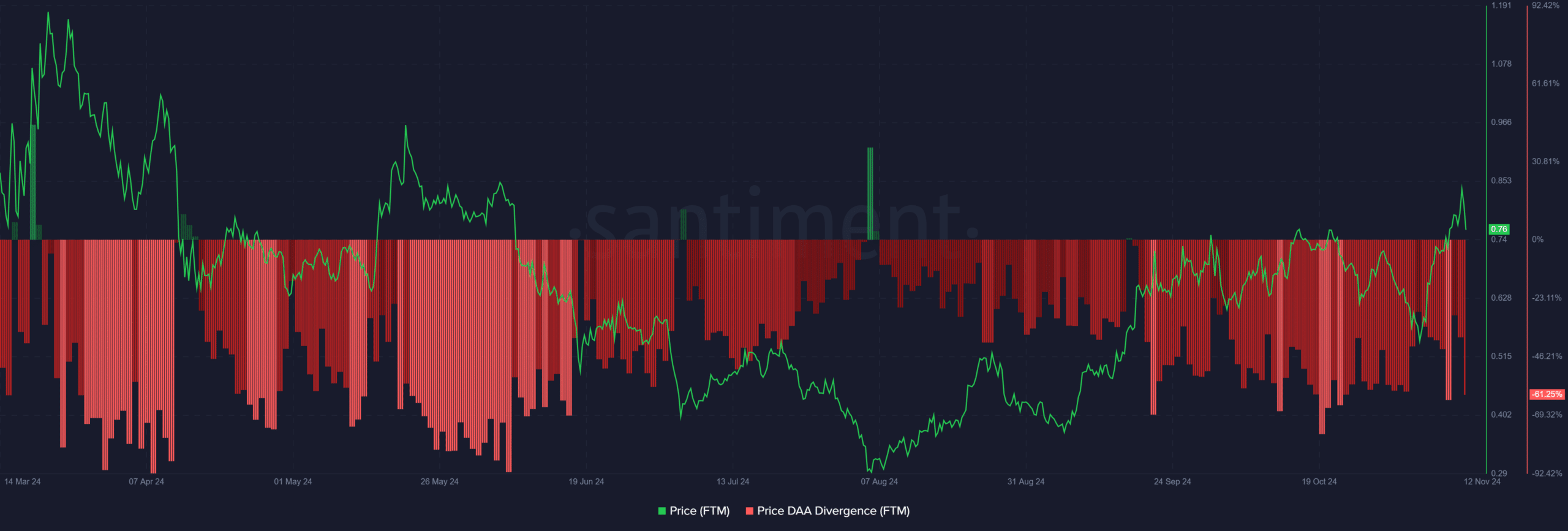

Price-DAA divergence signals caution

The difference between price and daily active addresses (DAA) was -61.25%, indicating that price exceeded user activity growth. This divergence is a cautionary signal, indicating that FTM’s price movement may not be fully supported by network activity, which could limit upside momentum.

Source: Santiment

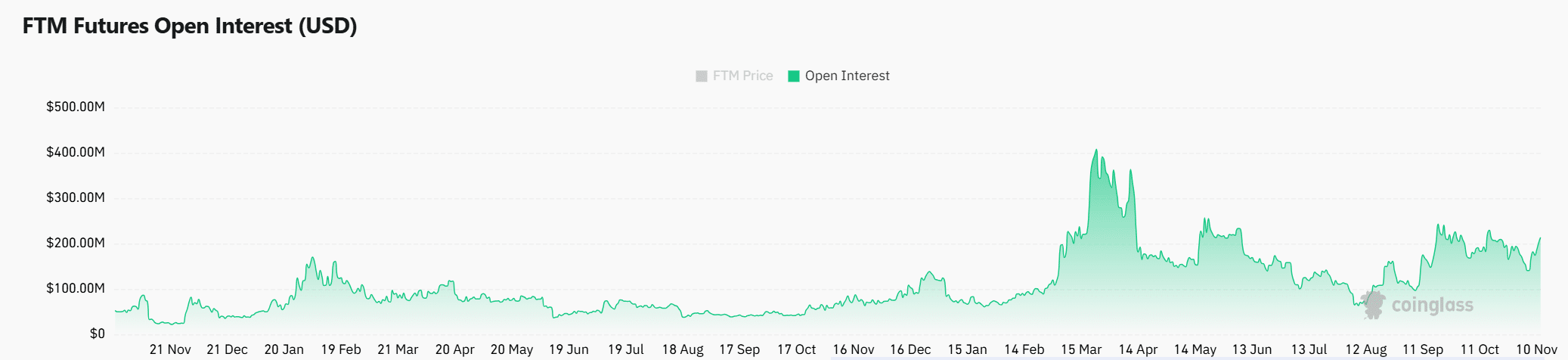

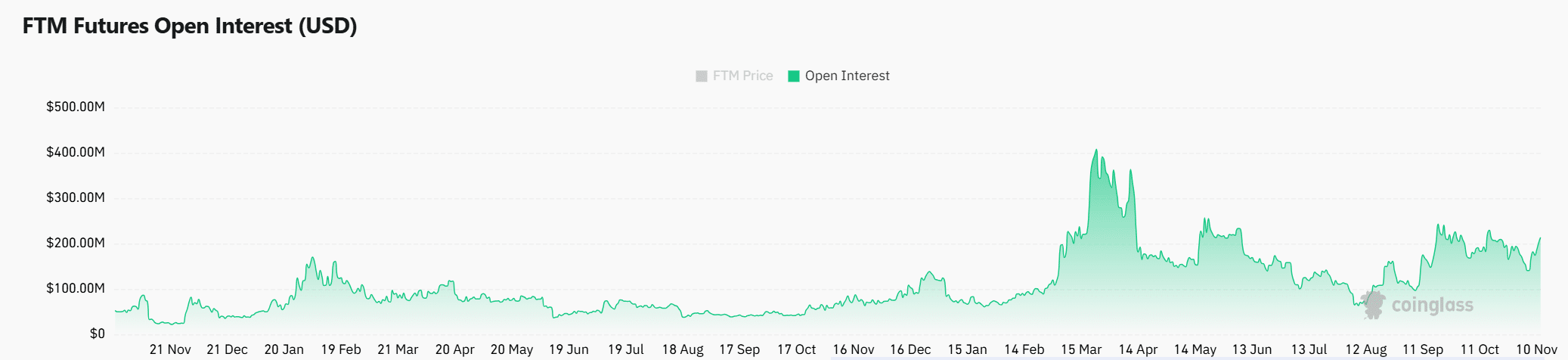

Market sentiment with Open Interest in focus

At the time of writing, Open Interest for FTM Futures was $193.63 million, down 2.79%. This decline in Open Interest underscored some caution among traders, indicating that market participants may be hesitant to make strong bets in either direction. This could impact FTM’s ability to sustain an outbreak.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024-25

A mixed vision with cautious optimism

Based on the analyzed data, FTM issued both bullish and cautionary signals. While technical patterns and on-chain metrics trended towards a possible breakout, the low growth in daily active addressing and the slight decline in Open Interest indicated caution.

Therefore, a confirmed breakout above $0.93 is crucial to validate further gains. Otherwise, FTM’s price could remain within the current consolidation range.